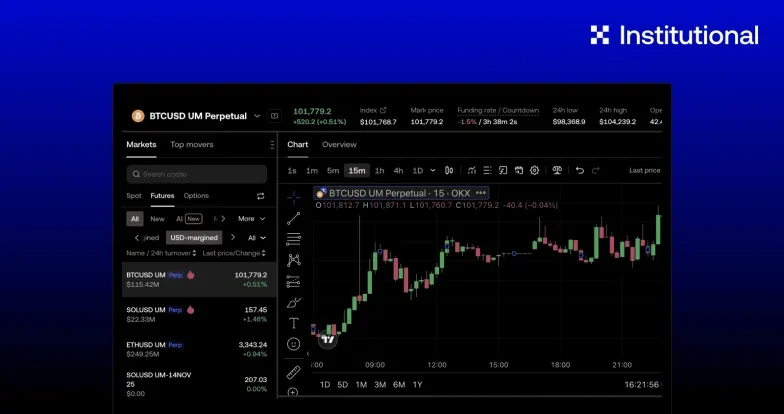

Futures spread trading on OKX Liquid Marketplace

1. How futures spreads are traded in crypto

Spread trading involves taking two futures positions in opposite directions: one long, one short. The idea is to make money off the price difference between the two futures – which are also called the two legs of the strategy. The profit a trader makes from this trade comes from the price difference, or spread, between those two contracts. That’s why this strategy is called market neutral: The underlying asset’s price direction does not influence its profitability. In other words, futures spread traders can profit when the market trends up or down, or remains flat over the terms of the traded contracts. In crypto, future spread traders usually target either the Calendar spread or the InterCoins spread:

- Calendar spread - the spread between two contrats with the same underlying asset, the same notional quantity, but different expiry dates and opposite directions.

- InterCoins spread – the spread between two different and highly correlated futures underlyings.

2. The challenges of futures spread trading

Since trading futures spread is market neutral and requires two legs, crypto traders often face several issues:

- Execution risk. Trading multiple legs strategies on the order book requires entering one leg of the trade after the other. The executed price of the second leg can differ from the desired price, particularly in times of high volatility.

- Customization. Futures spread trading is often only available on a limited number of instruments.

- Price impact. The depth of the orderbook may not be sufficient to absorb a large trade at the desired price which can cause price slippage (when the executed price differs from the expected price).

3. What the OKX Liquid Marketplace offers

Our on-demand liquidity network, Liquid Marketplace, offers a powerful solution to these problems. It allows traders to access deep liquidity through an execution layer that automates trades and settlements instantly and off the order book. For futures spread trading in particular, it offers:

Cost efficiency

- Tight quotes. Send custom RFQs for multiple market-makers to compete over.

- Minimal price slippage. Avoid price slippage with our instant off-order book execution solution for multiple-legs strategies.

- Low margin requirements. Benefit from lower margin requirements thanks to OKX's Portfolio Margin model, which offsets the risk of positions that have the same underlying and opposite directions.

- Volatility minimization. Avoid the volatility risk of only entering one leg of the trade – both legs of spread trades execute simultaneously, or else neither does.

Multiple instruments

- Predefined strategies. Leverage more than 20+ predefined instruments, including future spreads, options, straddles, etc.

- Spreads. Trade all sorts of spreads: Carry trades (spot vs future/perp), futures spreads (future vs future/perp), call/put spreads, calendar spreads, butterfly spreads, condors, ratio spreads, diagonal spreads, back spreads.

- Bespoke instruments. Customize your own strategies with up to 15 legs.

THIS ANNOUNCEMENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY. IT IS NOT INTENDED TO PROVIDE ANY INVESTMENT, TAX, OR LEGAL ADVICE, NOR SHOULD IT BE CONSIDERED AN OFFER TO PURCHASE OR SELL DIGITAL ASSETS. DIGITAL ASSET HOLDINGS, INCLUDING STABLECOINS, INVOLVE A HIGH DEGREE OF RISK, CAN FLUCTUATE GREATLY, AND CAN EVEN BECOME WORTHLESS. YOU SHOULD CAREFULLY CONSIDER WHETHER TRADING OR HOLDING DIGITAL ASSETS IS SUITABLE FOR YOU IN LIGHT OF YOUR FINANCIAL CONDITION.

© 2025 OKX. Bài viết này có thể được sao chép hoặc phân phối toàn bộ, hoặc trích dẫn các đoạn không quá 100 từ, miễn là không sử dụng cho mục đích thương mại. Mọi bản sao hoặc phân phối toàn bộ bài viết phải ghi rõ: “Bài viết này thuộc bản quyền © 2025 OKX và được sử dụng có sự cho phép.” Nếu trích dẫn, vui lòng ghi tên bài viết và nguồn tham khảo, ví dụ: “Tên bài viết, [tên tác giả nếu có], © 2025 OKX.” Một số nội dung có thể được tạo ra hoặc hỗ trợ bởi công cụ trí tuệ nhân tạo (AI). Không được chỉnh sửa, chuyển thể hoặc sử dụng sai mục đích bài viết.