As altcoins estão a superar hoje, com o WSJ a reportar que durante a noite Trump irá assinar uma ordem executiva para abrir os 401ks aos mercados privados.

OWL, BX, APO, KKR, TPG, HLNE, etc.

Private Credit, Bitcoin Mining, and the Infrastructure of AI

News hit the tape yesterday that TeraWulf ($WULF), a Bitcoin miner developing AI-related infrastructure, is securing $350 million in project financing. JPMorgan and Morgan Stanley are arranging the deal, but the eventual lenders are expected to be private credit firms rather than CLOs or syndicated loan buyers.

This reflects a broader shift in how capital is being raised for emerging infrastructure. Bitcoin miners, like TeraWulf, have long faced limited financing options. Traditional lenders have been hesitant, pushing miners toward convertibles, equipment loans, or equity dilution. Now, as some of these firms begin building data centers to support AI workloads, they are running into similar roadblocks. For operators not backed by hyperscalers, the financing environment remains challenging. These projects are capital intensive, technically complex, and often fall outside the comfort zone of conventional debt markets. The old pipes are not keeping up with the new demands.

Private credit has emerged as a solution. It is faster, more tailored, and more concentrated. Securitization, by contrast, can offer broader distribution and deeper pools of capital but requires intermediaries, ratings, and a sales process to reach institutional buyers like insurers, pensions, and sovereign wealth funds.

The distinction between these approaches is becoming more consequential. Private credit is winning share because it fits complex, non-standard use cases, but it is difficult to scale. Securitization offers reach but lacks the flexibility needed for frontier sectors like AI infrastructure or digital assets. New hybrids -- including credit REITs, listed BDCs, and eventually bespoke securitized products -- may help bridge that gap. Each comes with its own tradeoffs in terms of liquidity, transparency, and control.

