🧵 Stablecoins and the Overhaul of Global Credit

Lets explore how stablecoins are helping the US distribute its debt globally — and why stablecoin issuers may become the world’s most efficient credit allocator.

2/ Money today is crowded by banks & card providers. Like how SMSs depended on fragmented telecom networks.

Email unified the interface & it no longer mattered which network provider you used.

Stablecoins are our first real shot at doing for money what email did for messaging.

3/ US is warming up to potential of stablecoins:

• GENIUS act passed, greenlighting stablecoins.

• Bank of America, Citibank, JPM, Wells Fargo—exploring joint stablecoin issuance.

• Stripe made key acquisitions this year. Mastercard & Visa rolled out settlement networks.

4/ Stablecoins aren’t new, so why now?

This inflection point is a push from US.

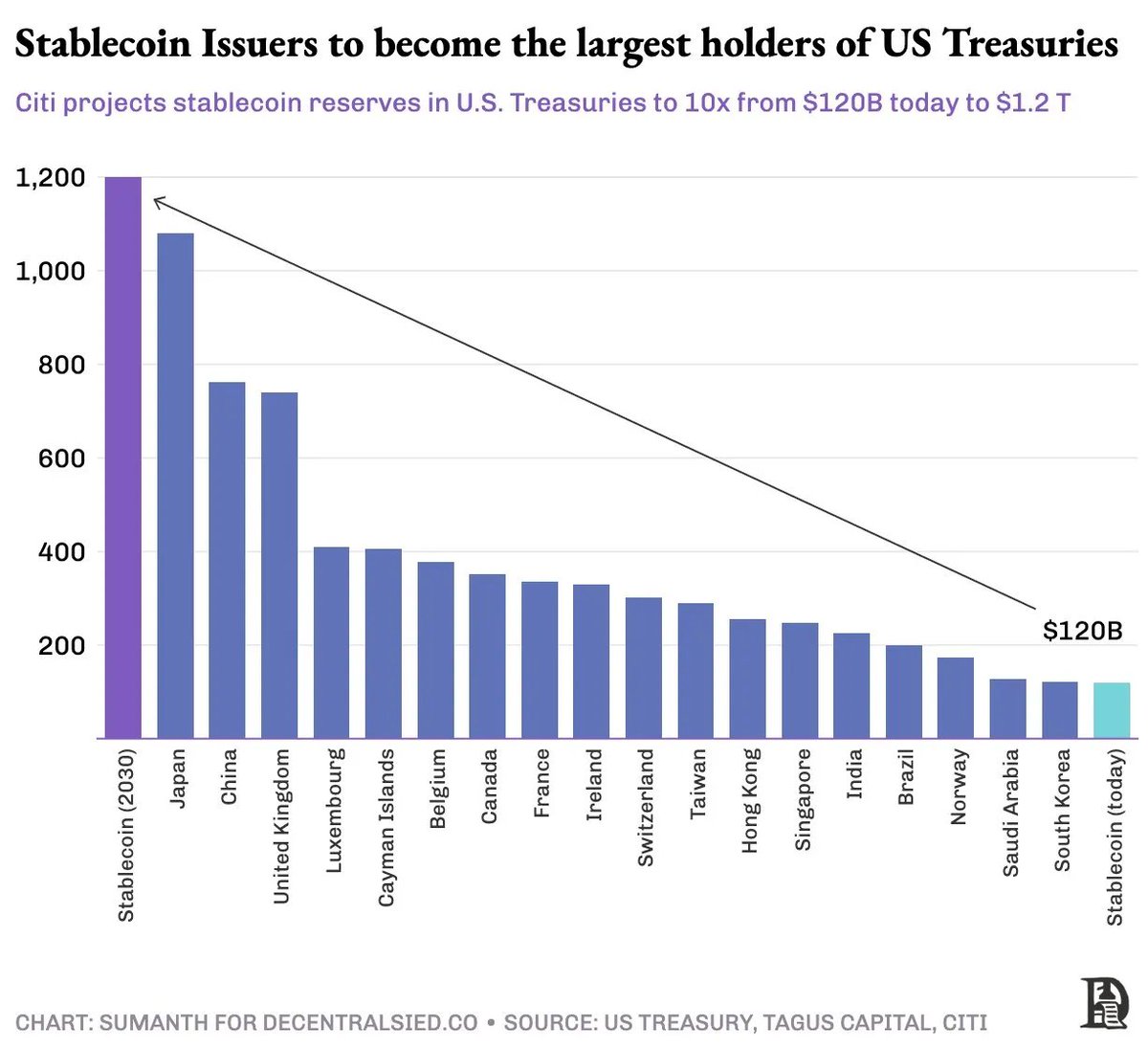

As other countries pull back from US debt amid tariff wars and debt crisis, US is looking for new T-Bill buyers.

