Yearn.finance price

in USDCheck your spelling or try another.

About Yearn.finance

Disclaimer

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Yearn.finance’s price performance

Yearn.finance on socials

Guides

Yearn.finance FAQ

Yearn Finance is a DeFi aggregator designed to streamline and optimize yield farming returns by leveraging automation and a comprehensive toolkit. By facilitating partnerships and collaborations, Yearn Finance aims to democratize passive income opportunities, making it accessible even to those with limited technical expertise.

Yearn Finance offers a range of benefits to DeFi enthusiasts. As an aggregator, it streamlines the complexities of yield farming, allowing users to maximize their returns by automatically navigating and optimizing yield farming strategies. This provides users with the opportunity to earn higher yields compared to traditional manual approaches.

Easily buy YFI tokens on the OKX cryptocurrency platform. Available trading pairs in the OKX spot trading terminal include YFI/USDT.

You can also buy YFI with over 99 fiat currencies by selecting the "Express buy" option. Other popular crypto tokens, such as Bitcoin (BTC), Tether (USDT), and USD Coin (USDC), are also available.

Alternatively, you can swap your existing cryptocurrencies, including XRP (XRP), Cardano (ADA), Solana (SOL), and Chainlink (LINK), for YFI with zero fees and no price slippage by using OKX Convert.

To view the estimated real-time conversion prices between fiat currencies, such as the USD, EUR, GBP, and others, into YFI, visit the OKX Crypto Converter Calculator. OKX's high-liquidity crypto exchange ensures the best prices for your crypto purchases.

Dive deeper into Yearn.finance

The year 2020 marked a pivotal moment in the trajectory of decentralized finance (DeFi), introducing a surge of projects vying for recognition and success in this domain. Amidst this wave, Yearn Finance emerged as a standout contender, distinguished by its innovative use of automation to amplify the returns yielded by yield farming. Rapidly capturing market attention, the project achieved an impressive $1 billion Total Value Locked (TVL) within just two months of its launch.

What is Yearn Finance

Yearn Finance operates as a dynamic aggregator service within decentralized finance (DeFi). This pioneering platform revolutionizes the pursuit of optimized yield farming returns by harnessing the power of automation. Alongside its commitment to forging partnerships and strategic collaborations, Yearn Finance strives to democratize passive income generation within the DeFi ecosystem. Its inclusive approach extends even to those less versed in technical intricacies, setting the stage for enhanced accessibility and participation in the DeFi sector.

The Yearn Finance team

Yearn Finance (previously iEarn) was founded by Andre Cronje. Cronje's extensive experience in the crypto sector, particularly in DeFi, propelled him into prominence, with affiliations extending to Fantom and CryptoBriefing.

How does Yearn Finance work

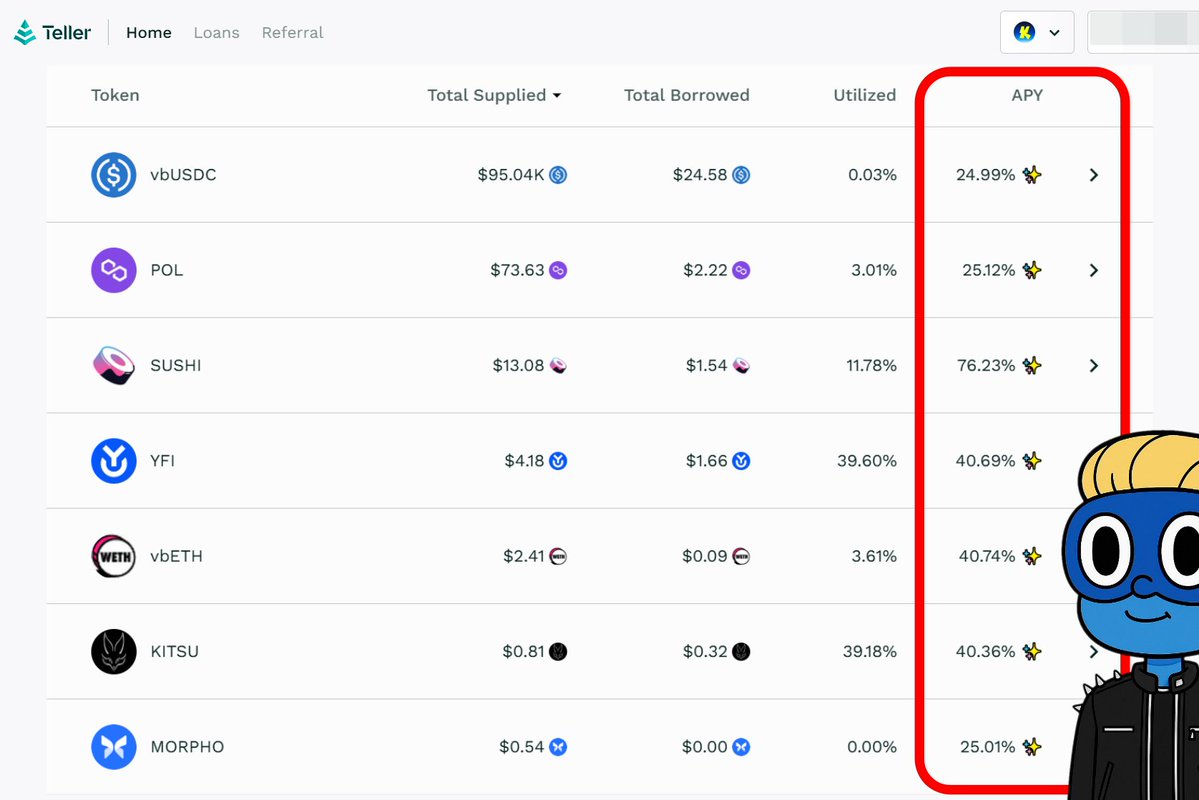

The protocol's architecture centers around three core components: Earn, Zap, and APY. The Earn platform offers users access to optimal lending interest rates through a cross-protocol search. The innovative Zap feature streamlines the process, allowing users to execute multiple transactions with a single click. Meanwhile, the APY (annual percentage yield) product maximizes lending opportunities across various protocols, ensuring users benefit from the best-in-market services.

Yearn Finance’s native token: YFI

At the core of Yearn Finance's ecosystem lies its native cryptocurrency, YFI, which debuted in mid-July 2020 amidst the explosive rise of DeFi. It originally has a capped supply of 30,000 YFI tokens. Responding to community consensus, an additional 6,666 YFI tokens were subsequently minted.

YFI use cases

YFI serves as a multi-faceted token within Yearn Finance's ecosystem. Primarily, it incentivizes liquidity providers. Beyond this, YFI operates as a governance token, granting holders the power to participate in project-related decision-making processes. Furthermore, YFI is tradable, enabling users to engage in crypto trading and utilize it as a store of value.

YFI distribution

The YFI token is distributed as follows:

- 27.3 percent: yCRV liquidity pool

- 54.6 percent: Balancer liquidity pools

- 18.1 percent: This represents the 6,666 tokens that were minted after launch. One-third of these were given to key protocol contributors and the other two-thirds to the platform’s governance-operated treasury.

ESG Disclosure