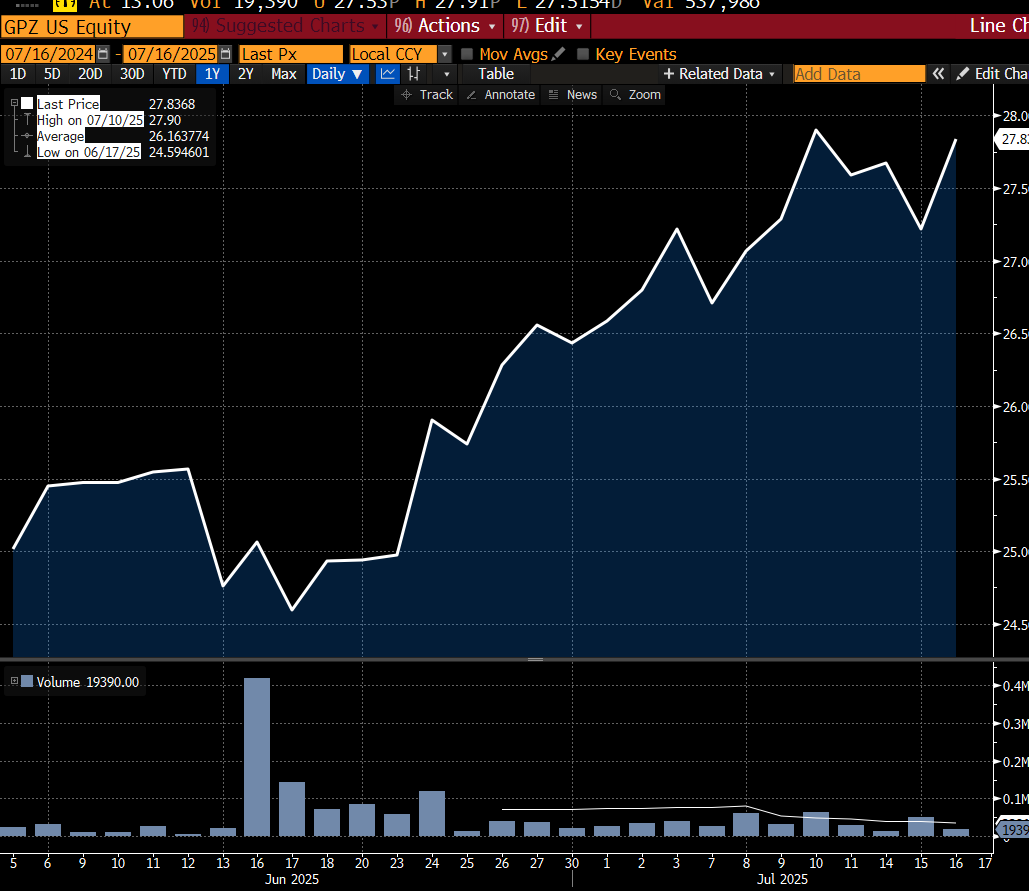

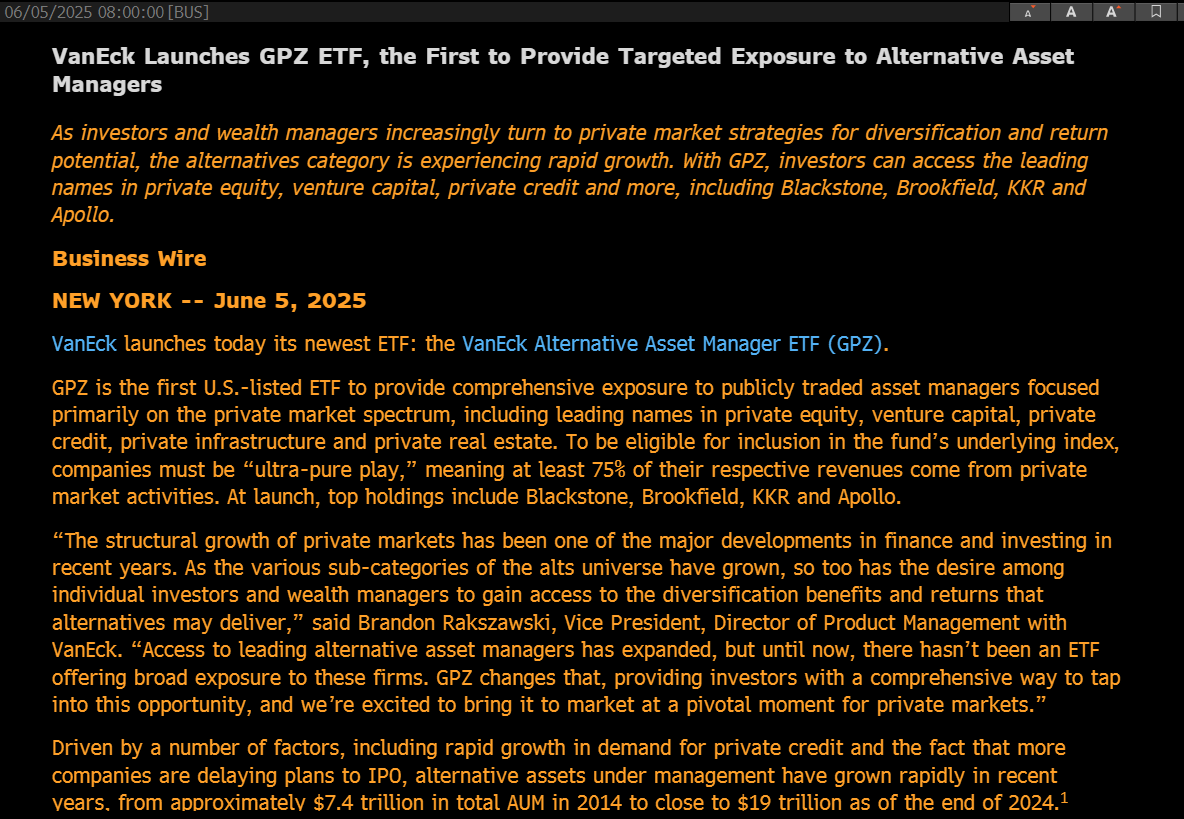

In order to realize the full potential of AI & Bitcoin, capital markets will need better access points, more flexible structures, and broader participation from both institutions and retail investors. If direct lending and private credit continue to expand their role in financing sectors like AI infrastructure and digital assets, the firms designing and executing these deals may stand to benefit. One way to express that view is through the just-launched VanEck Alternative Asset Manager ETF (ticker: GPZ), which began trading yesterday. It offers targeted exposure to firms such as Blackstone, Brookfield, KKR, Apollo, Carlyle, Ares, and TPG. These are the capital allocators who are increasingly shaping how modern infrastructure is financed and built - and taking a tidy cut in return.

Thank you for coming to my talk. Consider the risks below.

3,95 mil

12

O conteúdo apresentado nesta página é fornecido por terceiros. Salvo indicação em contrário, a OKX não é o autor dos artigos citados e não reivindica quaisquer direitos de autor nos materiais. O conteúdo é fornecido apenas para fins informativos e não representa a opinião da OKX. Não se destina a ser um endosso de qualquer tipo e não deve ser considerado conselho de investimento ou uma solicitação para comprar ou vender ativos digitais. Na medida em que a IA generativa é utilizada para fornecer resumos ou outras informações, esse mesmo conteúdo gerado por IA pode ser impreciso ou inconsistente. Leia o artigo associado para obter mais detalhes e informações. A OKX não é responsável pelo conteúdo apresentado nos sites de terceiros. As detenções de ativos digitais, incluindo criptomoedas estáveis e NFTs, envolvem um nível de risco elevado e podem sofrer grandes flutuações. Deve considerar cuidadosamente se o trading ou a detenção de ativos digitais é adequado para si à luz da sua condição financeira.