Institutional top of mind | #9

Keep up with the top industry updates as we present bi-weekly market insights that are important to traders in the institutional space.

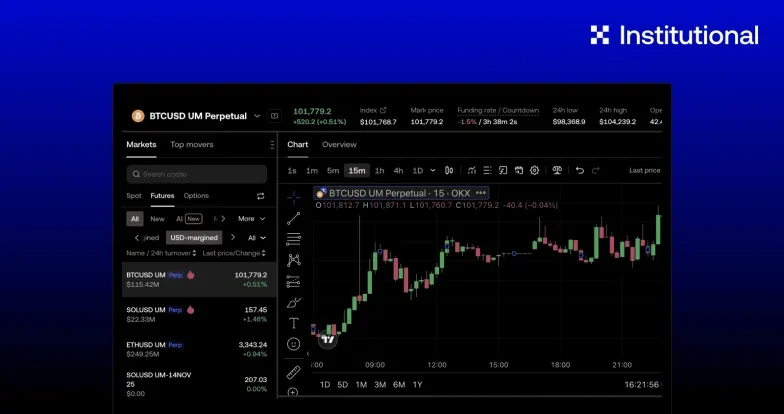

This week, Kelvin Lam, CFA, Head of Institutional Research for OKX, looks at one top-of-mind issue in this installment: how a recent collaboration between OKX, CoinShares & Komainu marks a significant advancement in institutional crypto trading.

How OKX, CoinShares & Komainu are reducing counterparty risk for institutional Crypto traders

The crypto industry has spent years building the infrastructure needed for meaningful institutional adoption. Secure custody solutions are live. Regulatory frameworks are taking shape. Exchange liquidity is deepening alongside the development of the trading ecosystem. Yet institutions have remained hesitant to allocate, and for good reason. Counterparty risk, or the chance that the other party in a transaction may fail to meet its obligations, continues to pose an issue. To address this challenge, a collaboration involving prominent figures in the industry - crypto exchange OKX, asset manager CoinShares, and custodian Komainu - offers an innovative solution via a robust tripartite agreement designed to mitigate counterparty risk. This arrangement incorporates clear legal frameworks that define rights, responsibilities, and mechanisms for dispute resolution, enabling institutional traders to access crypto liquidity whilst safeguarding their assets. We'll examine the key challenges institutions have traditionally faced navigating counterparty risk, and how this collaboration seeks to solve for each, specifically:

Custody assets on exchanges create risk of loss if the exchange fails, whereas the OKX and Komainu integration provides secure and regulated custody.

Trading requires constant moving of assets between custodian and exchange, which is slow and costly, whereas the tripartite agreement enables efficient mirrored balances to trade without giving up custody.

Legal uncertainty on recovering lost assets from exchanges whereas the tripartite agreement codifies rights and responsibilities.

Four key challenges for institutional traders - and how we solve them

1. Off-exchange custody

Challenge - At first glance, third-party custody arrangements have emerged as a solution for counterparty risk mitigation. But these often come with constraints that limit their upside.

With traders wary of leaving funds on exchanges given the counterparty risk, third-party custody has emerged as a potential solution. However, this approach also presents limitations for high-volume trading as it entails limited liquidity and restrictions on trading instruments. In some cases, there are also higher requirements for margin trading and no risk offset features for margin calculation. As a result, this will lower capital efficiency and trading profitability through traditional third-party custody solutions.

Our solution - We have successfully developed a highly customized framework through close collaboration with our clients. This framework empowers OKX to offer institutional traders an integrated digital asset solution, specifically tailored to their unique requirements. By incorporating tailored provisions on off-exchange settlements, margin call scenarios, collateral management, and advanced technology solutions, we deliver an optimal solution for institutional traders. These provisions not only enhance asset security but also drive transactional efficiency, surpassing the specific needs and requirements of institutional traders.

2. Storage

Challenge - Institutional traders are hard-pressed to find an acceptable middle ground to ensure security and regulatory compliance, while retaining the ability to move digital assets between accounts and trading venues.

Storage of digital assets is unique because they are hosted on blockchains and secured through private keys and digital wallets. This is markedly different from traditional financial assets, which ensure ownership through registered records or physical bearer instruments and are stored in bank vaults or by registered third-party custodians.

In the rapidly evolving digital asset landscape, institutional traders grapple with finding a balance between security, regulatory compliance, and the necessary mobility of digital assets across accounts and trading venues.

The question then becomes: How can institutional traders optimize their strategy to guarantee the security and safety of their digital assets while also adhering to applicable regulatory requirements? This conundrum places them in a difficult position, where they must navigate new terrain and adapt traditional trading practices to a digital asset environment.

Our solution - Under the tripartite structure, digital assets are custodied by Komainu, an independent and regulated custodian. Komainu uses institutional-grade technology to ensure the assets under custody are secure, segregated, and verifiable on the blockchain at any time. Komainu has an MLR registration with the UK Financial Conduct Authority (FCA), an OAM registration in Italy, and is regulated by the Jersey Financial Services Commission (JFSC), and Dubai Virtual Assets Regulatory Authority (VARA), ensuring that they adhere to the highest standards of compliance and customer protection.

3. Legal complexities

Challenge - The evolving legal and regulatory landscape surrounding digital assets poses unique challenges for institutional traders' risk management, unlike traditional assets with established property rights frameworks.

Specifically, the prospect of having to navigate complex contingencies and file time-consuming, costly claims to recover assets held on exchanges in extreme scenarios gives legal teams pause when considering market entry. Robust frameworks that provide clarity on digital asset ownership rights and protections are therefore crucial to removing barriers and enabling institutional adoption.

Our solution - The Tripartite arrangement solves these legal technicalities for traders. Under the structure, OKX and CoinShares enter a collateralization mirroring agreement, allowing CoinShares to trade on OKX using a mirroring facility provided by OKX. To collateralize OKX’s mirroring arrangement, CoinShares also enters into a custody agreement and an account control agreement with Komainu with respect to its account held with Komainu, for the benefit of OKX.

Through this structure, the client's digital assets are clearly defined and safeguarded, assuring they remain shielded in scenarios involving distressed assets. This protection reinforces the trust and confidence of institutional traders, creating a more resilient and reliable landscape for them to carry out digital asset transactions.

4. Lack of integration

Challenge - There is no comprehensive solution on the market that accounts for the full range of operational needs for institutional players. The current digital asset custody landscape entails various fragmentation of processes and systems. Without a fully integrated solution, operations such as onboarding, reporting and auditing, connectivity and integration with trading systems, and recovery processes in extreme scenarios remain disjointed, requiring separate providers or platforms. To overcome these challenges, a highly customized solution is necessary to streamline and optimize these operational procedures.

Our solution - The unique set up ensures we provide a platform with robust custodial solutions, resilient trading infrastructure, and seamless execution. Institutional clients benefit from our integrated offering to securely scale digital asset portfolios.

Our technical custodial solution has two modes: 1) Collateral mirroring and, 2) Intra-day settlement. In collateral mode, differences between collateral value and the client's exchange account values will be settled when risk parameters are triggered. In the intraday settlement mode, margin requirements and trade settlement from client trading activities will be settled intra-day between collateral and exchange account values, creating an optimised use of capital for both parties. This is all accomplished via API and by running the operation 24/7.

We anticipate that this setup will emerge as one of the best practices in the industry to foster a more trustworthy and transparent trading environment for institutional traders.

For further information on this solution, we encourage you to contact an OKX Institutional sales representative at institutions@okx.com. They'll be able to provide you with comprehensive details and address any inquiries you may have.