Adding my 2 cents to Celestia & Polychain drama.

I published this long-read about funding 7 months ago.

How the game works:

> Raise pre-seed, show off social activity

> Raise seed, build MVP (optionally)

> Raise Series A, show off more social activity

> Go live, no PMF

> Death

So, do we need VCs?

After a massive airdrop by @HyperliquidX, which is not backed by any VC funds, people have started discussing the pros and cons that VCs bring to the table.

Having VCs and not having VCs can bring both unlimited upside and unlimited downside to the protocol.

1. Funds are against communities.

The token distribution of an average protocol has changed significantly after VC money entered the crypto game. Some statistics:

• Bitcoin — 0% allocated for the team and investors (because there were no investors)

• Ethereum — 10% allocated for the team and investors

• Solana — 62% allocated for the team and investors

These days, it's alright for a team to have 20-25% of the whole supply (on paper, in reality even more), and investors to have 20-25% of the supply.

Low float and high FDV doesn't work anymore, if you're unsure, feel free to look at current charts of @Starknet, @Scroll_ZKP, @modenetwork, @bobanetwork, and others.

It is considered totally normal having big players controlling >50% of the supply. The same people say the word "decentralization".

One of the most famous cases is obviously @a16zcrypto controlling Uniswap DAO.

Can you really call Uniswap a DAO, if 4.15% of the supply is controlled by a single entity, which can be used to pass literally ANY proposal?

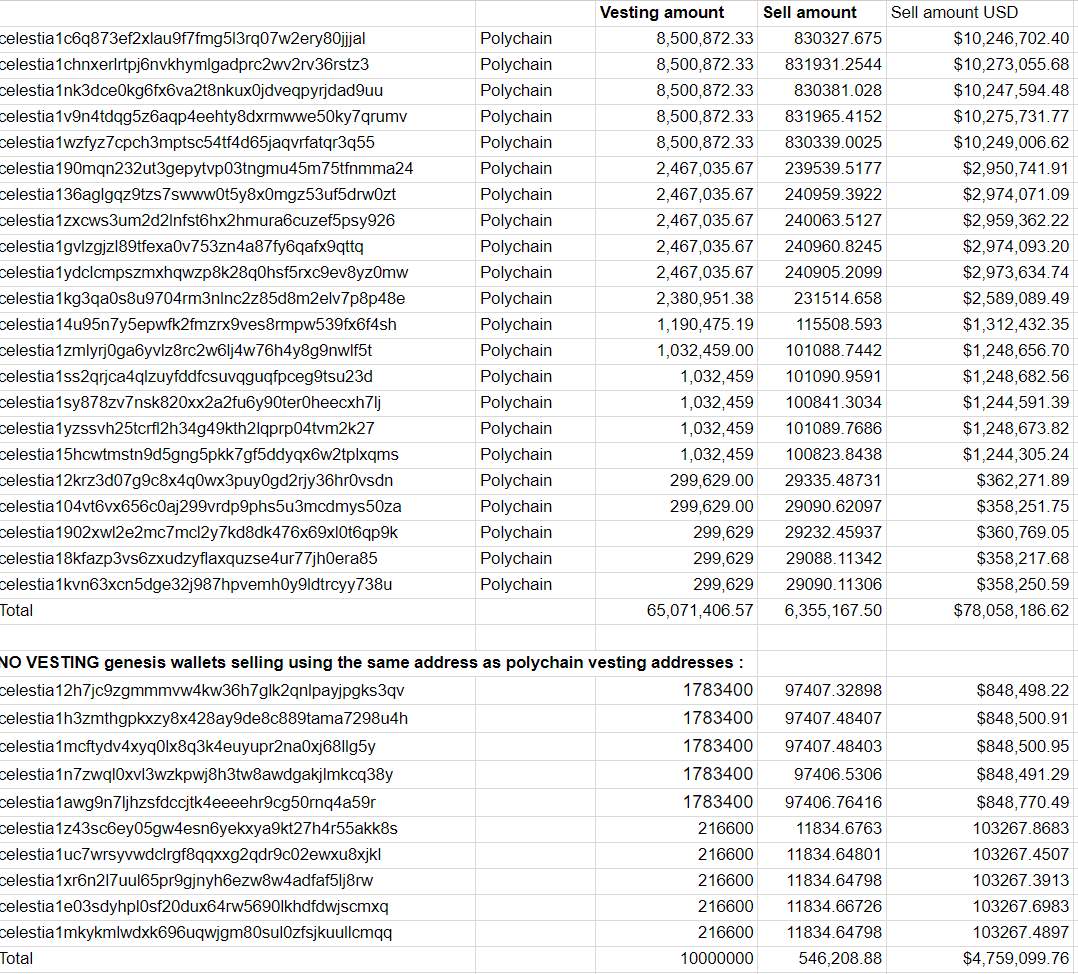

Another case is @polychain investing ~$20m in @CelestiaOrg and selling >$80m worth of $TIA just from staking rewards (s/o to @gtx360ti).

Yes, back then illiquid tokens that they had bought weren't even unlocked and they've already done >4x selling to the market obviously.

The whole idea of token investing is completely different from what you expect.

When you invest in equity, you buy some share of the company. When you invest in token, guess what? You buy a token.

