On-chain data week review: Bitcoin hit a new high for the third time in the current cycle, or there is still room for growth

By Glassnode

Compiler: Felix, PANews

Highlights:

- The Bitcoin market continued to strengthen, hitting a new high of $111,000, the third new high in the cycle.

- Investors' profitability and selling behaviour have improved significantly, and are still below the previous peak of the bull market.

- Exchange-related interactions have increased dramatically, with about 33% of Bitcoin's on-chain trading volume now taking place through centralised exchanges.

- Activity in the derivatives space is also increasing, with both open interest in both the futures and options markets seeing significant growth.

- If Bitcoin rises further, $120,000 will be the key area. Based on the crossover of on-chain price models in previous cycles, it is expected that seller pressure will accelerate in and around this area.

Bitcoin breaks new highThe

Bitcoin market remains strong, reaching a new high of $111,000, which is the third time in the cycle that it has broken through a new all-time high. Historically, the price discovery phase has often been followed by a brief sell-off, as early gainers have seized the opportunity to exit at new highs and reduce risk.

Bitcoin has followed this pattern so far, falling back to $107,000 shortly after the initial breakout before recovering and consolidating around $108,000 for the rest of the week.

Against the backdrop of a challenging macroeconomic situation and heightened geopolitical tensions, Bitcoin has outperformed most asset classes, making the overall outlook uncertain. In a relatively difficult market environment, this strong performance is indeed an encouraging sign.

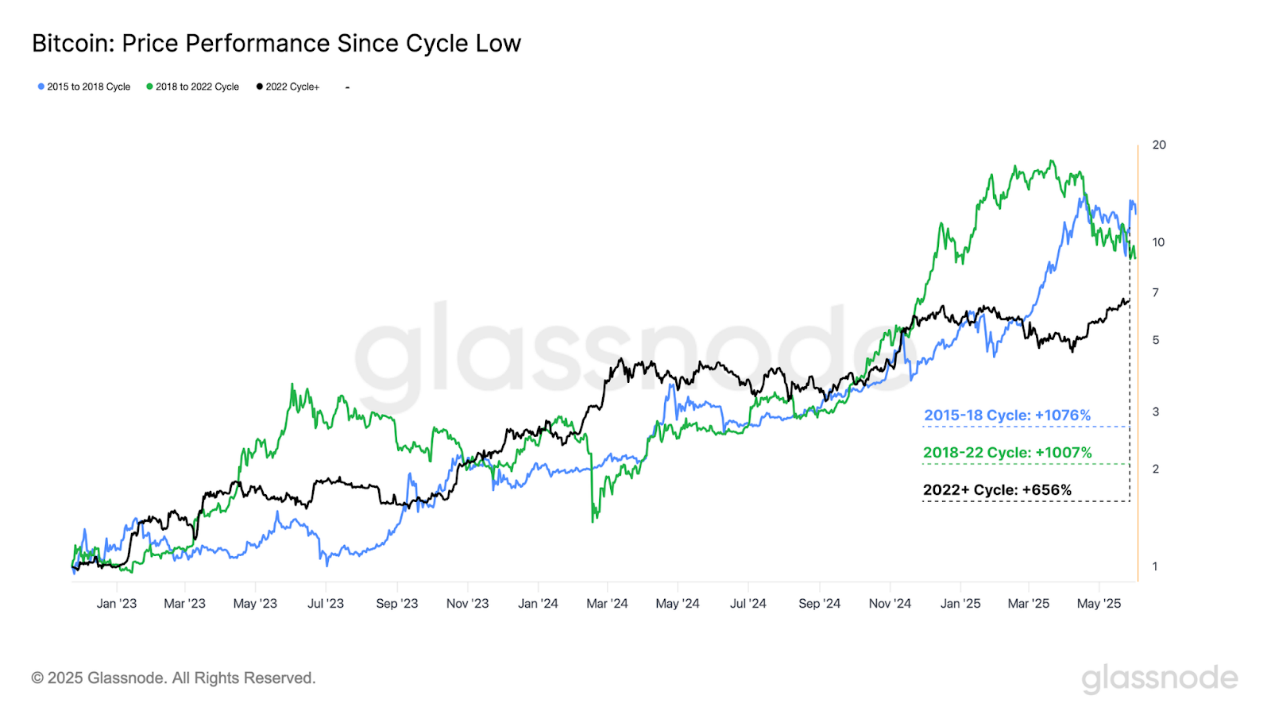

: GlassnodeComparingthe

price performance of the current cycle with the previous cycle, you will find that although the total market capitalisation size of Bitcoin differs by several orders of magnitude, there is a striking similarity in structure. The chart below illustrates the performance since the relative cycle lows:

- 2015-2018 cycle: +1076%

- 2018-2022 cycle: +1007%

- 2022 and beyond: +656%

It's a remarkable achievement to still be so close to the previous cycle considering that Bitcoin has increased its market cap so much today. This shows that the scale of demand for Bitcoin keeps pace with the growth rate of the asset.

: Glassnode

Evaluating the pattern of overweight for different wallet sizes, we can see that new highs tend to inspire significant overweight. This will push the overweight trend score towards the highest value of 1.0.

Notably, the pressure to increase holdings has increased significantly when it hit all-time highs of $70,000 and $107,000 in March and November 2024, respectively. This suggests that investors tend to buy heavily as the market enters the price discovery phase, but it also shows that existing holders tend to take profits when prices are higher. This "herd effect" highlights the convergence behaviour of market participants at key psychological levels and events, such as breaking new highs.

In contrast, the last cycle, which hit an all-time high of $69,000 in November 2021, has faced significant overweight pressure during and after the price peak. This finally marked the arrival of a cyclical top and kicked off a long bear market in 2022. While a strong overweight is usually a positive sign, it's important to recognise that overwhelming consensus behaviour isn't always a reliable indicator of future direction (it can actually be a contrarian indicator).

Source: Glassnode

Price Discovery ExplorationAs

the Bitcoin price returns to the price discovery phase, on-chain data and technical metrics can be combined to assess market momentum and identify potential signs of overheating.

The111-day moving average (DMA) and 200-day moving average are common technical indicators to assess the momentum and trend strength of the Bitcoin market. These technical price models can also be supplemented with an on-chain metric called short-term holder cost, which reflects the average purchase price for new investors in the market. Historically, this level has been a critical threshold and is often used to distinguish between local bull and bear markets.

- 111-Day Moving Average: $91,800

- 200-Day Moving Average: $94,300

- Short-Term Holding Cost: $95,900

Bitcoin price is currently well above these three key levels, highlighting the strength of the market rally since April. It is important to note that these price levels are very close numerically, and this convergence has created a convergence in a key support area, which is crucial if further upward momentum is to be maintained.