沒有 RWA 的 DeFi 將會消亡。

但是,沒有傳統金融,RWA 就不會增長。

我們需要量身定製的基礎設施。

然而,DeFi 和 tradFi 是截然不同的世界。

DeFi 的可組合性和傳統金融的合規性是兩個具有挑戰性的概念,但 @RaylsLabs 正試圖通過其 UniFi 區塊鏈來實現這一點。

Rayls 結合了許可和無許可基礎設施,提供符合機構要求的解決方案,而不會犧牲開放DeFi生態系統的優勢。

與本系列的前幾部分一樣,讓我們從深入研究技術開始,以瞭解生態系統是如何運作的。

⚙️ 技術

Rayls 正在構建一個由不同網路組成的生態系統,這些網路相互封裝和互連。基礎設施由四個主要部分組成:

1.) 公有鏈

2.) 私有子網

3.) 提交鏈

4.) 隱私分類賬

讓我們更深入地瞭解每個元件 👇

1.) 關於公有鏈的要點

Rayls 的公鏈是由 @arbitrum 提供支援的乙太坊 L2,需要所有使用者都必須進行 KYC。

KYC 流程是通過開放銀行 API 完成的,以驗證使用者的數據,同時保護他們的隱私(鏈上/鏈下不存儲任何數據)。

儘管受到 KYC 門控,但該鏈將是無需許可的,並且可以與 DeFi 的其餘部分互作。用戶和開發人員可以啟動和使用應用程式、代幣等,就像在任何其他生態系統中一樣。

通過這種設置,由於所有使用者都經過 KYC 認證,機構將更願意與他們和生態系統中的 DeFi 協議進行交互,從而為新資本和需求流向鏈上釋放大量機會。

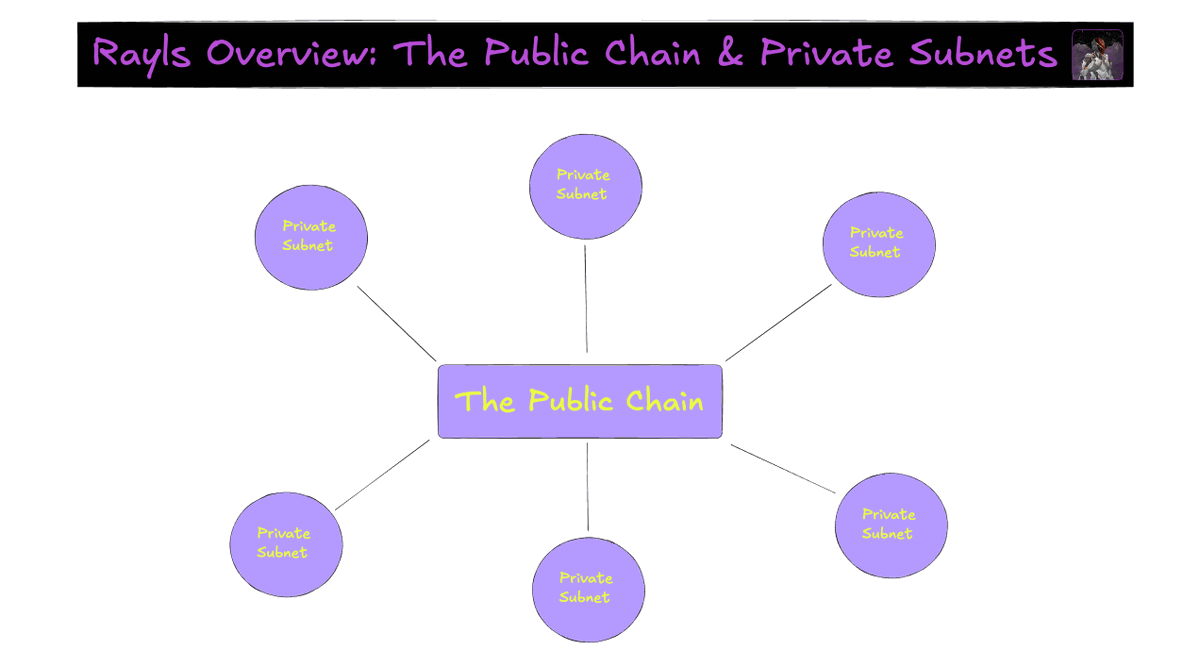

2.) 關於私有子網的要點

圍繞公有鏈,將有多個私有子網,它們是為機構量身定製的許可網路。

每個私有子網包括:

