Many people take Pendle at face value and 'trust' other people's conviction without diving into the details.

A nice write-up here from @MeshClans sums it up nicely:

"yes, pendle’s design can feel complex (e.g., pt/yt mechanics), but tooling is improving fast. ai agents from partners are simplifying user flows and unlocking retail value."

Pendle has always benefitted from partner integrations, and with the huge inflow we are about to see from institutions, Pendle is well positioned to further thrive in this environment.

Still don't understand what, why, or how Pendle? Maybe we'll drop something soon to explain.

why pendle is undervalued at $3.78: tokenomics, audits & growth drivers

by mesh, crypto content writer – august 3, 2025

in the volatile world of defi, where hype often overshadows fundamentals, pendle finance stands out as a protocol quietly building the future of yield trading.

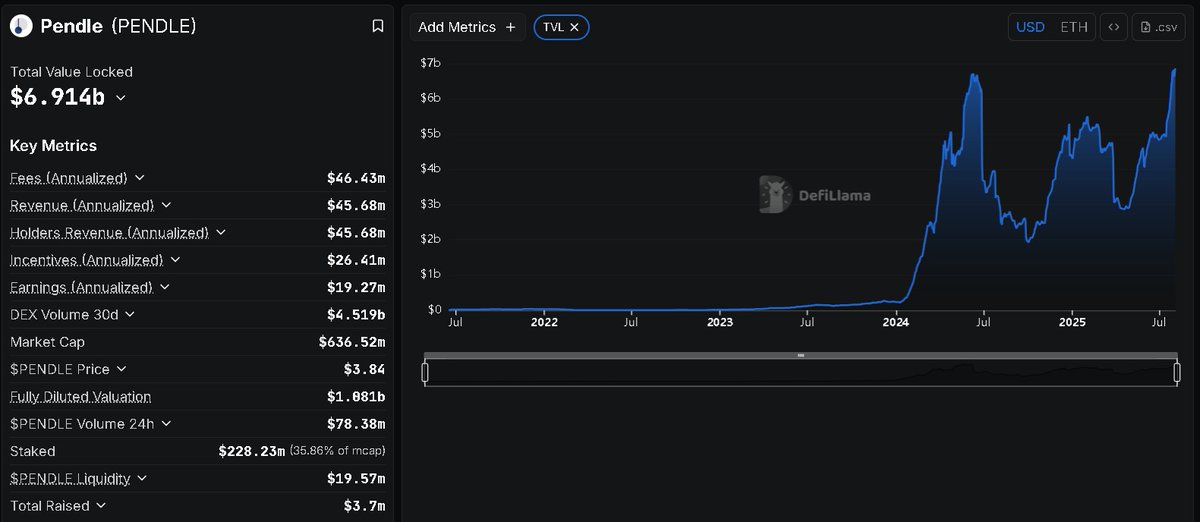

yet at a price of just $3.78 and a market cap of $627.48 million, $pendle still looks undervalued.

