Precio de Dogelon Mars

en USD

Sobre Dogelon Mars

Riesgo de emisor de Dogelon Mars

Aviso

OKX no proporciona recomendaciones de inversión o de activos. Debes considerar cuidadosamente si el trading o el holding de activos digitales es adecuado para ti a la luz de tu situación financiera. Consulta a tu asesor legal/fiscal/profesional de inversiones para preguntas sobre tus circunstancias específicas. Para obtener más información, consulta nuestros Términos de uso y Advertencia de riesgo Al usar el sitio web de terceros ("Sitio web de terceros" o "TWP"), aceptas que el uso del TWP estará sujeto a los términos de TWP. Salvo que se indique expresamente por escrito, OKX y sus afiliados ("OKX") no están asociados de ninguna manera con el propietario u operador del TPW. Aceptas que OKX no es responsable de ninguna pérdida, daño ni cualquier otra consecuencia generada por tu uso del TPW. Ten en cuenta que usar un TWP puede generar una pérdida o reducción de tus activos. El producto puede no estar disponible en todas las jurisdicciones.

Rendimiento del precio de Dogelon Mars

Dogelon Mars en las redes sociales

Guía

Crea una cuenta de OKX gratis.

Añade fondos a tu cuenta.

Elige tus criptos.

Preguntas frecuentes sobre Dogelon Mars

Compra fácilmente tokens ELON en la plataforma de criptomonedas OKX. La terminal de trading spot de OKX incluyeELON/USDTpar de trading.

También puedes comprar ELON con más de 99 monedas fiat seleccionando "Compra exprés" opción. Otros tokens de cripto populares, comoBitcoin (BTC),Tether (USDT)yUSD Coin (USDC), también están disponibles.

También puedes hacer swap de las criptomonedas que ya tengas,XRP (XRP),Cardano (ADA),Solana ( SOL)yChainlink (LINK), para ELON sin comisiones ni slippage de precios mediante el usoConvertir en OKX.

Para ver los precios de conversión estimados en tiempo real entre monedas fiat, como USD, EUR, GBP y otras, a ELON, visitaCalculadora para convertir criptos de OKX. El exchange de cripto de alta liquidez de OKX garantiza los mejores precios para tus compras de cripto.

