Your gateway to crypto trading is just a click away

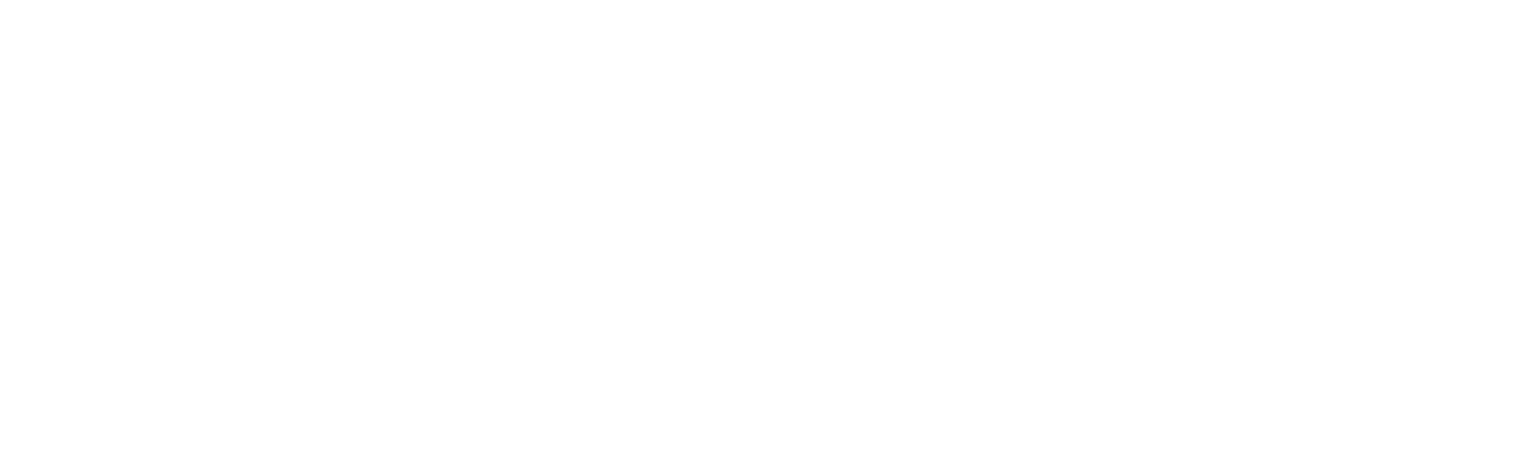

Open an account in minutes

Sign up, verify, and deposit to start your crypto journey today

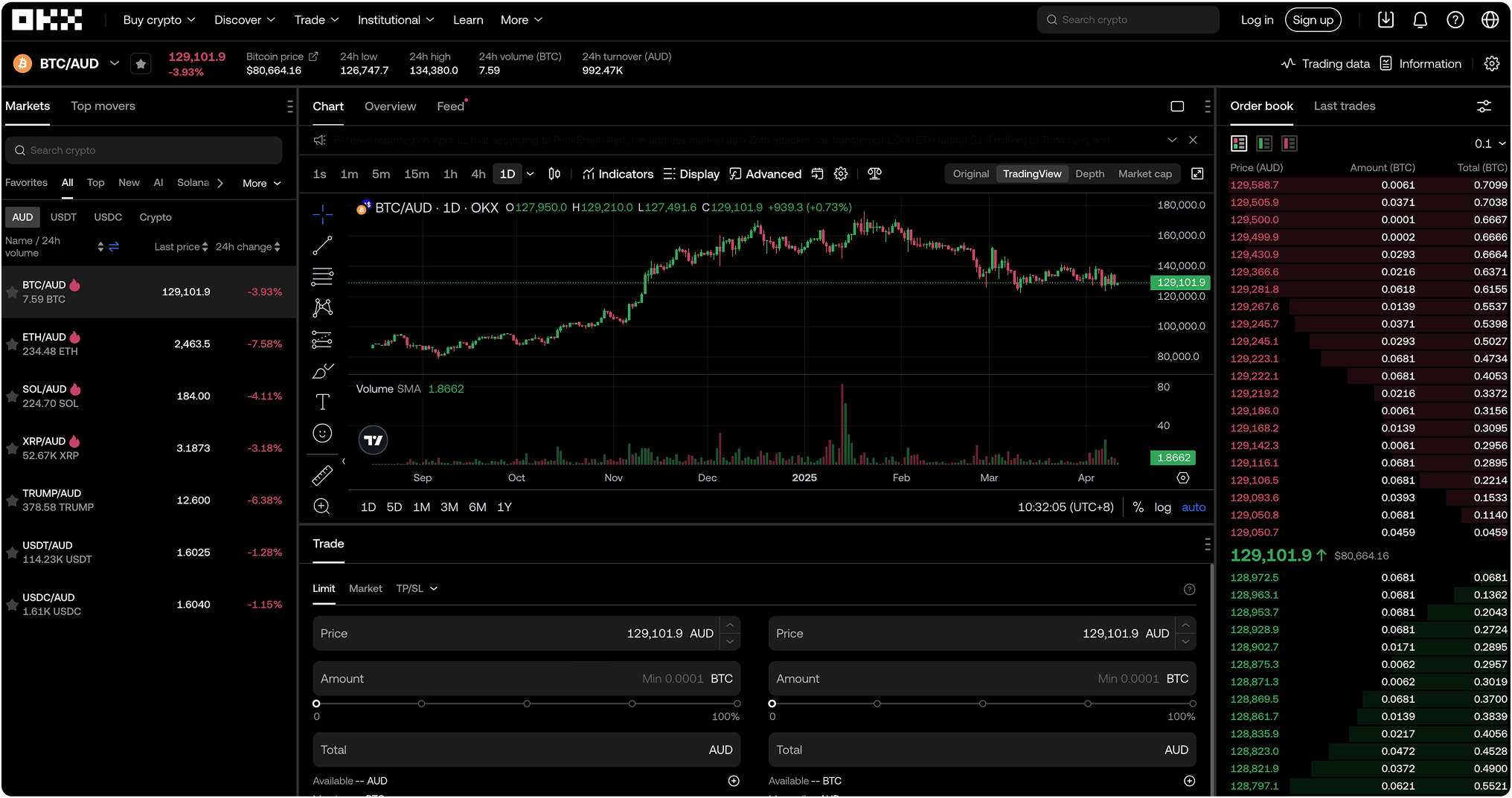

Build your portfolio

Whether you’re a seasoned professional or just starting out, our platform offers the tools and resources you need to access a range of digital assets with ease