• 提交鏈 (中心)

• 許多隱私帳本(輻條)

最後,每個 Subnet 都連接到主 Rayls 公鏈。

一個有趣的功能是,在創建子網時,會分別分配一個 Governor 和一個 Auditor 來規則和監督它。

• 調控器 - 管理監管規則並更改子網的運行方式。

• 審計員 - 監控交易活動 (通過 Commit Chain 而不是在 Privacy Ledger 內部的交易),並將任何可疑情況通知 Governor。

(查看圖片 n°1)

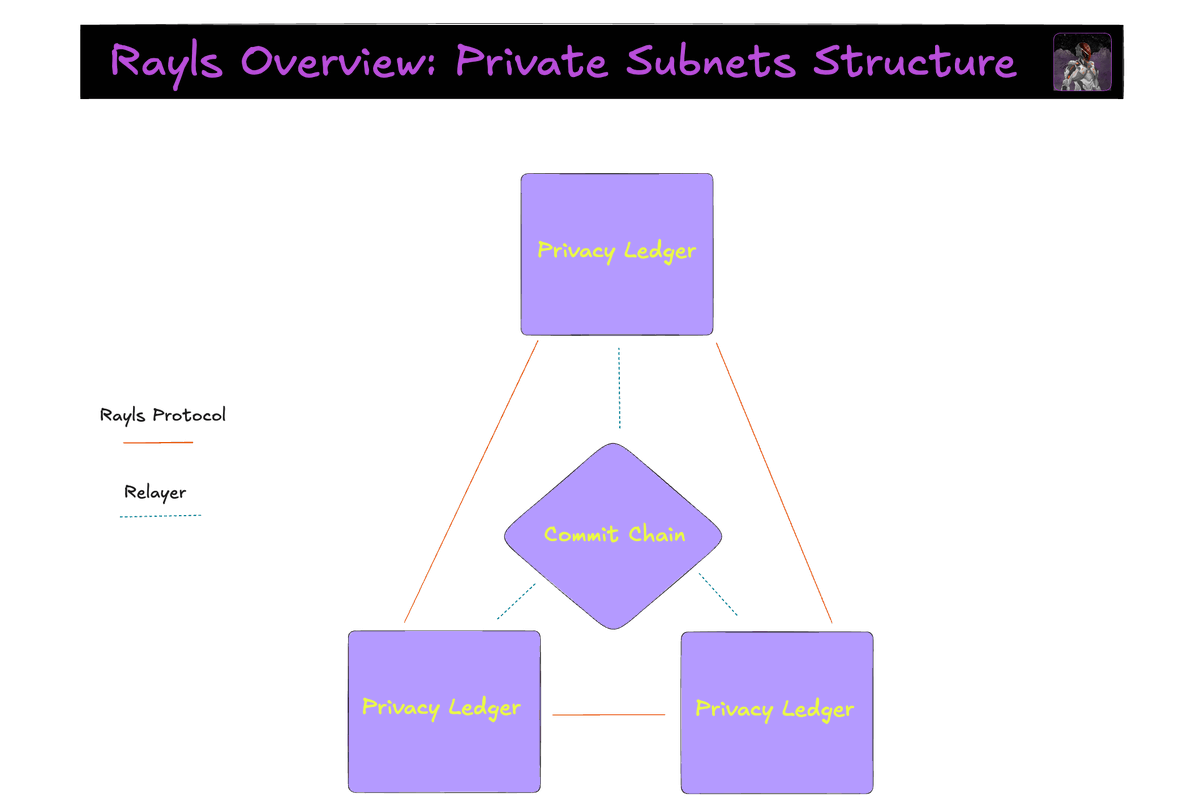

3.) 關於提交鏈的要點

提交鏈是位於每個私有子網中心的 EVM 相容鏈,用於編排隱私帳本之間的所有傳輸。

這是通過利用Rayls Relayers來實現的,Rayls Relayers是一個保護隱私的消息傳遞層,用於處理隱私帳本和提交鏈之間的通信和傳輸。

通過確保所有交易都以完全完整性中繼、驗證和記錄,中繼器在維護子網內的信任和可靠性方面發揮著關鍵作用。

想像一下這樣的結構:

提交鏈 <> 中繼器 <> 私有帳本

(查看圖片 n°2)

