Quick Explain & Personal Though on Pendle's @boros_fi

1. Funding rates are periodic payments between long and short prep traders. If the market is bullish (perp price > spot), longs pay shorts (positive funding rate)

2. Boros "tokenizes" these funding rates into assets called Yield Units (YU). Example: 1 YU-ETH = the funding yield from 1 ETH notional in Binance's ETH/USDT perp

3. If you think funding will go up ▶︎ Long YU. If you think funding will go down ▶︎ Short YU.

4. Use Case Example: Ethena, which relies on positive funding for stablecoin yields, can short YUs to lock in rates and protect against drops

---- thoughts:

1. This product is targeting the funding rate arbs and protocol, but not normal retail user. I don't think much retails really care about how much they are paying to the funding rate. For funding rate stablecoin protocol like Ethena, they may have huge demand on "Short YU", not sure about the liquidity for them to hedge if buy side is not enough.

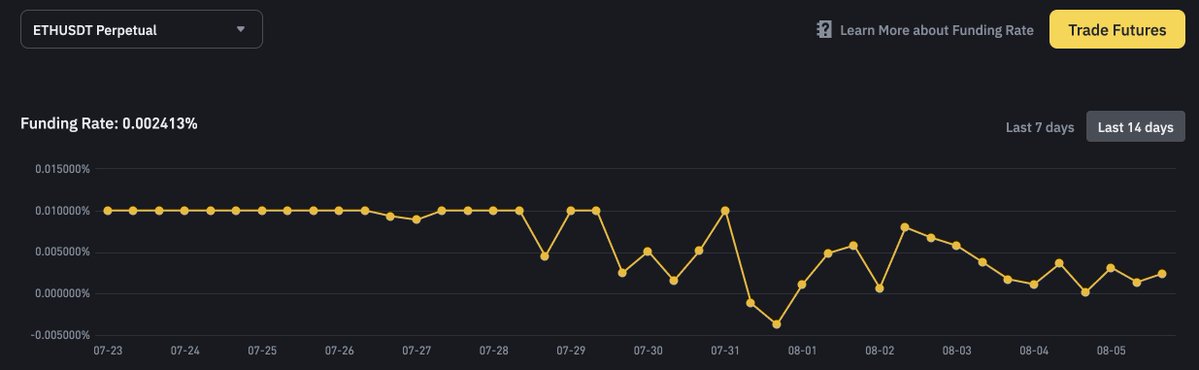

2. Funding rate formula can be adjusted by CEX. From below chart, you can actually observe the recent funding rate for $ETH is pretty consistent to stay on/below 0.01%, even during a bull market. Exchange generally now encourage more AUM so they tend to not make their funding rate too high.

The result is more smart users (who actually who play with trading funding rate) will also likely to sell YU as well. So I'm not too sure who will be the buy sides of YU.

3. Pendle Team always deliver a great product, I'm a pendle user and I'm willing to trust them have a proper mechan on this product, including risk control.

Mostrar original

14,68 mil

86

El contenido de esta página lo proporcionan terceros. A menos que se indique lo contrario, OKX no es el autor de los artículos citados y no reclama ningún derecho de autor sobre los materiales. El contenido se proporciona únicamente con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo vinculado para obtener más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. El holding de activos digitales, incluyendo stablecoins y NFT, implican un alto grado de riesgo y pueden fluctuar en gran medida. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti a la luz de tu situación financiera.