Lombard DeFi Vault, the tool for earning BTC effortlessly!

Integrating BTC into DeFi sounds simple, but those who have actually done it know:

※ You need to choose protocols, check APR, allocate funds, reinvest, and manage positions.

※ Just dealing with pendle, morpho, and gearbox can be overwhelming.

※ Every on-chain operation requires you to confirm, make judgments, and monitor liquidity and pool changes.

However, Lombard, in collaboration with Veda (the one behind it), has created a very practical tool; a DeFi Vault that can automatically configure BTC strategies, supporting LBTC, wBTC, and cbBTC all together!

▰▰▰▰▰▰

How to use this Vault?

It's simple!

1/ Deposit your LBTC, wBTC, or cbBTC.

2/ Receive an LP asset called LBTCv, representing your share in the Vault.

3/ Wait for the earnings to be automatically reinvested without any action needed.

LBTCv will automatically track your principal, strategy earnings, and also include what you can earn:

Babylon points, Lombard Lux, and Veda points.

⚠️ Updated every hour, you can check directly on the dApp!

▰▰▰▰▰▰

What strategies are running in the Vault?

I researched a bit, and it’s not just about randomly throwing funds into a mining pool; it’s about using Veda’s infrastructure to run real and effective combination strategies, including:

※ Uniswap v3: acting as a range LP.

※ Pools like Curve: participating in stablecoin arbitrage.

※ Pendle: engaging in BTC yield trading (buying future yields).

※ Morpho / Gearbox: leveraging lending or aggregating yields.

The Vault will periodically rebalance and reinvest, converting all rewards into more underlying assets. You don’t have to worry about anything; just hold LBTCv to receive corresponding compound earnings 🤑

▰▰▰▰▰▰

Why do I think this product is worth paying attention to?

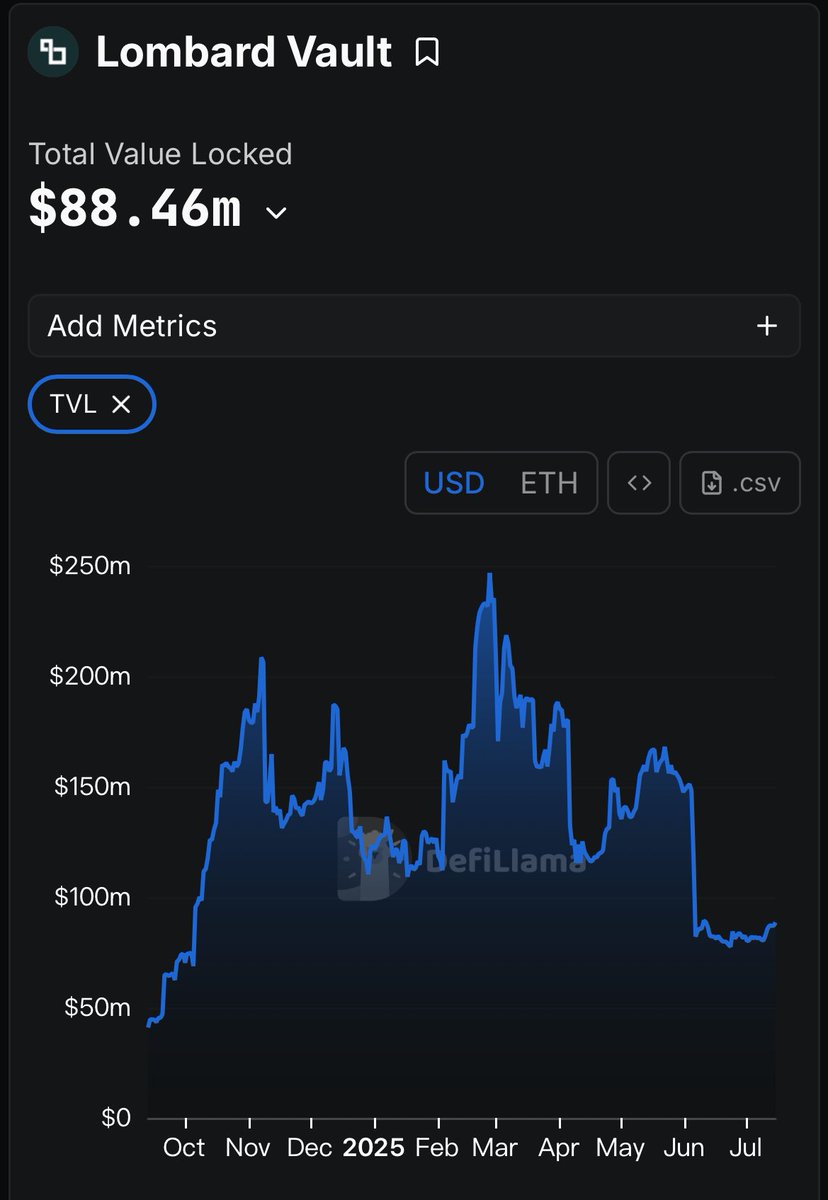

It’s not just a toy made by a BTC protocol; it’s a serious one-stop entry for integrating BTC into DeFi! Partnered with Veda, which has already established a $1B+ TVL yield structure, it’s reliable!

Supports multiple BTC types! LBTC is the main character, but wBTC / cbBTC can also participate, high scalability, clear strategy logic, not a black box, and avoids messy points and incentive models that inflate value ~

▰▰▰▰▰▰

In summary, if you don’t want to deal with the hassle of running BTC DeFi operations yourself, let Lombard Vault do it for you.

Deposit, get a receipt, wait for earnings, and redeem anytime. Simple and straightforward 🥱

#KaitoYap @KaitoAI @JacobPPhillips @Lombard_Finance #Yap

Show original

25.35K

191

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.