Sonic był jedną z najbardziej udanych prób uruchomienia mainnetu / GTM do tej pory w tym cyklu.

Zaledwie kilka miesięcy po uruchomieniu mainnetu, Sonic przekroczył 1 miliard dolarów w TVL i jest siecią o najwyższych wpływach netto od początku roku.

→ Wysokowydajny EVM, zbliża się równoległe wykonywanie

→ Finałowość 320 ms i teoretyczny limit 370 tys. TPS

→ Natywnie zintegrowany system oceny punktowej

→ Monetyzacja gazu (do 90% trafia do budowniczych)

→ Zachęty do udziału w programach Sonic Boom i Airdrop

→ Wysoce bezpieczna brama do Ethereum

→ więcej

Dzięki @RedactedRes niedawno ponownie przyjrzeliśmy się ekosystemowi @SonicLabs, aby dowiedzieć się, co dzieje się w onchain i dlaczego.

Sprawdź nasze szczegółowe informacje poniżej! ↓

Stan sieci dźwiękowej

@SonicLabs jest dostępny w mainnecie od pięciu miesięcy,

zastępując Fantom i dąży do tronu DeFi.

Ponieważ Sonic właśnie przekroczył 1 miliard dolarów TVL, trajektoria wydaje się obiecująca.

Ale czy nowa sieć @AndreCronjeTech spełni oczekiwania?

Czas się przekonać ↓

Aby przygotować grunt, najpierw przeanalizujmy stos technologiczny Sonica na wysokim poziomie.

Nie będziemy jednak zagłębiać się w chwasty, aby uzyskać bardziej szczegółowe informacje na temat architektury i funkcji sieci, sprawdź cytowany post poniżej.

➀ Stos technologii dźwiękowych:

→ Finality około 700 ms, przewyższając łańcuchy o wysokiej wydajności, takie jak Aptos (900 ms) i znacznie wyprzedzając większość łańcuchów EVM.

→ Osiągnięto przepustowość >10 000 TPS, skalowalną w kierunku 20 000+ z ciągłym rozwojem w celu zwiększenia wydajności dzięki równoległemu wykonywaniu.

→ Implementuje oparty na DAG asynchroniczny konsensus Byzantine Fault Tolerance (aBFT) (Lachesis) w połączeniu z SonicDB, optymalizując wymagania dotyczące pamięci masowej węzłów (redukcja o ~90% w porównaniu z Fantom Opera).

→ Wykorzystuje oczyszczanie na żywo w celu zmniejszenia zapotrzebowania na pamięć masową walidatora, umożliwiając ciągłą pracę poprzez automatyczne usuwanie danych historycznych za pośrednictwem oddzielnych bieżących i archiwalnych baz danych.

→ Minimalne opłaty transakcyjne (zazwyczaj <1 cent) zapewniają doskonałe wrażenia użytkownika.

Jednak, chociaż stanowi to mocną podstawę, sama wydajność nie jest tym, co napędza wzrost gospodarki onchain, którą Sonic zamierza skalować.

To, co naprawdę odróżnia Sonic od innych łańcuchów (EVM), to szereg naprawdę unikalnych funkcji, mających na celu skuteczne przyciągnięcie zarówno konstruktorów, jak i użytkowników.

➁ Podstawowe wyróżniki:

→ Monetyzacja opłat za gaz: Deweloperzy zarabiają do 90% opłat za gaz generowanych przez ich dApps, co bezpośrednio zachęca do rozwoju wysokiej jakości.

→ Natywny scoring kredytowy on-chain: Zachowujący prywatność scoring kredytowy on-chain bez KYC odblokowuje niedostatecznie zabezpieczone rynki pożyczkowe szacowane na 11,3 biliona dolarów.

→ Abstrakcja konta natywnego: Bezproblemowe wdrażanie i interakcje użytkowników za pośrednictwem loginów społecznościowych i sponsorowania gazu przez osoby trzecie.

→ Solidne zabezpieczenia mostu: Sonic Gateway wykorzystuje zdecentralizowaną walidację i zawiera wbudowane mechanizmy awaryjnych wypłat, znacznie łagodząc tradycyjne ryzyko pomostowe.

Okej, spoko, ale co z danymi?

Czy ludzie w ogóle używają Sonica?

Przyjrzyjmy się bliżej kluczowym wskaźnikom ekosystemu.

