Dein globales Konto in digitalen Dollars

Von unserer MiCA-Lizenz bis zu den monatlich veröffentlichten Proof of Reserves – wir tun unseren Teil, damit du sorgenfrei handeln kannst.

1, 2, eingezahlt!

Egal ob PayPal, Apple Pay oder SEPA – wir machen dir das Einzahlen so leicht wie möglich!

Trainer Pep Guardiola

Erklärt „verrückte Fußball-Aufstellung“

Das System umschreiben

Willkommen bei Web3

Snowboarder Scotty James

Bringt die ganze Familie mit

Du hast Fragen? Wir haben die Antworten.

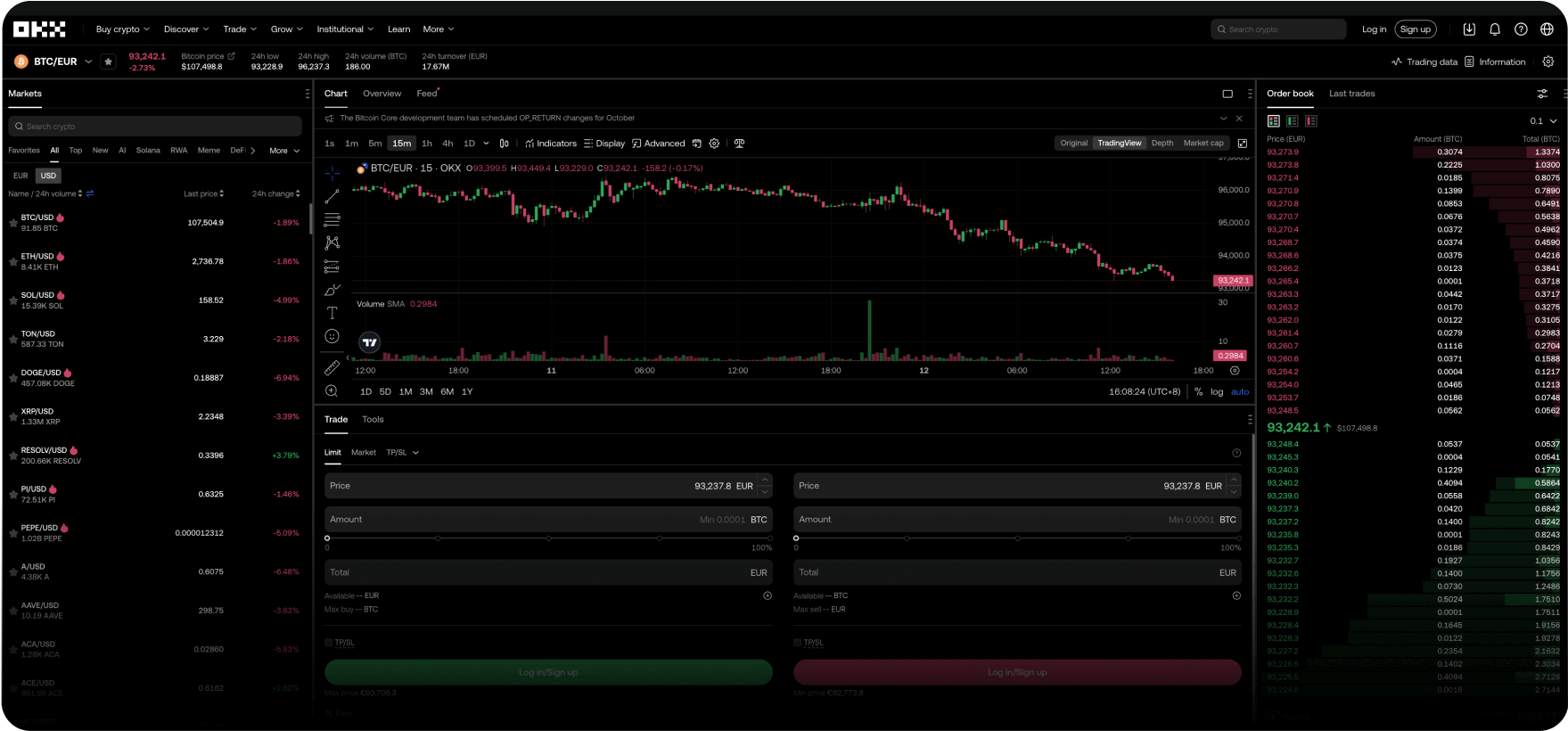

Welche Produkte bietet OKX an?

Wie kann ich Bitcoin und andere Kryptowährungen bei OKX kaufen?

Wo ist der Hauptsitz von OKX?

Können Einwohner der Europäischen Union OKX nutzen?