Le altcoin stanno sovraperformando oggi con il WSJ che riporta che Trump firmerà un ordine esecutivo per aprire i 401k ai mercati privati.

OWL, BX, APO, KKR, TPG, HLNE ecc.

Private Credit, Bitcoin Mining, and the Infrastructure of AI

News hit the tape yesterday that TeraWulf ($WULF), a Bitcoin miner developing AI-related infrastructure, is securing $350 million in project financing. JPMorgan and Morgan Stanley are arranging the deal, but the eventual lenders are expected to be private credit firms rather than CLOs or syndicated loan buyers.

This reflects a broader shift in how capital is being raised for emerging infrastructure. Bitcoin miners, like TeraWulf, have long faced limited financing options. Traditional lenders have been hesitant, pushing miners toward convertibles, equipment loans, or equity dilution. Now, as some of these firms begin building data centers to support AI workloads, they are running into similar roadblocks. For operators not backed by hyperscalers, the financing environment remains challenging. These projects are capital intensive, technically complex, and often fall outside the comfort zone of conventional debt markets. The old pipes are not keeping up with the new demands.

Private credit has emerged as a solution. It is faster, more tailored, and more concentrated. Securitization, by contrast, can offer broader distribution and deeper pools of capital but requires intermediaries, ratings, and a sales process to reach institutional buyers like insurers, pensions, and sovereign wealth funds.

The distinction between these approaches is becoming more consequential. Private credit is winning share because it fits complex, non-standard use cases, but it is difficult to scale. Securitization offers reach but lacks the flexibility needed for frontier sectors like AI infrastructure or digital assets. New hybrids -- including credit REITs, listed BDCs, and eventually bespoke securitized products -- may help bridge that gap. Each comes with its own tradeoffs in terms of liquidity, transparency, and control.