4.) 關於隱私分類賬的要點

最後一塊拼圖是隱私帳本,它可以在彼此之間發送和接收代幣。

Rayls 正在構建生態系統,以確保所有交易都經過加密,並且對子網中的其他參與者隱藏。

這使機構能夠在完全隱私的情況下為其客戶創建帳戶,在完全隱私的情況下發行代幣,並在完全隱私的情況下與其他機構進行交易。

在這種情況下,子網內隱私帳本之間的互作由Rayls協議處理,這是一種端到端的私有傳輸解決方案。

以這種方式想像結構:

隱私帳本 ⇄ Rayls 協定 ⇄ 隱私帳本

(再次查看圖片 2)

📈 機會和用例

1.) 有一個具體的機會看到現有和新的協定與 TradFi 參與者合作,並在他們的子網中部署定製的應用程式。

這將需要團隊與這些實體密切合作,並且可能比在另一條鏈上部署投入更多的資源,但好處可能超過努力,因為他們將獲得專屬的客戶池和流動性。

2.) 第二個具體用例是多 CBDC 支付基礎設施,其中不同的政府設置一個或多個子網,銀行是結算和協調方。

在過去幾個月的PoC中探討了這種模式,並在2024年10月發佈的 G20 TechSprint 報告中進行了介紹。

🌎 拉丁美洲的擴張和機構採用

@parfin_io 是Rayls的母公司,與南美洲的企業和機構有著密切的聯繫,這促進了Rayls在近幾個月的多個PoC和機構測試中的使用。

Rayls 參與的主要舉措包括:

1.) Drex - 巴西 CBDC

Rayls 被巴西中央銀行 (Bacen) 選為該國官方 CBDC Drex 的隱私解決方案。

“對於任何代幣化資產流程——我們所說的代幣化資產,是指任何可以產生價值的東西——結算交易都是必不可少的。要結算,需要法定貨幣,而要在區塊鏈技術中使用法定貨幣,它也必須被代幣化”

該計劃涉及 16 家銀行、巴西中央銀行和 Rayls。據該團隊稱,其中至少有5家機構正在繼續測試其基礎設施並與之合作。

對於銀行和金融機構來說,CBDC 對交易費用和利差等傳統收入來源構成了挑戰。銀行可能會轉向為代幣化資產提供交易基礎設施或流動性橋樑,而不是充當仲介。

測試的主要亮點是:

• 金融機構 (FI) 之間的Drex轉帳

• 金融機構客戶之間的代幣化 Real/Drex 交易

• 金融機構之間代幣化聯邦公共證券 (TPFt) 的交易(DvP 方法 - 交付與付款)

• 金融機構客戶之間的 TPFt 交易 (DvP)

2.) 巴西最大的金融科技基礎設施供應商

一些背景資訊:Nuclea 是巴西最大的金融技術基礎設施供應商。僅在 2022 年,該公司就處理了超過 310 億筆交易,總額超過 19 萬億雷亞爾(巴西 GDP 的 2 倍)。

