Crypto ETPs Face $1.4B In Weekly Outflows, Largest Since March

Key Insights:

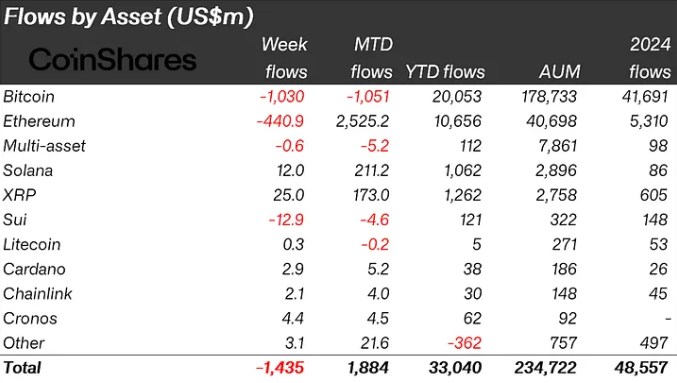

- Digital asset investment products saw $1.43 Billion outflows, driven by Bitcoin’s $1 Billion exodus.

- US Bitcoin spot ETFs hit sixth consecutive day of outflows, approaching $3 Billion total.

- Ethereum ETFs broke a four-day outflow streak with renewed institutional interest.

Digital asset investment products recorded their first significant outflows in weeks, totaling $1.43 Billion in the largest weekly exodus since March.

As CoinShares reported, trading volumes in exchange-traded products reached $38 Billion, about 50% above this year’s average, as investor sentiment became increasingly polarized over US monetary policy.

Early in the week, pessimism around the Federal Reserve’s stance drove outflows of $2 Billion.

However, sentiment shifted following Jerome Powell’s address at the Jackson Hole Symposium, which sparked inflows of $594 Million as markets interpreted his remarks as more dovish than expected.

Bitcoin Bears Brunt of Institutional Exodus

Bitcoin (BTC) recorded $1 Billion in outflows, while Ethereum showed resilience with only $440 Million in losses.

The disparity reflected changing investor sentiment toward the two largest cryptocurrencies by market capitalization.

US-traded Bitcoin spot ETFs faced their sixth consecutive day of outflows, with Farside Investors data showing combined declines approaching $3 Billion.

The sustained selling pressure stressed institutional uncertainty about Bitcoin’s near-term prospects amid monetary policy concerns.

Month-to-date figures revealed stark differences between the assets. Ethereum posted $2.5 Billion in inflows compared to Bitcoin’s $1 Billion net outflows, marking a notable shift in institutional preference.

Further, Ethereum (ETH) spot ETFs broke their four-day outflow streak. The reversal came as institutional investors rotated capital from Bitcoin into Ethereum products, viewing the shift in monetary policy as more favorable for alternative digital assets.

Inflows year-to-date for Ethereum represent 26% of total assets under management compared to just 11% for Bitcoin. The divergence suggests Ethereum’s growing appeal as institutions seek exposure beyond Bitcoin.

This shift in tone was more strongly reflected in Ethereum than in Bitcoin following Powell’s Jackson Hole address.

The Fed chair’s dovish pivot sparked renewed interest in risk assets, with Ethereum benefiting more than its larger counterpart.

Mixed Altcoin Performance

Altcoin flows presented a mixed picture, with several smaller digital assets attracting institutional attention. XRP led altcoin inflows with $25 Million, followed by Solana at $12 Million and Cronos at $4.4 Million.

However, some altcoins suffered losses as investors consolidated positions in larger assets. Sui and Ton recorded the most significant outflows at $12.9 Million and $1.5 Million, respectively.

The selective nature of altcoin flows suggested institutional investors were becoming more discriminating in their digital asset allocations. Rather than broad-based selling, the data revealed tactical repositioning across different cryptocurrency sectors.

