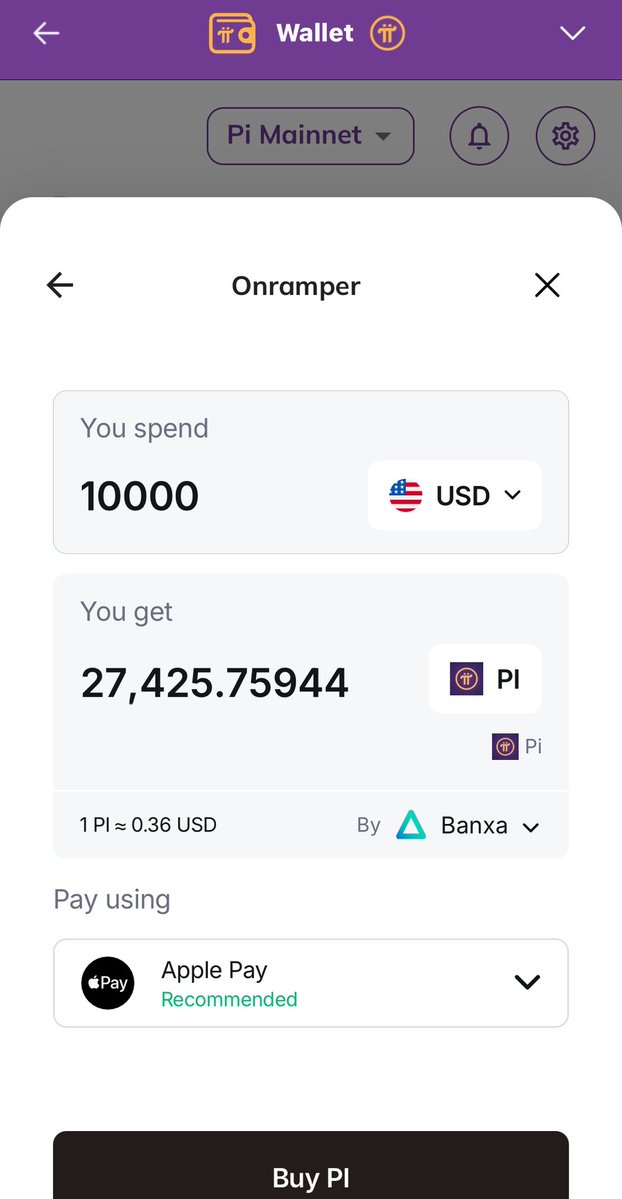

Pi previously launched a wallet that allowed direct fiat purchases through Banxa, leading to the emergence of spot whales and causing a rapid surge on July 28.

Now, Pi has introduced a second platform, TransFi, that offers fiat purchasing services.

The purpose of launching these two platforms is to serve users from different countries, as not everyone can use Banxa. Importantly, this time, TransFi is aimed at the European community.

TransFi is a platform providing fiat exchange services in Lithuania. Following the impact of Banxa, the current purchase price of Pi on TransFi is 0.1 higher than on exchanges. Yes, you read that right; the exchange price is currently 0.35, while TransFi's purchase price is 0.45.

Will this entry into the European fiat market lead to another wave of spot whale buying? Let's wait and see.

On-chain prices are generally rising. As previously explained, exchange prices are merely private contracts, similar to game prices within a private game; they cannot correspond to external fiat prices because they are private contract prices.

Therefore, there will currently be two types of prices, which may even be completely contradictory, creating a high premium space. When retail investors sell at exchange prices thinking they reflect on-chain Pi prices, they are voluntarily choosing to sell at a low price within someone else's private contract.

If the exchange price is 0.1 and the on-chain price is 0.5, and an investor chooses to sell at the exchange price of 0.1, that is their own business. We just need to wait for fiat exchanges to become more complete; once on-chain DeFi is launched, exchange prices will no longer be manipulable.

Currently, most retail investors, due to not knowing how to check on-chain prices, have no choice but to use exchange prices for pricing.

In reality, once someone launches an on-chain price K-line chart, it will reveal that the private contract prices on exchanges are all manipulated deceptive prices.

Once everyone knows to look at on-chain prices, exchange prices will quickly become obsolete.

Just like using USD, where the external price is pegged at 1:1 with USDT, why would anyone want to sell their USDT at 0.1 in a private contract?

This highlights the difference between on-chain prices and exchange private contract prices, which allows uninformed investors to be manipulated into selling at low prices.

Currently, the price of Pi must be based on the value of foreign exchange fiat on-chain conversion. Stop looking at exchange prices; you can sell to others at a price slightly lower than the on-chain price. Why would you want to sell at a low exchange price?

Manipulation by others is their business; we only use on-chain prices.

Withdraw Pi from exchanges to reduce the manipulation of borrowing whales in private contracts.

