USD1 amplified move, the increase tells you who is the hottest "Trump concept" target?

On May 22, 2025, the market wind continued to rise, with Bitcoin breaking through a record high of $110,000 in one fell swoop, and in the context of the passage of the "GENIUS Act", an "unexpected" stablecoin USD1 quietly became the focus of the market.

According to official news, Binance has announced that it will list the stablecoin World Liberty Financial USD (USD1) at 20 o'clock today, becoming the third mainstream exchange to support USD1 after HTX and MEXC. With the strong exit of USD1, the market has also ushered in a wave of "US dollar hot money + Trump label" linkage market.

Today, B (BUILDon) on the Binance Alpha platform surged 192% in a single day, and tokens such as LISTA and STO on the Binance gainer list also rose significantly, and the community's confidence in the "WLFI concept" and "Binance-system" projects has increased significantly.

WLFI officially announced its support for BUILDon and purchased B tokens, and Binance's direct support for USD1 has also made the community generally believe that it will replace FDUSD as Binance's main stablecoin.

Now, with BUILDon's wave of "USD1 craze" giving investors a sniff of alpha opportunities, what other concepts are related to USD1 and WLFI in the Binance ecosystem? BlockBeats has a simple combing through this.

USD1 enlarges the "ecological binding"

USD1 is a U.S. dollar-pegged stablecoin issued by World Liberty Financial (WLFI) in March 2025, with the goal of converting to U.S. dollars 1:1, with 100% backed by short-term U.S. Treasuries, U.S. dollar deposits, etc., and the custodian is BitGo Trust Company. With strong endorsements from the Trump family and co-founders including Eric Trump, USD1 has brought its own traffic since its launch.

just two months, USD1's market capitalization has surged from $128 million to $2.1 billion, making it one of the top seven stablecoins in the world. It accounts for 90% of the circulating supply on the BNB Chain and is the first to be listed on mainstream exchanges such as HTX.

At the same time, it also completes multi-chain deployment through Chainlink's CCIP protocol, which currently supports Ethereum and BNB Chain. In May, USD1 continued to heat up, with Abu Dhabi MGX injecting $2 billion into Binance through USD1.

Related Reading: "Behind BUILDon's 40-fold Surge, Trump and CZ Spread $2 Billion in Coin Speculation 'Yang Plot'" Some

users even speculate that Binance is "testing the waters" of USD1 through the Alpha platform, intending to make it the core stablecoin of BNB Chain.

a summary

, let's take stock of several of the most popular "Trump concept" targets in the current market.

USD1 concept

BUILDon (up 480% in 6 hours).

Token B was listed on Binance Alpha on May 21, and the market value of BUILDon exceeded $220 million in a single day, hitting a record high, rising 480% in 6 hours.

