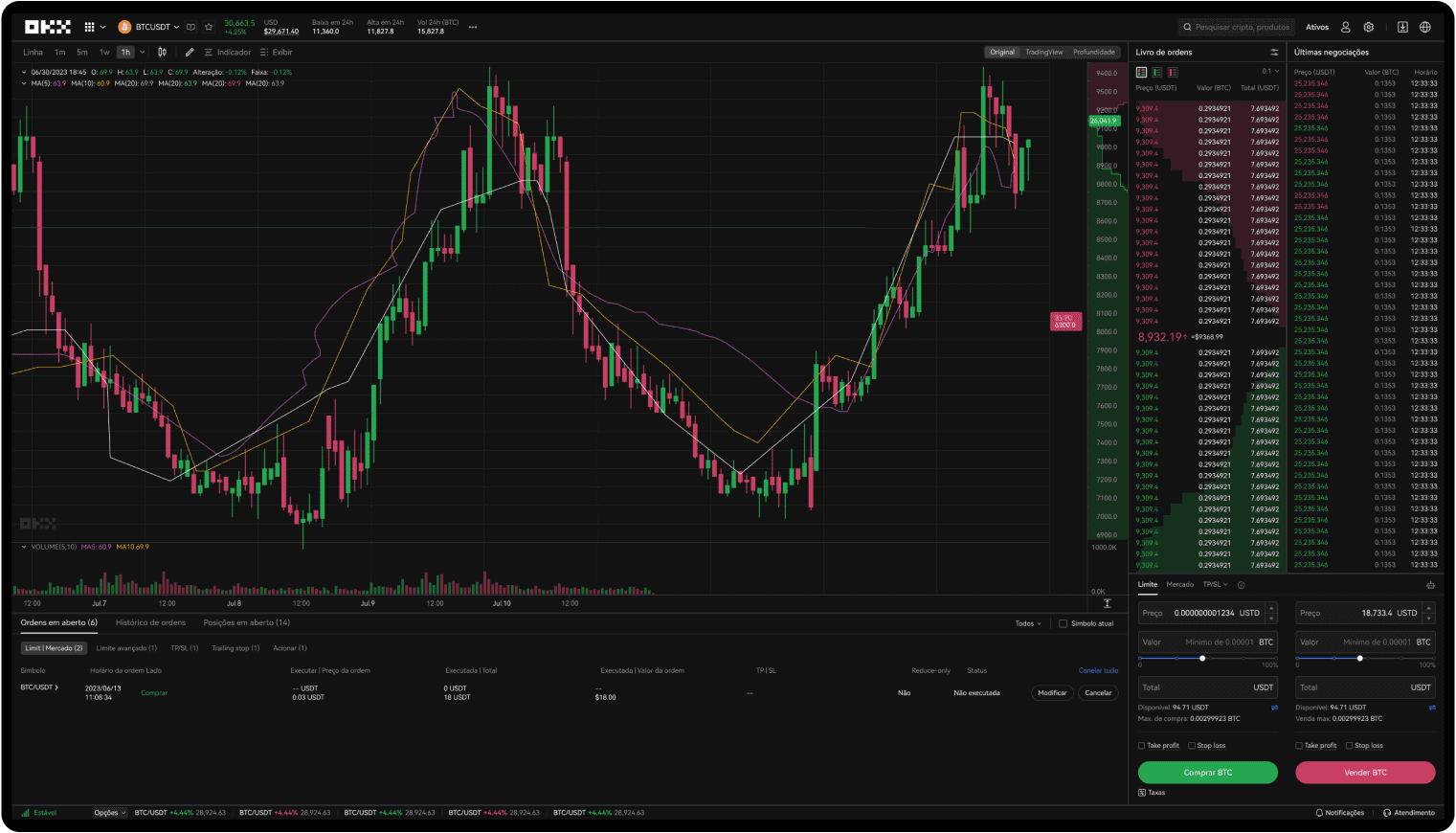

Trade like a pro

Get the lowest fees, fastest transactions, powerful APIs, and moreLowest fees, world-class matching engine, powerful APIs and much more

With you every step of the way

From making your first crypto trade to becoming a seasoned trader, you’ll have us to guide you through the process. No question is too small. No sleepless nights. Have confidence in your crypto.

Coach Pep Guardiola

Explains “crazy football formation”

Rewrite the system

Welcome to Web3

Snowboarder Scotty James

Brings in the whole family

Questions? We’ve got answers.

What products does OKX provide?

How do I buy Bitcoin and other cryptocurrencies on OKX?

What is crypto?