Mid-2025 Highlights: Who is the "mudslide" that made you lose so much?

Written by Bright, Foresight News

It is common for the currency circle to return to zero, but it is not common for large-capitalization tokens to fall by more than 80% in one hour. The plot of a short cut in half or even an ankle is still particularly "conspicuous" in this volatile market.

More than halfway through the 25 years, Bitcoin has experienced a V-shaped trend of 100,000-70,000-110,000, and during this period, how many "mudslides" formed by the convergence of the big black lines in the currency circle?

Milley's stain that can't be washed away: Libra

Meme is the main theme track of the crypto world in 24-25. From community memes to AI Agent Fomo craze, memes with a market value of more than $100 million on the chain are frequent, and P players are happy to fight each other in various narrative plays.

And looking back, there have been two presidents who have played a historic role in this meme-flowing feast.

The first is U.S. President Donald Trump, whose Trump was named in January and has a market capitalization of nearly $80 billion in two days. Many cars in the Chinese-speaking region have won the gods, and the single currency A8 is the most uncontroversial "big opportunity" in 25 years so far. It can be said that Trump's issuance of coins has pushed the meme track to the climax. For a while, the market was shaken, and it was unanimously agreed that Trump's move to issue coins would become an example for politicians and celebrities from all over the world to follow.

Sure enough, the second candidate for the "2025 Most Influential Award in the Cryptocurrency Circle", Argentine President Milley appeared. ON FEBRUARY 14, MILLAY PUBLICLY ENDORSED LIBRA, A TOKEN THAT WAS INITIALLY ADVERTISED ON X AS A TOOL TO SUPPORT SMALL BUSINESSES AND ARGENTINIAN STARTUP PROJECTS. However, with the disclosure of huge profits from more insider addresses and Milley's denial of any connection to the token, the price of LIBRA briefly crashed to $0.2, becoming the first major "mudslide" in the currency circle since the New Year.

If Trump is the highlight of the meme track, then Libra is the key node for the meme to turn from prosperity to decline. According to DefiLlama data, Solana's liquidity plummeted from $12.1 billion to $8.29 billion since the Libra harvest, and the price of Sol has also fallen by more than 20%.

According to on-chain statistics, a total of 75,000 users were affected by the Libra flash crash, with a total loss of about $286 million, more than 86% of the total number of traders, and it can be called the largest on-chain fraud incident in 25 years. The Libra scandal, which drained the on-chain liquidity at that time and destroyed the trust of "celebrity coins", exposed the ugly faces of KIP Protocol, Kelsier Ventures, Meteora, Jupiter and other "RUG PULL" related players one after another.

Hayden Davis, also known as CEO of Kelsier Ventures, was one of the instigators of the incident. According to rumors, he has said that he can "control" Argentine President Milley by channeling benefits to Milley's sister. In fact, Hayden Davis is a habitual offender in orchestrating a number of meme tokens "RUG PULL", involving insider trading of various meme tokens such as MELANIA, ENRON, BOB, and collecting more than $200 million. Hayden Davis later downplayed Libra as "a meme", and also expressed his attitude of only seeing memes as harvesting tools, without considering any substantive obligations and consequences.

The crypto world is moving at a high speed, and the loss threshold for retail investors is very high. But what Hayden Davis says is enough for all meme conspirators. "But [everything I do] is not illegal in the meme market. That's what happens in every trade. That's the rule here, people know this, agree to this, and make money on this. If you're going to blame that, you're going to have to blame everything else."

"This is not a capital market, this is a casino."

The vicious "delisting coin": ACT

However, even established community memes are at risk of flash crashes under the sophisticated system collectively constructed by exchanges, market makers, and large coin holders.