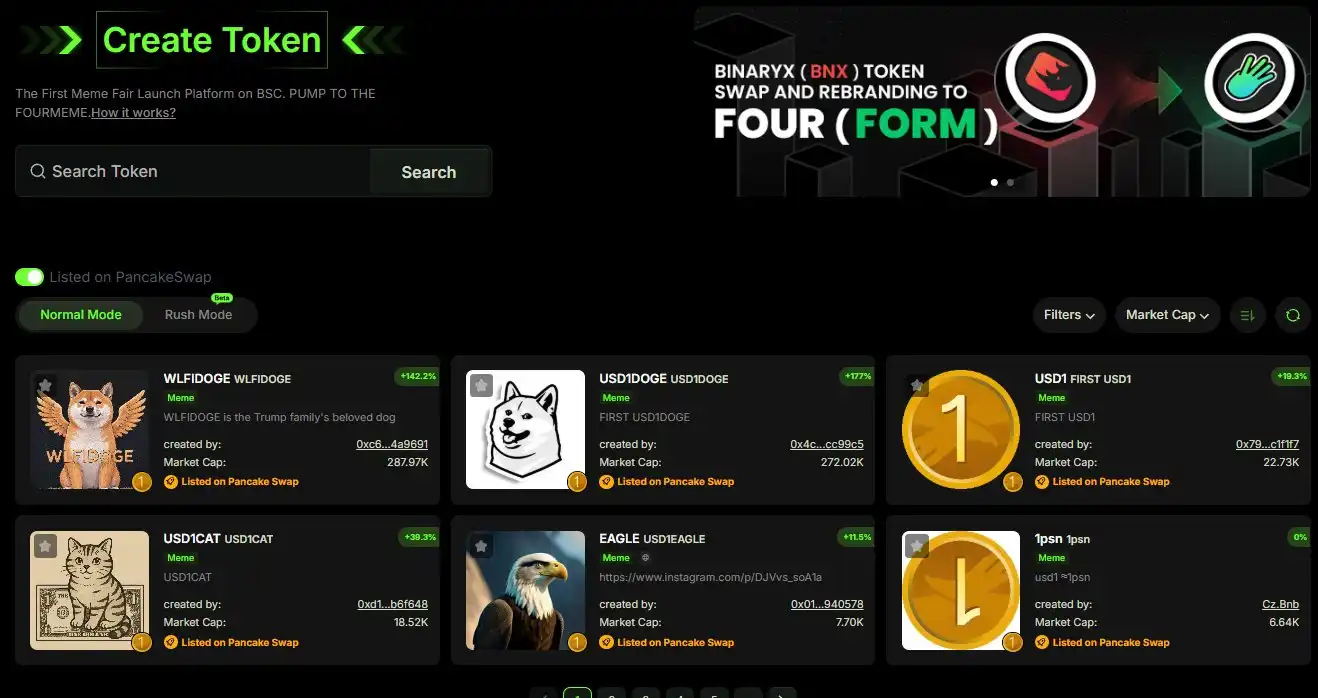

BUILDon is a token launched fairly through the Four.meme platform, with the core being the mascot that promotes BSC's construction culture, and will officially launch the USD1 construction plan in the near future to further promote the development of the stablecoin USD1.

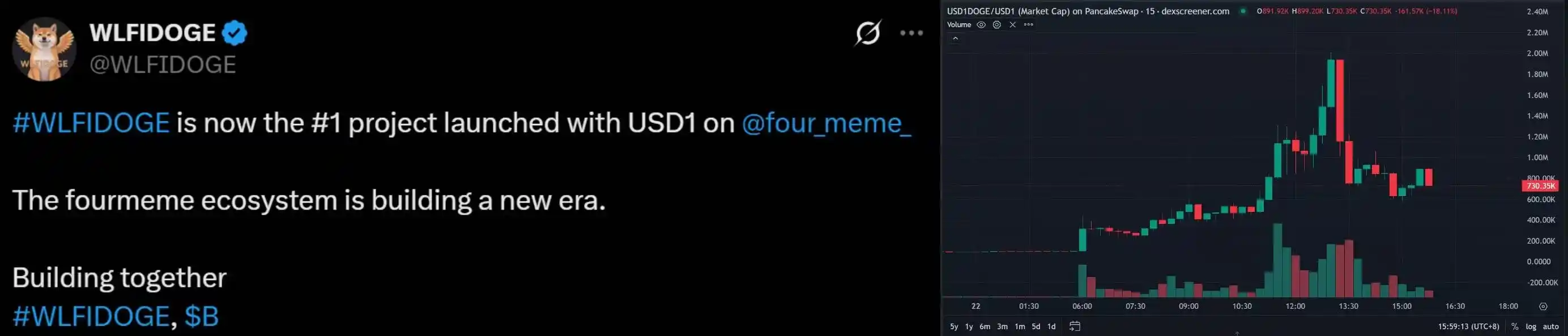

usd1doge (10x increase) &wlfidoge (4x increase).

On May 22, 2025, USD1DOGE achieved a 10-fold surge in 24 hours, rising from $130,000 to $2 million, and then immediately fell back, and is currently around $730,000, failing to form sufficient market potential.

EAGLE (highest intraday gain of 1067

EAGLE was the first USD1-related token on the Ethereum chain, but again, the meme's market cap quickly rose to a high of $3.74 million before falling to $1.79 million, The current price is $0.018.

The following tokens are all projects launched on the Four.Meme platform and are part of the USD1 ecosystem, but these memes that have not run out have low market capitalization and do not form market popularity.

WLFI officially announced the cooperation concept

LISTA (up 46.62%)

On May 22, LISTA rose by 46.62%, and as early as May 7, official news had announced that WLFI and Lista DAO had reached a strategic cooperation, USD1 has officially landed on the Lista DAO ecosystem, and USD1 is now online in the ListaDAO treasury.

