🚀 2025 is the year of stablecoins, and the most overlooked potential stablecoin in the market is --- @ethena_labs

@ethena_labs is diversifying and actively embracing traditional finance, with new airdrops in the ecosystem that can be anticipated. When interest rate cuts arrive, the @ethena_labs ecosystem will experience significant growth.

📈 @ethena_labs USDe market cap has risen significantly

Compared to the same period last year: growth of 65% (from 3.485 B → 5.306 B)

Airdrop opportunities

1️⃣ @etherealdex: A decentralized exchange based on $USDe (has committed to airdropping 15% of tokens to $ENA stakers)

2️⃣ @Terminal_fi (the most important ecosystem layout in 2025): A settlement network combining traditional finance and digital assets, allowing trading of traditional finance and crypto assets in the future (just a heads up: you can deposit and stake to earn related points, so get in early 🤫)

👇 @ethena_labs is the most overlooked dark horse in the stablecoin race.

👀 While everyone is focusing on the "Genius Act" and @circle, many may overlook that $ENA is also a strong player in the stablecoin arena.

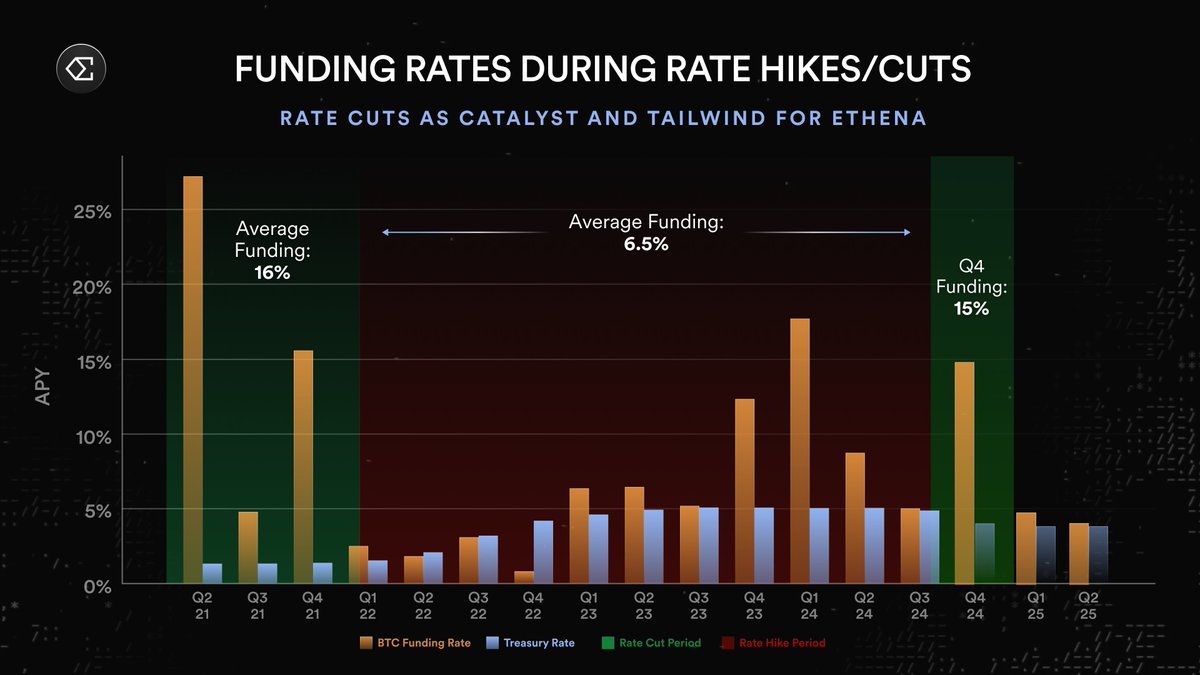

According to a tweet from @0xTindorr: "When market interest rates start to decline and the market favors risk assets, leading to an increase in funding rates, @ethena_labs will gain more revenue, while @circle will see a decrease in their income, as they rely solely on the yield of U.S. Treasuries for revenue."

Looking back to December 2024 when interest rates were cut, the funding rate for $BTC soared to 15%.

👉 @ethena_labs made a profit of 90 million dollars that month.

🌟 The probability of a rate cut in September is at 25 percentage points, reaching 66.2%. There is already a precedent from December 2024. If the market indeed improves as expected, @circle will be impacted, while @ethena_labs will benefit.

Everyone’s watching $CRCL and USDC right now because of the Genius Act…

but I feel like nobody’s talking about what’s about to happen with $ENA.

If we get rate cuts, Circle takes the hit (their yield dries up).

Ethena? That’s when it actually shines.

Lower rates = more demand for long risk → funding rates pop → Ethena earns more.

We saw it in Dec 2024 — BTC funding hit 15%, Ethena pulled in $90M revenue. And that wasn’t even a proper low-rate cycle.

Right now, @ethena_labs is at $6.8B stablecoin supply (USDe + USDTB). $ENA is still way off the highs.

Just feels like the market’s not ready for what happens when rate cuts and regulatory clarity hit at the same time.

8.62K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.