Spot and futures cross margin mode

1.Trading rules for spot and futures cross margin mode

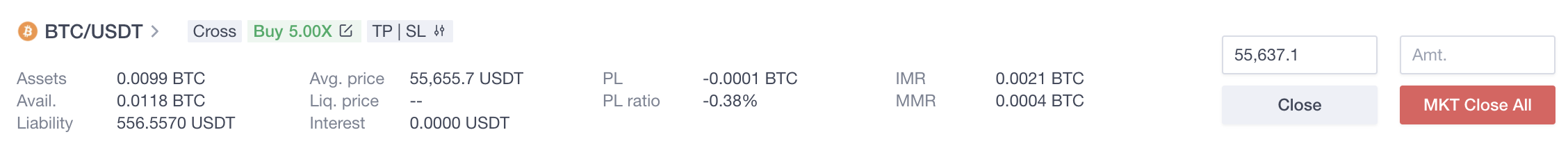

If a user trades a certain margin pair in the spot and futures cross margin mode, the margin positions will be displayed as below:

| Term | Explained |

| Assets | The amount of positive assets in the position (excluding margin). |

| Available asset | The amount of positive assets to close a position. For detailed info, please refer to the following. |

| Liability | Initial liabilities + deducted interest • Long position: Liability is calculated in the quote currency. •Short position: Liability is calculated in the trading currency. |

| Interest | Generated interest that has not been deducted yet. |

| Avg.open price | (Original holding amount * Original Avg.open price + new holding amount * filled price)/(Original holding amount+new holding amount) |

| Est.liquidation price | Note: there an options or margin non-usdt pair in single-currency mode, est. cant be calculated.in usdt if are contracts positions with different underlyings, cannot calculated either.>The underlying price when the cross position of a single- currency account meets the liquidation conditions.The price is indicative.Note: When there is an options position or a margin position of non-USDT pair in single-currency cross margin mode, the Est. liquidation price can't be calculated.In the USDT single-currency cross margin mode, if there are contracts or margin positions with different underlyings, the Est. liquidation price cannot be calculated either. |

| P&L | Unrealized profit or loss of the current position.Calculation formula of P&L:1) Long positions with the trading currency serving as the margin currency, and the P&L is calculated in the trading currency.P&L = Total assets - (liability + interest) / mark price2) Long positions with the quote currency serving as the margin currency, and the P&L is calculated in the quote currency.P&L = Total assets * mark price - (liability + interest)3) Short positions with the quote currency serving as the margin currency, and the P&L is calculated in the quote currency.P&L = total assets - (liability + interest) * mark price4) Short positions with the trading currency serving as the margin currency, and the P&L is calculated in the trading currency.P&L = Total assets / marked price - (liability + interest) |

| P&L ratio | P&L/initial margin |

| Initial margin | 1) Long positions with trading currency as margin currency, and liability calculated in quote currency.Initial margin = (liability + interest) / (mark price * leverage)(2) Short positions with trading currency as margin currency, and liability calculated in trading currency.Initial margin = (liability + interest) / leverage(3) Short positions with quote currency as margin currency, and liability calculated in trading currency.Initial margin = (liability + interest) * mark price / leverage(4) Long positions with quote currency as margin currency, and liability calculated in quote currency.Initial margin = (liability + interest) / leverage |

| Maintenance margin | 1)Long positions with trading currency as margin currency.Maintenance margin = (liability + interest) * maintenance margin ratio / mark price2) Long positions with quote currency as margin currency.Maintenance margin = (liability + interest) * maintenance margin ratio3) Short positions with quote currency as margin currency.Maintenance margin = (liability + interest) * maintenance margin ratio * mark price4) Short positions with trading currency as margin currency.Maintenance margin = (liability + interest) * maintenance margin ratio |

2.Principle of initial margin

Principle of initial margin: both tokens of a pair can be used as margin for long/short positions.

Examples:

1. As to BTC/USDT pair, you can choose either BTC or USDT as margin currency to open long/short margin positions in spot and futures cross mode.

2. Now open a long position of 1BTC under 10X leverage. If the user chooses to take BTC as the margin currency, a margin of 0.1 BTC is required (the available equity in spot and futures account should be greater than or equal to 0.1 BTC), the filled price is 10,000 USDT/BTC, and 10,000 USDT needs to be borrowed; no currency will be borrowed if the transaction is not filled. No interest is accrued, but the margin will be on-hold.

