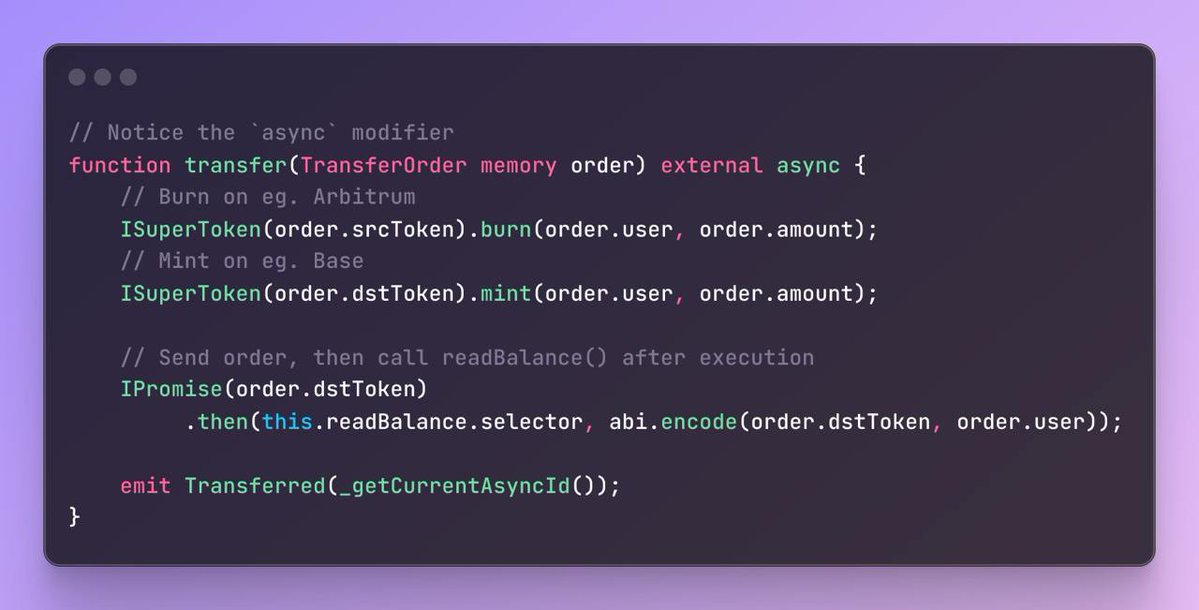

Pour illustrer à quel point cela est puissant pour les développeurs :

c’est ainsi que vous pouvez graver un jeton sur une chaîne et le frapper sur une autre en utilisant l’abstraction de la chaîne SOCKET

représenterait plus de 100 lignes de code dans un monde de messagerie inter-chaînes

Contrats intelligents asynchrones optimisés par SOCKET

J’ai passé un week-end à réfléchir aux applications phares de ce cycle, à ce qu’elles ont en commun et à ce que cela se rapporte à ce que nous faisons chez SOCKET.

À savoir, beaucoup d’applications à succès ont changé la donne en rompant avec le statu quo accepté et en introduisant de nouvelles architectures pour offrir de nouvelles primitives ou de meilleures expériences utilisateur.

@hyperliquid > modifié la conception de mempool pour donner la priorité aux annulations d’ordres au sein d’un bloc - crucial pour qu’un carnet d’ordres on-chain réussisse, que les MM fournissent de la liquidité et évitent un flot de tx défaillants

@cowswap -> introduit des enchères hors chaîne pour permettre le regroupement des tx des utilisateurs, trouver les COW et permettre la concurrence des solveurs

@ethena > exécute des transactions de base sur les CEX, contrairement à leurs prédécesseurs qui étaient limités à des DEX beaucoup plus petits, tout en conservant les garanties sur la chaîne

C’est exactement l’avenir que nous envisageons.

