Hyperliquid HIP 1/2/3 and builder code in simple terms

Hyperliquid is a layer 1 blockchain and also a rapidly growing decentralized trading platform. Think of it as a digital farmers market where anyone can create, trade, or build financial products. HIP-1, HIP-2, HIP-3, and Builder Codes are its core tools, enabling token creation, liquidity, futures markets, and custom apps.

Here is a quick explanation of how each of these lego blocks work and how they enable trading experience for users. It's important to understand this evolution to truly appreciate the power of what Hyperliquid team is building

HIP-1: Token Creation (Lemonade Stand)

What is it?

HIP-1 lets anyone create a token and list it for spot trading by paying a fee in HYPE tokens. It’s like setting up a lemonade stand at the market to sell your own drink.

Pricing: You set the initial token price; market trading (supply/demand) determines its value, like auctioning lemonade.

Trading: Uses an on-chain order book for transparent buy/sell orders, like a market ledger, not automated pools.

Risk Management: Low risk, no leverage—simple spot trading (buy/sell tokens directly).

Oracle: None needed, as prices come from market trades, not external data.

Liquidity Provisioning: You provide initial tokens; traders add liquidity by buying/selling.

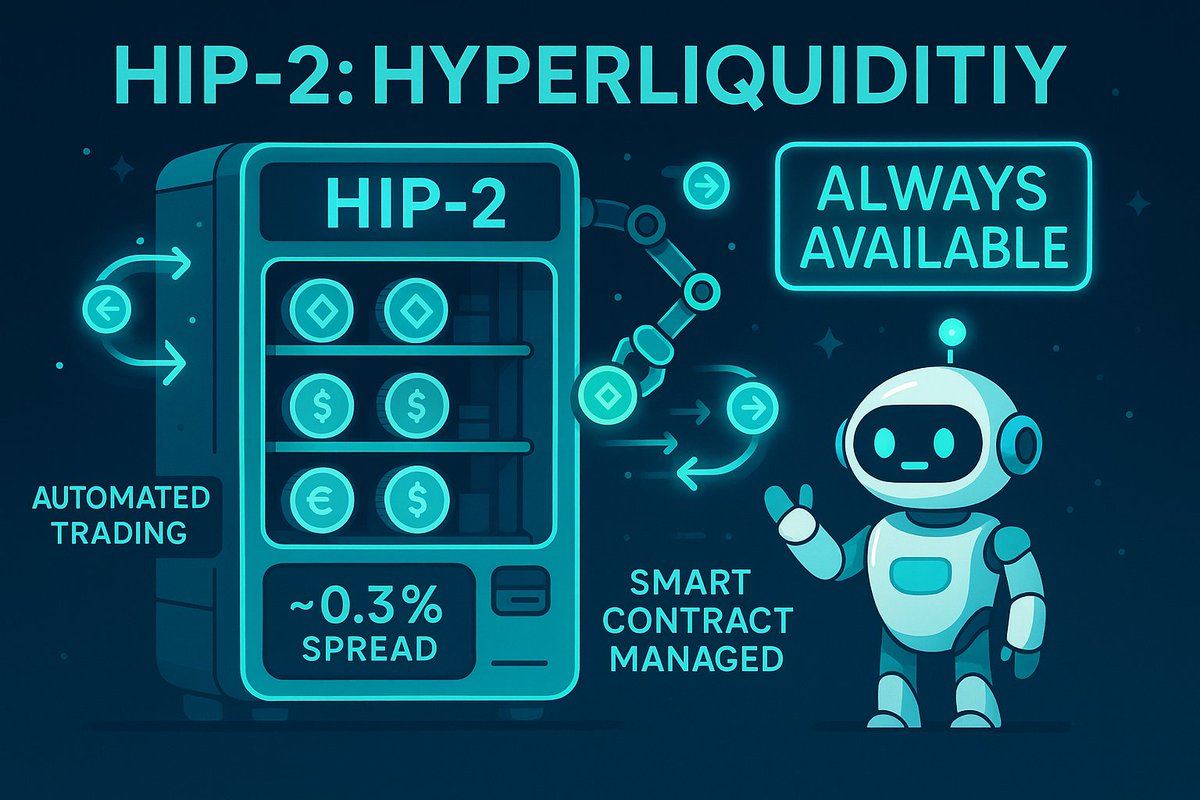

HIP-2: Hyperliquidity (Smart Vending Machine)

What is it?

HIP-2 ensures HIP-1 tokens have constant trading availability via automated buy/sell orders (~0.3% spread). It’s like a vending machine that’s always stocked with lemonade, ready to trade and constantly adjusts the price to stay stocked.