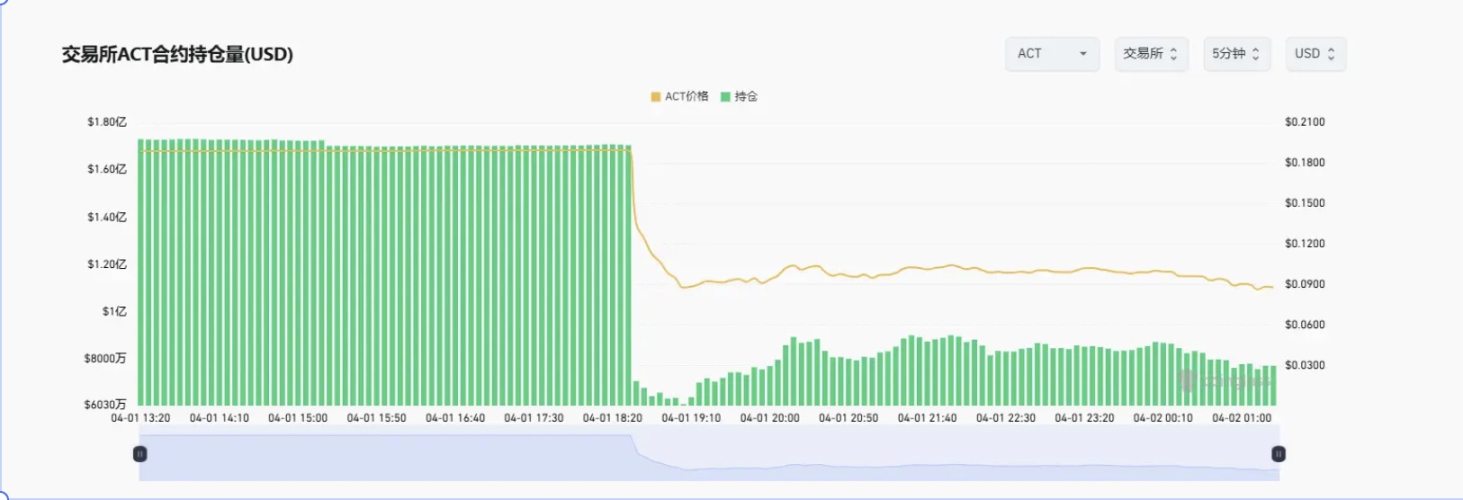

At 18:30 p.m. on April 1, 2025, the flash crash of low-cap tokens such as ACT in half an hour was called an April Fool's Day horror. Among them, ACT, which once hit the $1 billion market capitalization mark in 24 years, fell from $0.1899 to $0.0836 in 36 minutes, a staggering drop of more than 55%.

At 15:30 on April 1, Binance issued an announcement on adjusting the leverage and margin tiers of a number of U-margined perpetual contracts, including ACTUSDT, PNUTUSDT, NEOUSDT and other trading pairs, and stated that the adjustment time was 18:30.

The content of the announcement is aimed at the adjustment of the position limit and leveraged margin ratio of the above token contract transactions, which obviously became the fuse of the panic plunge in the evening. In the case of the ACT, for example, the position cap was capped at a maximum of $4.5 million before the adjustment, which was reduced to a maximum of $3.5 million after the adjustment.

After the crash, most users pointed the finger at the Binance exchange, believing that the exchange lowered the position limit and triggered the forced liquidation, further triggering panic selling. In addition, the community also questioned whether the collapse was caused by the market maker's initiative to smash the market by Wintermute, which was previously suspected to be an ACT market maker, sold a large number of meme tokens at the same time.

After 8 p.m., Binance released a preliminary investigation report into the incident, which said that the decline in ACT was mainly due to the price drop caused by three VIP users and one non-VIP user selling about $1.05 million in spot tokens in a short period of time.

Evgeny Gaevoy, founder of Wintermute, also said that the company did not participate in the leading operations of meme coin crash events such as ACT, and only arbitraged the AMM pool after the price fluctuated sharply, and the crash was not led by Wintermute.

For a time, only four unknown Binance users carried the black pot. However, CoinGlass data shows that at 18:30, the Binance ACT contract open interest fell sharply by 75%, which may hardly be explained as a "masterpiece" of the four big sellers.

At this point, the ACT has basically declared a slow death. There may not have been a bad actor like Libra in this flash crash, but retail investors still fell victim to a "fortuitous" mistake by the game-makers.

VC Coin Zero Tragedy: OM

To paraphrase Tolstoy, "Rising tokens are always similar, while falling coins have their own misfortunes."