3. After the transaction is filled, a long position will be opened: the total asset of this position is 1BTC, while its liability is 10,000USDT. The margin of 0.1BTC is in the account balance, and will not be transferred to spot and futures margin position asset (It is different from isolated position, where margin for isolated position will be transferred to the position asset).

3.Closing positions

3.1 Position assets and margin currency are the same—use the trading currency as margin to open long, or use the quote currency as margin to open short.

1) Principle of closing positions: Only the available asset can be used for closing a position. Users can close the position when they pay off the liability; Users can also choose whether to use "reduce only" when closing a position.

2) The available asset formula for closing positions:

The main difference from the isolated margin: the available asset can be used for closing the position is the total asset of the isolated margin positions, while in spot and futures cross margin mode (where position assets and margin currencies are the same), the available asset that can be used for closing the position may be the sum of total position asset and part of the equity in account balance.

Fundamentally, closing a margin position cannot affect the risks of other positions in a spot and futures cross margin mode. When the total equity is greater than or equal to the initial margin required for the coin, the available asset for closing a margin position can include the initial margin of this position; when the equity is less than the initial margin required for the coin, the available asset for closing a margin position can include the maintenance margin of this position.

a) Closing long positions with liability calculated in quote currency:

Coin equity ≥ coin initial margin, the available asset for closing margin positions = (|liability + interest| of this margin position) * (1 + IMR% of this margin position) / mark price

Coin equity < coin initial margin, the available asset for closing margin positions = (|liability + interest| of this margin position) * (1 + MMR% of this margin position) / mark price

b) Closing short positions with liability calculated in trading currency:

Coin equity ≥ coin initial margin, the available asset for closing margin positions = (|liability + interest| of this margin position) * (1 + IMR% of this margin position) * mark price

Coin equity < coin initial margin, the available asset for closing margin positions = (|liability + interest| of this position) * (1 + MMR% of this position) * mark price

3) The rules of closing positions are the same as those of isolated positions, except the available asset formula.

| No. | Mode | Closing method | Rule | Example |

| 1 | Close in Position | Market close all | 1. Only pay off the liabilities, and the remaining assets will be transferred to the single-currency account balance.2.Only the available assets can be used to close the positions.3. The default setting is “reduce only". | The current margin position is long position—Its available asset is 2 BTC, liability 10,000 USDT, and interest 10 USDT.1. The system will calculate how much USDT needs to be bought to close the position and pay off liabilities (Interest and fees will also be included). If it is 10,020 USDT, the system will sell 2 BTC at the market price, and then stop it when you receive 10,020 USDT. Due to transaction accuracy, it may exceed a little.2. Assuming the average filled price is 10,000 USDT, then buying 10,020 USDT requires 1.002 BTC, and the remaining 0.998 BTC will not be sold.3. After closing the position, the remaining 0.998 BTC will be transferred to the BTC single-currency account balance, and due to accuracy reasons, the remaining USDT will also be transferred to the USDT single-currency account balance after the liability is paid off. |

| Closing at limit price | 1. You can buy assets that exceed the liabilities. Once the liability is paid off, the margin position will be closed. The oversold assets and remaining ones will be transferred to the single-currency account balance.2.Only the available asset can be used to close the position.3.The default setting is "reduce only". | The current margin position is long position—Its available asset is 2 BTC, liability 10,000 USDT, and interest 10 USDT1. Sell 0.5 BTC at the filled price of 10,000 USDT, then 5,000 USDT is bought. After deducting the fee of 5 USDT and interest of 10 USDT, the remaining 4,985 USDT will be used to pay off the liability. With a remaining liability of 5,015 USDT, the position still exists.2. After partially closing the position: the position asset is 1.5 BTC, liability 5,015 USDT, and interest 0 USDT.3. Sell 1 BTC at the filled price of 10,000 USDT, then 10,000 USDT is bought. After deducting the fee of 15 USDT, the remaining 9,985 USDT will be used to pay off the liability of 5,015 USDT. Since liability has been paid off, the position disappeared;4. The remaining assets of 0.5 BTC and 4,970 USDT will be transferred to the account balance of BTC and USDT single-currency account separately. | ||

| 2 | Close in close short/close long area | Reduce only | The same as those of [Close in Position] | - |