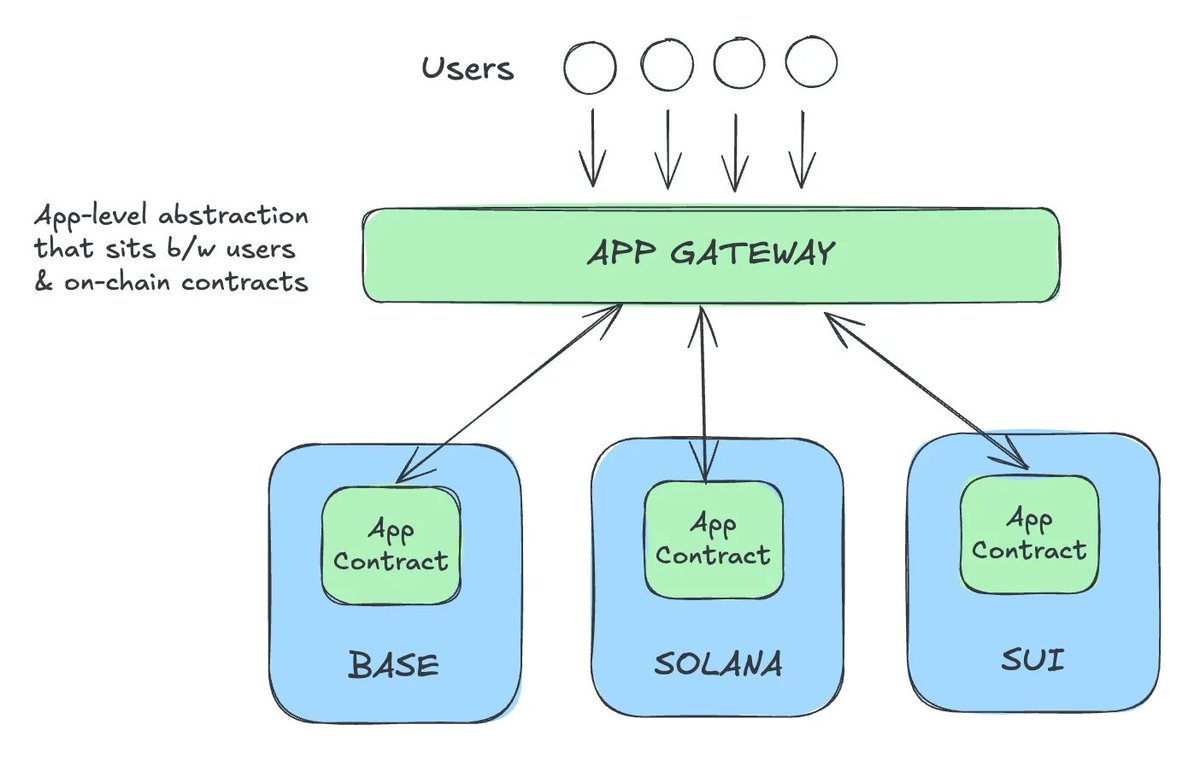

Le protocole d’abstraction en chaîne de SOCKET permet aux créateurs de créer des applications qui bénéficient de niveaux de personnalisation similaires via son concept d’AppGateway. Les AppGateways sont une abstraction au niveau de l’application qui se situe au-dessus de toutes les chaînes, entre les utilisateurs et les contrats sur la chaîne.

Avec AppGateway, les créateurs d’applications peuvent définir n’importe quelle logique de pré-exécution pour les transactions avant qu’elles n’atterrissent sur la chaîne. Une transaction utilisateur atteint la passerelle, les AppGateways exécutent leur logique, puis un flux de transactions est exécuté sur la chaîne.