Pricing: A protocol Smart Contract sets buy/sell prices close to the market price (e.g., buy at $0.99, sell at $1.01 for a $1 token).

Trading: Same on-chain order book as HIP-1, but the Smart Contract guarantees trades even with low human activity.

Risk Management: Smart Contract adjusts orders dynamically to minimize losses, like restocking based on demand.

Oracle: None needed; prices are based on current market trades, not external feeds.

Liquidity Provisioning: Protocol or HLP vault funds auto-provide liquidity, ensuring no empty markets.

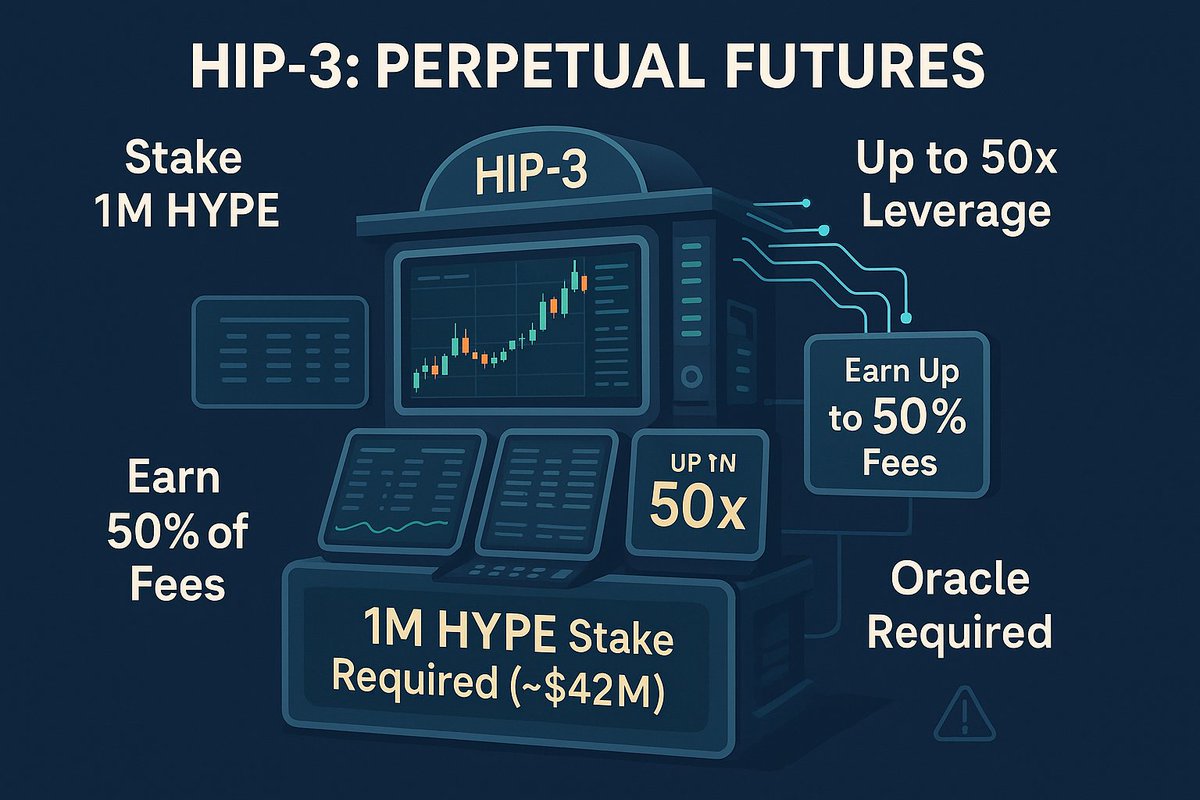

HIP-3: Perpetual Futures (High-Tech Trading Kiosk)

What is it?

HIP-3 lets you create a perpetual futures market by staking 1M HYPE (~$42M). You set rules and earn up to 50% of fees. It’s like renting a kiosk to bet on future lemonade prices.

Pricing: You choose the asset (e.g., S&P 500) and oracle; traders bet on future prices, paying fees (e.g., 0.1%).

Trading: On-chain order book with up to 50x leverage, like a high-stakes betting game on HyperCore.

Risk Management: You set leverage/margin rules; validators can slash your stake for oracle mismanagement.

Oracle: You pick a price feed (e.g., Chainlink), ensuring accurate asset pricing, but you’re liable for errors.

Liquidity Provisioning: You attract market makers with fee rebates; no auto-liquidity, so you bootstrap the market.

