Investigation Report of Market Manipulation of ETC futures

On Nov 3rd, 2017, an amount of 7330 ETC societal loss happened on ETC1110 and ETC1117. After a thorough investigation, user ID 2155603, 6519751 and 2015504 simultaneously sells and buys the same aforementioned contracts with the intention to artificially trigger the societal losses by one account and benefit from account clawback with the other accounts – which is found to be controlled the same ultimate beneficiary owner. The incident, also commonly known as self-matching, deemed to be deliberately market manipulation and price rigging.

OKX decides to exercise right to reprimand and freeze the said user accounts based on OKX’s User Agreement on Futures Contract Sec. 5.2

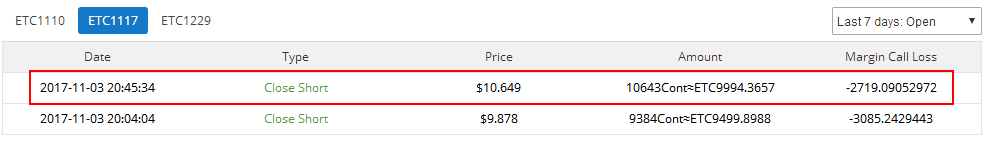

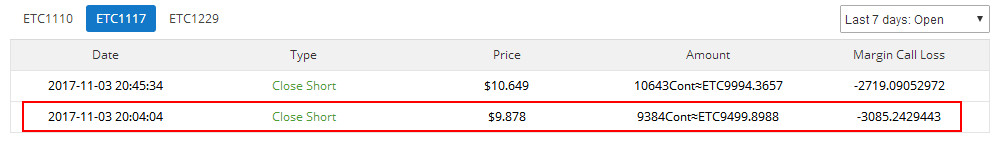

Those three accounts have been suspended. Regarding the societal loss on ETC1110 (2017-11-03 19:47:29), ETC1117 (2017-11-03 20:45:34 ; 2017-11-03 20:04:04), OKX would take the following actions:

OKX would deduct the unlawful profits made by market manipulation in-between User ID 2155603, 6519751 and 2015504. Hence, the aforementioned societal loss would be rectified. No account claw-back for all other users.

OKX would then unfreeze, after the contracts settlement, for the user to withdraw or other non-trading operation.

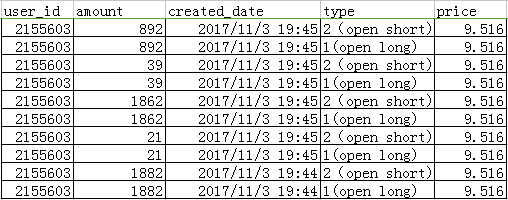

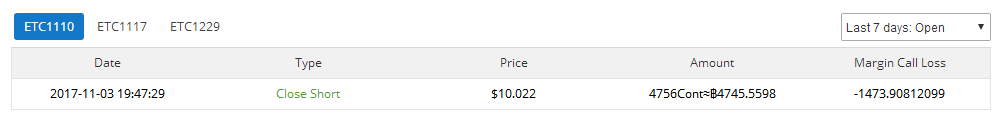

ETC1110 Findings:

- 2155603 open long and open short at 19:44~19:45 on 3rd 4696 contracts transactions filled at $9.516.

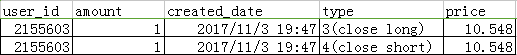

- 2155603 user placed the order at $10.548 to close his position at 19:44~19:45 on 3rd User short positions were thus margin called and liquidated

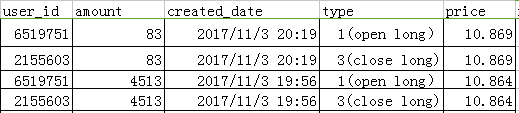

- 2155603 cross trades with 6519751 at 19:44~19:45 on 3rdNov at the price of $10.86 for 4596 contracts. 2155603 made a profits.

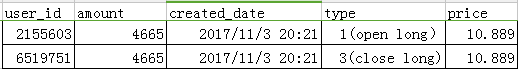

4. 6519751 closed his long position of 4665 contracts at 20:21on 3rdNov.transferring to 2155603 who opened a long position of 4665 contracts at the same time.

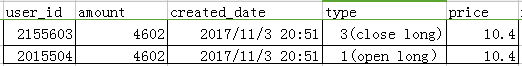

5. 2155603 closed long position of 4602 contracts at 20:21on 3rdNov and transferring to2015504. Eventually 2015504 held a long position of 4602 contracts at $10.4.

ETC1117 Findings

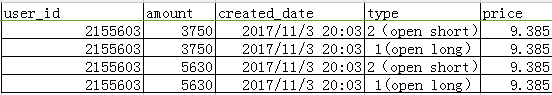

- 2155603 open long and open short filled at $9.385 on 3rdNov at 20:03 with 9380 contracts.

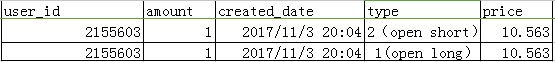

- 2155603 placed the order at $10.563 to close his position at 20:04 on 3rd User short position was liquidated.

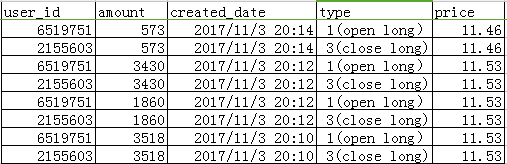

- 2155603 cross trades with 6519751 and close the position at 20:10~20:14 on 3rdNov at the price of $11.46 and at $11.53. 2155603 user made a profit.

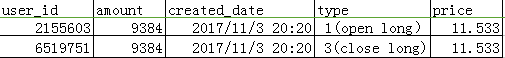

- 6519751 cross traded of 9384 contracts with 2155603 on Nov 3 20:20. 2155603 turned out has a long position amounted to 9384 contracts

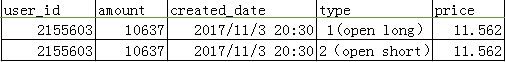

- 2155603 open long and open short on 3rd Nov at 20:30 simultaneously and net

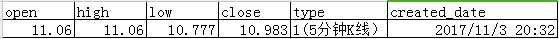

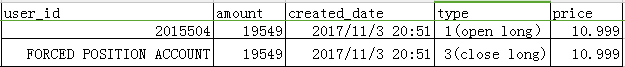

- During the trading hour, contract price dropped to $10.777 at 20:32 triggered a margin called on long position of 2055603 at a size of 20021. At 20:51, 2055603 margin called long positions filled at 10.999 while 20115504.

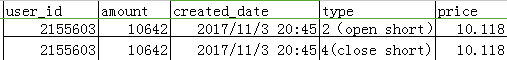

7. 2155603 simultaneously open long and open short on 3rd Nov at 20:45 of 10642 contracts filled. The average cost of short position downed to $10.118.

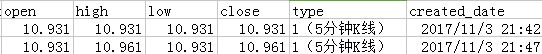

- During the trading hour, the contract price up to 10.931 at 20:45. 2055603 short positions were margin called.