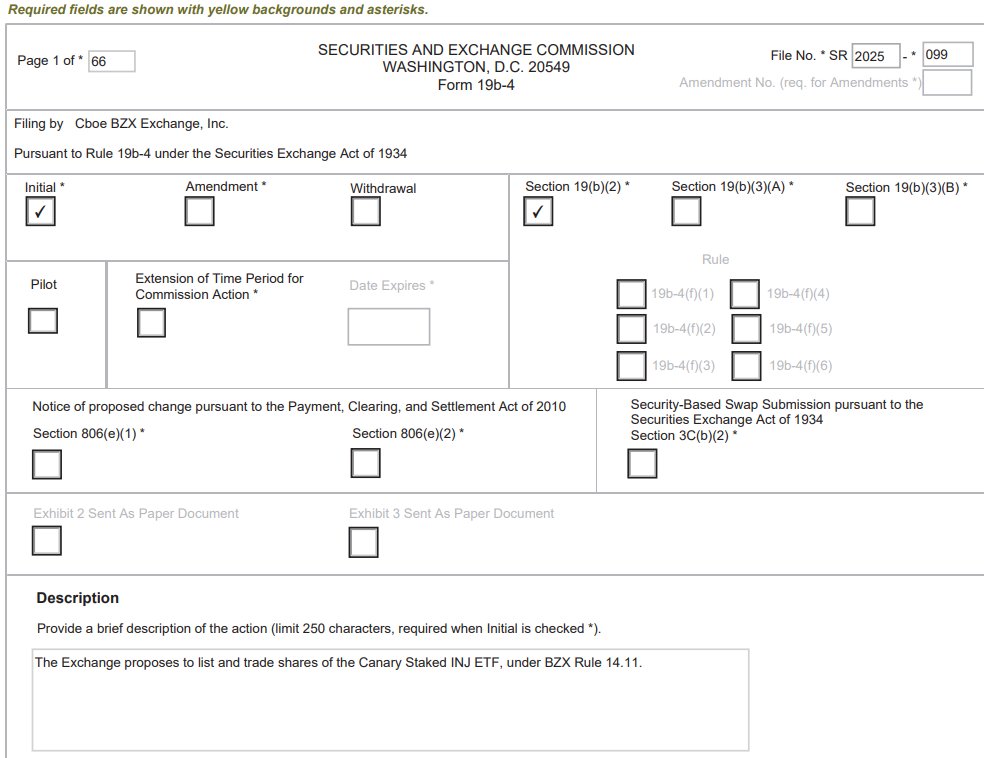

The Cboe has officially filed to list Canary Capital’s staked Injective ETF this week, potentially making it the third staked crypto ETF following $ETH and $SOL.

But what is the Cboe and why is this such a massive deal for everyone? A quick primer:

What is the Cboe?

1️⃣ The Cboe is a major traditional finance exchange in the US and is currently the largest regulated options exchange in America.

2️⃣ The Cboe often handles over 40% of total U.S. options market share on a monthly basis and about 15–20% of total U.S. equity trading volume. This represents trillions of dollars being traded.

3️⃣ The Cboe is known for pioneering many popular index products such as the Cboe Volatility Index ($VIX) and routinely creates new options products and ETFs.

Why is INJ getting listed on the Cboe a huge deal?

1⃣ The $INJ ETF getting listed on the Cboe brings not only institutional legitimacy for Injective but also opens the doors for pensions, mutual funds, RIAs, and wealth managers to gain exposure to INJ

2⃣ The INJ ETF would also be available across major brokerage accounts such as Fidelity, Schwab, and Robinhood, which introduces millions of potential new users to Injective.

This is only the beginning. Injective is making major strides to break into institutional circles, opening up access to new capital, new users and new innovation to flow into $INJ, putting us far ahead of anyone else.

Don’t believe me? Just watch.

4.87K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.