Giá Convex Finance

bằng USD

Về Convex Finance

Hiệu suất giá của Convex Finance

Convex Finance trên mạng xã hội

Hướng dẫn

Tạo tài khoản OKX miễn phí.

Nạp tiền vào tài khoản.

Chọn crypto.

Convex Finance Câu hỏi thường gặp

Bạn có thể mua CVX từ sàn giao dịch OKX. OKX cung cấp cặp giao dịch CVX/USDT.

Trước khi bắt đầu giao dịch với OKX, bạn cần tạo tài khoản. Sau đó, để giao dịch CVX/USDT, hãy click "Basic trading" (Giao dịch cơ bản) dưới mục "Trade" (Giao dịch) ở thanh điều hướng trên cùng.

Nếu không sở hữu USDT, bạn có thể mua USDT bằng tiền pháp định ưa thích của mình trước khi đổi lấy CVX trong cổng giao dịch.

Tìm hiểu sâu hơn về Convex Finance

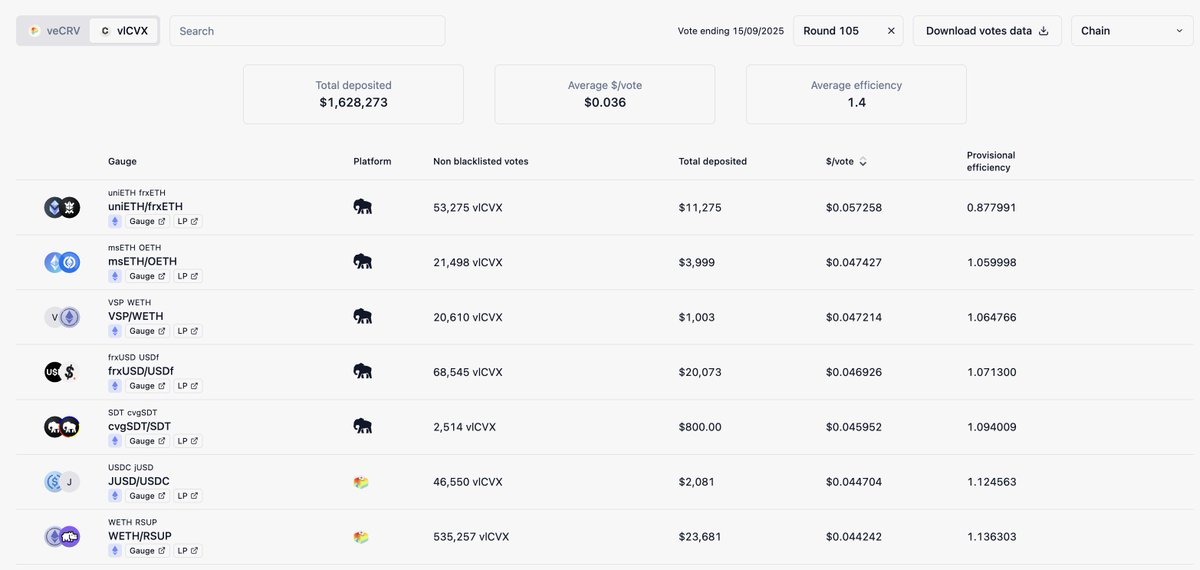

Convex Finance là bể thanh khoản DEX hàng đầu trên Ethereum cho phép các nhà cung cấp thanh khoản (LP) và nhà đầu tư của Curve Finance kiếm được CVX tăng cường và CRV, mã thông báo gốc của Curve DAO. MixBytes đã kiểm toán Convex Finance trước khi ra mắt để tối đa hóa tính bảo mật. CVX là tên và ký hiệu mã của mã thông báo nền tảng gốc của Convex Finance.

