What We See in the Markets: A Return to Bull Market Dynamics?

Keep up with the latest in crypto research as we share the insights from leading institutional research players.

In this edition, we share what Cumberland sees in the markets with Bitcoin breaking $100K as ETH surges 36%, signaling a potential return to 2021-style high-beta market dynamics while stablecoin infrastructure expands amid Meta and Stripe announcements.

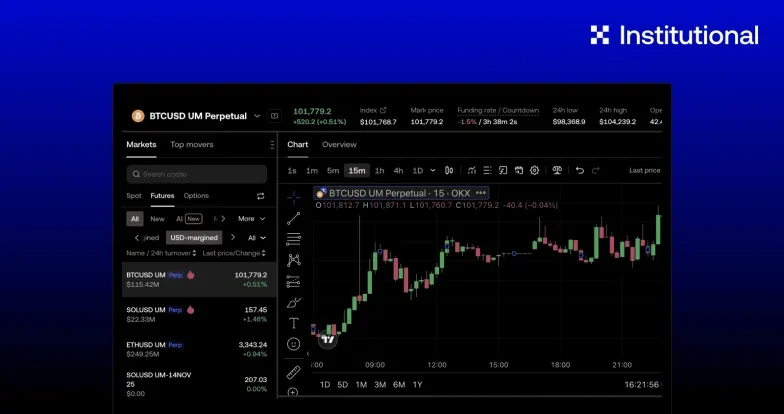

Good Morning and Happy Monday from Cumberland APAC! Last week was a big one for crypto, both from a price and a headline perspective. There’s been an interesting flow of price action, and it has felt in some ways like a throwback to 2021. The initial movement came from the macro space, where equities mostly recovered from a damaging April amidst positive trade developments. BTC had been stuck in a tension between comparisons to Gold, which had an amazing April, and equities, which reminded Bitcoiners that BTC was still broadly a risk asset. The easing of the macro headwinds allowed BTC to recover to the high $90ks, and the breakthrough came on Thursday, when BTC broke above $103k and has not really retraced since.

What is interesting here is the outperformance that this triggered in ETH. In the 2021 bull market, we would typically see alts perform as high-beta assets during upticks, but that was simply not the case during 2024, when alts would underperform during rallies. This resulted in ETH being one of the most-unloved assets of the cycle, which was probably why there was meaningful short interest on it heading into last week. BTC’s strength pushed ETH up towards $2200, and from there it accelerated; over the past week, ETH is up a staggering 36%, compared to BTC’s +8%, the largest weekly rally since May of ’21. In just two days, ETHBTC erased the losses it saw in March (before it moved uninspiringly sideways for the entire month of April). The last time ETHBTC saw this type of move was immediately following the Merge.

This leaves the market in an interesting spot. This rally could just be ETH-specific (and one could argue that it was driven by the Pectra upgrade, though it doesn’t really seem like this was the driver). However, if it is a return to the 2021 dynamics of high Beta, it could be an interesting week. During the 2021 era, BTC rallies would lead to ETH rallies, and then if the price of the majors held, alts would make a major catchup move and then often accelerate past. Again, this has not been the paradigm for the last year, and alts do seem hesitant to rally here. ETH was by far the best performer among L1s since the start of May; most alt L1s are in the 10-25% range. SOL, which is up 15% on the month, will probably be the best indicator of whether the market will return to beta dynamics; if it picks up some interest on the week, it could spread to the rest of the L1 sector.

There were headlines as well, though mostly in the sector least-associated with price: the stablecoin space. Stablecoins are one of the sole sectors within crypto that have found true product-market fit, so we view this as one of the key areas for sustainable infrastructure growth, though normally stablecoin headlines don’t have near-term price impact.

Meta announced it is exploring stablecoin integrations.

Stripe launched stablecoin-funded accounts in over 100 countries; their new features will not only allow pay-in and pay-out, but will also enable merchants to hold stablecoins

Ramp launched a series of stablecoin-powered cards

On the negative side, the stablecoin GENIUS bill failed its first vote in the Senate, with debate resuming on Monday.

It wouldn’t surprise to see continued volatility this week. Macro is not likely to quiet down, with trade deal headlines trickling through. As discussed above, BTC seems to be trading with strength just below its all-time high. Next week will feature prominent events from Solana and Avalanche, followed by Bitcoin Vegas, where JD Vance and David Sacks will speak. Intriguingly, thanks to the low realized volatility in April, upside vol in BTC is still fairly cheap, and backend vol has barely moved (BTC Sep-Dec vol is up less than 1v.) In the grand scheme of things, BTC implied vols are actually fairly close to their all-time lows, which almost certainly would not persist if BTC were to break through its previous ATH.

Happy Trading!

Disclaimer

The information (“Information”) provided by Cumberland DRW LLC and its affiliated or related companies (collectively, “Cumberland”), either in this document or otherwise, is for informational purposes only and is provided without charge. Cumberland is a principal trading firm; it is not and does not act as a fiduciary or adviser, or in any similar capacity, in providing the Information, and the Information may not be relied upon as investment, financial, legal, tax, regulatory, or any other type of advice. The Information has not been prepared or tailored to address, and may not be suitable or appropriate for the particular financial needs, circumstances, or requirements of any person, and it should not be the basis for making any investment or transaction decision. THE INFORMATION IS NOT A RECOMMENDATION TO ENGAGE IN ANY TRANSACTION.

