90%!

Didn’t expect the market sentiment to be this exaggerated? It seems everyone has very high expectations for the Q4 1.5-level market!

The APY on PENDLE's YT - sKaito is still soaring, and everyone is bullish on the Q4 airdrop profits, while the price of $Kaito is still oscillating in place, creating a stark contrast between the two!

This indicates that the market believes the upcoming ecological airdrops will still be very attractive! But the price of @KaitoAI's token is just average...

However, theoretically speaking, as YT rises so high, the cost gradually increases, which means the cost-effectiveness of YT will slowly decline, making the cost-effectiveness of spot trading relatively better. As for why the price of $Kaito hasn't risen yet?

I guess there should be quite a bit of arbitrage capital at play, buying PT on one side while shorting Kaito in the futures market to lock in the profits from this APY. Currently, considering the funding rate, an annualized return of 40%~50% shouldn't be difficult~

This indirectly leads to a large amount of short liquidity in the Kaito futures market. I wonder if anyone will play a short squeeze operation targeting this phenomenon...

After all, those holding PT must wait until next year to receive the full amount of sKaito, selling now would mean a loss, so speculators can easily turn a large number of PT buyers and short futures positions into fuel for price increases...

Since unlocking sKaito takes a week, if there’s a situation where Kaito's price skyrockets in the future and then drops back within a week, it’s likely that big funds are behind this kind of operation~

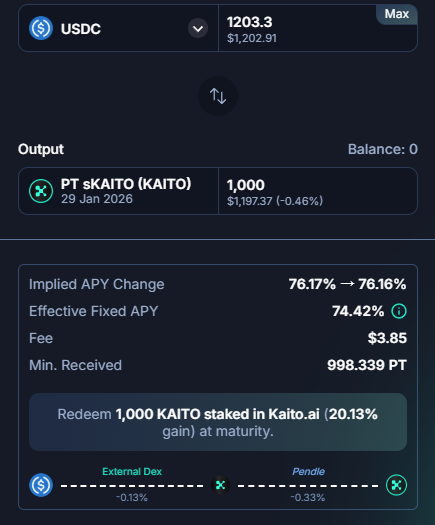

A simple explanation of the benefits of directly using U to buy PT-sKaito:

First, my requirement is to maintain a stable growth in staking volume without affecting current equity, especially since there are still many projects to TGE in Q4, so I temporarily gave up the idea of directly exchanging sKaito for PT.

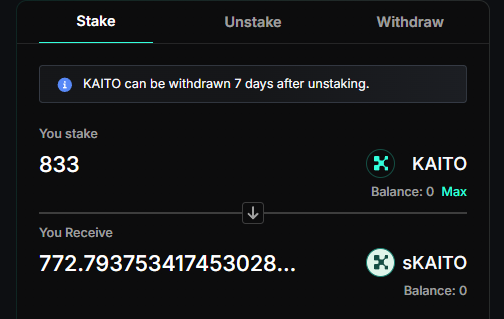

As shown in the figure, at the current APY (76.17%), using 1200 U can exchange for 1000 PT-sKAITO, while if I directly buy Kaito (price 1.44 U) with that 1200 U, I can only get 833, and after staking, I would only have 722 sKaito...

However, after 120 days, 1000 sKaito will be worth at least 1100 Kaito...

1100 - 722 = 378 Kaito!

In other words, without the urgency to quickly increase the staking volume, under high APY conditions, buying PT can yield more Kaito. Based on the current price, buying PT is equivalent to buying Kaito at an average price of 1.09 U after 120 days!

And when after 120 days, if the price of Kaito is higher than 1.09, then I can also earn a profit from the price difference. All the discounts come from the FOMO premium provided by a large number of people buying YT.

Therefore, for those who already have a considerable staking volume, the cost-effectiveness of increasing positions at this price level is not high, as the new staking volume will have a negligible impact on ecological benefits in the next 120 days. However, after 120 days, there will be an additional effect of about 22% increase in this transaction.

The 2% here comes from the APR earnings given to stakers by @KaitoAI accumulated over 120 days.

So the best conditions for increasing positions next may not necessarily be a price drop, but rather a price drop while the YT-APY remains high. The greater the rate of change between the two, the more discounts obtained!

So I really shouldn't buy spot anymore; if I'm going to buy, I should buy PT!

49.55K

72

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.