. ݁₊ ⊹ . ݁˖ . ݁VAULT OF THE DAY. ݁₊ ⊹ . ݁˖ . ݁

Why are whales quietly parking tens of millions in vaults with 2% APY?

Today's @gauntlet_xyz vault of the day might look basic on the surface. However, it's one of the most powerful yield tools for passive capital in the market right now, powered with @MorphoLabs to endure and grow through various market conditions.

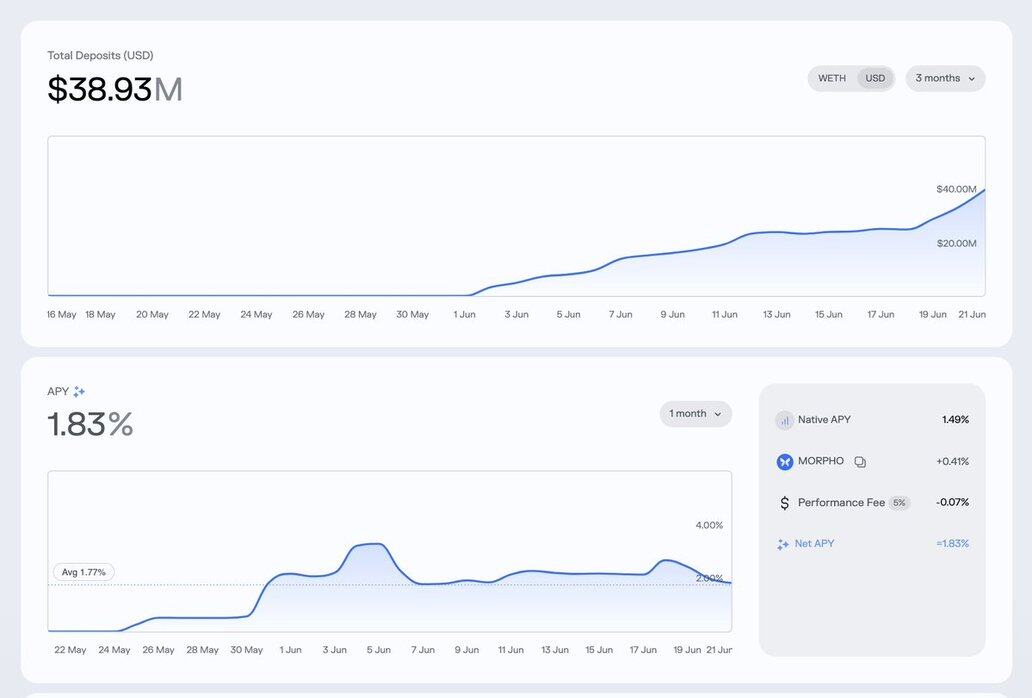

This is Vault Bridge WETH, launched in May 2025 by Gauntlet and live on Morpho. It currently holds over $38.9M in deposits with $21M in active liquidity.

It doesn’t rely on risky directional strategies or degen yield hopping. Instead, it aims to optimize risk-adjusted yield across large market cap and high liquidity collateral markets.

The strategy is simple, reliable, and capital-efficient.

Users deposit WETH, which is lent out to borrowers using ETH LSTs (like wstETH and weETH) or assets like cbBTC as collateral. Yields are generated from interest paid by borrowers and rebalanced automatically based on risk.

Here's what matters:

→ Net APY is currently 1.83%

→ Zero idle capital

→ Top LTVs: wstETH 96.5%, weETH 94.5%

→ Major allocation to staked ETH collateral (94%+)

→ Full integration with Gauntlet risk simulations +

@MorphoLabs optimizer

This makes it ideal for users who want predictable, passive ETH denominated yield.

Vault supply has been climbing steadily since launch. From $0 on May 23 to $38.9M by June 21.

Utilization on key collateral markets like weETH and cbBTC is consistently over 90%, showing high capital efficiency without liquidity risk.

The vault is also protected by @gauntlet_xyz 's simulation engine, which stress tests loan health under thousands of volatility and correlation scenarios. Collateral is never unmanaged, and risk parameters are tuned daily.

This adds resilience to the strategy.

There’s no complex yield flow to follow. No need to worry about protocol hopping, impermanent loss, or depegs.

Users simply deposit WETH and earn yield from a diversified, overcollateralized, high liquidity lending market, auto-optimized by Morpho and Gauntlet.

What makes this vault special isn’t the raw APY, it’s the structure behind it. A vault like this is a cornerstone for sustainable passive yield in the Ethereum ecosystem.

Smart money isn’t always chasing the highest number. It’s chasing what lasts.

Explore the vault on @MorphoLabs

View allocations, metrics, and APY history on @gauntlet_xyz and discover other vaults

1,24 rb

0

Konten pada halaman ini disediakan oleh pihak ketiga. Kecuali dinyatakan lain, OKX bukanlah penulis artikel yang dikutip dan tidak mengklaim hak cipta atas materi tersebut. Konten ini disediakan hanya untuk tujuan informasi dan tidak mewakili pandangan OKX. Konten ini tidak dimaksudkan sebagai dukungan dalam bentuk apa pun dan tidak dapat dianggap sebagai nasihat investasi atau ajakan untuk membeli atau menjual aset digital. Sejauh AI generatif digunakan untuk menyediakan ringkasan atau informasi lainnya, konten yang dihasilkan AI mungkin tidak akurat atau tidak konsisten. Silakan baca artikel yang terkait untuk informasi lebih lanjut. OKX tidak bertanggung jawab atas konten yang dihosting di situs pihak ketiga. Kepemilikan aset digital, termasuk stablecoin dan NFT, melibatkan risiko tinggi dan dapat berfluktuasi secara signifikan. Anda perlu mempertimbangkan dengan hati-hati apakah trading atau menyimpan aset digital sesuai untuk Anda dengan mempertimbangkan kondisi keuangan Anda.