Crossing the divide, "crypto-related" companies will replace "crypto-native" projects into the mainstream

Written by: Richard Chen

Compiled by: Tim, PANews

It's 2025, and cryptocurrencies are going mainstream. The GENIUS Act has been officially signed into law, and we finally have a clear regulatory framework for stablecoins. Traditional financial institutions are embracing cryptocurrencies. Crypto wins!

As cryptocurrencies cross the divide, this trend for early-stage VCs means: We see crypto-related projects gradually overtaking crypto-native projects. The so-called "crypto-native projects" refer to projects built by crypto experts for the crypto field. "Crypto-related projects" refer to the application of encryption technology in other mainstream industries. This is the first time I've witnessed this transformation in my career, and this article hopes to delve into the core differences between building crypto-native projects and crypto-related projects.

Built natively for crypto

Almost all of the most successful crypto products to date are built for crypto-native users: Hyperliquid, Uniswap, Ethena, Aave, etc. Like any niche culture movement, cryptocurrency is so timeless that it is difficult for ordinary users outside the crypto circle to "understand its essence" and become avid daily users. Only those crypto-native players who are on the front line of the industry have enough risk tolerance and are willing to spend energy testing each new product and survive various risks such as hacker attacks and project team runaways.

Traditional Silicon Valley venture capital has refused to invest in crypto-native projects because they believe their overall effective market is too small. This is understandable, at that time the crypto space was indeed in a very early stage. There are only a handful of on-chain applications, and the term DeFi was not coined in a group chat in San Francisco until October 2018. But you have to bet on faith and pray for a macro dividend that will make a leap in the size of the crypto-native market. Sure enough, with the dual blessing of the liquidity mining boom in the DeFi summer of 2020 and the zero interest rate policy period in 2021, the crypto-native market has expanded exponentially. In an instant, all Silicon Valley venture capitalists rushed into the crypto field and asked me for advice, trying to make up for the four years of cognitive gap they had missed.

As of now, the total serviceable market size of crypto-native users is still limited compared to traditional non-crypto markets. I estimate that the number of Twitter users in the crypto space is only tens of thousands at most. Therefore, to achieve nine-figure ($100 million) annual recurring revenue (ARR), average revenue per user (ARPU) must be maintained at a very high level. This leads to the following key conclusions:

Crypto-native projects are built entirely for the connoisseurs.

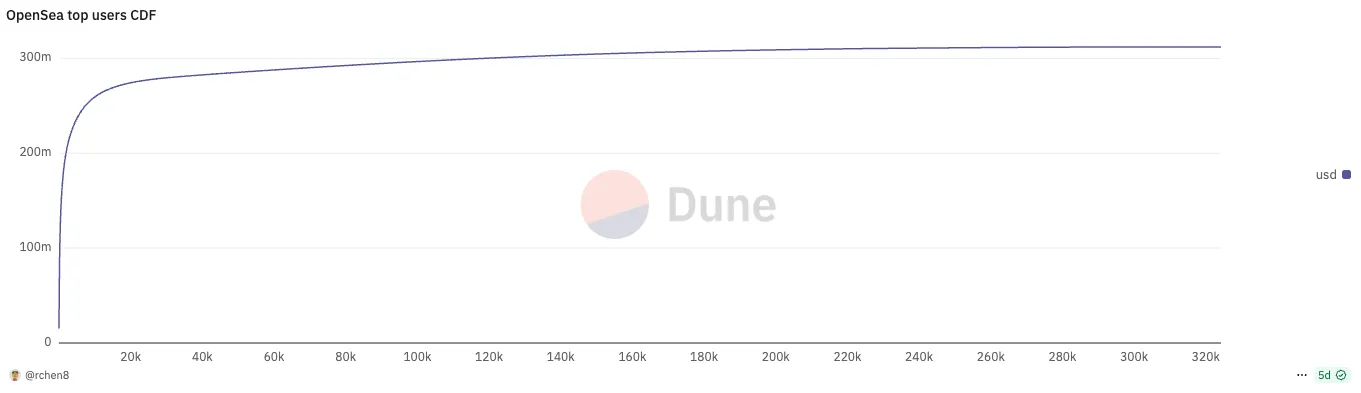

Every successful crypto-native product follows a user usage pattern with an extreme power law distribution. Last month, the top 737 users on the OpenSea platform (accounting for only 0.2%) contributed half of the total trading volume; The top 196 users on the Polymarket platform (accounting for only 0.06%) also completed 50% of the platform's trading volume!

As the founder of a crypto project, what really keeps you up at night should be how to retain top core users, rather than blindly pursuing the growth of the number of users, which is completely contrary to the traditional concept of "daily active users first" pursued by Silicon Valley.

User retention in the crypto space has always been a challenge. Head users are often mercenary and easy to be pried away by incentive mechanisms. This allows emerging competitors to dig up a few core users and eat away at your market share, such as Blur vs. OpenSea, Axiom vs. Photon, LetsBonk and Pump.fun, and more.

In short, compared to Web2, the moat of crypto projects is much shallower, and with all code being open source and projects being highly prone to forks, native crypto projects are often short-lived, with a lifecycle rarely exceeding a market cycle, sometimes lasting only a few months. Founders who get rich after TGE often choose to "lie flat" and retire and turn to angel investing as a retirement side hustle.