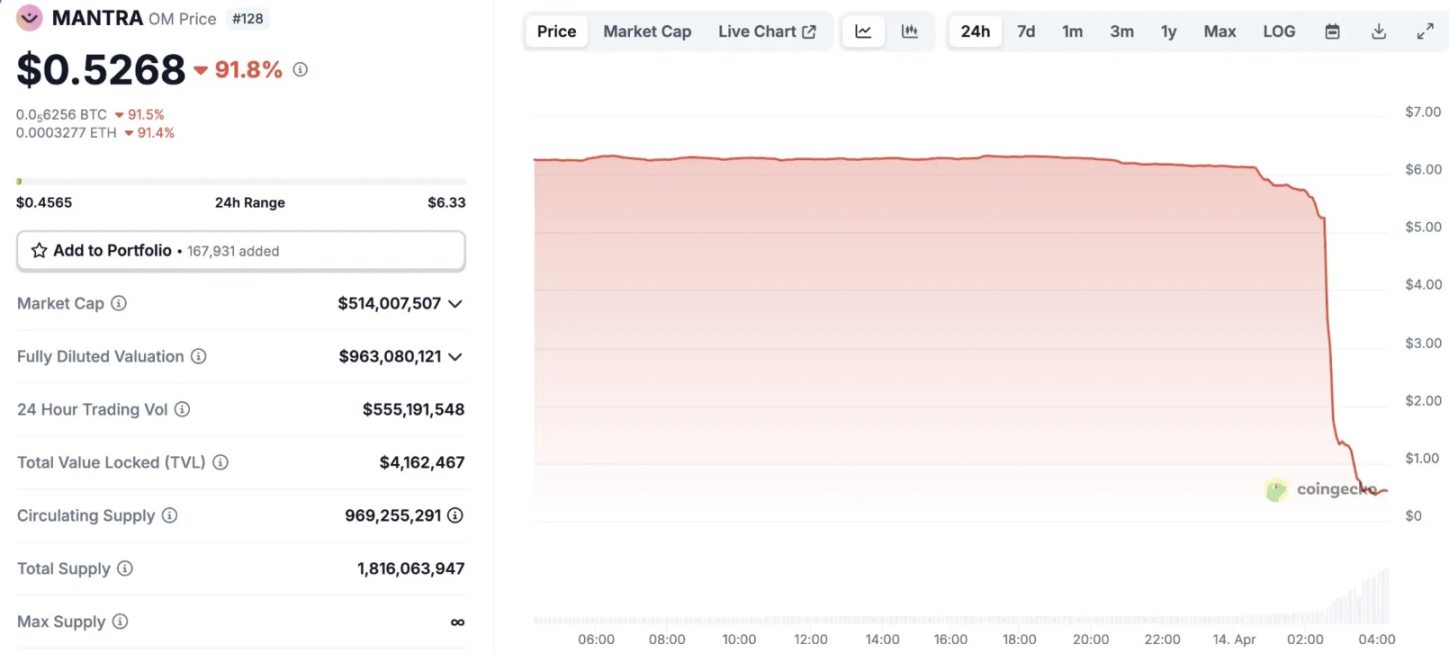

Then on April 14, 2025, MANTRA (OM) evaporated $5.5 billion in market value in 15 minutes in the middle of the night, plummeting by more than 90%, falling directly from the top 25 in the cryptocurrency market capitalization to outside the 90th, which can definitely be regarded as the "worst" in the currency circle.

However, before the crash, OM took a path of "demon coins" that seemed to never look back. From October 2023 to February 2025, OM violently ramped from $0.017 to $9.17, an increase of nearly 540 times, which is not common for a VC coin. Both the market and the community blame the myth that OM only goes up and not down to the strong dealer behind OM.

OM has almost everything a VC coin should be imagined - a luxurious financing background, application scenarios (tokenization cooperation with Middle Eastern real estate groups), the launch of mainstream exchanges such as Binance, and moreover, it can only go up and down.

There must be a reason for the anomaly, and the entire OM project is essentially very opaque. MULTIPLE SOURCES HAVE REPORTED THAT THE MANTRA TEAM HOLDS 792M OF OM IN A SINGLE ADDRESS, WHICH IS 90% OF THE TOTAL SUPPLY, AND THE ACTUAL MARKET CIRCULATION MAY BE LESS THAN 1%. One commented, "The team didn't even bother to spread these supplies across multiple wallets."

Analyst Mosi has written about how OM, a project with only $4 million in TVL, can have more than $10 billion in FDV. In fact, the only way is to control the vast majority of the real circulation.

The MANTRA team has been airdropping OM to the PUA community, with an initial high-profile announcement that it will distribute 50 million OM tokens within a month, with a promise to unlock 20% at launch. However, in practice, it has repeatedly delayed and changed the rules, extending the redemption cycle indefinitely, so as to realize the passive lock-up of community tokens. In fact, if the full airdrop is indeed issued, then the true circulation of OM will increase significantly, and according to the on-chain data, the price will definitely fall sharply.

In stark contrast to the constant teasing of the community, there is a trend of frequent withdrawals and transfers to exchanges by large OM account addresses.

