Most stablecoins sit in wallets.

And don't generate yield.

But some new ones actually give you extra rewards while you hold them.

They're called yield-bearing stablecoins and they work totally different from regular ones.

Here's some tea on yield:

Regular stablecoins = (almost) always $1/€1.

Yield-bearing stablecoins = start at 1, but give you rewards over time.

Think of them like a savings account, but everything happens automatically (on the blockchain, ofc).

And the rewards come from different places.

Yield can come in two ways:

- Rebasing = your wallet balance goes up over time (more tokens)

- Value accrual = token count stays same but each token is worth more than $1 (or €1)

Both give you extra value but mechanisms work differently.

Lending-pool wrappers are the simplest type.

You deposit USDC into Aave or Compound and get aUSDC back.

Your aUSDC slowly grows in value as the lending pool earns interest.

When people borrow less, your rewards go down.

RWA-backed stablecoins buy real-world assets like Treasury bills.

Projects like USDM and USDY park funds in short-term government bonds.

The interest from those bonds becomes your yield.

Often restricted because regulation sets the access gates...

Basis-trading stablecoins use delta-neutral strategies.

They buy $1 of ETH spot and short $1 of ETH futures.

Price changes cancel out but they collect funding fees from the futures market.

When funding flips negative, smart contracts can switch sides.

Protocol-fee models share trading revenue directly.

Curve's scrvUSD takes fees from their lending protocol and pays holders.

More protocol activity = more rewards for holders.

Everything stays onchain with no external assets needed.

Hybrid models combine multiple strategies.

Maybe 70% Treasury bills for safety and 30% basis trading for higher yield.

Teams can adjust the mix when market conditions change.

But... more diversified can also mean more complex risk exposure.

You can stack yields through composability.

Pair two yield-bearing stablecoins in an AMM to earn swap fees + dual yields.

Or use yield stables as collateral to borrow more yield stables.

Meta-vaults automate the best strategies for you.

Main risks to watch:

- Smart-contract & oracle exploits

- Exchange failures (for basis trading)

- Interest rates crashing

- Liquidity crunches during exits

Yield-bearing stablecoins are growing fast.

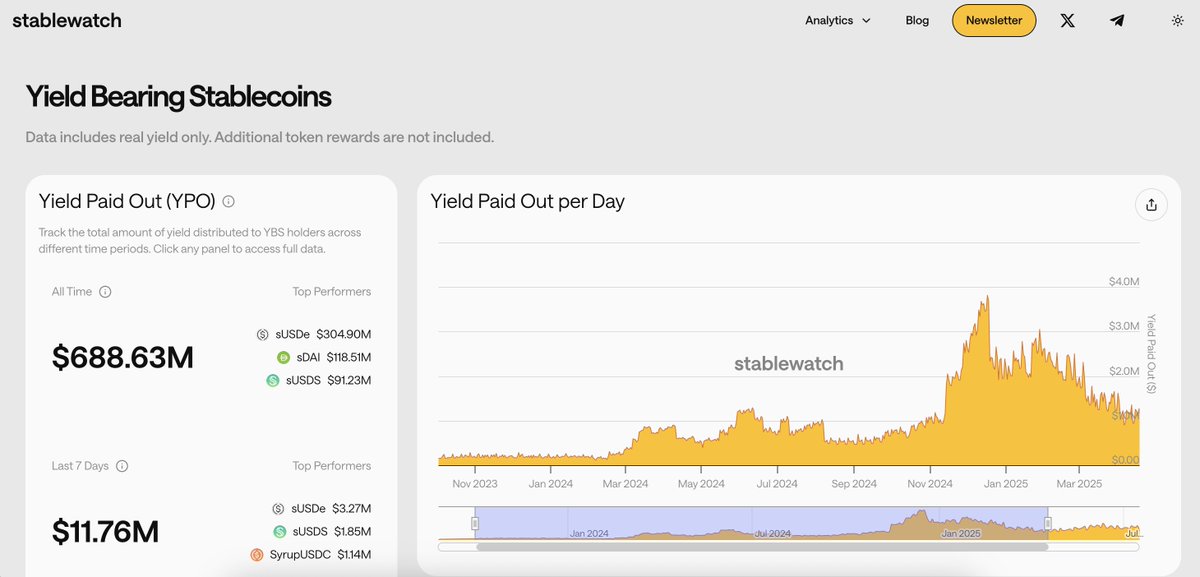

Market went from $660M to $12B in under a year according to @stablewatchHQ data.

Still tiny compared to $200B regular stablecoin market though.

Plus you can also check out how much yield is being paid out each day:

Btw, there are a lot more articles that cover similar topics on Stable School (ran in collaboration with @stable_summit)

Go check them out:

18.36K

86

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.