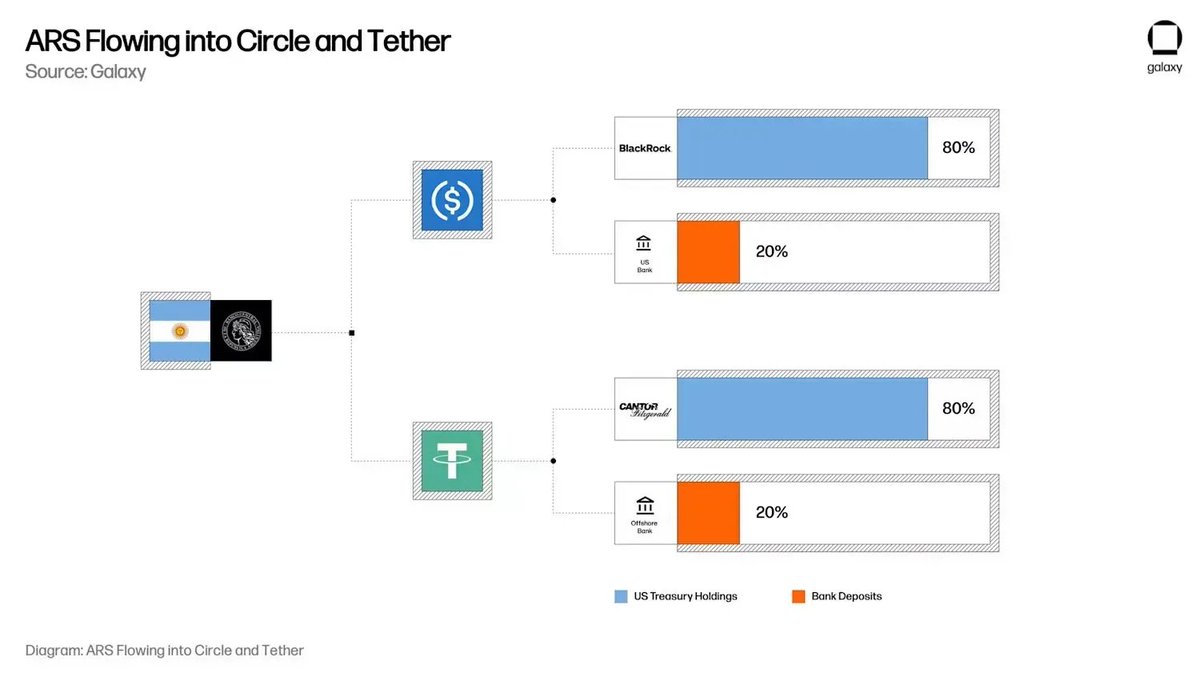

Stables backed by USTs offer a global dollar distribution + large T-Bill demands.

5/ Onboarding the Masses. Three main factors driving non-linear user growth within non-crypto native circles:

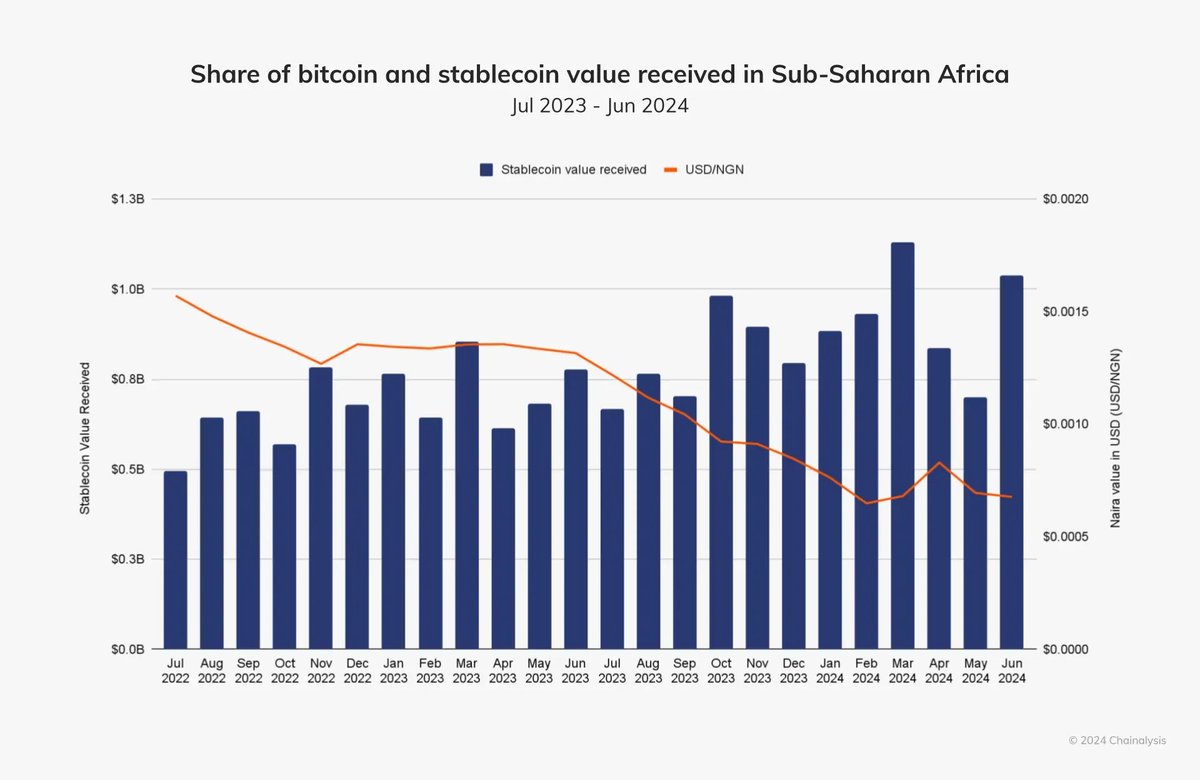

• Stablecoin as a savings instrument: In Nigeria, inflows under $1M align with currency depreciation.