Núclea 管理巴西 100% 的發票註冊以及 90% 的轉帳卡和信用卡結算。

儘管沒有提供有關該主題的太多資訊,但 Nuclea 正在探索區塊鏈技術,特別是 Rayls,以推進其基礎設施並探索代幣化用例。

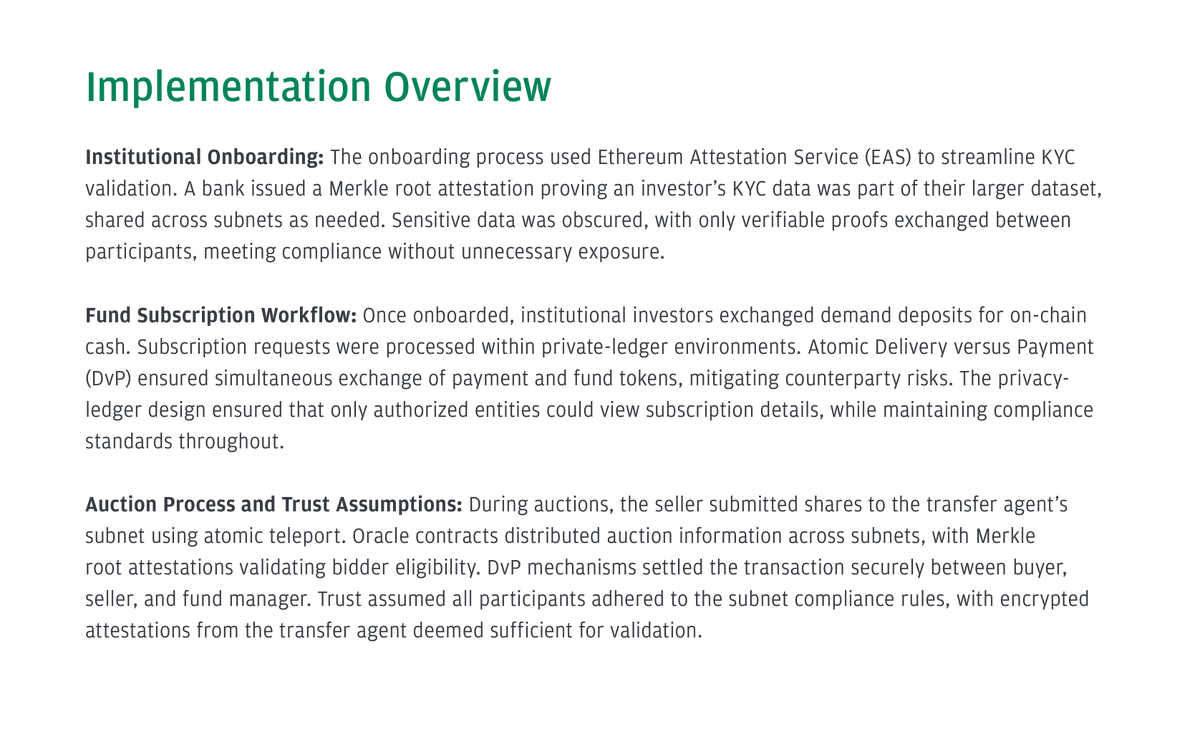

3.) 摩根大通的 EPIC 計劃

去年 11 月,在摩根大通區塊鏈部門的一份報告中,Rayls 被強調為參與 EPIC 專案的合作夥伴,以探索為機構量身定製的隱私和身份解決方案。

官方公告指出:「在 Parfin 的實施中,Rayls 展示了一個安全合規的全球機構交易系統。

(查看圖片 n°3)

Everyone is talking about RWAs.

But no one is speaking about the elephant in the room.

A $1.8 Quadrillion industry that only a few protocols are targeting.

In the third part of this series, we'll focus on @Mantle_Official, which is positioning itself as a "financial hub" at the intersection of Web3 and Web2 with its latest two products:

• Mantle Index Four (MI4)

• Mantle Banking

Before diving into them and into Mantle's vision, a bit of context:

⚙️ THE TECH

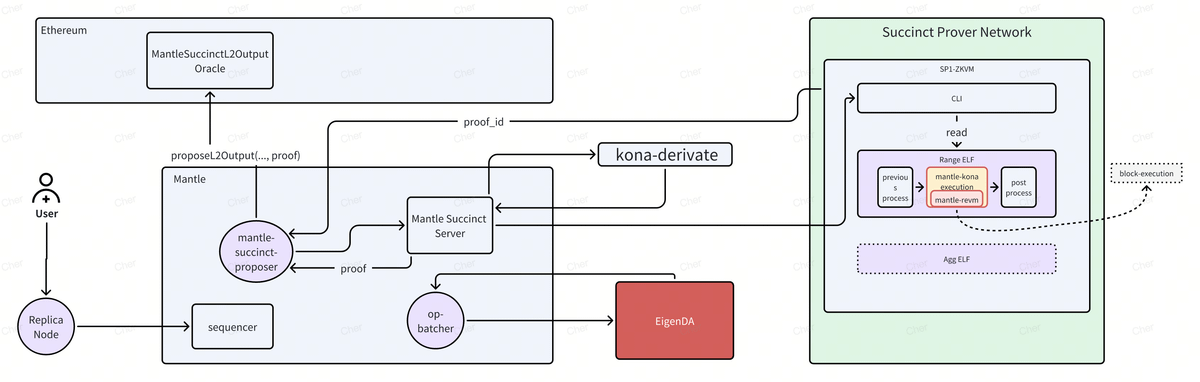

Mantle Network is an EVM-compatible Layer 2 that integrates @eigen_da for data availability and @SuccinctLabs for zero-knowledge proving to provide institutions with a scalable infrastructure to build on.

Both integrations were made this year and represent key steps in Mantle's shift from an optimistic to a zero-knowledge rollup.

The original OP Proposer was replaced with the new Mantle Succinct Proposer, responsible for submitting ZK proofs to Ethereum L1. In parallel, @SuccinctLabs's SP1 Prover Network was integrated to delegate more compute-intensive ZKP generation tasks to a professional network, thus enhancing the chain's performance and scalability.

