What are tech giants betting on stablecoins?

Writing by Ben Weiss, Leo Schwartz

Compiler: Luffy, Foresight News

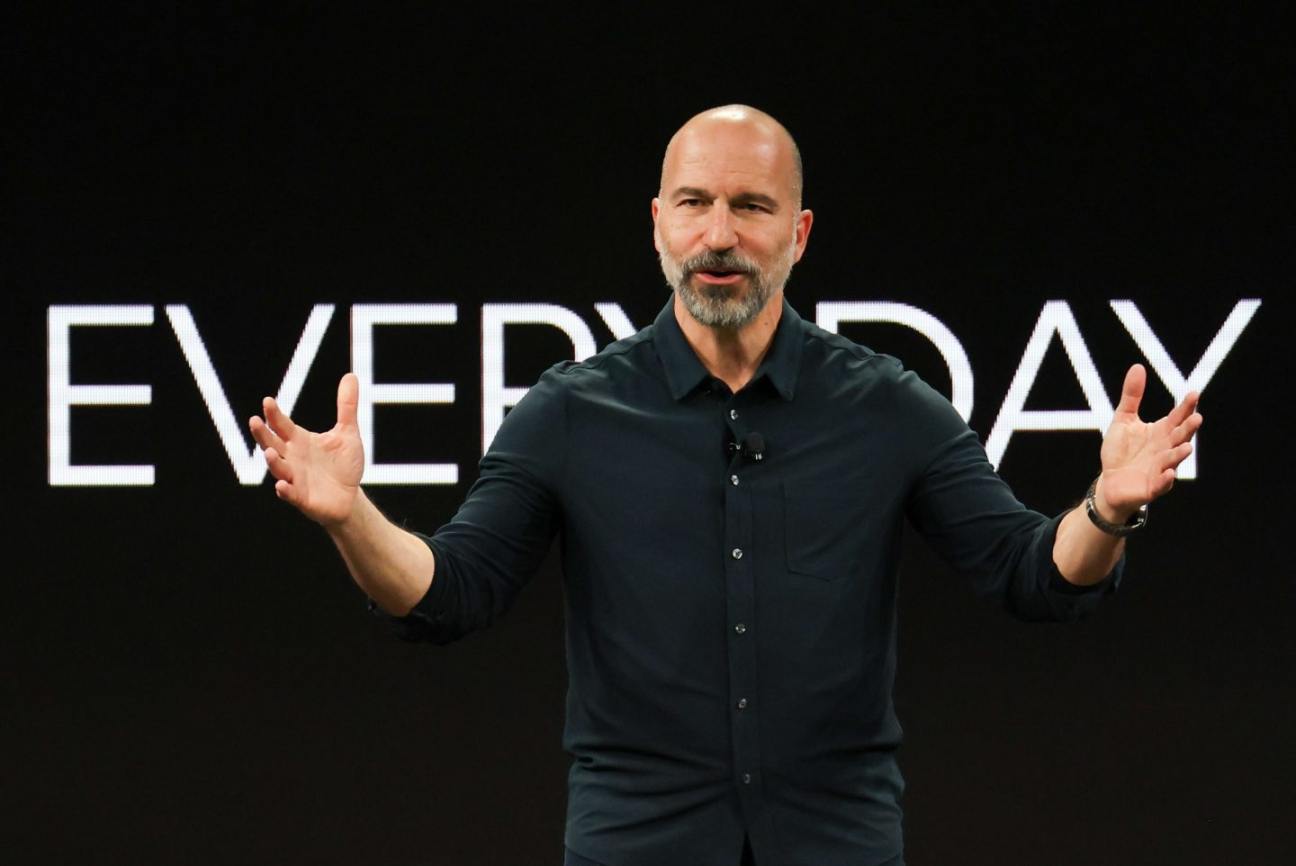

Dara Khosrowshahi, CEO of Uber

In June, Uber CEO Dara Khosrowshahi announced that the ride-sharing giant was considering stablecoins as a way to transfer funds globally. A year ago, a tech executive's remark would have been outrageous. But now, everything from Apple to Amazon, not to mention major banks and brokerages, are scrambling to embrace stablecoins, a cryptocurrency pegged to underlying assets like the U.S. dollar. What exactly has changed?

Most obviously, the regulatory environment in Washington, D.C., has shifted dramatically. The Senate has passed a bill that is currently being considered by the House of Representatives that would clear the way for stablecoins to be integrated into the financial system.

Crypto proponents also say...