Most of the tokens don't have a real utility and any use cases (don't tell me governance and staking are utilities). Moreover, the overall value that project provides doesn't correlate with the token price at all.

Infra tokens are basically memecoins with a company brand. You can perfectly see it with $ARB being a stablecoin when they only had governance utility.

Another example is @chainlink. One of the key infra providers had their token not performing at all, because the only utility was paying for their oracles. There was no incentive to hodl. After they implemented staking, it changed.

So yeah, in most of the cases, success of the company doesn't have to do anything with token price, and VCs will dump on you, because they also need to earn money.

2. VCs make you FOMO.

This is more addressed to the community, it’s not a VC problem but a derivative of the VC problem.

Almost everyone who spent at least a couple months in crypto knows about @paradigm as arguably one of the best VCs in crypto, because they do lots of amazing things in open source besides investing.

Most of people who see Paradigm as investor, start going crazy to farm an airdrop.

Kind reminder that @friendtech ended up slow rugging the users. But in the first place, how many people would use Friendtech, which was literally OnlyFans with (3,3) model on a blockchain, if it weren’t backed by Paradigm?

Slightly different situation here goes with @Scroll_ZKP. One of the worse executed airdrops and overall token distribution, but people farmed in most cases just because they had "Polychain name" on board.

3. Funding never ends.

Yes, lots of protocols raise just for the sake of raising, which doesn't make any sense.

Lots of protocols that were promising like ZKX, Nocturne, Fuji, and others simply shut down, because they didn't achieve product market fit.

VC money become pretty addictive and protocols burn it effortlessly spending their time trying to show off for next round instead of building.

Today, most of the protocols aren't profitable, and founder's plan is raise as much as possible, let VCs exit at a good price, so they're happy.

The whole idea of Venture Investing is to support founders until they have found PMF, but many of them don't find it even after raising Series A.

The flow looks like this:

Raise pre-seed → show off social activity of users who never used the protocol → raise seed → build MVP (optionally) → gain more social engagement without releasing the product → raise series A → release the product → no PMF → death.

Founder's time is wasted raising instead of executing, it's tough to think about revenue when you're not hungry.

The good use of venture capital is expand quickly and focus on the current markets — you want to have more money than the revenue you get.

Some example here:

• I want to expand and gain more users using the protocol, and I’m currently generating $100k a month.

• With $100k a month, I’ll need to spend 12 months to get to the point where I want to be.

• Risks: the market can change really quickly, so I want to reach the point in 3 months to catch the opportunity.

• I sell my share to VCs to get that money to expand + adding the revenue.

• Now I can focus on expanding, farming more revenue, getting new features, R&D, etc.

4. Some of the founders don't even need VCs.

This is exactly the case with Hyperliquid. Founders were already rich before starting the company, so they didn't need to raise a round, right???

Well, not exactly that. When I was working at VC, you don't imagine how many founders I've seen who already had the money (tens of millions in the bank), but willing to raise from VCs anyway.

- "So, why do you want to raise, if you have that much money already?"

- "Eh, we look more for partners who can help us build the thing and marketing than money".

It can be surprising, but some founders prefer raising the money just to have investors list on their website and a sentence "backed by X" in twitter description.

It's up to you how to rule the company, you don't need a step-by-step guide how to do that, you don't need robbery terms for top VCs just to put them on page. What you need is a piece of advice. You can message any guy you like and who you feel like will give you a great advice and talk to him — it's free, you don't have to sell a portion of a token supply.

4. VCs are great.

Raising round is ideal choice for someone young and ambitious. Those who didn't make much money yet, but they have a courage to do so. Or VC money can be used for something really complex that will require multiple years of development and will be earning money only after that.

But as I said before, company earnings have nothing to do with token price.

So if VCs dump tokens, why are they great?

You cannot imagine how committed a venture capital fund can be, because it's literally a startup.

Let's say VC has $50m AUM and do standard 2/20 scheme (2% annual fee and 20% performance fee). We are left with $1m yearly to hire a small team + 20% performance fee, which is not stable.

For $1m a year VC has to do operations, investments, due dilligence, talk to countless startups, talk to limited partners (LPs), define the vision of the fund, develop new ways to invest, travel to conferences, demo days, dealflow sharing, etc, etc, etc. All of this is done just to receive 2% management fee and 20% performance fee.

I hope that explains the reason why VCs like tokens more than equity, it's just easier to exit and attention spans are generally shorter + get the money to live.

Moreover, different VCs offer not just money, but something else called "value-add". It could be different stuff:

• Marketing support

• Research & Development

• BD + Partnerships

• Liquidity to your product when launched

• Hiring & operations support

• Etc, etc, etc

So yeah, if you REALLY need VC money, go for it, but make sure to choose only ones that offer something else and will not rob you in return.

Also avoid VCs who want to build your company and see your progress "way too often".

Nowadays, we could easily observe the shift towards the concept of “protocol of the founder with a little support from the investors” to “protocol of the investors with a little support from the founder.”

Lots of great protocols wouldn't be built without venture capital and the amount of impact they bring to the space is truly amazing.

Don't raise if you already have enough money and you feel like you can execute everything on your own with a clear goal defined. Raise if you know why it would be helpful for you, identify the best investors who are willing not only to invest their money, but their time.

19.88K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.