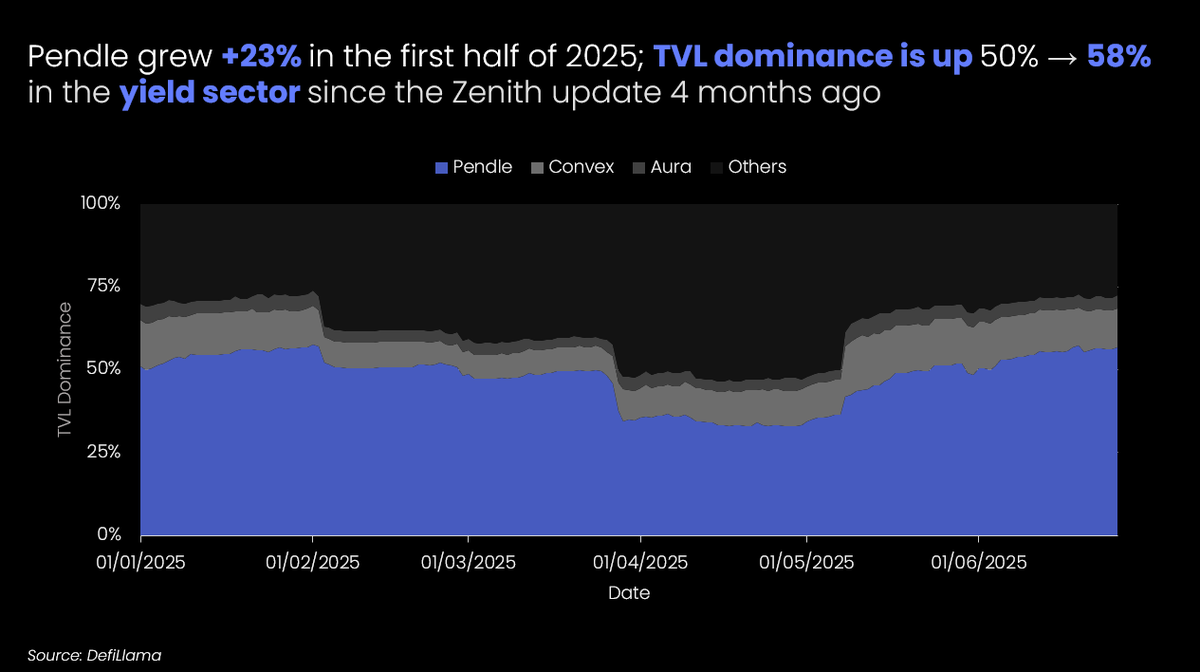

• tvl has climbed to $6.835 billion a major jump from early 2025 levels

• annualized revenue sits at $45.68 million

• pendle is gaining ground not just surviving this market dip

this post breaks down why pendle’s token model, security and growth drivers make it one of the most overlooked tokens in defi. if you're hunting for asymmetric upside, keep reading.

pendle's tokenomics: a sustainable flywheel built for long-term value

@pendle_fi tokenomics are built around real utility, not hype. the $pendle token fuels the vependle system where users lock tokens, earn a share of fees, and vote on incentives.

→ this creates a feedback loop that rewards long-term holders and powers protocol growth.

• supply: circulating supply excludes locked tokens, multisigs, team funds, and ecosystem reserves

➥ team/investor tokens fully vested by sept 2024...emissions now go only to incentives

• emissions: started at 216k/week in sept 2024, decreasing by 1.1% weekly until april 2026

➥ post-2026: inflation flattens to 2% annually

• vependle: locked tokens earn voting power and fee share, while being removed from circulation

➥ dynamic caps ensure high-performing pools get most incentives

• fdv: $1.065 billion...low relative to $6.835b tvl, pointing to long-term upside

critics point to high emissions through 2026, but recent updates like asymmetrical caps have freed up ~50% of emissions for more impactful use.

→ vependle holders now direct emissions toward pools that matter (e.g., for institutional yield sources)

yes, pendle’s design can feel complex (e.g., pt/yt mechanics), but tooling is improving fast. ai agents from partners are simplifying user flows and unlocking retail value.

➜ tokenomics favor sustainability, not short-term pumps a setup for real value accrual as defi matures.

