Circle's IPO is questioned: the valuation is almost halved, and the desperate monetisation attempt under the pressure of profits?

Author: Nancy, PANews

After years of unsuccessful IPO preparations, Circle, the issuer of stablecoin USDC, recently submitted an application to the SEC to be listed on the New York Stock Exchange. However, issues such as valuations nearly halved, high dependence on U.S. Treasuries for revenues, and high share losses have also raised questions about Circle's business prospects.

The valuation was almost halved, and the shares were sold to Coinbase in exchange for the full issuance rights of USDC

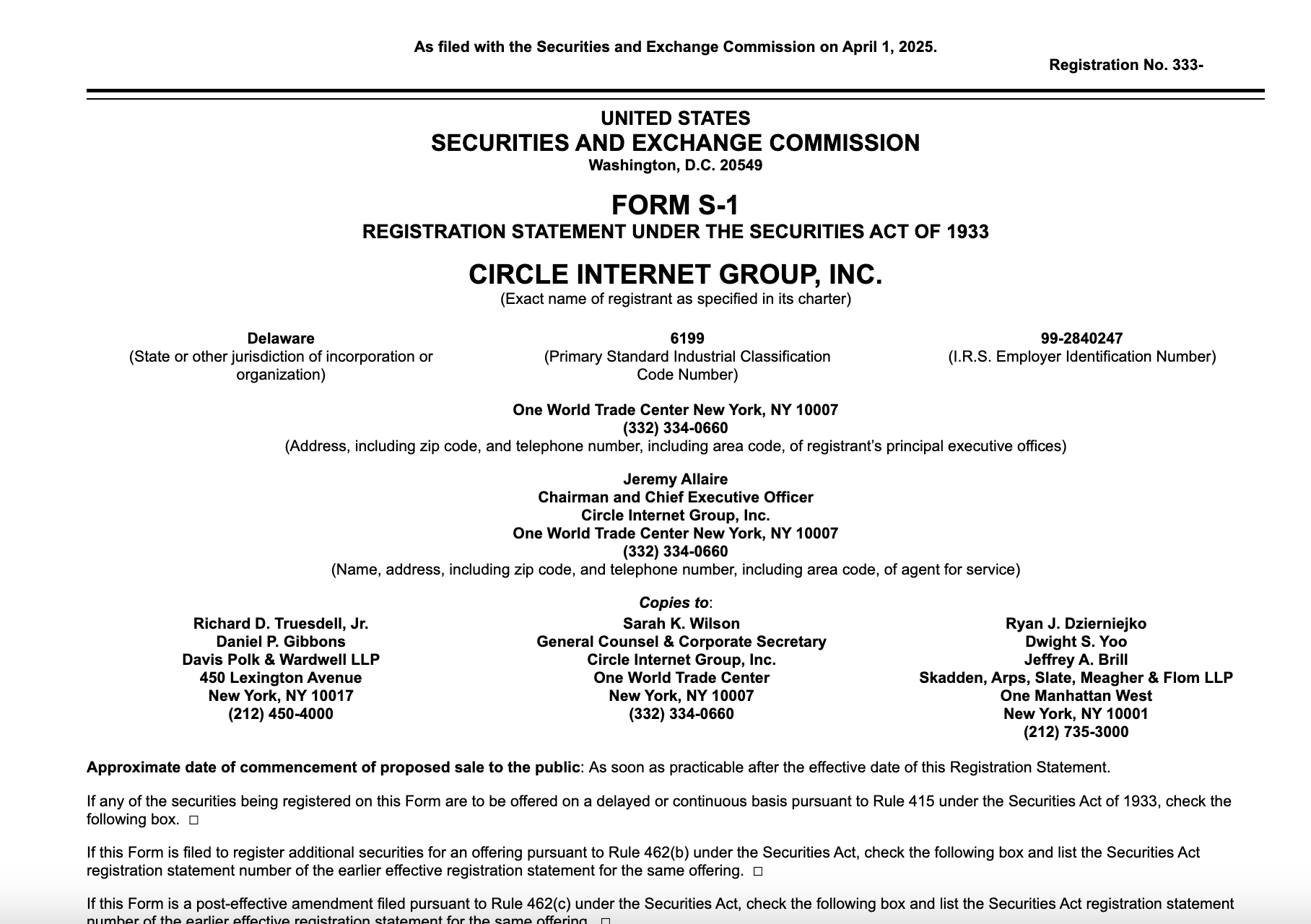

The day before the U.S. House of Representatives plans to amend and vote on the stablecoin regulatory bill GENIUSAct, SEC website documents show that Circle filed an S-1 file with the SEC to conduct an initial public offering under the ticker symbol "CRCL" and apply for listing on the New York Stock Exchange. Meanwhile, Circle has hired JPMorgan Chase...