| Reduce + reverse position | 1. When the liability is paid off, the margin position will disappear. The oversold asset will be used to open a reverse position;2. Only the available asset can be used to close the position, and the margin for opening a reverse position is the available equity of the corresponding single-currency account. | The current margin position is a short position—Its available asset is 30,000 USDT, liability 2 BTC, Leverage is 5X, margin currency is USDT, with interest and transaction fees temporarily ignored.1. Buy 1 BTC at the filled price of 10,000 USDT. This order uses assets of 10,000 USDT to pay off the liability of 1 BTC;2. After partially closing the position: the remaining asset of it is 20,000 USDT, and the remaining liability is1 BTC. Since the liability has not been paid off, the position still exists;3. 3. Buy 1.5 BTC at the filled price of 10,000 USDT. 1.5 BTC > liability of 1 BTC. After the order is filled, the position will be closed first, and then a reverse position will be opened. 4. The asset of 10,000 USDT is used to paid off the liability of 1 BTC, and after the long position is closed, the remaining 10,000 USDT asset on the position will be transferred to the USDT single-currency account balance; 5. The reverse position of 0.5 BTC will use 1,000 USDT in the single-currency account balance as its margin, and 5,000 USDT will be borrowed to open a reverse long position; 6. At this time, the position asset of this margin long position is 0.5 BTC, and liability is 5,000 USDT. |

3.2 Position assets and margin currencies are different—use the trading currency as margin currency to open short, or use the quote currency as margin currency to open long.

1) Principle of closing positions: only position assets can be used to close a position. If the position assets are sold out, the position will be closed. If the liability is not paid off, the equity in the account will be used to directly pay off the remaining liabilities; Users can choose whether to use "reduce only".

2) The available asset that can be used to close the position = position assets.

|

No. |

Mode |

Closing method |

Rule |

Example |

|

1 |

Close in Position |

Market close all |

1. The position will be closed when all position assets are sold at market price.2. The default setting is “reduce only”. |

The current margin position is a long position—Its position asset is 2 BTC, liability 10,000 USDT, with interest and fees temporarily ignored.Its margin currency is USDT, and its margin is in USDT single-currency account balance. 1. The system will sell 2 BTC. If the average filled price is 9,000 USDT, a total of 18,000 USDT will be bought. The liability of 10,000 USDT will be paid off. The remaining 8,000 USDT will be transferred to USDT account balance and the position will be closed. 2. If the average filled price is 2,000 USDT, a total of 4,000 USDT will be bought. The remaining liability will be 6,000 USDT, which will be paid off by USDT account balance. Then the position will be closed. |

|

Closing at limit price |

1.The position will be closed when all position assets are sold at limit price.2. The default setting is “reduce only” |

The current margin position is a long position—Its position asset is 2 BTC, liability 10,000 USDT, with interest and fees temporarily ignored.Its margin currency is USDT, and its margin is in USDT single-currency account balance. 1. Sell 1BTC at the average filled price of 15,000 USDT, a total of 15,000 USDT will be bought. The liability of 10,000 USDT will be paid off. The remaining 5,000 USDT will be transferred to the USDT account balance. The position is not closed yet because there is still 1 BTC position asset, which is different from the margin currency. 2. Sell the remaining 1 BTC position asset at the filled price of 10,000 USDT, then a total of 10,000 USDT will be bought. Since liability has been paid off, 10,000 USDT will be transferred to the USDT account balance. Because the position asset is 0, the position is closed. |

||

|

2 |

Close in close short/close long area |

Reduce only |

The same as those of [Close in Position] |

- |

|

Reduce only + reverse position |

1. The position will be closed when all position assets are sold. The remaining assets will be used to open a reverse position;2. The available asset is position assets, and the margin for opening a reverse position is the available equity of the corresponding currency of the account. |

The current margin position is a short position—Its position asset is 30,000 USDT, Leverage is 10X, liability 2 BTC, with interest and fees temporarily ignored.1. Buy 2.5 BTC at the filled price of 10,000 USDT. This order uses position asset of 25,000 USDT to pay off the liability of 2 BTC. The remaining 0.5 BTC will be transferred to BTC single-currency account balance. Although the liability is paid off, the position is not closed yet with a position asset of 5,000 USDT.2. Buy 1.5 BTC at the filled price of 10,000 USDT. 15,000 USDT> a position asset of 5,000 USDT. After the order is filled, the position will be closed first, and then a reverse position will be opened;3. 0.5 BTC will be bought by a position asset of 5,000 USDT, and transferred to BTC single-currency account balance.4. 10,000 USDT will be borrowed to buy 1 BTC to open a reverse long position, and 0.1 BTC in the single-currency account balance will be used as margin.5. At this time, the position asset of this margin long position is 1BTC, and liability of it is 10,000 USDT. |