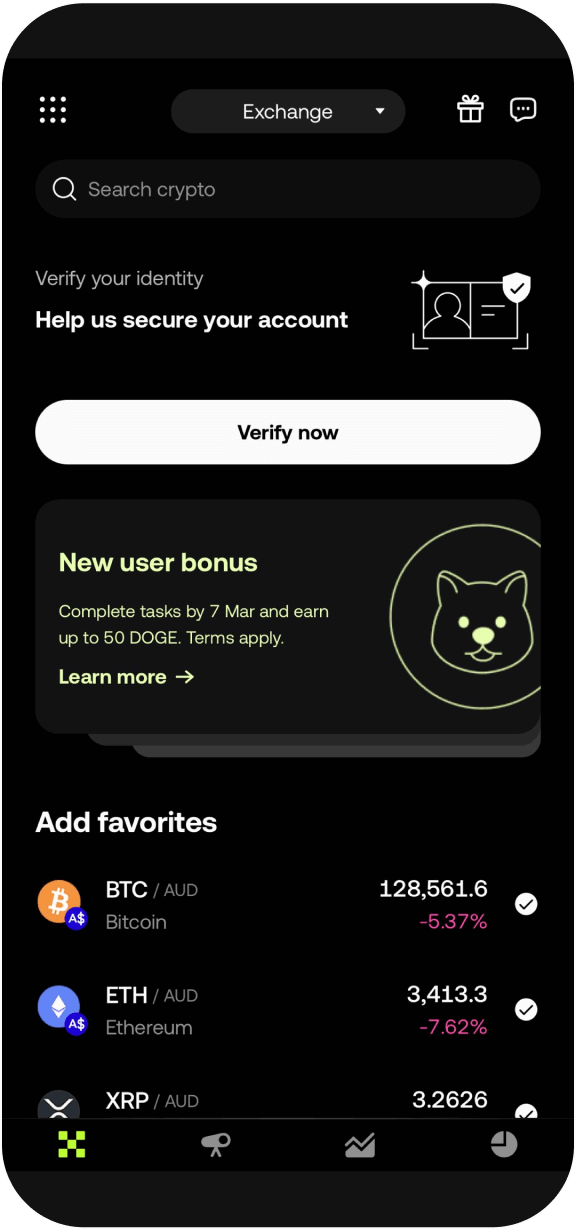

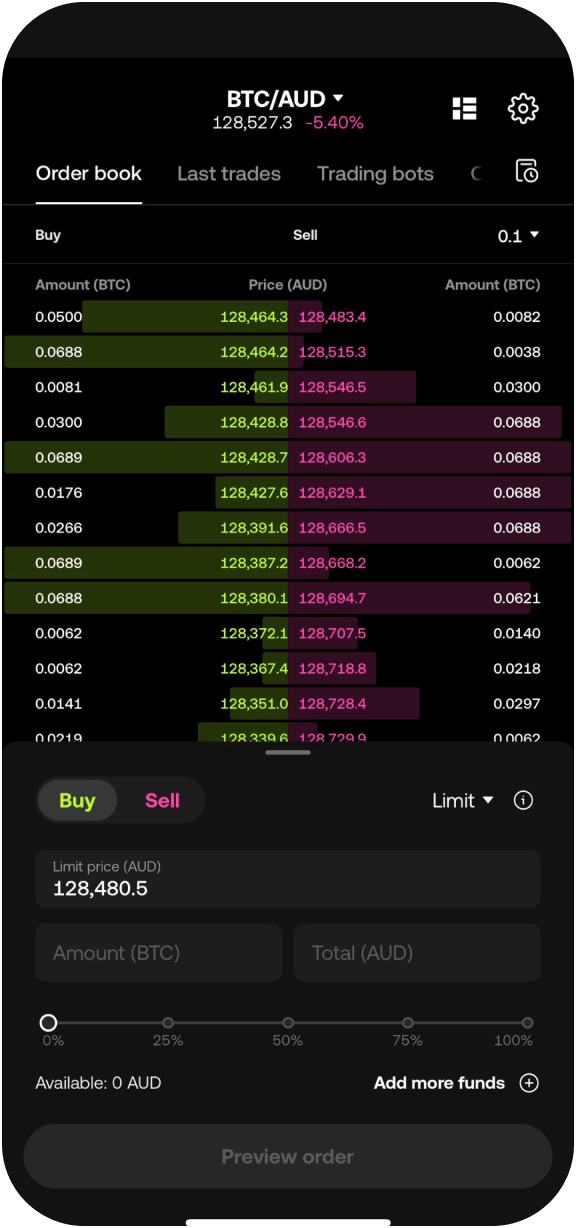

Buy cryptoComplete your favourite trades with competitive fees in Australia

One platform — unlimited possibilities. Get low fees, high-speed transactions, powerful APIs, and more.

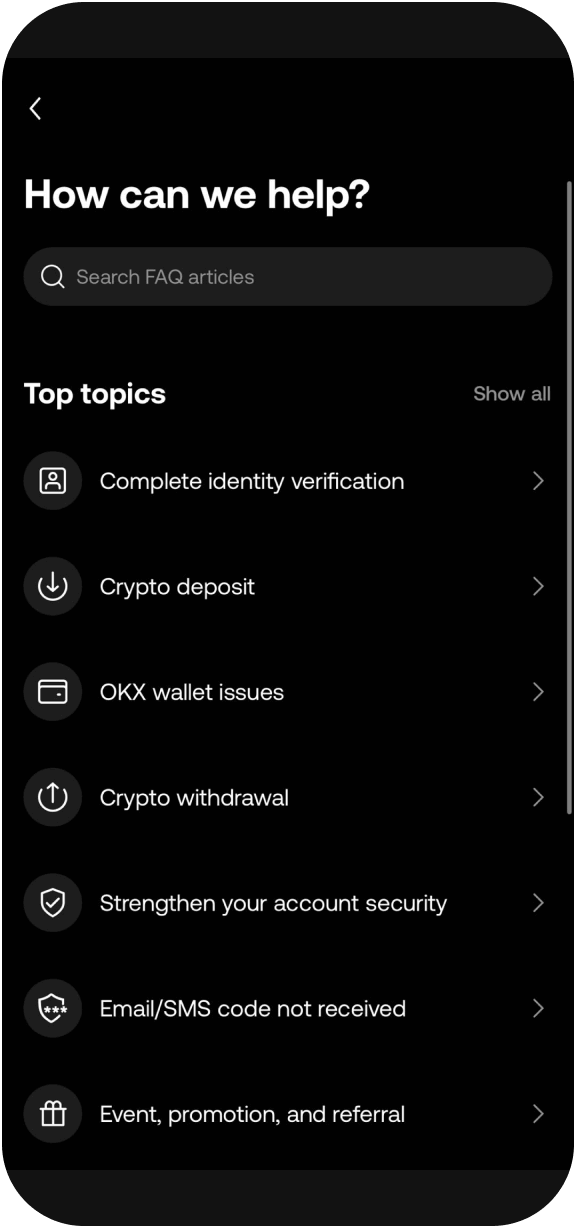

With you every step of the way

From making your first crypto trade to becoming a seasoned trader, you’ll have us to guide you through the process. No question is too small. No sleepless nights. Have confidence in your crypto.

Coach Pep Guardiola

Explains “crazy football formation”

Rewrite the system

Welcome to Web3

Snowboarder Scotty James

Brings in the whole family

Questions? We’ve got answers.

What products does OKX provide in Australia?

Do I have to be in Australia to use OKX?

Why should I trust OKX Australia?

Is OKX licensed in Australia?

How can I apply for access to derivative products on OKX?