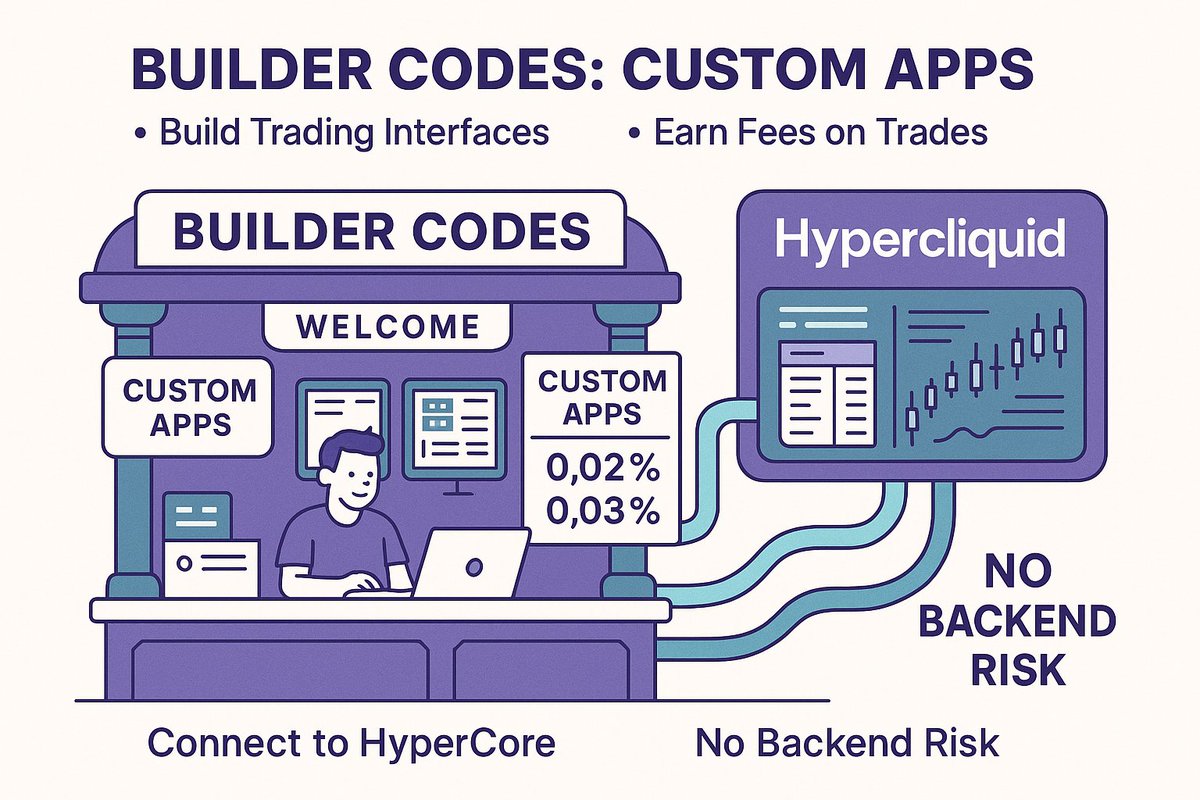

Builder Codes: Custom Trading Apps (Ticket Booth)

What is it?

Builder Codes let developers build trading apps on Hyperliquid’s engine, earning fees on trades. It’s like a ticket booth for the market, selling access to trades and keeping a cut.

Pricing: You set extra fees on top of Hyperliquid’s; users pay for trading via your app (e.g., 0.05% extra).

Trading: Connects to HyperCore’s order book for spot or futures, offering a custom interface.

Risk Management: No risk for you; Hyperliquid handles backend risks like liquidations.

Oracle: Uses Hyperliquid’s existing oracles, so no setup needed.

Liquidity Provisioning: Taps Hyperliquid’s liquidity (HLP vaults, HIP-2/3), ensuring smooth trades.

Key Differences Across HIP-1, HIP-2, HIP-3, and Builder Codes

Pricing: HIP-1 is market-driven; HIP-2 uses tight Smart Contract-set spreads; HIP-3 relies on oracle-based futures pricing; Builder Codes add custom fees.

Trading: All use HyperCore’s order book, but HIP-1 is spot, HIP-2 automates spot, HIP-3 is leveraged futures, and Builder Codes are interfaces.

Risk Management: HIP-1 is low-risk; HIP-2’s Smart Contract self-manages; HIP-3 risks stake loss; Builder Codes have no backend risk.

Oracle: HIP-1/2 need none; HIP-3 requires a reliable oracle; Builder Codes use existing oracles.

Liquidity Provisioning: HIP-1 relies on traders; HIP-2 auto-provides; HIP-3 needs market makers; Builder Codes use Hyperliquid’s liquidity.

#hyperliquid

1.17K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.