➂ Analiza oparta na danych

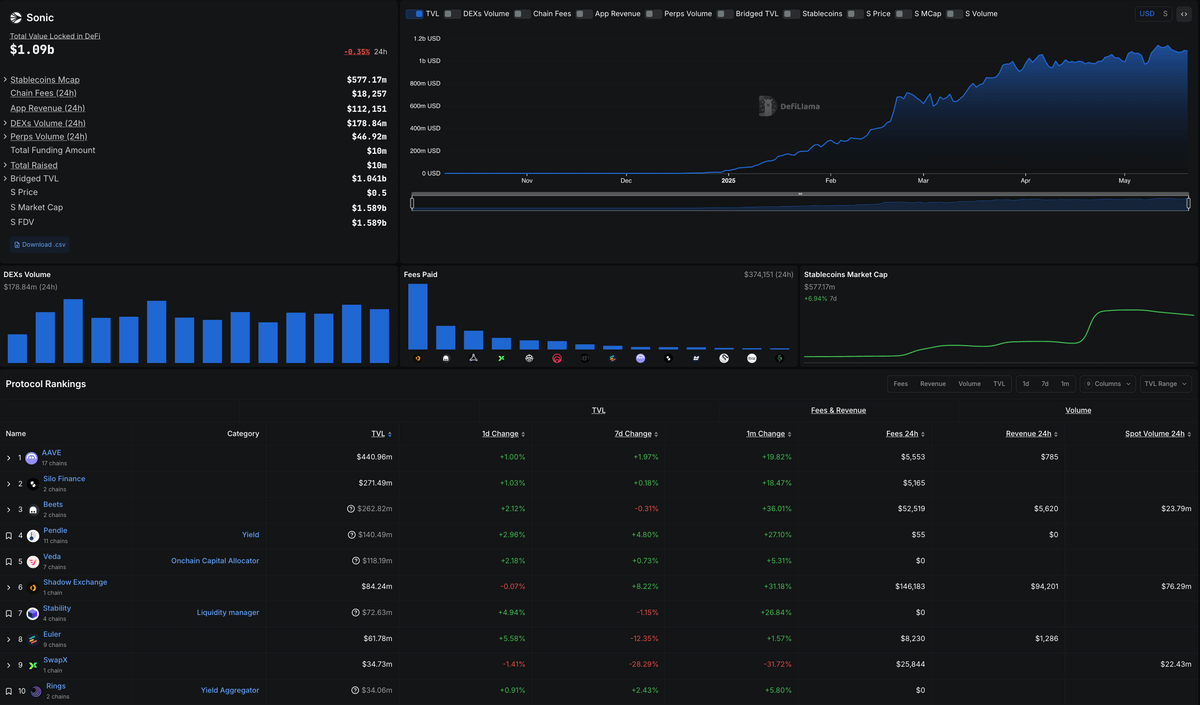

→ Sonic TVL gwałtownie wzrósł z ~27 mln USD w momencie premiery do około 1,09 mld USD w ciągu pięciu miesięcy, wykazując stały napływ kapitału.

