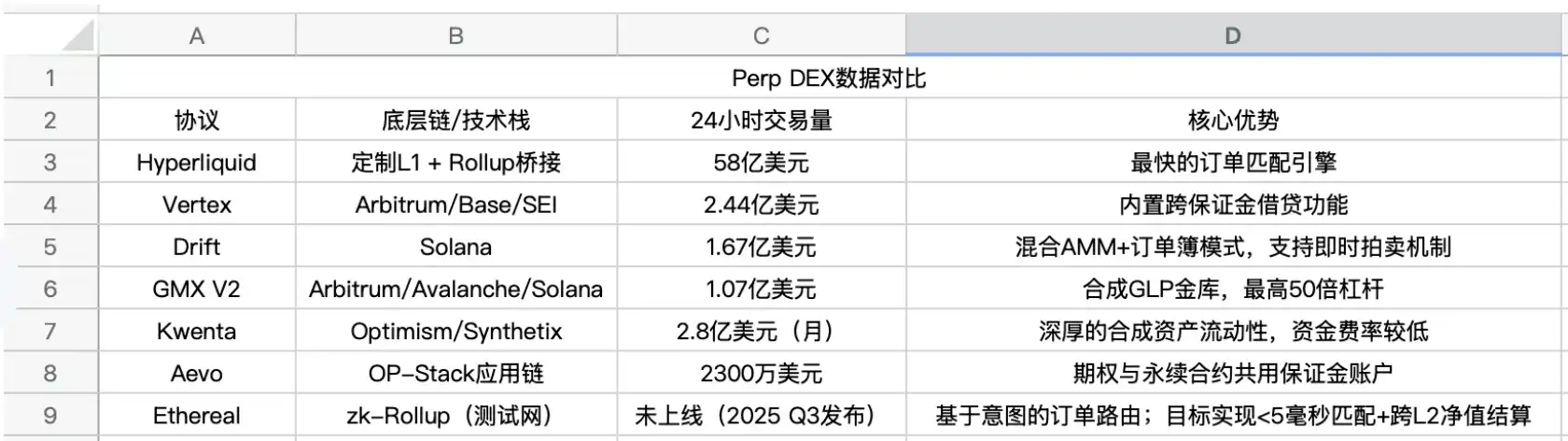

Eight cutting-edge Perp DEXs will compete in the "second half of the contract", who will harvest tens of billions of liquidity?

Original Title: My Perp DEX Watchlist to Front-Run the Next Meta

Original Author: arndxt

Original compilation: Azuma, Odaily Daily Planet Daily

Editor's note: The decentralized perpetual contract trading platform (Perp DEX) has become the most volatile track in the industry, although the leading position of Hyperliquid looms, but more new generation of Perp DEXs are also menacing. In the following, crypto analyst arndxt provides a differentiated analysis of the core highlights of multiple up-and-comers in the Perp DEX track, covering eight projects including Vertex, Drift, GMX V2, Kwenta, Aevo, Ethereal, OstiumLighter, and edgeX, which may help investors find potential alpha in the track. The following is the original content of arndxt, compiled by Odaily.

The rise of decentralized perpetual contract trading platforms (Perp DEXs) is inevitable, because they eliminate the possibility of centralized platform thunderstorms from the economic mechanism.

The current technology architecture is trending towards a design that completely eliminates the risk of custody of funds while preserving the Binance-level user experience. The next 12 months will be a critical period for the development of this track, with the winners being able to monopolize liquidity by optimizing the design structure, while the losers will be reduced to just another mediocre project supported by token incentives.

Necessary design mission

The collapse of FTX in November 2022 interrupted the development trend that had been the default in the industry – trading custody access for speed and liquidity. Suddenly, in the face of the security of the funds themselves, no matter how fast the execution is, it seems pointless. However, first-generation Perp DEXs (such as GMX V1 and Gains) are too slow and rigid to compete with centralized exchanges (CEXs) in terms of execution quality. The gap between "CEX-grade speed" and "DeFi-grade security" has become a core issue that needs to be solved urgently.

Today, a slew of new Perp DEXs are responding head-on, with transaction matching speeds typically below 10 milliseconds, funds settled entirely on-chain, and no custody of user funds. Liquidity is converging around the order book engine rather than the vAMM model. Whoever is the first to break the $1 billion to $5 billion daily trading volume threshold will be able to build a moat – where arbitrageurs and copy bots will take root.

In addition to the much-talked-about Lighter and Ostium, Ethereal is also worth paying attention to. If the team can achieve matching speeds of less than 5 milliseconds and remain unmanaged, it could become the first "high-frequency" DEX with direct access to intent routing rather than an isolated order book.

How newcomers build moats

It is becoming increasingly clear that the competitive dimension of the new generation of Perp DEX is not only in terms of transaction volume, but also in intent trading, deep cultivation of vertical scenarios, and filling the unresolved systemic gaps of industry leaders such as Hyperliquid. Against this backdrop, the strategy for the new Perp DEX is clear – first identifying the trading needs that Hyperliquid is not met, then building a dedicated execution layer around it, and then using new technology primitives that were not feasible two years ago as the core support.

Currently, the following projects are targeting gaps that Hyperliquid has not yet covered:

· Ostium: TradFi Assets;

· Lighter: Cryptographic Fairness

· edgeX: Ultra-Private Throughput;

· Ethereal: Cross-L2 Intent Routing;

When evaluating the state of the major Perp DEXs in Q3 2025, I prefer to use differentiated order flow rather than volume alone as the core rating metric.

· Hyperliquid: Still the undisputed king, looking forward to the second season airdrop.

· Vertex Protocol + Drift Protocol: Cross-margin pioneers on two of the fastest blockchains (Arbitrum and Solana).

· edgeX + Lighter: Once zk-proof throughput is battle-tested, it may become an institutional-grade choice.

· Ostium: A dark horse, the notional trading volume of RWA perpetual contracts may crush native crypto assets.

· Traditional vAMM-type Perp DEX (GMX, Gains): There are still strong retail fundamentals, but the order book must be launched, otherwise the trading volume will be lost.

Link to original article