LISTA focuses on decentralized lending, and if the WLFI ecosystem expands, its liquidity will be significantly improved, and Lista DAO lending product Lista Lending has launched USD1Vault, which is the first application of USD1 on BNB Chain.

– >

– >

STO (up 20% on the day).

The official release plan of STO is based on STONE and USD1 to create a more flexible cross-chain income experience. As an infrastructure focused on full-chain liquidity, StakeStone has integrated 20+ chains and 100+ protocols, and its yield-bearing token STONE can improve asset utilization for USD1 users while retaining liquidity. At present, although only the official announcement of cooperation, large-scale purchase has not yet been made.

StakeStone announced on May 9 that it had completed its integration with Trump's crypto project WLFI, and its deployer address received a test transfer of 10,000 USD1 from the USD1 official custody address on May 6.

the

the

concept of "WLFI buying"

Liberty Financial began buying crypto assets on a large scale in December last year, and here is a breakdown of some of the main assets it has purchased:

Related reading: "Throw 4500 Buy $10,000 coins: Who is the trader behind Trump's project WLFI? On

January 21, 2025, WLFI purchased $4.7 million worth of TRX, approximately 19.58 million TRX

on January 22, it purchased an additional TRX worth approximately $2.62 million, approximately 10.8 million, bringing its total TRX holdings to its total holdings 30.1 million TRX

· On January 24, 2025, WLFIWLFI purchased 10.61 million TRX again, worth $2.65 million

total purchase of about 40.99 million TRX.

On March 18, WLFI officially announced that it had included BTC, ETH, TRX, LINK, SUI, and ONDO in their strategic reserve assets. On May 1, co-founder Zack Witkoff revealed in an interview with Cointelegraph that USD1 will also be deployed natively on the Tron chain next, further expanding its multi-chain layout.

Vaulta(A)

On May 14, the original EOS was renamed EOS, and the token supports 1:1 wear-free exchange and no tokenomics changes. The Trump family crypto project WLFI bought $3 million worth of EOS through the BSC ecosystem DEX protocol Pancake, while buying $3 million in Vaulta(A) through the exSat ecosystem DEX protocol 1DEX.

WLFI purchased a total of approximately 7.386 million Vaulta(A) (including 3.636 million EOS and 3.75 million Vaulta A), with a total value of approximately 6 million USDT (approximately $6 million).

LINK

·On December 12, 2024, WLFI purchased 41,335 LINK for 1 million USDC

On December 13, 2024, WLFI purchased an additional 37,052 LINK for 1 million USDC

On January 21, 2025, a total of 4.7 million USDC worth of LINK

was purchased, and WLFI purchased a total of approximately 256,314 LINK, with a total value of approximately 6.7 million USDC.

On

December12, 2024, WLFI purchased 3,357 AAVE for 1 million USDC

On January 21, 2025, WLFI purchased AAVE

WLFI purchased a total of approximately 17,730 AAVE, with a total value of 5.7 million USDC.

SEI

·Spend 125,000 USDC to buy 547,990 SEI

on February 20, 2025·Spend 100,000 USDC to buy 541,242 SEI

Purchase $775,000 of SEI on April 13, 2025.

In the past 3 months, WLFI spent approximately 1 million USDC to purchase 5.983 million SEI in 3 transactions, with an average price of $0.167.

AVAX

March 16, 2025, WLFI spent 2 million USDT to buy 103911 AVAX.

MNT

MNT will purchase a total of two units in March 2025, namely 2 million U on the 16th and 3 million U on the 23rd, with a total quantity of about 5.99 million MNT and a total value of 5 million U.

ENA

Spend 2 million USDC to buy ENA on January 21, 2025.

ONDO

January 21, 2025, WLFI spent 2 million USDC to buy ONDO.

MOVE

January 29, 2025, WLFI spent 1.9 million USDC to buy MOVE, and in February 2025, it bought 286,000 USDC of MOVE.

Market sentiment is high. USD1 ecological tokens such as BUILDon, usd1doge, and wlfidoge have attracted a lot of attention from the market with several multiples in a short period of time, while LISTA, STO and other projects that cooperate with WLFI or integrate USD1 applications have also begun to attract attention.

Currently, a new narrative built around USD1 and WLFI is gradually taking shape, ambushing potential alpha opportunities in advance and becoming a forerunner in the next round of hot rotation.