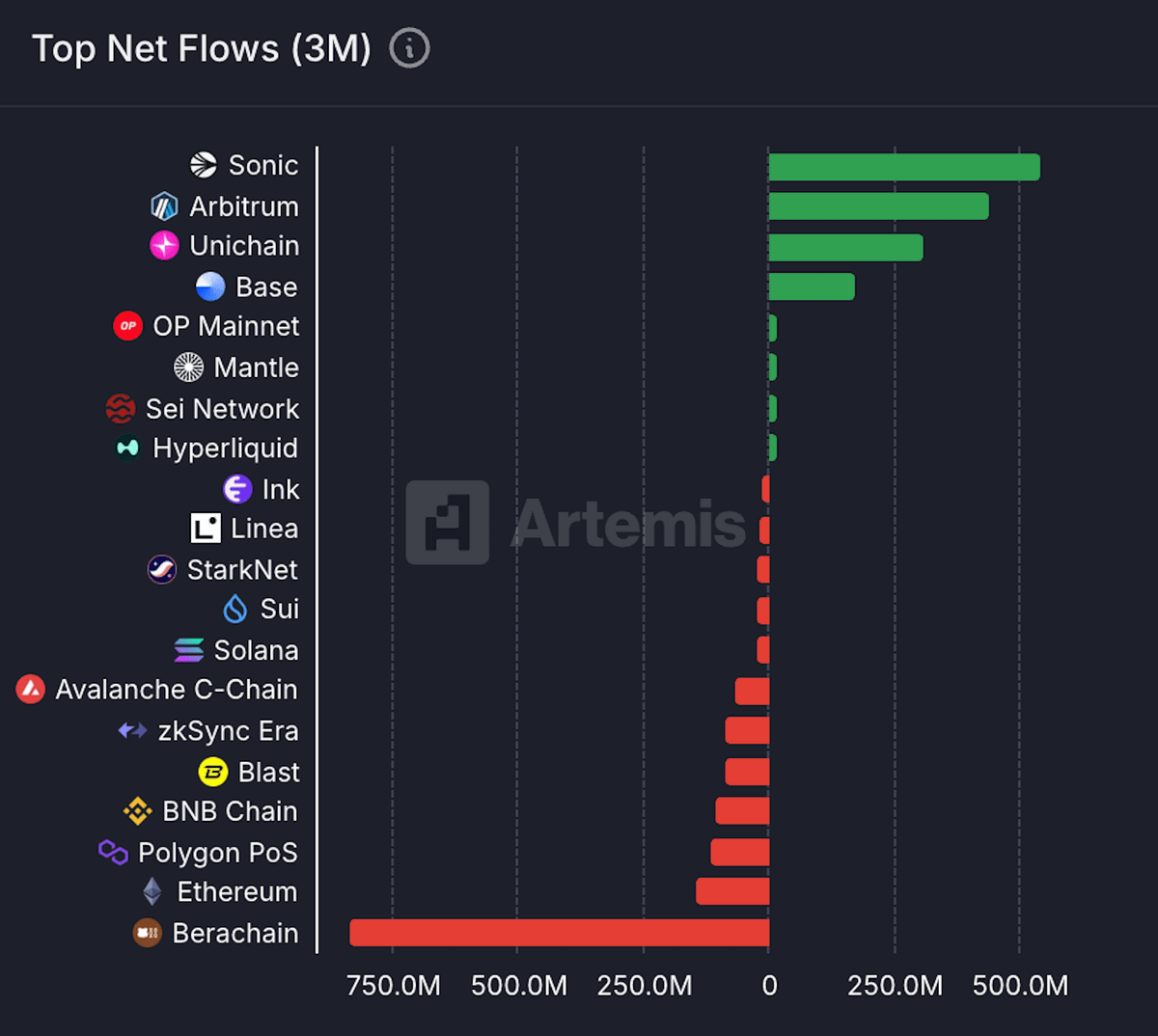

→ Sonic Network zapewnił sobie najwyższe wpływy netto (~505 mln USD w ciągu ostatnich 3 miesięcy, głównie z Ethereum) ze wszystkich łańcuchów, wyprzedzając głównych konkurentów, takich jak @arbitrum, @base czy @unichain.

→ Dominujące protokoły DeFi według TVL obejmują @aave V3 (440,96 mln USD), @SiloFinance (271,49 mln USD) i @beets_fi (~262,82 mln USD). To rozprzestrzenianie się TVL w różnych aplikacjach zmniejsza ryzyko systemowe i wskazuje na zdrową dywersyfikację protokołów.

