Regarding the Forced Liquidation Incident on Jul 31, 2018

An enormous long position in BTC0928 futures contract was force-liquidated at 20:17:14 July 31, 2018 (Hong Kong Time, UTC+8). Due to the sheer size of the order, our risk management system may be triggered to activate the societal loss risk management mechanism.

OKX has adopted the societal loss risk management mechanism since launched and it has been working orderly as intended. When the insurance fund cannot cover the total margin call losses, a full account clawback 1 occurs. In such case, only users who have a net profit across all three contracts for that week will be subject to the clawback. We will take a portion of the profit in equal percentage from all profited traders only to cover the difference between the liquidated price and settled price.

For example, user A and B place 1 BTC each as the margin for opening positions. Assuming the price of BTC is USD1, then each contract costs USD1 as well. At this price, user A longs 10 contracts with 10x leverage, and user B shorts 10 contracts with 10x leverage. If now the spot index price drops from USD1 to USD0.1, user B should gain USD9 and user A should lose USD9 from this trade. However, the margin from user A for this order is 1 BTC, which worths USD 1 only. So the actual gain for user B will also be 1 BTC only, the remaining 8 BTC will be socialized instead.

In order to prevent socialized clawbacks from occurring, we have been working really hard to optimize our risk management system, such as launching price limit rules, early forced liquidation system, forced liquidation order price adjustment and more. There have been malicious rumors accusing us of manipulating the forced liquidation system. We hereby would like to point out the fact that, most of the similar price movements in the market are caused by forced liquidation orders.

The client with user ID 2051247 initiated an unusually large long position order (4168515 contracts) at 2am on July 31 (HKT) and triggered our risk management alert system. Our risk management team immediately contacted the client, requesting the client several times to partially close the positions to reduce the overall market risks. However, the client refused to cooperate, which lead to our decision of freezing the client’s account to prevent further positions increasing 2. Shortly after this preemptive action, unfortunately, the BTC price tumbled, causing the liquidation of the account.

To reduce the market risks induced by this incident, the following actions will be executed:

- Injecting 2500 BTC from OKX’s own capital pool into the insurance fund.

- During the settlement at 4pm August 3, 2018 (HKT), if any attempts of malicious manipulation of the settlement price are found, we will delay the settlement process for 10 minutes and manually adjust the price back into a reasonable level before delivery or settlement. The account which made the malicious attempt will be suspended immediately.

Such actions will largely reduce the socialized clawback ratio of this week.

Also, in light of this incident, we will implement a series of risk management enhancements, which are in line with our futures roadmap released on July 17, 2018, to prevent any similar cases from occurring again. The enhancements are as follows:

1. Anti-manipulation policy to be released on Aug 4, 2018 (now in production)

Different measures will be employed on different margin modes.

Cross-margin Mode: Adopting a scaling margin ratio. Higher margin ratios will be required for opening bigger positions. Therefore, the cost of maliciously manipulating the market will be maximized, thus avoiding such behavior.

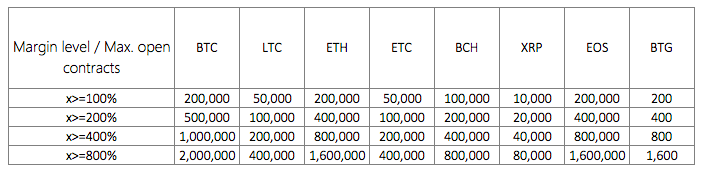

For 10x leverage:

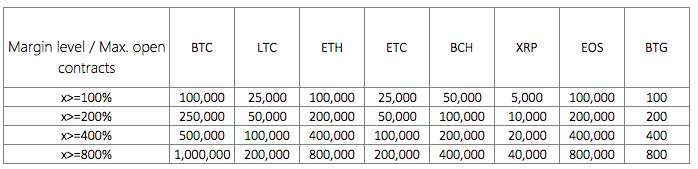

For 20x leverage:

Fixed-margin Mode: Applying maximum limits on opening positions per account. This will prevent the potential market risks triggered by the opening of unusually large positions.

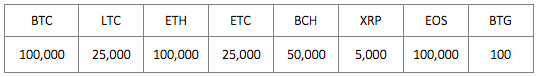

The maximum number of contracts can be opened per account for 10x leverage:

The maximum number of contracts can be opened per account for 20x leverage:

Moreover, to allow our users to have a better understanding of the concept of margin call coefficient, we will also adjust the margin ratio formulae.

