For anyone reading your tweet, just know that 90% of what you just posted is AI slop, that was prompted by a person who didn't even know that Chainlink wasn't a blockchain a week ago, so they don't even know how to prompt the AI properly to analyze what's happening here.

>This is about building infrastructure for institutional crypto adoption, not directly overlapping with Ripple’s payment-focused solutions.

Wrong. Directly from the blog:

The partnership will also focus on facilitating payment versus payment (PvP) for FX and cross-border transactions using Chainlink CCIP, whilst also leveraging Chainlink Proof of Reserve to provide transparent onchain verifications of the reserves backing stablecoins.

So, it turns out that SBI *IS* building alternate cross-border, cross-payment solutions using Chainlink CCIP (atomic PvP), which requires *ZERO* use of XRP as a bridge currency and *ZERO* use of the XRPL.

>Enough with anti-XRP maxi nonsense.

There is zero "anti-XRP maxi nonsense." There is empirical-reality maximality happening.

The XRP community has been getting gaslit in their echo-chamber for so long, their understanding of the state of blockchain technology is still frozen in 2014.

What the XRP community doesn't understand is that XRP was designed in 2011. This was years before we had:

1. Smart contract blockchains

2. Stablecoins

3. Chainlink platform that moves data and value, and connects onchain and offchain sytems.

The **combination** of these technologies allow for cross-chain, cross-border, atomic DvP (Delivery vs Payment) and PvP (Payment vs Payment) swaps to execute **WITHOUT** a bridge currency, and allows the counterparties to settle that transaction on any of *hundreds* of blockchains.

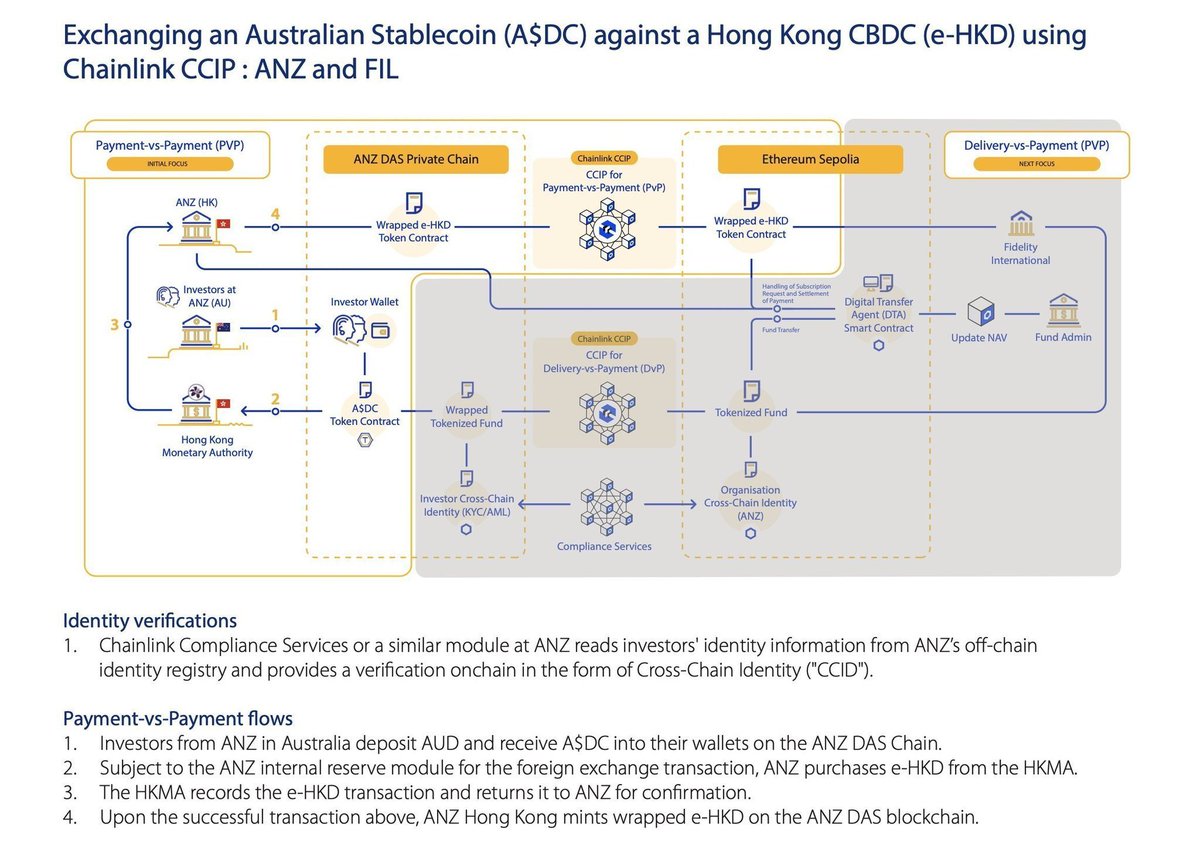

Here is another example of a workflow from a recent report published by Visa that illustrates what I am describing very clearly:

Look at this workflow of a Hong Kong CBDC being exchanged for an Australian dollar stablecoin via Atomic Payment vs Payment (PvP) with Chainlink, Visa, ANZ, China AMC, and Fidelity International.

This transaction is a cross-border, cross-chain atomic PVP swap: Payment-vs-Payment (PvP) trade settlement of a bank-issued stablecoin (A$DC) on a permissioned chain (ANZ DASChain) against a CBDC (e-HKD) on a public blockchain (Ethereum Sepolia)

Look at steps 1 through 4 in the Payment vs Payment flow. Nowhere in those steps is there a "bridge currency" like XRP or usage of XRPL.

What Chainlink is doing with SBI will mimic this workflow.

Let’s just not mention that SBI is a major shareholder of Ripple and all the partnerships and projects between them involving XRP and, early next year, RLUSD.

Quite disingenuous of you.

Here are some examples

*Use of Ripple payments and the XRPL, for projects such as MoneyTap, a payment app for instant domestic transfers in Japan to streamline its ATM network.

*SBI Remit, which uses XRP for remittances to improve speed and lower costs

*also a project that involves promoting non-fungible tokens on the XRP Ledger through SBI Digital Community’s Bto3 initiative.

On the other hand, the SBI partnership with Chainlink, focuses on different use cases, primarily tokenized real-world assets, tokenized funds, and regulated stablecoins, in Japan and later the Asia-Pacific.

SBI will seek to leverage Chainlink’s Cross-Chain Interoperability Protocol for secure cross-chain transactions involving assets like real estate and bonds, Chainlink SmartData for on-chain net asset value data for tokenized funds, and Chainlink Proof of Reserve for transparent stablecoin reserve verification.

This is about building infrastructure for institutional crypto adoption, not directly overlapping with Ripple’s payment-focused solutions.

Ripple’s relationship with SBI focuses on payments and liquidity, like remittances and stablecoin distribution, while Chainlink’s partnership is more about tokenization and data interoperability for institutional finance.

The different relationships are complementary, not competitive.

Enough with anti-XRP maxi nonsense. Link will never be the one coin to rule them all. It’s just another very good project.

19.12K

164

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.