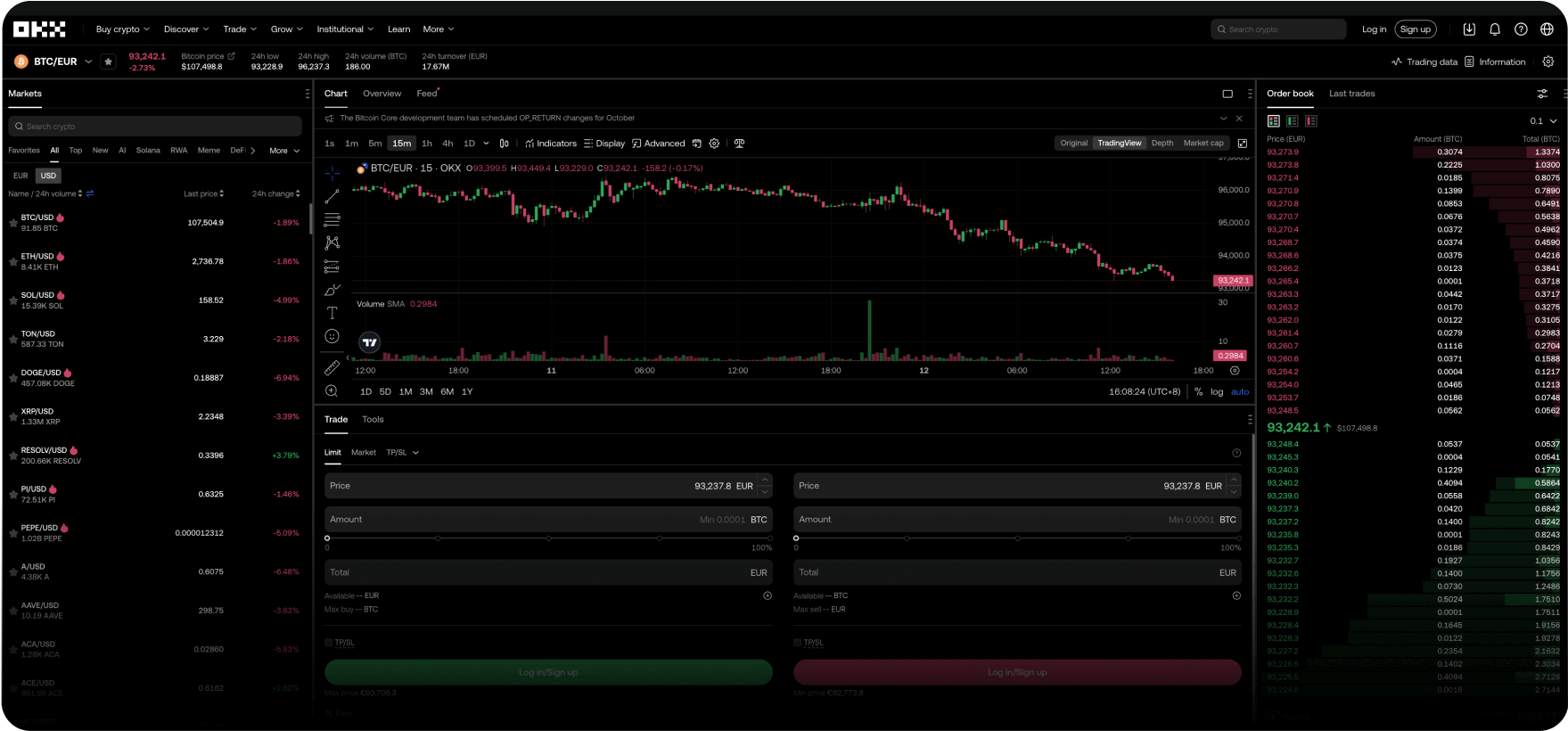

Trade wie ein Profi

Profitiere von unseren niedrigen Gebühren, blitzschnellen Transaktionen, leistungsstarken APIs und mehr.

Wir sind bei jedem Schritt an deiner Seite

Vom ersten Krypto-Trade bis hin zum erfahrenen Trader – wir begleiten dich auf jedem Schritt. Keine Frage ist zu klein, keine schlaflosen Nächte. Hab Vertrauen in deine Krypto.

Trainer Pep Guardiola

Erklärt „verrückte Fußball-Aufstellung“

Das System umschreiben

Willkommen bei Web3

Snowboarder Scotty James

Bringt die ganze Familie mit

Du hast Fragen? Wir haben die Antworten.

Welche Produkte bietet OKX an?

Wie kann ich Bitcoin und andere Kryptowährungen bei OKX kaufen?

Wo ist der Hauptsitz von OKX?

Können Einwohner der Europäischen Union OKX nutzen?