More Money, Less Tokens?

It’s no surprise that bigger fundraises tend to dominate mindshare - large rounds act as instant signal boosts, drawing in users who (often rightly) expect a juicy airdrop to follow (if there’s a token coming, why would it trade below the latest valuation?)

The tradeoff:

The bigger the raise, the tighter the token distribution usually gets. Whether it’s sybils or cap table constraints, most high-profile drops end up heavily diluted. Once capital is locked in, there’s rarely room left for a generous community slice.

That’s why stories like Hyperliquid and Kaito stand out.

Both bootstrapped growth. Both gave back meaningfully.

Hyperliquid dropped 30% of supply & was entirely bootstrapped.

Kaito raised just $10M, yet still allocated 10% to its community (yes only 3% was actually claimed I know but still).

What if:

Smaller raises could actually prove to be a competitive edge - giving teams more flexibility to reward early adopters & create those success stories that convert farmers into long term evangelists & attract the next wave of believers?

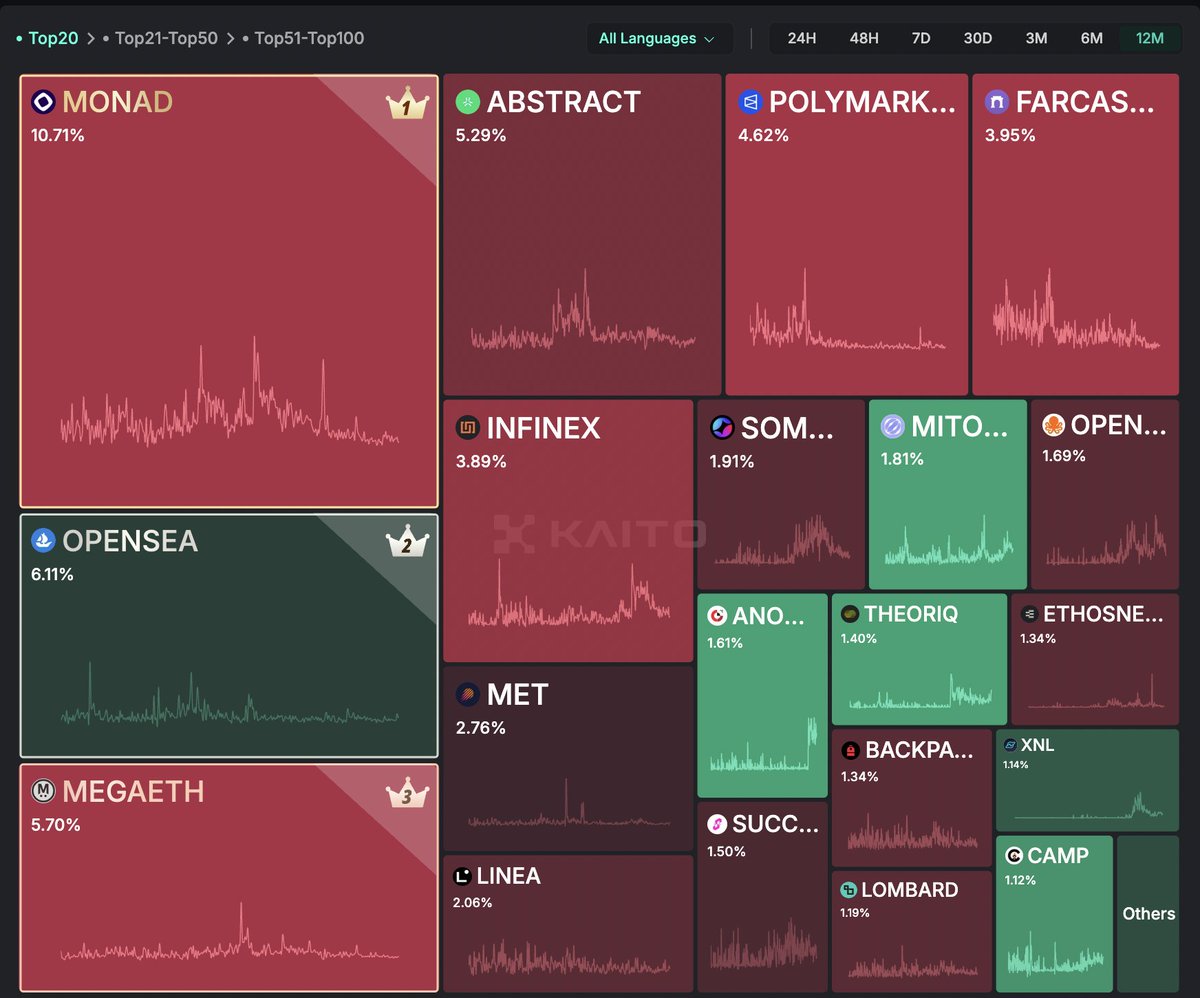

With that lens, a few current projects stand out as ones to watch:

- Ethos (~$2M raised)

- Abstract (~$11M)

- Theoriq ($10M+)

- OpenLedger ($8M+)

- Mitosis ($7M+)

I don't have the answers but I'll be bookmarking this hypothesis for future receipts

932

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.