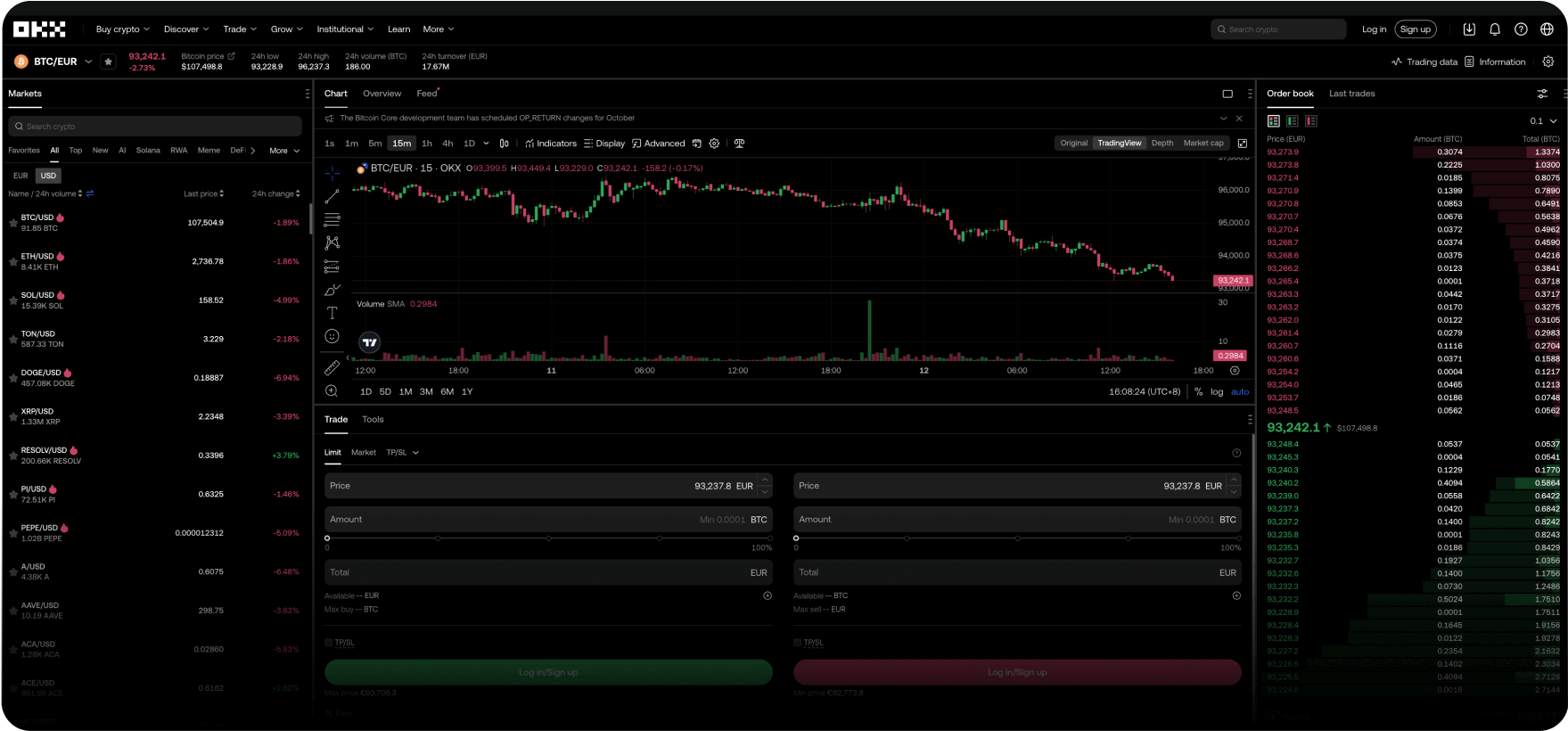

Contul dvs. global în dolari digitali

Obține cele mai mici comisioane, tranzacții rapide, API-uri puternice și multe altele.

Alături de tine pas cu pas

De la prima tranzacționare cripto la statutul de trader experimentat, vă vom fi alături pe tot parcursul procesului. Nu există întrebări greșite. Evită nopțile nedormite. Aveți încredere în activele dunmeavoastă crypto.

Antrenorul Pep Guardiola

Explică „formația de fotbal nebună”

Rescrieți sistemul

Bine ați venit la Web3

Snowboarderul Scotty James

Adună întreaga familie

Ai întrebări? Avem răspunsuri.

Ce produse asigură OKX?

Cum cumpăr Bitcoin și alte criptomonede pe OKX?

Unde își are OKX sediul?

Pot cetățenii Uniunii Europene să utilizeze OKX?