One of the main upgrades was replacing the original OP Proposer with the Mantle Succinct Proposer, responsible for submitting ZK proofs of Mantle's state changes to Ethereum L1. In parallel, to handle more compute-heavy tasks while maintaining high performance, Mantle also integrated @SuccinctLabs’s SP1 Prover Network to delegate those tasks to its specialized network.

(See image n°1 for a breakdown)

About the EigenDA integration, previously used a custom solution built on top of EigenDA, while now it directly leverages EigenDA’s solution. This allows the chain to scale data availability further without compromising security.

Now that we've recapped how Mantle distinguishes itself from other networks, let's dive into the core topics of this piece.

🏦 MANTLE BANKING

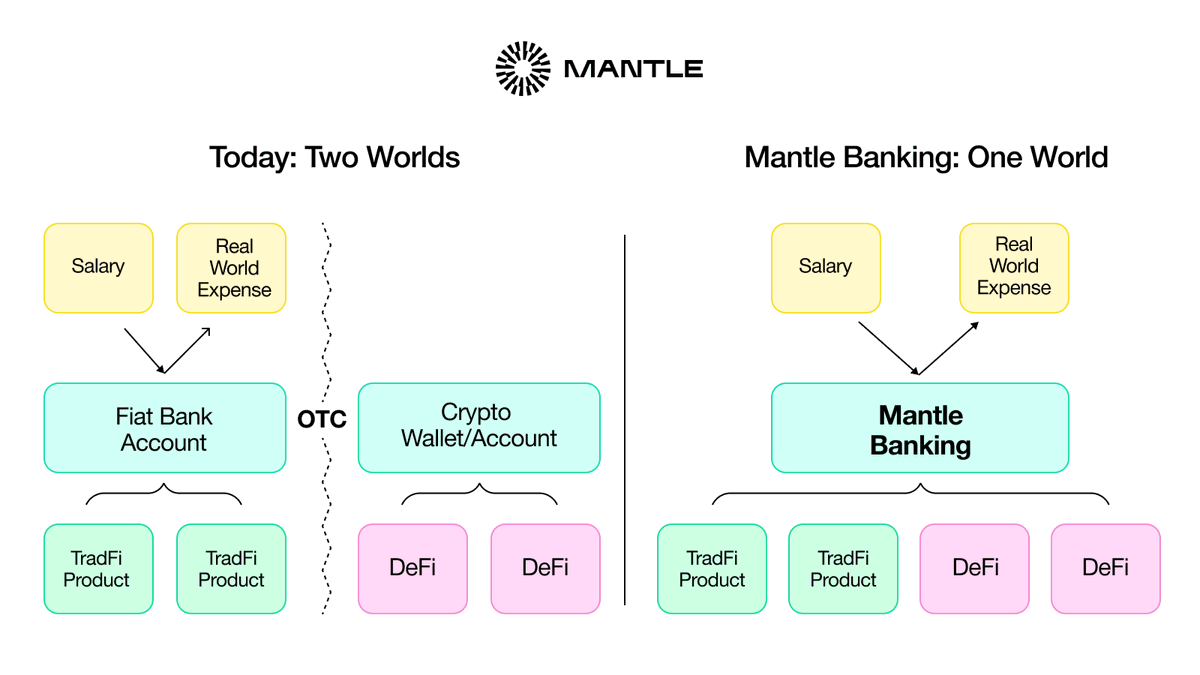

Mantle Banking is a crypto neobank that lets you manage fiat and crypto in one account, making it easy to receive, spend, and invest in both.

The platform allows users to set up a Swiss bank account and receive a globally accepted virtual debit card.

While launching such a service isn’t very difficult, there are two recurring problems most startups in this vertical face:

1.) Third-parties Dependency

2.) Web3 <> Web2 Interoperability

1.) Third-parties Dependency

Most startups launching these products don't control the underlying infra and, therefore, have a weak position when it comes to customer acquisition costs (CAC) and Lifetime value (LTV).

This is because:

1. They pay fees to external providers (e.g., custodians, payment processors, offramps, bridges).

2. They rely on their rules, uptime, and costs.

Ultimately, these two aspects increase the cost of serving customers and lower margins.

On top of that, users expect everything in one place. If your platform doesn’t offer spending, saving, investing, borrowing, and so on, they’ll quickly move towards whoever provides all of these.