If any person elects to enter into transactions with Cumberland, whether as a result of the Information or otherwise, Cumberland will enter into such transactions as principal only and will act solely in its own best interests, which may be adverse to the interests of such person. Before entering into any such transaction, you should conduct your own research and obtain your own advice as to whether the transaction is appropriate for your specific circumstances. In addition, any person wishing to enter into transactions with Cumberland must satisfy Cumberland’s eligibility requirements. Cumberland may be subject to certain conflicts of interest in connection with the provision of the Information. For example, Cumberland may, but does not necessarily, hold or control positions in the cryptoasset(s) discussed in the Information, and transactions entered into by Cumberland could affect the relevant markets in ways that are adverse to a counterparty of Cumberland. Cumberland may engage in transactions in a manner inconsistent with the views expressed in the Information.

Cumberland makes no representations or warranties (express or implied) regarding, nor shall it have any responsibility or liability for the accuracy, adequacy, timeliness, or completeness of, the Information, and no representation is made or is to be implied that the Information will remain unchanged. Cumberland undertakes no duty to amend, correct, update, or otherwise supplement the Information.

The virtual currency industry is subject to a range of risks, including but not limited to: price volatility, limited liquidity, limited and incomplete information regarding certain instruments, products, or cryptoassets, and a still emerging and evolving regulatory environment. The past performance of any instruments, products, or cryptoassets addressed in the Information is not a guide to future performance, nor is it a reliable indicator of future results or performance. Investing in virtual currencies involves significant risks and is not appropriate for many investors, including those without significant investment experience and capacity to assume significant risks.

Cumberland SG Pte. Ltd. is exempted by the Monetary Authority of Singapore (“MAS”) from holding a license to provide digital payment token (“DPT”) services. Please note that you may not be able to recover all the money or DPTs you paid to a DPT service provider if the DPT service provider’s business fails. You should not transact in a DPT if you are not familiar with the DPT. This includes how the DPT is created, and how the DPT you intend to transact is transferred or held by your DPT service provider. You should be aware that the value of DPTs may fluctuate greatly. You should buy DPTs only if you are prepared to accept the risk of losing all of the money you put into such tokens. You should be aware that your DPT service provider, as part of its license to provide DPT services, may offer services related to DPTs which are promoted as having a stable value, commonly known as “stablecoins.”

The information provided in this document by Cumberland DRW LLC is for informational purposes only and does not necessarily represent the views of OKX. Any additional disclaimers issued by these third parties are also applicable and should be considered as part of this document.

This report is not intended as financial advice, investment recommendation, or an endorsement of specific trading strategies. The contents of this report, including but not limited to any graphs, charts, and numerical data, are provided “as is” without warranty of any kind, express or implied. The warranties disclaimed include but are not limited to performance, merchantability, fitness for a particular purpose, accuracy, omissions, completeness, currentness, and delays.

The cryptocurrency markets are highly volatile and unpredictable, subject to substantial market risks including significant price fluctuations. The strategies, opinions, and analyses included are based on information available at the time of writing and may change without notice. They are also based on certain assumptions and historical data that may not be accurate or applicable in the future. Therefore, reliance on this report for the purpose of making investment decisions is at your own risk.

Past performance is not indicative of future results. While we strive to provide accurate and timely information, we cannot guarantee the accuracy or completeness of any data or information contained in this report. We are not responsible for any losses or damages arising from the use of this report, including but not limited to, lost profits or investment losses.

Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The inclusion of any specific cryptocurrencies or trading strategies does not constitute an endorsement or recommendation by OKX. Cumberland New York is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Here is a link to the disclosures on the Cumberland website: https://cumberland.io/compliance/disclosures

An in-principle approval (IPA) reflects MAS’ view that a license may be issued to the applicant upon the fulfilment of specified conditions and provided there are no material adverse developments affecting the applicant. An IPA does not constitute a license at this juncture. MAS reserves the right to rescind the IPA in circumstances where it considers appropriate.

© 2025 OKX. Dieser Artikel darf in seiner Gesamtheit vervielfältigt oder verbreitet oder es dürfen Auszüge von 100 Wörtern oder weniger dieses Artikels verwendet werden, sofern eine solche Nutzung nicht kommerziell erfolgt. Bei jeder Vervielfältigung oder Verbreitung des gesamten Artikels muss auch deutlich angegeben werden: „Dieser Artikel ist © 2025 OKX und wird mit Genehmigung verwendet.“ Erlaubte Auszüge müssen den Namen des Artikels zitieren und eine Quellenangabe enthalten, z. B. „Artikelname, [Name des Autors, falls zutreffend], © 2025 OKX.“ Einige Inhalte können durch künstliche Intelligenz (KI) generiert oder unterstützt worden sein. Es sind keine abgeleiteten Werke oder andere Verwendungen dieses Artikels erlaubt.