BlackRock Dominates Despite Recent Turbulence

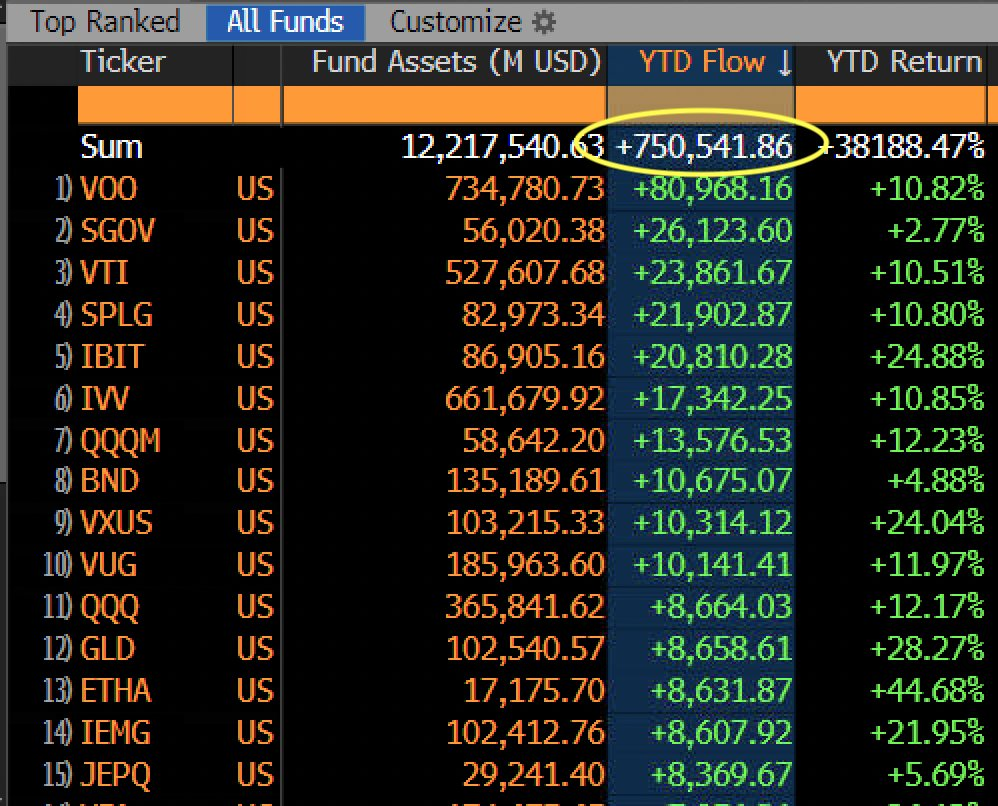

Despite the recent outflows, Bloomberg ETF analyst Eric Balchunas shared an image highlighting that BlackRock’s Bitcoin (IBIT) and Ethereum (ETHA) ETFs represented 3.9% of year-to-date flows across all ETFs globally.

The combined Bitcoin and Ethereum funds demonstrated remarkable market penetration this year.

Among the top 15 ETFs by year-to-date performance, BlackRock’s cryptocurrency products stood apart with exceptional returns. IBIT posted a 24.88% return while ETHA achieved 44.68%, significantly outpacing traditional asset classes.

The strong performance metrics underscored the long-term appeal of cryptocurrency ETFs despite short-term volatility. Institutional investors continued viewing these products as essential portfolio diversification tools.

Crypto ETP Flows Highlight Market Maturation

Crypto exchange-traded products (ETP) trading volumes reached $38 Billion, representing a 50% increase above this year’s average. The surge reflected heightened investor activity as market participants positioned for different monetary policy scenarios.

The elevated trading activity suggested institutional investors were actively managing cryptocurrency exposure rather than adopting passive buy-and-hold strategies.

This dynamic approach contributed to increased market volatility but also provided enhanced price discovery mechanisms.

Market participants closely monitored Federal Reserve communications for additional signals about interest rate policy.

The cryptocurrency market’s sensitivity to monetary policy developments became increasingly apparent as institutional adoption accelerated.

The week’s events highlighted the growing maturity of cryptocurrency ETPs as institutional investment vehicles.

While short-term flows remained volatile, the products demonstrated their ability to attract significant capital during both positive and negative market cycles.

The post Crypto ETPs Face $1.4B In Weekly Outflows, Largest Since March appeared first on The Coin Republic.