Convex Finance duy trì tính thanh khoản của tất cả tài sản đồng thời tối đa hóa phần thưởng. mã thông báo Curve LP kiếm cho người dùng phí giao dịch, CRV và ưu đãi khai thác thanh khoản trong CVX. Đồng thời, những người stake CRV sẽ nhận được một phần CRV, mã thông báo CVX và phí giao dịch của Curve được tăng cường. Thẻ Curve LP có thể được rút bất kỳ lúc nào.

Ngoài ra, người dùng có thể cung cấp thanh khoản cho nhóm thanh khoản cvxVRV/CRV và CVX/ETH trên SushiSwap trao đổi phi tập trung và kiếm mã thông báo SUSHI LP. Mã thông báo SUSHI LP kiếm được có thể được stake trên Convex để kiếm phần thưởng của nhà cung cấp thanh khoản trong CVX. Với CVX, người dùng sẽ kiếm được một phần thu nhập CRV của Curve LP. Tương tự, người dùng stake CVX sẽ nhận được phí cvxCRV. Cuối cùng, chủ sở hữu CVX có thể bỏ phiếu về các quyết định của giao thức.

Giá mã thông báo CVX

Convex Finance có nguồn cung tối đa 100 triệu mã thông báo CVX. 50% nguồn cung CVX được dành làm phần thưởng Curve LP trên Convex Finance. Giao thức tạo ra CVX tỷ lệ thuận với từng mã thông báo CRV được yêu cầu bởi Curve LP trên Convex Finance. Tỷ lệ đúc CVX/CRV giảm sau mỗi 100.000 CVX, do đó ảnh hưởng đến giá CVX.

25% nguồn cung CVX được dành riêng cho khai thác thanh khoản, 9,7% được phân bổ cho kho bạc Convex Finance, 3,3% cho các nhà đầu tư và 10% sẽ dành cho nhóm Convex Finance. Kho bạc, cổ phần của nhà đầu tư và mã thông báo của nhóm Convex Finance sẽ tuân theo lịch trình trao quyền một năm. Khi mã thông báo trao quyền được mở khóa, biểu đồ giá CVX sẽ bị ảnh hưởng. 2% số mã thông báo còn lại sẽ được airdrop cho chủ sở hữu veCRV.

Về những người sáng lập

Convex Finance được ra mắt vào tháng 5 năm 2021 và được hỗ trợ bởi nhóm Curve Finance. Ngoài ra, Convex Finance có quan hệ đối tác với Frax Finance, BadgerDAO và Zerion, cho phép người dùng theo dõi các vị thế của Convex Finance trên nền tảng của họ.

Miễn trừ Trách nhiệm

OKX không cung cấp khuyến nghị về đầu tư hoặc tài sản. Bạn nên cân nhắc cẩn thận xem việc giao dịch hoặc nắm giữ tài sản số có phù hợp với điều kiện tài chính của mình hay không. Vui lòng tham khảo ý kiến chuyên gia pháp lý/thuế/đầu tư nếu có thắc mắc về hoàn cảnh cụ thể của bạn. Để biết thêm chi tiết, vui lòng tham khảo Điều Khoản Sử Dụng và Cảnh Báo Rủi Ro trên OKX. Khi sử dụng trang web của bên thứ ba ("TPW"), bạn chấp nhận rằng mọi hoạt động sử dụng TPW đều sẽ tuân theo và chịu sự điều chỉnh của các điều khoản thuộc TPW. Trừ khi được nêu rõ ràng bằng văn bản, OKX và đối tác của mình (“OKX”) không có bất kỳ liên kết nào với chủ sở hữu hoặc nhà điều hành của TPW. Bạn đồng ý rằng OKX không chịu trách nhiệm hoặc nghĩa vụ đối với bất kỳ tổn thất, thiệt hại hoặc hậu quả nào phát sinh từ việc bạn sử dụng TPW. Xin lưu ý rằng việc sử dụng TPW có thể dẫn đến mất mát hoặc giảm giá trị tài sản của bạn. Sản phẩm có thể không có sẵn ở một số khu vực.