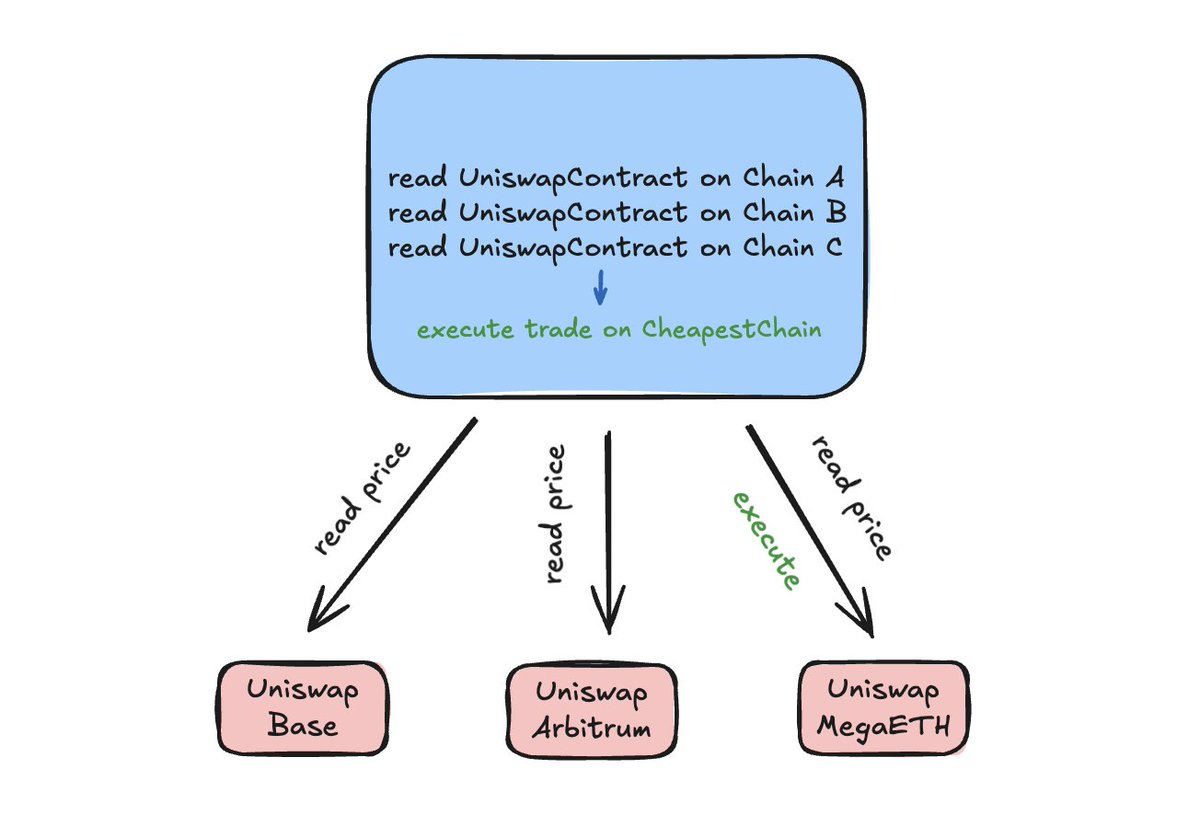

N’importe lequel des 3 exemples précédents pourrait être construit sur SOCKET. Mais là où cela brille vraiment, c’est si un constructeur d’applications veut écrire une application qui exécute une logique sur plusieurs chaînes.

Avec SOCKET, ils peuvent écrire leur application avec une solidité normale, comme si elle fonctionnait sur une seule chaîne. Les contrats d’une chaîne peuvent être composés de manière transparente avec des contrats d’autres chaînes ou même avec des systèmes hors chaîne.

Il est important de noter qu’ils n’ont pas besoin d’écrire du code spaghetti ultra complexe pour gérer la messagerie inter-chaînes. Demander à un constructeur d’applications en crypto de comprendre la messagerie inter-chaînes, c’est comme demander à un développeur web2 de s’occuper de TCP/IP pour gérer le transport et le routage des paquets de données émis par son application.

Dans le statu quo d’aujourd’hui avant SOCKET, un constructeur qui veut, par exemple, lire le prix d’un actif sur 3 chaînes différentes pour exécuter une transaction là où il est le moins cher, doit écrire un contrat qui envoie des messages à toutes les chaînes, récupérer les prix, renvoyer les messages à la chaîne d’origine et s’occuper de la vérification des messages, du coût et de la latence. Impossible de créer une expérience utilisateur transparente à l’aide de l’ensemble d’outils actuel.

Du point de vue du constructeur d’applications, vous pouvez considérer que SOCKET prend en charge toute l’orchestration nécessaire à travers les chaînes pour établir ce qui a été défini dans l’AppGateway par une armée d’acteurs hors chaîne pour exécuter les actions de vos utilisateurs avec une sécurité modulaire sur la chaîne.

En production en ce moment, nous avons :

@BungeeExchange notre place de marché de liquidité, qui réalise un volume de > milliard de dollars par mois, est la première application construite sur SOCKET. Le BungeeGateway est l’endroit où les intentions et les transactions de l’utilisateur sont traitées et mises en correspondance avec des solveurs et des remplisseurs.

@useenclave est en train de créer une couche « Universal Balance » en tant que service pour permettre aux portefeuilles d’extraire les soldes de chaîne fragmentés et de les remplacer par un solde fongible que les utilisateurs peuvent dépenser sur n’importe quelle chaîne, instantanément. Ici, l’EnclaveGateway fait correspondre les commandes des utilisateurs avec Paymasters.

@rathfinance transforme le rendement de la DeFi en une fonctionnalité native pour les portefeuilles. Les fonds des utilisateurs sont automatiquement acheminés vers les meilleures opportunités à travers les chaînes, sans étapes supplémentaires.

Des projets comme @derivexyz @aevoxyz @KintoXYZ @reya_xyz etc. utilisent SOCKET pour les dépôts abstraits en chaîne dans leur application.

Mais nous ne faisons qu’effleurer la surface de ce qu’il est possible de construire avec cette nouvelle façon de créer des applications.

C’est littéralement le jour 0 pour Chain Abstraction.

Si vous construisez quelque chose d’ambitieux dans le domaine de la crypto aujourd’hui, contactez-nous.

12,77 k

57

Le contenu de cette page est fourni par des tiers. Sauf indication contraire, OKX n’est pas l’auteur du ou des articles cités et ne revendique aucun droit d’auteur sur le contenu. Le contenu est fourni à titre d’information uniquement et ne représente pas les opinions d’OKX. Il ne s’agit pas d’une approbation de quelque nature que ce soit et ne doit pas être considéré comme un conseil en investissement ou une sollicitation d’achat ou de vente d’actifs numériques. Dans la mesure où l’IA générative est utilisée pour fournir des résumés ou d’autres informations, ce contenu généré par IA peut être inexact ou incohérent. Veuillez lire l’article associé pour obtenir davantage de détails et d’informations. OKX n’est pas responsable du contenu hébergé sur des sites tiers. La détention d’actifs numériques, y compris les stablecoins et les NFT, implique un niveau de risque élevé et leur valeur peut considérablement fluctuer. Examinez soigneusement votre situation financière pour déterminer si le trading ou la détention d’actifs numériques vous convient.