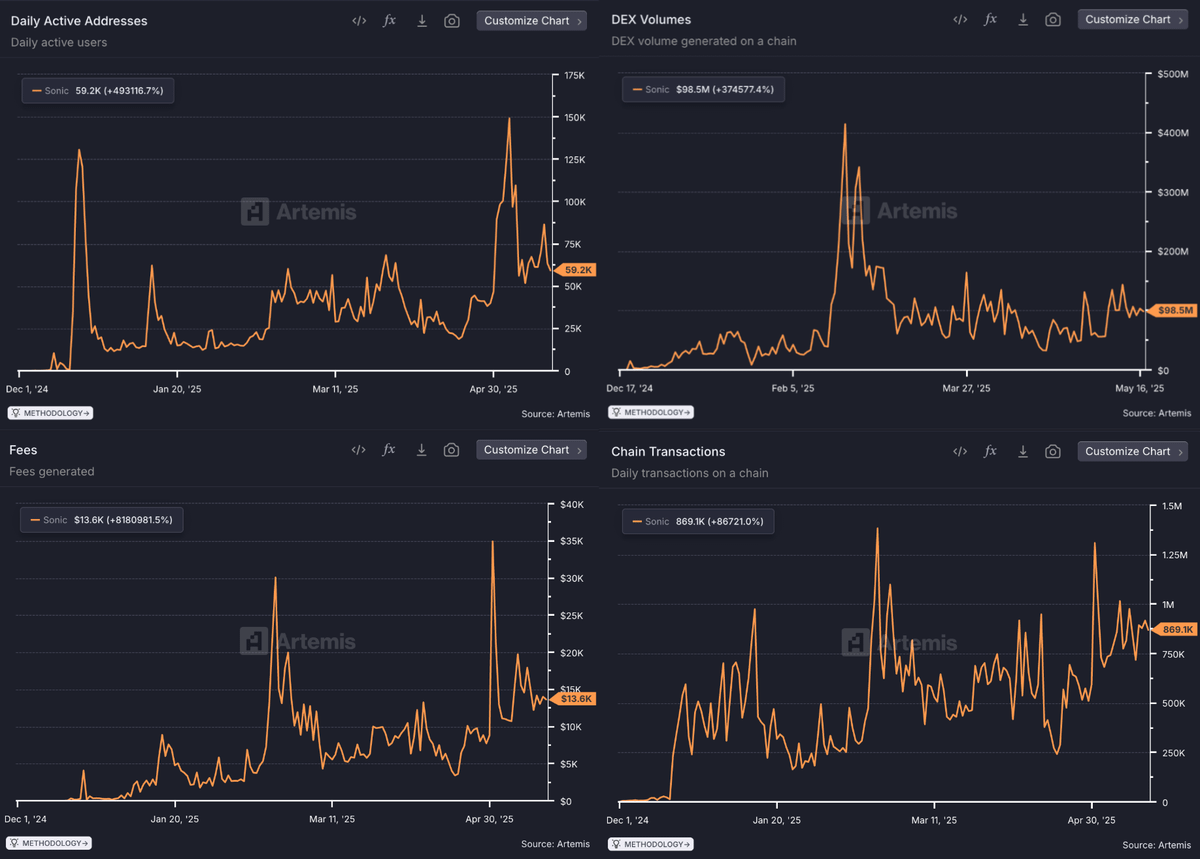

→ Dzienne aktywne adresy wzrosły do szczytowego poziomu ~170 000, stabilizując około ~60 000 użytkowników, co wskazuje na razie na solidną retencję użytkowników (nawet jeśli tą metryką można łatwo manipulować).

→ Dzienne wolumeny transakcji stale przekraczają 800 000, osiągając szczyt powyżej 1,3 miliona, co wskazuje na znaczne zaangażowanie wykraczające poza początkowy szum związany z wprowadzeniem na rynek. Musimy jednak po raz kolejny pamiętać, że tego rodzaju metryki są dość łatwe do manipulowania.

→ wolumeny DEX wzrosły początkowo do ~ 450 mln USD dziennie, przy utrzymujących się wolumenach około ~ 100 mln USD, co świadczy o silnej i stabilnej aktywności handlowej + płynności. Jednak objętość organiczna jest prawdopodobnie niższa.

→ Generowane opłaty osiągały szczyty około 35 000 USD dziennie, stabilizując się na poziomie około 13 600 USD, podkreślając znaczną aktywność gospodarczą i potencjał przychodów deweloperów.

→ Kapitalizacja rynkowa stablecoinów (577,17 mln USD) szybko rośnie i wzmacnia znaczną głębokość płynności sieci, wspierając działalność handlową i pożyczkową.

Ogólnie rzecz biorąc, dane wyraźnie pokazują silne fundamenty, co wskazuje, że strategia Sonica, aby powrócić do dawnej chwały DeFi Fantom, działa dobrze.

Nasuwa się jednak pytanie: co dokładnie ci wszyscy użytkownicy robią ze swoimi pieniędzmi na @SonicLabs?

➃ Plony + Rolnictwo punktowe na Sonicu

Niewątpliwie silnym czynnikiem przyciągającym, który przyciąga płynność i użytkowników z innych łańcuchów i ekosystemów, są zyski, które można uprawiać w pulach płynności i pożyczek w ekosystemie Sonic.

Różne miejsca oferują rynki stablecoinów, które przynoszą atrakcyjne APY w wysokości 5-12%, podczas gdy pule płynności w całym ekosystemie zapewniają stałe APR na poziomie 15-30%, przy czym niektóre z nich przynoszą jeszcze wyższe zyski, zapewniając trwałe zachęty dla dostawców płynności.

