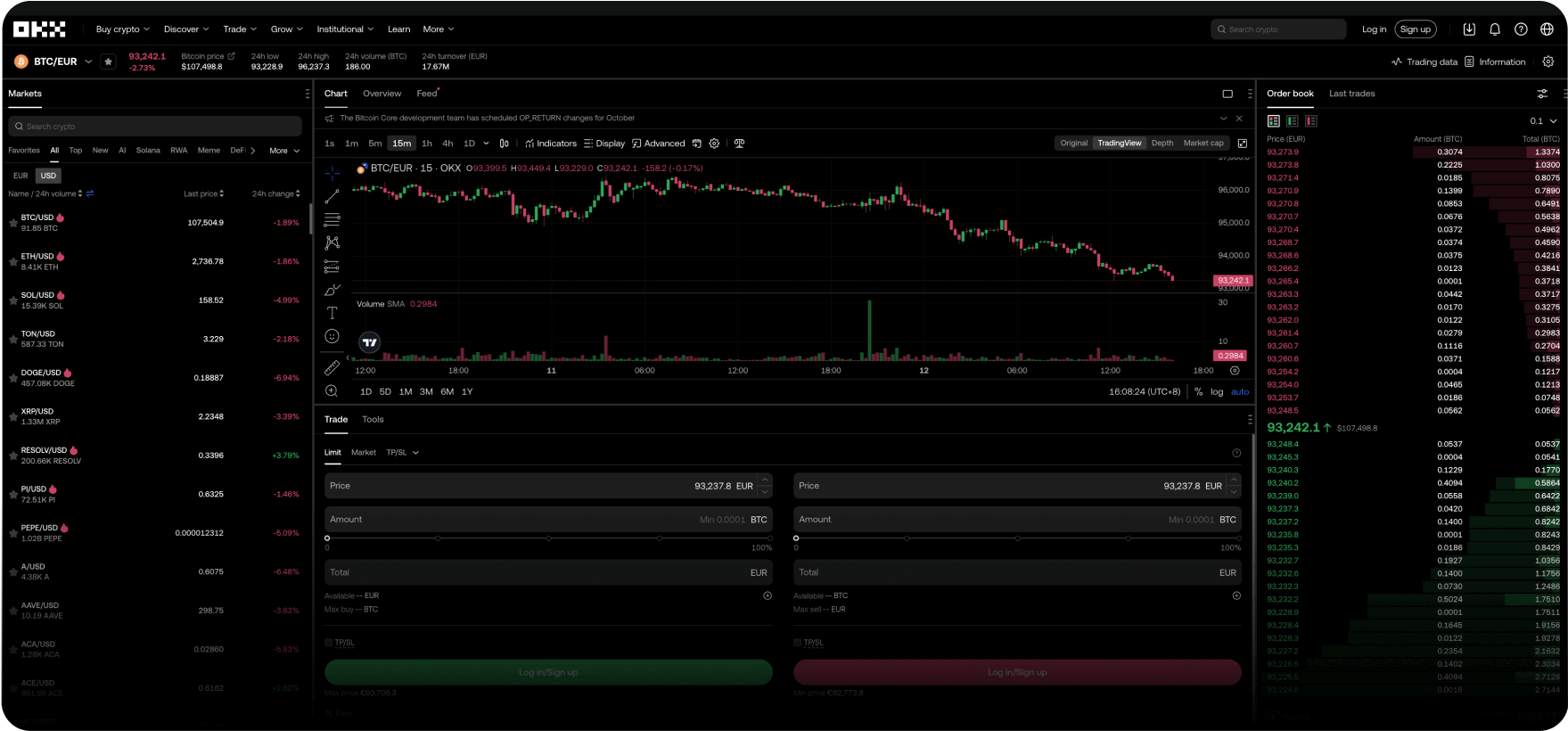

Váš globální účet v digitálních dolarech

Začněte využívat naše vysokorychlostní transakce s nejnižšími poplatky, výkonná rozhraní API a další výhody.

S vámi na každém kroku

Provedeme vás celým procesem – od prvního kryptoměnového obchodu až ke statusu ostříleného obchodníka. Žádná otázka nezní dětinsky. Žádné bezesné noci. Získejte sebedůvěru ve světě kryptoměn.

Trenér Pep Guardiola

Vysvětluje „bláznivé fotbalové formace“

Přetvořte systém

Vítá vás Web3

Snowboardista Scotty James

Zapojuje celou rodinu

Máte otázky? My máme odpovědi.

Jaké produkty OKX nabízí?

Jak u OKX nakoupím bitcoin a další kryptoměny?

Kde společnost OKX sídlí?

Mohou osoby s trvalým pobytem v Evropské unii používat služby OKX?