Existing Margin Ratio Formulae:

The coefficient of 10x leverage is 10%;

The coefficient of 20x leverage is 20%.

Fixed-margin Margin Ratio = (Margin + UPL)/Position Margin - Adjustment Coefficient

Cross-margin Margin Ratio = Equity Balance/Position Margin - Adjustment Coefficient

If the trader’s margin ratio breaches 0%, a margin call will be triggered

New Margin Ratio Formulae:

Fixed margin Margin Ratio = (Fixed Margin + UPL) * Avg Price of Open Positions / (Contract Face value * Holding Positions)

Cross-margin Margin Ratio = Equity Balance / Position Margin + Withholding Margin of working orders)

After the adjustment:

If the trader’s margin ratio breaches 10% for 10x leverage, a margin call will be triggered.

If the trader’s margin ratio breaches 20% for 20x leverage, a margin call will be triggered.

The above new formulae are only a conceptual adjustment, and there is no actual change in the conditions of triggering a forced liquidation. Also, the new formulae will be employed together with the Anti-manipulation policy.

2. Mark Price to be released at the end of August (now testing)

Mark price will be employed to calculate the unrealized profit and loss, margin ratio, and more reference figures. Forced liquidation will then only occur when the mark price reaches the estimated forced-liquidation price.

Mark price is the Spot Index Price plus EMA (futures market price - spot index price).

The methodology of the mark price formula is to construct a reasonable price for the futures market by taking reference of the spot index price plus recent price data. Since EMA (Exponential Moving Average) places a greater weighting on recent price data, it prevented the mark price from varying largely in a short period of time, thus preventing the risks induced by any deliberate market manipulation.

3. Tiered Margin System & Optimized Process of Forced Liquidation to be released in September (development begins in early August)

The tiered margin system will place different risk limits depending on the position sizes. The required maintenance margin will be adjusted according to the user’s positions holding: the larger the positions a user holds, the higher the margin is required, and the effective leverage will be lowered. This system will be the cornerstone of minimizing the occurrence of socialized clawback.

We will optimize our liquidation algorithm for forced liquidation orders by deleveraging users’ positions to a lower margin tier. This would vastly minimize the size of forced liquidation positions and the potential market impact being generated.

Example

Assume that a client holds 100,000 futures contracts and his account falls into tier 3, which requires a maintenance margin ratio of 2.5%. And further assume that for tier 2, the positions holding limit and maintenance margin ratio are 80,000 contracts and 2% respectively. When forced liquidation occurs, OKX’s system will first reduce his holding positions by 20,000 contracts, reducing the maintenance margin ratio required by lowering his tier, so as to prevent further liquidation of the remaining positions. However, if the maintenance margin ratio required is still not met by the account, further liquidation will occur until the account reaches the lowest tier.

4. Optimization of Insurance Fund Usage to be released in September (development begins in mid August)

The followings will limit the liquidation losses promptly should it occur and also the possibilities of further losses on the settlement day.

- Our risk management system will monitor all unfilled forced liquidation orders. Once the unrealized loss reaches a certain level, the shortfall will immediately be covered by the insurance fund.

- The execution engine will take over the forced liquidation orders and route to the market as soon as possible with a relatively aggressive execution algorithm to prevent further liquidation losses.

- When the insurance fund is fully depleted, socialized clawback will occur on Friday of the week.

We will continue to make our best efforts to accelerate the optimization of our futures trading platform and also the enhancement of the risk management framework. As always, we appreciate and welcome any thoughts you may have. Should you have any comments or suggestions, please email us at futures@OKX.com.

Note

1. For more information about our clawback system, please visit https://support.OKX.com/hc/en-us/articles/360000139652-Forced-Liquidation.

2. As per OKX Futures Trading User Agreement:

- 6.2 OKX reserves the right to enact executive control over accounts if malicious price manipulation or any other malicious wrongdoing occurs. If required, OKX reserves the right to close accounts, limit trading, halt trading, cancel transactions, and rollback transactions to eliminate any adverse effects in the futures market.

- 6.3 If the size of a user’s position or open orders accumulates to a level which poses a clawback threat to the futures trading system or other users, OKX may request to cancel your orders or close part of your position. As a final measure, OKX reserves the right to limit or partially cancel the position or orders to reduce the risk in the system.