2.) Web3 <> Web2 Interoperability

The second issue is most crypto apps can't properly connect to traditional banks or brokerages.

From on-ramping limitations (high fees, geo limitations, etc.) to banks limiting you once you interact with crypto apps, the UX is horrible.

Mantle nails these two problems by owning all parts of the value chain, from the blockchain to the banking one. This allows them to customize each layer of the stack and stay competitive in the market.

The mantle team outlined how ultimately capturing salaries via direct deposit into their neobank is the objective they're working toward.

From there, the use cases would be many, such as:

• Swap & send fiat currencies (USD, EU, SGD, etc.)

• Pay across platforms and merchants

• Interact with Mantle's DeFi Ecosystem

(Check image n°2)

🌐 THE PAYFI VISION

• The global payments industry records an annual transaction volume of $1.8 quadrillion.

• Total revenue across the sector reached $2.2 trillion in 2023 and is projected to surpass $3 trillion by 2030.

• Cross-border payments exceeded $150 trillion in volume in 2023.

• Digital wallets account for over 50% of global e-commerce payments and are expected to rise to 60% by 2026.

This is the scale of the payments industry today. However, most of this value still moves on traditional infrastructure.

And that's where the concept of PayFi comes in.

PayFi, aka Payment Finance → the merge of stablecoins, tokenized assets, and DeFi with legacy payment rails.

PayFi is based on the principle of the Time Value of Money, the idea that a dollar today is worth more than its value in the future because it can be invested or lose value due to inflation.

I'm briefly outlining this because it's exactly where Mantle wants to position itself with the Banking platform.

We're entering the phase where CEXs, L1s, and L2s will scale from targeting traders and DeFi users to the masses. This won't be done by creating some crazy DeFi apps that most of the population wouldn't be able to understand but by serving them what they already use daily.

Onchain and offchain worlds are converging, with CEXs, ecosystems, and FinTech giants racing to capture their share of the pie.

📈 MANTLE INDEX FOUR (MI4)

Simply put, the yield-bearing S&P 500 of crypto.

MI4 is a tokenized fund that offers diversified exposure to yield-bearing assets, with @Securitize as the tokenization partner, @FireblocksHQ as the custody provider, and the Mantle Treasury as the main investor by committing $400M from its balance.

The reason MI4 is very interesting is its institutional-focused approach, as it provides a relatively low-risk, index-based product that’s familiar to traditional investors.

On top of that, it bakes in yield generation, making it even more attractive to asset managers and funds.

The yield comes from blue-chip staking strategies like:

• @mETHProtocol's mETH

• @Bybit_Official’s bbSOL

• @ethena_labs’ sUSDe

These allocations are rebalanced quarterly, and the current fund's structure looks like this:

• BTC - 50%

• ETH - 28%

• USD - 15%

• SOL - 7%

What's remarkable about MI4 is that it's @Securitize’s largest tokenized fund, demonstrating Mantle's commitment to attracting more institutional participation and expansion beyond a generic-purpose L2.

🌱 INITIATIVES TO DRIVE THE INDUSTRY FORWARD

Lastly, as we did in the previous pieces, it's worth mentioning the initiatives Mantle is carrying out to increase ecosystem adoption and global expansion.

1.) Mantle EcoFund - Launched in 2023, it's a $200M fund investing in startups building in the Mantle ecosystem. The fund is also invested in Synergy, a $5 million initiative in collaboration with TON Ventures to advance cross-chain developments between the two networks.

2.) LATAM Expansion - In partnership with @odisealabs, Mantle is engaging with local developers, entrepreneurs, and communities, providing resources and support to accelerate Web3 adoption across the region. This is also part of a bigger vision, in which LATAM will be a main propeller of Mantle Banking's adoption.

5.07萬

34

本頁面內容由第三方提供。除非另有說明,OKX 不是所引用文章的作者,也不對此類材料主張任何版權。該內容僅供參考,並不代表 OKX 觀點,不作為任何形式的認可,也不應被視為投資建議或購買或出售數字資產的招攬。在使用生成式人工智能提供摘要或其他信息的情況下,此類人工智能生成的內容可能不準確或不一致。請閱讀鏈接文章,瞭解更多詳情和信息。OKX 不對第三方網站上的內容負責。包含穩定幣、NFTs 等在內的數字資產涉及較高程度的風險,其價值可能會產生較大波動。請根據自身財務狀況,仔細考慮交易或持有數字資產是否適合您。