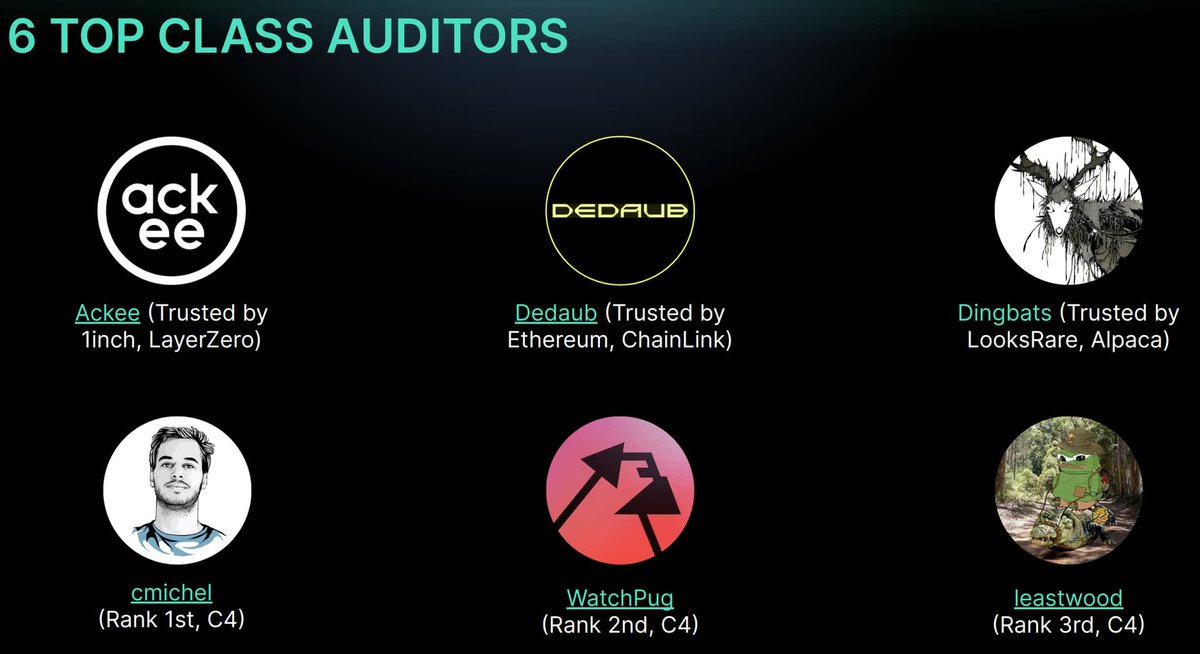

rock-solid security: audits that build trust

security is the baseline and not a bonus. pendle’s contracts have been audited by top-tier teams.

• ackee, dedaub, dingbats - reviewed core contracts, solvency, and logic

• chainsecurity - focused on arithmetic safety and oracle precision in v2

• least authority - confirmed no major vulnerabilities in smart contracts

• code4rena wardens - community-led audits, catching edge cases in yield design

• halborn - audited 2025 strategies like jigsaw finance integrations

→ pendle has never suffered a major exploit. in a space full of rug pulls, that track record matters.

➜ strong audits + open-source code = a protocol that deserves higher trust premiums

growth drivers: from $6.8b tvl to defi’s fixed income layer

pendle is not just yield trading its core pitch has evolved. it’s becoming the fixed income backbone of defi just like i always say.

• tvl: $6.835b locked

➥ driven by integrations like hwhlp (hyperevm) and t-receipts (terminal finance)

➥ 87% of tvl is in stable vaults - sticky, low-volatility capital

• revenues: $46.43m in fees, $45.68m in protocol revenue

• new use cases: boros yield perps launching this month, plus converge (tokenized securities)

• key partners: @ethena_labs (sUSDe at 40% peak usage), @Terminal_fi , @AlchemyPay (fiat on-ramps)

→ strategies like basis trades (20%+ apy) and yt leverage (up to 340%) are bringing in serious capital

• user metrics: over 70k new users in h1 2025

• dex volume: $4.519b in the last 30 days

• efficiency optimizations: yt fee increases to 7% with minimal churn

analyst price targets? some put $pendle at $9+ by eoy largely driven by institutional flows and protocol upgrades.

final thoughts: time to buy the dip?

at $3.78, pendle still trades well below where fundamentals suggest it should be.

→ supply is under control

→ audits are airtight

→ revenue is growing

→ use cases are expanding

→ users are piling in

with annualized earnings at $19.38m and incentives at $26.3m, pendle is maturing into a full-blown defi yield platform.

emissions and complexity are hurdles but they’re being solved.

⬇️ your move: does pendle belong in your portfolio?

follow for more defi deep dives, and drop your take bullish or bearish on $pendle?

big week ahead for pendle(insider info i guess)

disclaimer: this is not financial advice. crypto investments carry risks. also a financial advice but dyor

2.56K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.