Zaawansowane produkty finansowe, takie jak @pendle_fi (tokenizacja plonów), @eggsonsonic (lewarowane rolnictwo plonów) i @Rings_Protocol (stabilne kryptowaluty przynoszące plony) dodatkowo zapewniają bardziej wyrafinowane opcje strategii rolniczej i poszerzają ogólny zakres możliwości dla użytkowników.

Wreszcie, co nie mniej ważne, zyski ze stakingu pozostają porównywalnie atrakcyjne na poziomie 5-8%, wzmocnione płynnymi instrumentami pochodnymi do obstawiania, takimi jak $stS, które ułatwiają dalszą integrację DeFi, co stanowi znaczną poprawę w porównaniu z infrastrukturą do obstawiania Fantom Opera, która w dużej mierze nie zawierała żadnych opcji płynnego obstawiania.

Jednak prawdopodobnie nie tylko RRSO przyciąga użytkowników i napędza dzienną liczbę transakcji, która stale przekracza 1 milion, a łączna liczba unikalnych adresów zbliża się do 2,5 miliona.

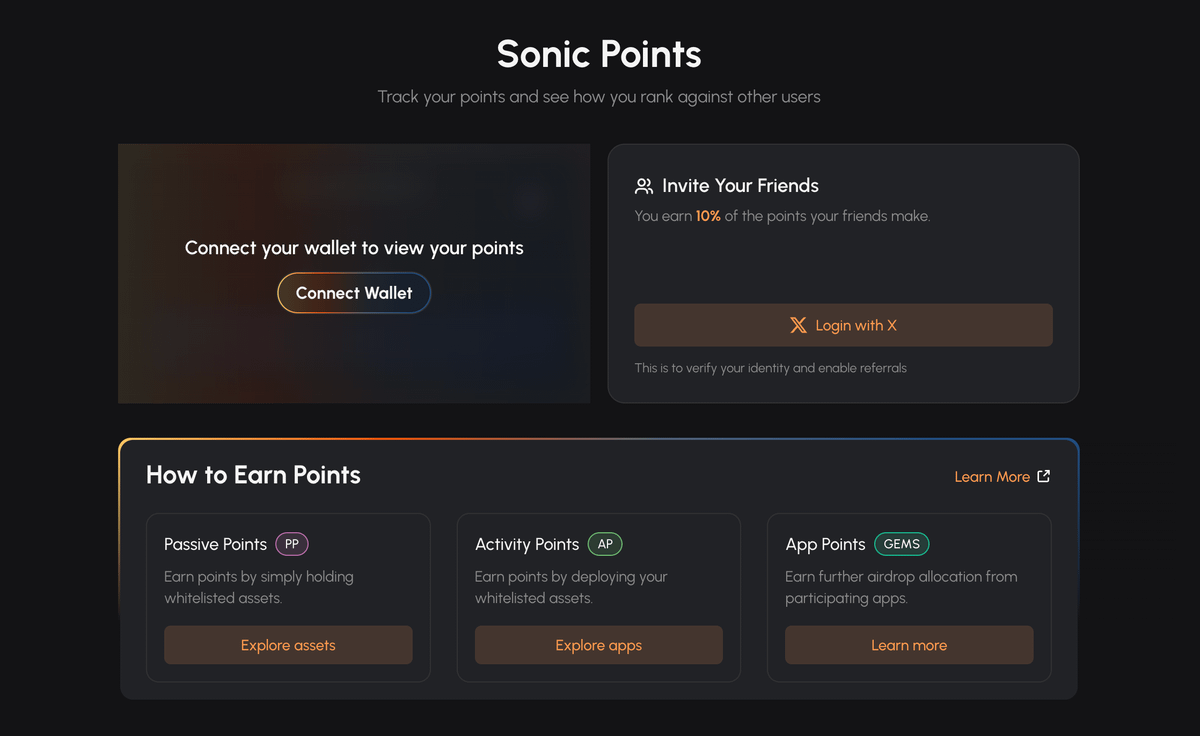

Podczas gdy aktywność deweloperów jest znacznie zwiększana przez Sonic Innovator Fund (200 mln przydzielonych tokenów $S) i zachęty dla programistów Sonic Boom, Sonic stosuje również strategiczny system motywacyjny oparty na punktach, mający na celu zwiększenie adopcji i zaangażowania użytkowników w całym ekosystemie.