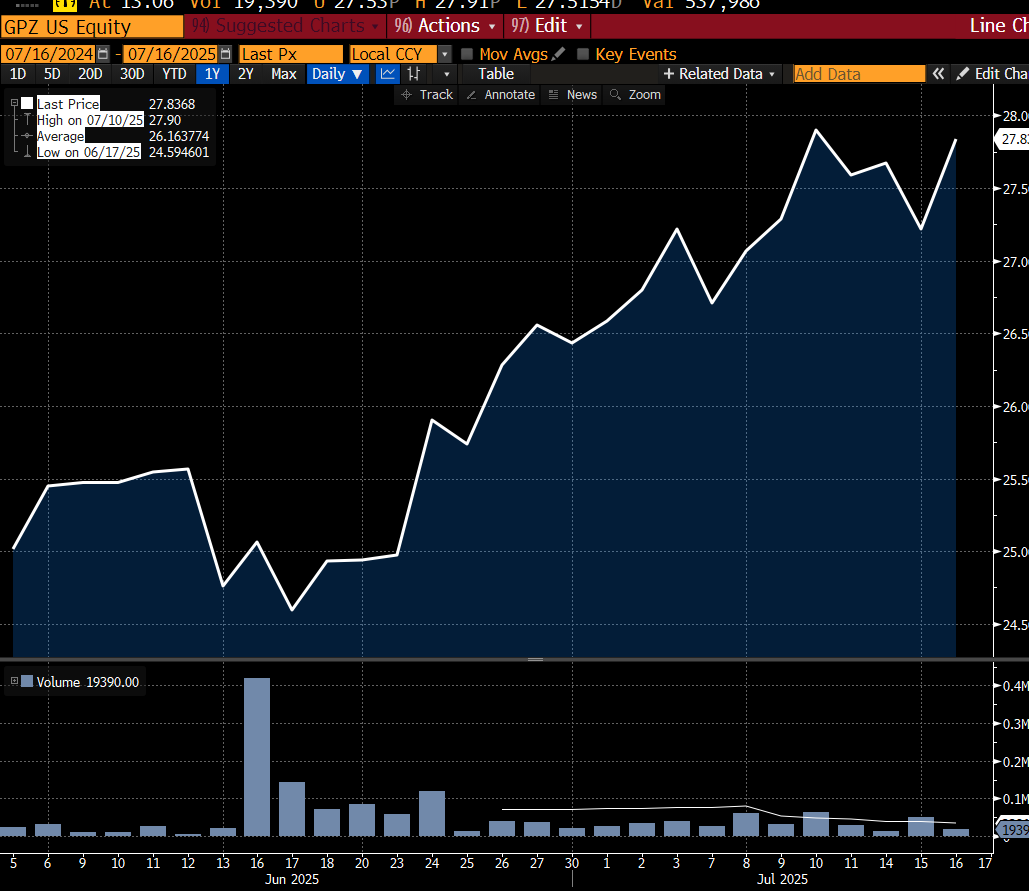

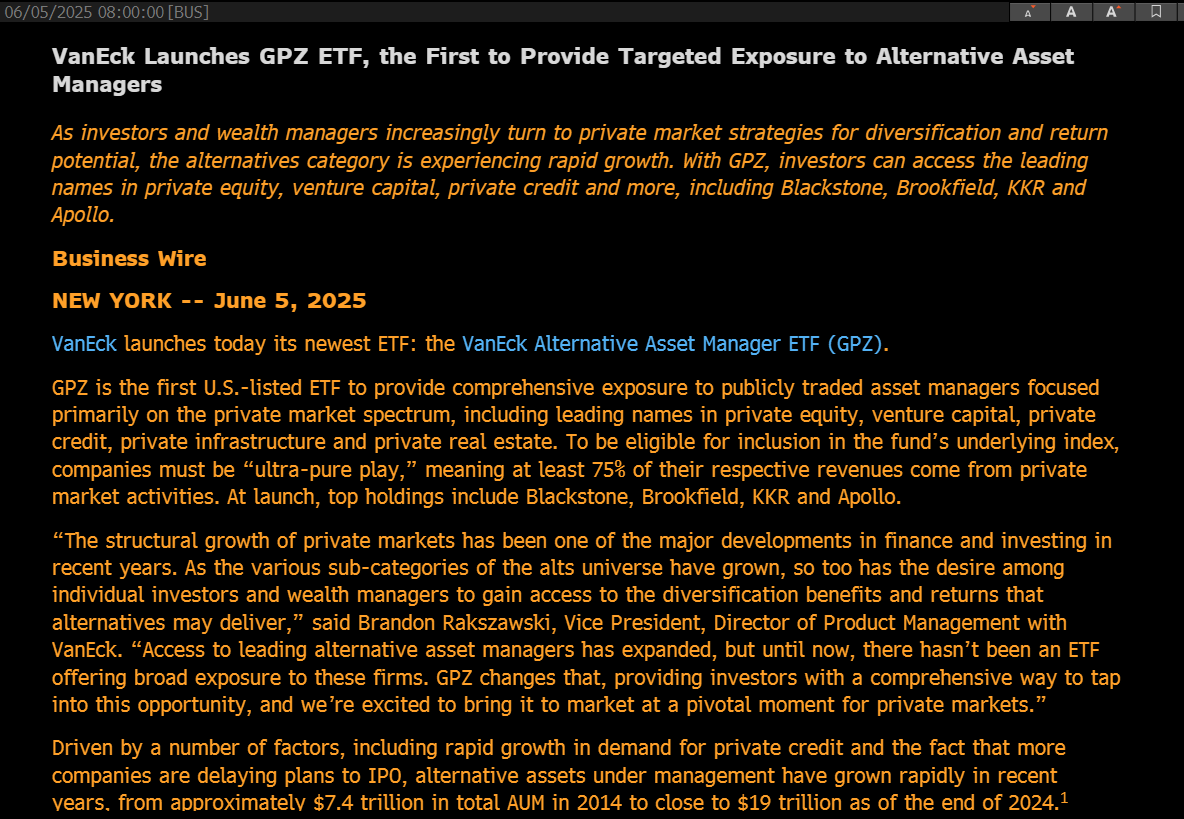

In order to realize the full potential of AI & Bitcoin, capital markets will need better access points, more flexible structures, and broader participation from both institutions and retail investors. If direct lending and private credit continue to expand their role in financing sectors like AI infrastructure and digital assets, the firms designing and executing these deals may stand to benefit. One way to express that view is through the just-launched VanEck Alternative Asset Manager ETF (ticker: GPZ), which began trading yesterday. It offers targeted exposure to firms such as Blackstone, Brookfield, KKR, Apollo, Carlyle, Ares, and TPG. These are the capital allocators who are increasingly shaping how modern infrastructure is financed and built - and taking a tidy cut in return.

Thank you for coming to my talk. Consider the risks below.

3.969

12

Il contenuto di questa pagina è fornito da terze parti. Salvo diversa indicazione, OKX non è l'autore degli articoli citati e non rivendica alcun copyright sui materiali. Il contenuto è fornito solo a scopo informativo e non rappresenta le opinioni di OKX. Non intende essere un'approvazione di alcun tipo e non deve essere considerato un consiglio di investimento o una sollecitazione all'acquisto o alla vendita di asset digitali. Nella misura in cui l'IA generativa viene utilizzata per fornire riepiloghi o altre informazioni, tale contenuto generato dall'IA potrebbe essere impreciso o incoerente. Leggi l'articolo collegato per ulteriori dettagli e informazioni. OKX non è responsabile per i contenuti ospitati su siti di terze parti. Gli holding di asset digitali, tra cui stablecoin e NFT, comportano un elevato grado di rischio e possono fluttuare notevolmente. Dovresti valutare attentamente se effettuare il trading o detenere asset digitali è adatto a te alla luce della tua situazione finanziaria.