Descubre más sobre Dogelon Mars

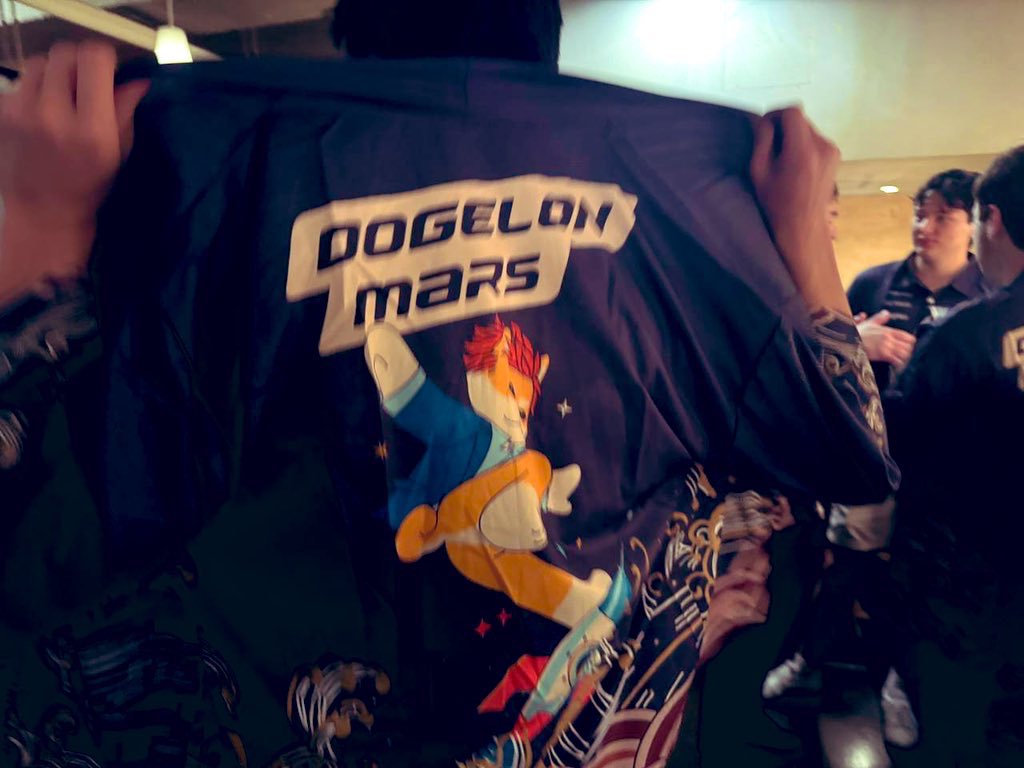

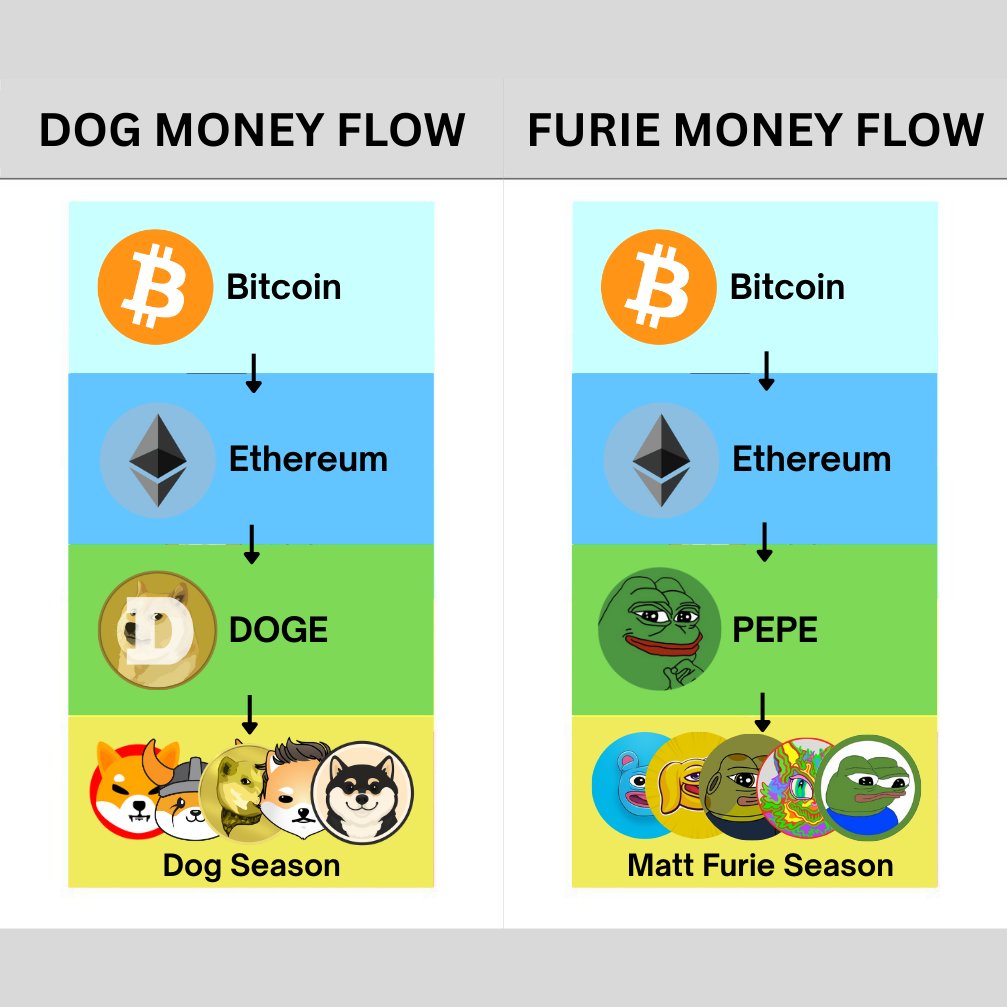

Dogelon Mars es un proyecto meme construido sobre la blockchain de Ethereum que hace airdrops de tokens ELON a los titulares de cripto que han sido estafados por proyectos de estafa. El nombre del proyecto está inspirado en Dogecoin y Elon Musk. ELON es el nombre y el símbolo de ticker del token ERC-20 nativo de Dogelon Mars.

Dogelon Mars ha lanzado cinco cómics en OpenSea que describen las aventuras de Dogelon. Además, el proyecto ha hecho airdrop de 734 millones de tokens ELON a cada víctima del rug pull de WOGE y más de 72 millones a cada víctima del rug plug de CUBACOIN.

En el futuro, los titulares de tokens ELON podrán hacer staking de sus tokens para ganar tokens xELON. Los tokens xELON permitirán a los titulares participar en la gobernanza del proyecto Dogelon Mars. Esto incluye votar en las iniciativas de Dogelon Mars, participar en la toma de decisiones del protocolo, distribuir subvenciones de la tesorería, acceder a oportunidades de ganar DeFi, etc. Además, habrá incentivos de staking de xELON para la comunidad Dogelon Mars. Tras el lanzamiento de xELON, el proyecto lanzará una nueva colección de NFT de Dogelon Mars en la que los propietarios tendrán mayores derechos de voto en la gobernanza de Dogelon Mars, entre otros beneficios.

Dogelon Mars ha contribuido a la Methuselah Foundation, una organización benéfica biomédica sin ánimo de lucro centrada en la investigación de la longevidad y la prolongación de la vida humana. Además, el Laboratorio Nacional de EE.UU. de la Estación Espacial Internacional (ISS) ha reconocido a Dogelon Mars por su apoyo a la investigación en la Estación Espacial Internacional.

Precio de ELON y tokenomics

El 23 de abril de 2021, ELON fue liberado con un suministro máximo de 1 cuatrillón de unidades a través de un lanzamiento justo. El 50 % de este suministro fue transferido al cofundador de Ethereum, Vitalik Buterin. El 50 % y 400 ETH fueron enviados a Uniswap para proporcionar liquidez inicial.

El 12 de mayo de 2021, Vitalik donó el 43 % de ELON a la Methuselah Foundation. Intercambió el 7 % restante en ETH antes de hacer más donaciones.

En menos de un mes desde su lanzamiento, Dogelon Mars contaba con más de 30.000 titulares de ELON. Esta cifra se multiplicó hasta superar los 100.000 titulares en noviembre. Según el anuncio de Dogelon Mars, el proyecto se sumergirá en el espacio DeFi y NFT en el futuro.

Sobre los fundadores

El proyecto Dogelon Mars se lanzó el 23 de abril de 2021. Desde su lanzamiento, el equipo de Dogelon Mars se ha asociado con la Methuselah Foundation para ayudarles a lograr su objetivo de ampliar la esperanza de vida humana. El proyecto también ha colaborado con proyectos DeFi, como Popsicle Finance, para proporcionar liquidez a los titulares de ELON.

Declaración de GEI