Moonriver-prijs

in EUR

Over Moonriver

Disclaimer

OKX geeft geen beleggings- of vermogensadvies. Je moet zorgvuldig overwegen of het verhandelen of bezitten van digitale bezittingen voor jou geschikt is in het licht van je financiële toestand. Raadpleeg je juridische, fiscale of beleggingsadviseur als je vragen hebt over je specifieke situatie. Raadpleeg voor meer informatie onze Gebruiksvoorwaarden en Risicowaarschuwing. Door gebruik te maken van de website van derden ('TPW'), ga je ermee akkoord dat elk gebruik van de TPW onderworpen is aan en beheerst wordt door de voorwaarden van de TPW. Tenzij uitdrukkelijk schriftelijk vermeld, zijn OKX en haar partners ("OKX") op geen enkele manier verbonden met de eigenaar van de exploitant van de TPW. Je gaat ermee akkoord dat OKX niet verantwoordelijk of aansprakelijk is voor verlies, schade en andere gevolgen die voortvloeien uit jouw gebruik van de TPW. Houd er rekening mee dat het gebruik van een TPW kan leiden tot verlies of vermindering van je bezittingen. Het product is mogelijk niet in alle rechtsgebieden beschikbaar.

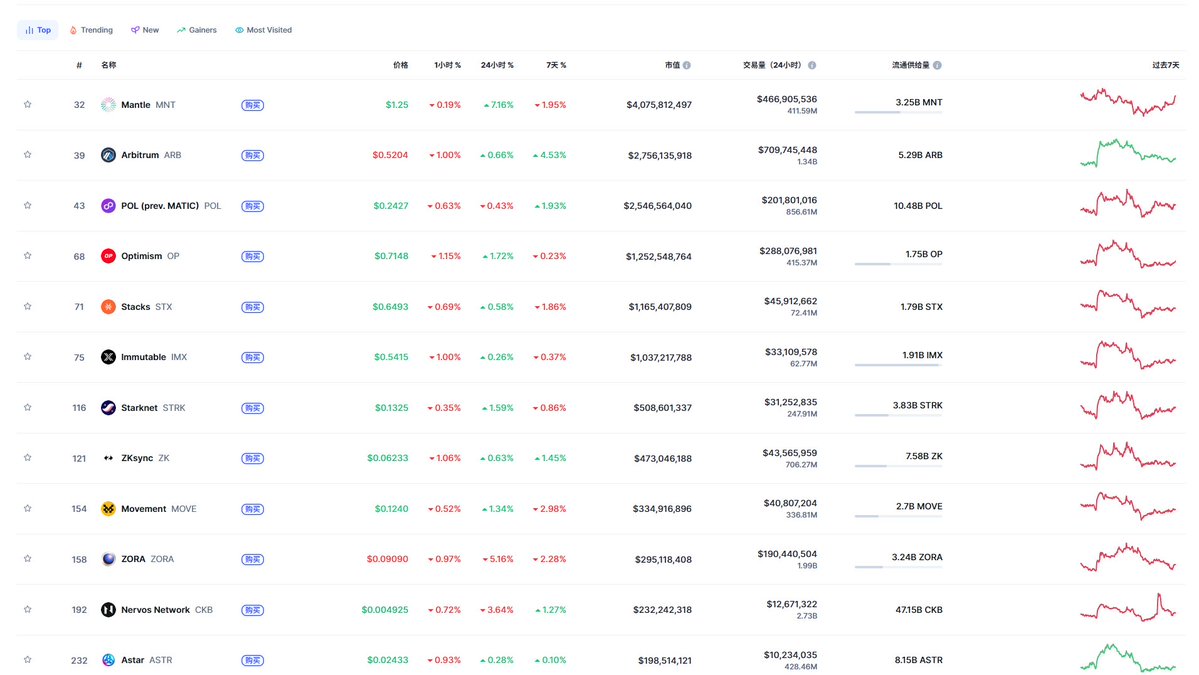

Prijsprestaties van Moonriver

Moonriver op sociale media

Handleidingen

Maak een gratis OKX-account aan.

Stort geld op je account.

Kies je crypto.

Moonriver Veelgestelde vragen

Duik dieper in Moonriver

Moonriver, sesterská síť sítě Moonbeam, je decentralizovaná smart contract platforma postavená jako parachain naKusama. MOVR je název a ticker symbol nativního tokenu společnosti Moonriver.

Síť Moonriver byla na Kusamě spuštěna v červnu 2021. Podobně jako Kusama funguje jako kanárková síť k Polkadotu, Moonriver funguje jako plně motivovaná platforma pro testování nových projektů před jejich nasazením na Moonbeam.

Platforma zrcadlí ekosystém Etherea, pokud jde o jeho Web3 RPC, účty, systémy hesel, předplatné, dokumentaci, peněženky Etherea a vývojářské nástroje. Díky tomu lze jakýkoli projekt Ethereum replikovat a nasadit na platformě Moonriver s nízkými poplatky za plyn a vyšší rychlostí.

Moonriver a Moonbeam se snaží zachovat stejnou úroveň decentralizace a bezpečnosti jako jejich příslušné relay řetězce Polkadot a Kusama. Moonriver má ve své síti více než 900 validátorů a je nejaktivnějším DeFi ekosystémem v mainnetu Kusama. Kromě toho mají Moonriver a Moonbeam také vznikající DeFi ekosystém s DEXy, půjčování a výpůjčními protokoly, automatizovanými tvůrci trhu (AMM), stakingovými protokoly, launchpadem a dalšími.

Primárním případem použití Moonriveru je motivace kolaterálů a účastníků, kteří provozují základní decentralizovanou infrastrukturu uzlů pro provádění chytrých smluv. Platforma také od počátku přijala plně decentralizovaný systém správy, kdy držitelé tokenů pomocí MOVR spravují platformu navrhováním aktualizací, volbou členů rady a hlasováním o návrzích.

Cena MOVR a tokenomika

Celková nabídka MOVR činila při spuštění 10 milionů kusů. Maximální nabídka je neomezená a roční míra inflace činí 5 %. Z inflace tokenu se platí za funkce sítě, včetně motivace kolátorů, placení za parachainový slot na jejím relay řetězci a odměňování stakerů tokenů.

V srpnu 2021 bylo 30 procent tokenů MOVR rozděleno zpět účastníkům aukce MOVR parachain na Kusamu. Zbývajících 70 procent bylo vyhrazeno pro vývojáře, komunitní iniciativy a další nezbytné týmy.

80 procent poplatků získaných z transakcí a provádění chytrých kontraktů na platformě se spálí, čímž vznikne dočasná deflace, která ovlivní cenu MOVR. Zbývajících 20 procent se převádí do pokladny pro komunitou odhlasované projekty.

ESG-vermelding