• Stablecoin for payments: SpaceX and ScaleAI using stablecoins for treasury management & global payouts.

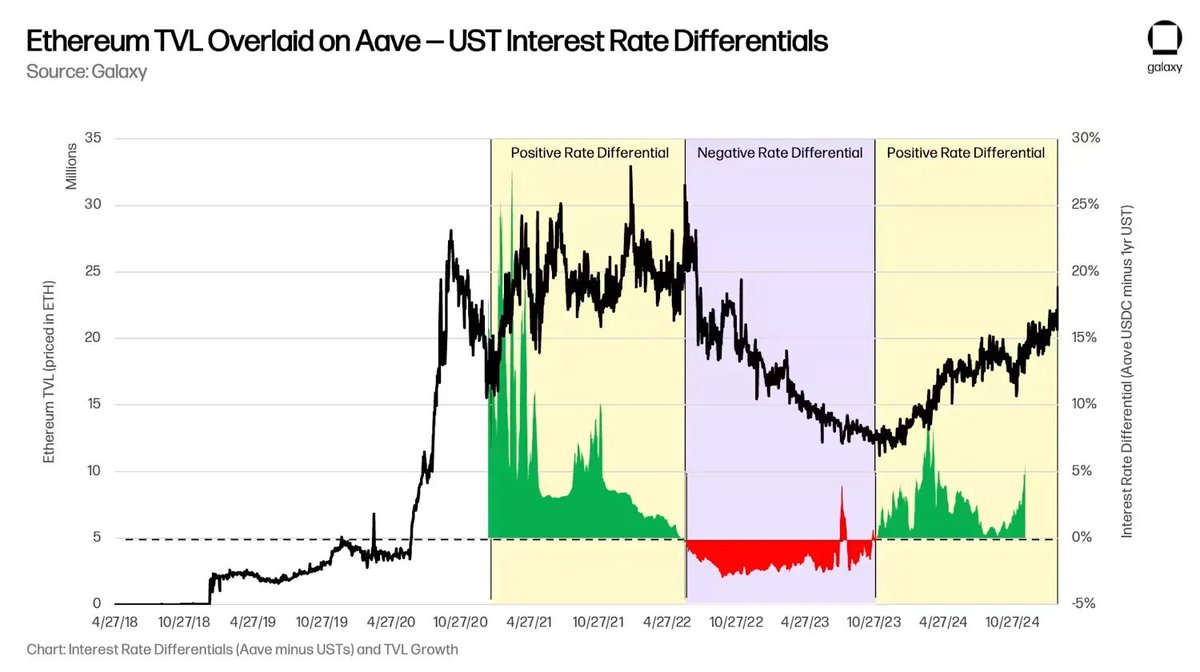

• Attractive DeFi Yields: Historically, as Aave yields rise above T-Bill rates, participants shift liquidity into DeFi, showing a trend.

9/ Some long term predictions and concerns:

We’re shifting from fractional reserve banks to narrow-bank-like models where deposits are backed 1:1 by T-Bills + reserves.

This shift will trigger deep second-order effects across finance. Lets discuss.

11/ Draining liquidity out of Emerging Markets

As stablecoins gain traction in emerging markets, they may unintentionally drain liquidity from domestic banking systems into US markets, reducing local banks' capacity to extend credit, and in turn, slowing economic activity.

12/ Global Credit Allocators

If a fraction of stablecoin issuer reserves shifts from passive T-bill holdings to credit markets, stablecoin issuers can begin allocating credit at global scale.

Shrinking regional bank’s liquidity, evolving into global credit allocators & reshaping how credit is created and distributed globally.

13/ Looming Dollar Risks

• US debt now exceeds $36.2 trillion, or 122% of GDP, growing by $1 trillion every quarter.

• All three major credit agencies have downgraded US credit from AAA.

Citi forecasts places Stablecoins amongst the top holders of US T-Bills, if US debt climbs and T-Bills wobble, so does the trust in digital dollar. Creating a temporary shift to other currencies.

14/ Some Open Questions:

• What does wide adoption of yield-bearing stablecoins look like, and what second-order effects might follow?

• How might global credit evolve if stablecoin issuers replace fractional-reserve banks?

• What alternative reserve models could emerge beyond T-Bills and bank deposits?

• Can these models thrive against the U.S. push for T-Bill-backed stablecoins?

15/ Huge shoutout to @100y_eth from Four Pillars, @Moomsxxx from A1 Research, @ranjitups from Token Dispatch, @web3_pastel from Arakis and @poopmandefi — for their feedbacks. And

6.49K

35

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.