System Sonic Points działa poprzez nagradzanie użytkowników za wykonywanie różnych działań w łańcuchu, takich jak handel, udzielanie pożyczek, zapewnianie płynności, staking i łączenie aktywów z siecią. Każda akcja daje użytkownikowi określoną liczbę punktów, które kumulują się, aby określić uprawnienia do ukierunkowanych zrzutów $S tokenów.

Aby jeszcze bardziej zachęcić do określonych zachowań związanych z rozwojem ekosystemu, Sonic wprowadził mnożniki dla niektórych działań, takich jak deponowanie stablecoinów na kluczowych rynkach pożyczkowych lub zapewnianie płynności podstawowym parom handlowym, przyznając mnożniki do 12-15 punktów. To znacznie zwiększa postrzeganą wartość uczestnictwa w tych krytycznych działaniach, tworząc silną zachętę dla użytkowników do aktywnego i konsekwentnego angażowania się w aplikacje DeFi na Sonic.

W związku z tym użytkownicy są motywowani nie tylko natychmiastowymi zyskami, ale także znacznym potencjałem wzrostu związanym z przyszłymi airdropami. Ta zgrywalizowana struktura nagród w szczególności przyczyniła się do utrzymania użytkowników po uruchomieniu (przynajmniej do tej pory), co znajduje odzwierciedlenie w wysokiej dziennej aktywności adresów ekosystemu i stabilnych wolumenach transakcji.

Wydaje się, że system airdropów oparty na punktach Sonica skutecznie katalizował adopcję organiczną i rozwój społeczności, zapewniając użytkownikom aktywność poza krótkoterminowymi zachętami do uprawy dzięki protokołom warstwy aplikacji.

➄ Wniosek

Początkowe wskaźniki Sonica wykazują przyzwoitą przyczepność, wspieraną przez silne możliwości techniczne i strategicznie zaprojektowane zachęty. Jednak znaczna część jego szybkiego wzrostu wydaje się być ściśle związana z obecnie obowiązującymi agresywnymi strukturami nagród.

Idąc dalej, głównym wyzwaniem jest przekształcenie tej motywowanej adopcji w zrównoważoną działalność organiczną i innowacyjne dApps. Podczas gdy innowacje Sonica są godne pochwały, prawdziwa długoterminowa rentowność i odporność sieci będzie w dużej mierze zależała od utrzymania użytkowników i aktywności ekosystemu po zmniejszeniu programów motywacyjnych.

Szczególnie interesujące będzie obserwowanie, czy Sonic będzie w stanie utrzymać swój wczesny impet i przekształcić przelotne zainteresowanie w trwałe, fundamentalne zaangażowanie. Unikalne prymitywy DeFi Sonica i zintegrowane funkcje, takie jak punktacja kredytowa onchain, monetyzacja opłat za paliwo i natywna abstrakcja konta, mogą być tutaj kluczowe.

⚠️ Nie jest to porada finansowa, a raport NIE jest sponsorowany przez żadną stronę trzecią.

42,28 tys.

14

Treści na tej stronie są dostarczane przez strony trzecie. O ile nie zaznaczono inaczej, OKX nie jest autorem cytowanych artykułów i nie rości sobie żadnych praw autorskich do tych materiałów. Treść jest dostarczana wyłącznie w celach informacyjnych i nie reprezentuje poglądów OKX. Nie mają one na celu jakiejkolwiek rekomendacji i nie powinny być traktowane jako porada inwestycyjna lub zachęta do zakupu lub sprzedaży aktywów cyfrowych. Treści, w zakresie w jakim jest wykorzystywana generatywna sztuczna inteligencja do dostarczania podsumowań lub innych informacji, mogą być niedokładne lub niespójne. Przeczytaj podlinkowany artykuł, aby uzyskać więcej szczegółów i informacji. OKX nie ponosi odpowiedzialności za treści hostowane na stronach osób trzecich. Posiadanie aktywów cyfrowych, w tym stablecoinów i NFT, wiąże się z wysokim stopniem ryzyka i może podlegać znacznym wahaniom. Musisz dokładnie rozważyć, czy handel lub posiadanie aktywów cyfrowych jest dla Ciebie odpowiednie w świetle Twojej sytuacji finansowej.