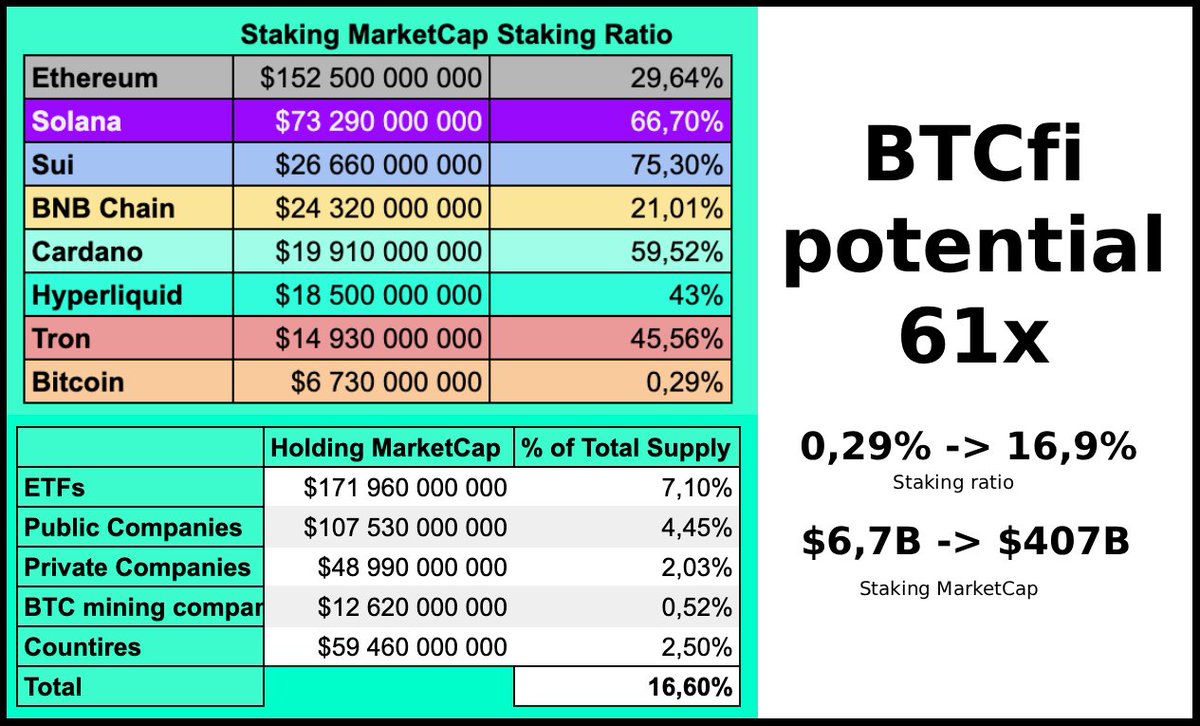

Why does BTCfi matter or growth potential in 6000%.

Classic PoS assets have a fairly high Staking Rate - the share of staked assets.

- Solana has the highest rate with 75% Staking Rate, BNB Chain has the lowest - 21%.

- The average Staking Ratio for the Top-6 PoS networks is 48%.

- Now look at the same number for Bitcoin - a modest 0.29%.

You may ask - how can you compare Bitcoin with its PoW consensus and a bunch of other PoS. You will be right, but only partly.

What is BTCfi? Why does it need?

The fact is that several teams in BTC eco are recreating BTC staking through different mechanisms and innovations. The whole point comes down to the fact that BTC can be made a PoS asset on top of PoW by adding some services to it. Globally, these services are divided into 3 categories:

- Shared Security Service

- L2 service a top Bitcoin

- DeFi strategies

Shared Security service, which is being built by @babylonlabs_io , is one of the most innovative. And it is of great importance, as it enables networks to achieve a level of security comparable to the Bitcoin network. You may think that this is not so important, but perhaps you missed the latest developments.

Last week, hackers attacked the largest privacy network - Monero, which has existed since 2014 and is built on the Bitcoin code base. They were able to take over 51% of the network's power, gaining the ability to roll back blocks and transactions.

For example, if at that moment you transferred all your money from one wallet to another, the attackers could redirect it to their address.

Would you want to use such a network? - No.

Because your money is at risk.

Similarly, TradFi cannot trust all its money to PoS networks that have weak security and the number of staked assets.

That is why 90% of the entire RWA sector is hosted on Ethereum, as the largest and most reliable PoS network.

Babylon allows you to make any PoS network even more reliable than Ethereum thanks to Shared Security.

Therefore, almost every network will be ready to pay for this service.

The only thing is that Babylon must also be decentralized, independent and have enough liquidity.

This is exactly the task that @Lombard_Finance solves, which is a liquidity layer for Babylon and distributes it between Finality Providers.

At the same time, Lombard provides opportunities for staking BTC in various DeFi protocols and strategies. Thus, combining 2 of the 3 largest BTCfi services.

The Right Moment

And most importantly, the large market is already ready to direct its capital to BTCfi.

Whales in the form of governments of different countries, ETFs, public and private companies already hold 16.6% of the supply of BTC.

And this number will only increase every year.

Ultimately, they will look for options for generating yield for BTC.

PoS will be the best and most reliable option, which will become an analogue of US bonds - even a low yield of 2% - 4% will suit everyone given the highest level of security.

At the moment, the leaders and most reliable companies in BTCfi are Lombard and Babylon, not only from a technical point of view, but also from the point of view of the longterm development vision of both companies.

This means that the first flows of the potential $400 billion will go through them, and they will benefit greatly from this through the growth of TVL and the use of their products.

BTCfi has just begun.

BTCfi growth potential is 61x

Just a patience, and you 'll see how this sector explodes.

======================================

If you liked the research, plz like/retweet and follow to @Eugene_Bulltime

And follow on strong visioners and analysts:

@0xBreadguy

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@Moomsxxx

@hmalviya9

@Mars_DeFi

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@0xCheeezzyyyy

@arndxt_xo

@alpha_pls

15.96K

62

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.