The only way to retain core users is to continuously drive product innovation and stay one step ahead of competitors. The key to Uniswap's ability to stand tall in the face of seven years of fierce competition lies in its continuous launch of breakthrough features from 0 to 1, and innovations such as V3 centralized liquidity, UniswapX, Unichain, and V4 hook design continue to meet the needs of core users. This is particularly commendable, after all, its deeply cultivated decentralized exchange track can be called the most fierce field in all the Red Sea markets.

Built for crypto-related

There have been many attempts to apply blockchain technology to broader real-world markets, such as supply chain management or interbank payments, but they have failed due to premature timing. Although Fortune 500 companies have tried blockchain technology in R&D and innovation laboratories, they have not seriously put it into large-scale actual production. Remember those buzzwords back then? "Blockchain does not require Bitcoin", "Distributed ledger technology", etc.

We are currently seeing a complete shift in the attitude of a large number of traditional institutions towards cryptocurrencies. Major banks and giants have launched their own stablecoins, and the regulatory clarity during the Trump administration has opened up policy space for the mainstreaming of cryptocurrencies. Today, cryptocurrencies are no longer a financial wilderness that lacks regulation.

For the first time in my career, I started to see more and more crypto-related projects rather than crypto-native projects. And for good reason, because the biggest success stories in the next few years are likely to be crypto-related projects rather than crypto-native projects. IPOs are expanding to the order of tens of billions of dollars, while TGEs are often limited to hundreds of millions of dollars to billions of dollars. Examples of crypto-related projects include:

-

Fintech companies that use stablecoins for cross-border payments

-

Robotics companies that use DePIN incentives for data collection

-

Consumer companies that use zkTLS to authenticate private data

The common rule here is that encryption is just a feature, not a product itself.

Professional users remain crucial for industries that rely heavily on crypto, but their extreme tendencies have eased. When cryptocurrencies exist only as a function, the key to success depends less on the crypto technology itself and more on whether the practitioner has profound knowledge in crypto-related fields and has an insight into the core elements of the industry. Take the fintech sector as an example.

The core of fintech is to achieve user acquisition with good unit economics (user acquisition cost / user lifetime value). Today's emerging crypto fintech startups are constantly facing fear, fearing that established non-crypto fintech giants with larger user bases can easily crush them by simply adding cryptocurrencies as functional modules, or push up the industry's customer acquisition costs and make them uncompetitive. Unlike pure crypto projects, these startups cannot continue to operate by issuing market-sought-after tokens.

Ironically, the crypto payment space has long been a neglected track, as I said during my speech at the Permissionless Conference 2023! However, before 2023 is the golden age to start a crypto fintech company, and you can seize the opportunity to build a distribution network. Now, with Stripe's acquisition of Bridge, crypto-native founders are moving from DeFi to payments, but they will eventually be crushed by former Revolut employees who know how to play fintech.

What does "crypto-related" mean for crypto venture capital? The key is to avoid reverse screening of founders who have been rejected by non-professional venture capitalists, and don't let crypto venture capitalists become takeovers because they are not familiar with related fields. A large number of reverse screening stems from the selection of native crypto founders who have recently switched from other fields to "crypto-related". Here's the hard truth: in general, crypto founders tend to be frustrated in Web2 (although the top 10% are different).

Crypto venture capital institutions have historically had a high-quality value depression to explore potential founders outside the Silicon Valley network. They don't have a strong resume (such as a Stanford degree or Stripe experience), nor are they good at pitching projects to venture capital firms, but they understand the essence of crypto culture and how to build a passionate online community. When Hayden Adams was laid off from his position as a mechanical engineer at Siemens, he wrote Uniswap with the intention of learning the programming language Vyper; Stani Kulechov started Aave (formerly ETHLend) just before graduating from law in Finland.

Successful crypto-related project founders will be in contrast to successful crypto-native project founders. No longer the Wild West financial cowboy who knows the speculator mentality and can build his charisma around his token network. They will be replaced by more sophisticated and business-minded founders, often from crypto-related fields and with unique market entry strategies to achieve user reach. As the crypto industry matures and steadily develops, a new generation of successful founders will also emerge.

At last

1. The Telegram ICO event in early 2018 vividly demonstrated the thinking gap between Silicon Valley venture capital institutions and crypto-native venture capital institutions. Institutions such as Kepeng Huaying, Benchmark, Sequoia Capital, Lightspeed Ventures, Red Dot Ventures, and others have invested because they believe Telegram has the user base and distribution channels to become the dominant application platform. And almost all crypto-native VCs have chosen to give up their investments.

2. My contrarian view of the crypto industry is that there is no shortage of consumer applications. In fact, the vast majority of consumer projects simply do not receive VC support because their ability to generate income is unstable. Entrepreneurs of such projects should not seek venture capital at all, but should be self-reliant to achieve profitability and take advantage of the current consumption boom to make money quickly. The original accumulation must be completed before the tide turns.

3. Brazil's Nubank has an unfair competitive advantage because it pioneered the category before the concept of "fintech" became popular. What's more, it only needs to compete with Brazil's traditional banking giants for users in its early days, and there is no need to deal with competition from emerging start-up fintech companies. As Brazilians reached their limit of patience with the original bank, they collectively switched to Nubank immediately after the product launch, making it a rare opportunity for the company to achieve near-zero customer acquisition costs and perfect product-market fit at the same time.

4. If you were to build a stablecoin digital bank for emerging markets, why would you stay in San Francisco or New York? You need to go deep into the local conversation with users. Surprisingly, this has become the primary criterion for screening entrepreneurial projects.