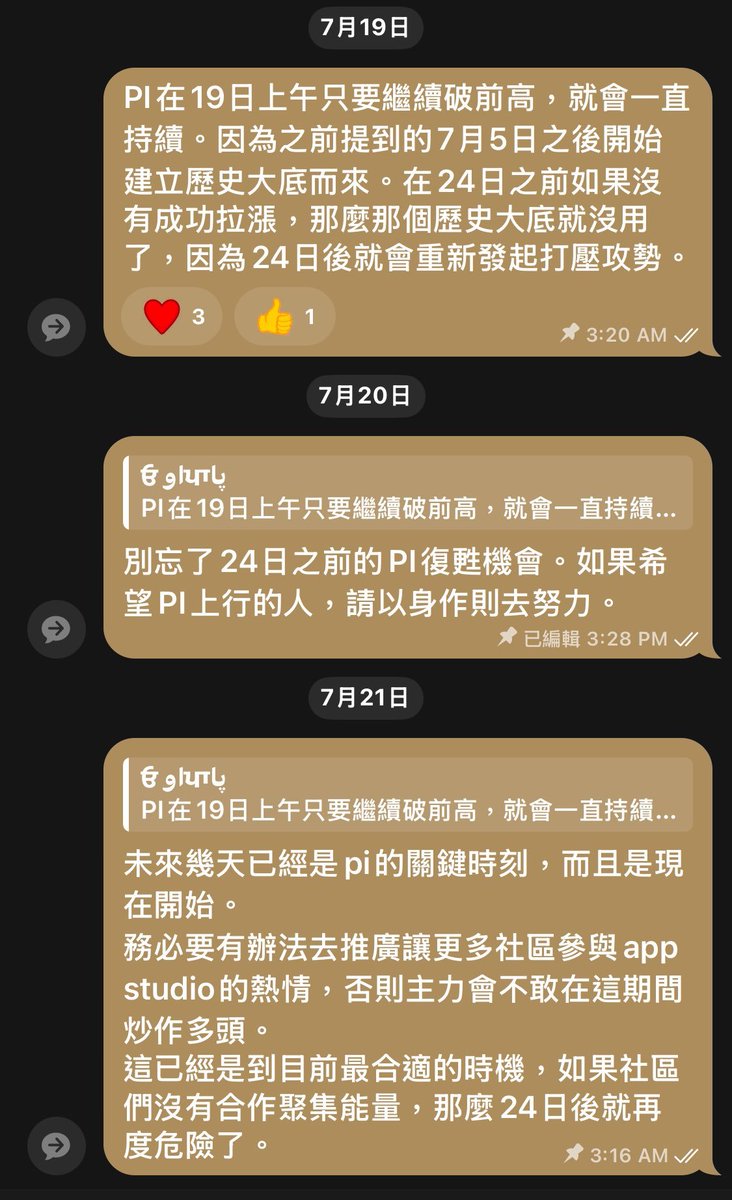

After PI mentioned the historical bottom mentioned earlier on the 19th, the most important speculation was mostly before the 24th. Now on the 22nd, it is pulling up one!

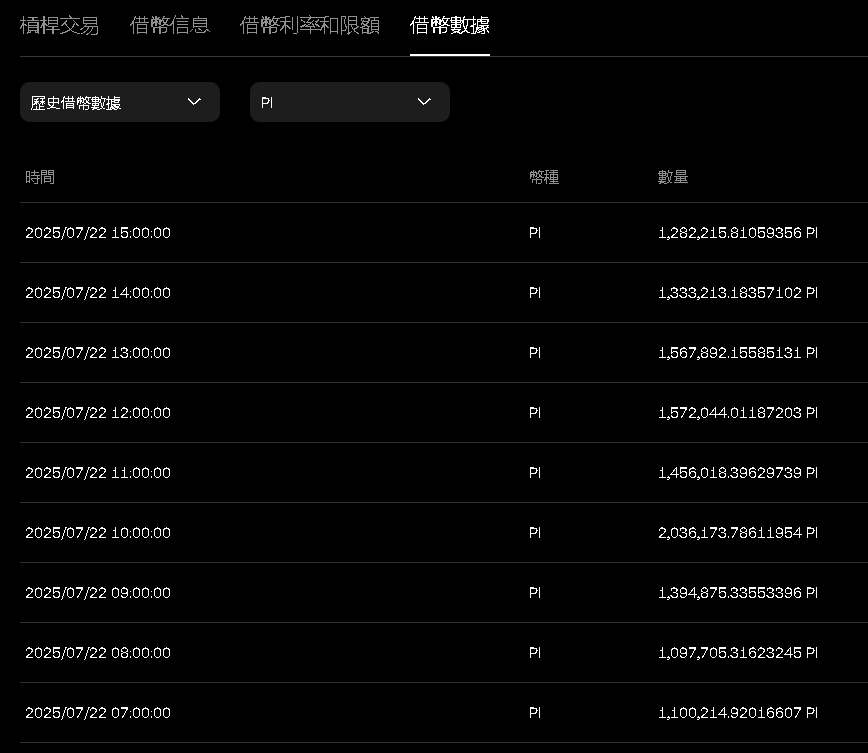

What is special this time is that as long as there is a rise in history, borrowing whales will quickly borrow millions of PI to sell and suppress.

However, this time, since the 19th, the borrowing whales have only repurchased and returned the currency, and the sellers are all retail investors who hold a large number of coins.

"And after pulling the market this morning, the borrowing whale borrowed 60 PI at 10 a.m., and it was all returned in less than four hours."

Whales definitely know what is going on with the PCT, otherwise they would not have dared to borrow a lot of money to suppress PI since this period of history

#PI

#pi

33.02K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.