On March 25, the address of MANTRA's investment arm, Laser DIgital, deposited 1.7 million OM worth $11.49 million to Binance. According to Genç Trader, the wallet address 0x9a... 1a28 transferred about $20 million of OM to OKX a day before the crash. Judging from the on-chain interaction records, this address just withdrew about $40 million of OM from Binance in early March, and is one of the whales that pulled up the price of the coin before.

In addition, on-chain detective ZachXBT posted on the day of the crash that the OM crash may be related to Denko (founder of Reef Finance) and Fukogoryushu. The two allegedly contacted multiple people in the days before the 90% plunge in the OM token price in an attempt to secure a large loan against their OM token holdings. Rumors of large OTC off-the-counter sums of time have added conspiracy theories to a harvest that seems to have been prepared for a long time.

IN RESPONSE TO THE CRASH, THE MANTRA TEAM ISSUED A STATEMENT SAYING THAT THE DECLINE WAS CAUSED BY AN IRRATIONAL LIQUIDATION, THAT IT HAD NOTHING TO DO WITH THE PROJECT ITSELF, AND THAT IT WAS NOT THE TEAM'S DOING. Later, Mantra co-founder JP Mullin said in a podcast: "I'm sad, the community is bad, but we didn't do anything bad." In his public statement, he alluded to the fact that the OM plunge was sniped at by an exchange, and promised "open and transparent all information" and "buyback and burn plans".

However, today, the MANTRA team has "changed" as always, and after clarifying responsibilities and shifting conflicts, the team has allowed the unimplemented plan to go all the way south with the price of the coin.

Binance Alpha spawns new scythes: ZKJ, KOGE

When it comes to the cryptocurrency circle in 2025, Binance Alpha's innovation is definitely an unavoidable topic. However, the flash crash of ZKJ and KOGE in Binance Alpha poured cold water on the enthusiasm of the whole people to compete for alpha trading volume.

At 20:30 p.m. on June 15, Polyhedra Network's native token, ZKJ, plummeted by more than 85% in two hours, with its price flash crashing from $2 to $0.29, and its market value evaporated by nearly $500 million. 48 Club DAO's governance token, KOGE, fell from $61 to $8.46 in half an hour.

Coinglass data shows that from 20 o'clock to 22 o'clock that night alone, the amount of liquidation on the whole network reached 102 million US dollars, and ZKJ alone contributed 94.336 million US dollars in liquidation, and the long liquidation was as high as 93.6878 million US dollars, completely harvesting the liquidity of the contract.

Binance Alpha's points mechanism essentially constructs an "illusion of liquidity" - in order to obtain Binance Alpha airdrops, users need to frantically swipe trading pairs to get points. However, many Alpha tokens are still volatile new coins or memes, and rushing to start trading is not in line with the risk appetite of alpha players. Then, the tokens with good liquidity and relatively stable coin prices in the Binance Alpha ecosystem have been on the "first list".

ZKJ and KOGE, which are in the eye of the storm, happened to be the two most traded tokens on the BSC chain on Binance Alpha before the accident. ZKJ-KOGE's low-wear strategy for brushes has been spread by word of mouth in the community and social platforms. Prior to the incident, the pair's daily trading volume had exceeded $200 million for several consecutive days.

However, the calm before the storm did not last long. The "liquidity illusion" has led to a very narrow price range from ZKJ-KOGE to LP (liquidity provider). Once the illusion is punctured, after the massive sell-off causes the price to break through this narrow range, the market will not have enough funds to accept sell orders, and there will only be an endless death spiral.

According to on-chain analyst Ai Aunt, the flash crash of ZKJ and KOGE showed the characteristics of a well-planned harvesting operation. The three main addresses aimed at the huge trading volume and liquidity formed by the two tokens in the context of Binance Alpha, and through the double blow of "large withdrawal of liquidity + continuous selling", the two tokens collapsed one after another:

Address 0x1A2 began with two withdrawals of bilateral liquidity of approximately $3.76 million KOGE and $532,000 ZKJ between 20:28 and 20:33, followed by the exchange of 45,470 KOGEs for ZKJ, worth $3.796 million, and the sale of 1.573 million ZKJ in batches.

The second key address withdrew about $2.07 million in KOGE and $1.38 million in ZKJ in bilateral liquidity, while selling 1 million ZKJ.

The third address carried out a liquidation operation after receiving the 772,000 ZKJ transferred from the second address, further exacerbating the downward trend of ZKJ.

Therefore, Binance Alpha is not a guarantee of the security and credibility of the project. Short-term stability and high returns are just poisons that make you form the inertia of your thinking, so that you will not forget it when you finally close the net.