From JLP to Neutral: How to Capture Strategy Gains on SOL?

Written by Alex Liu, Foresight News

From JLP to Neutral

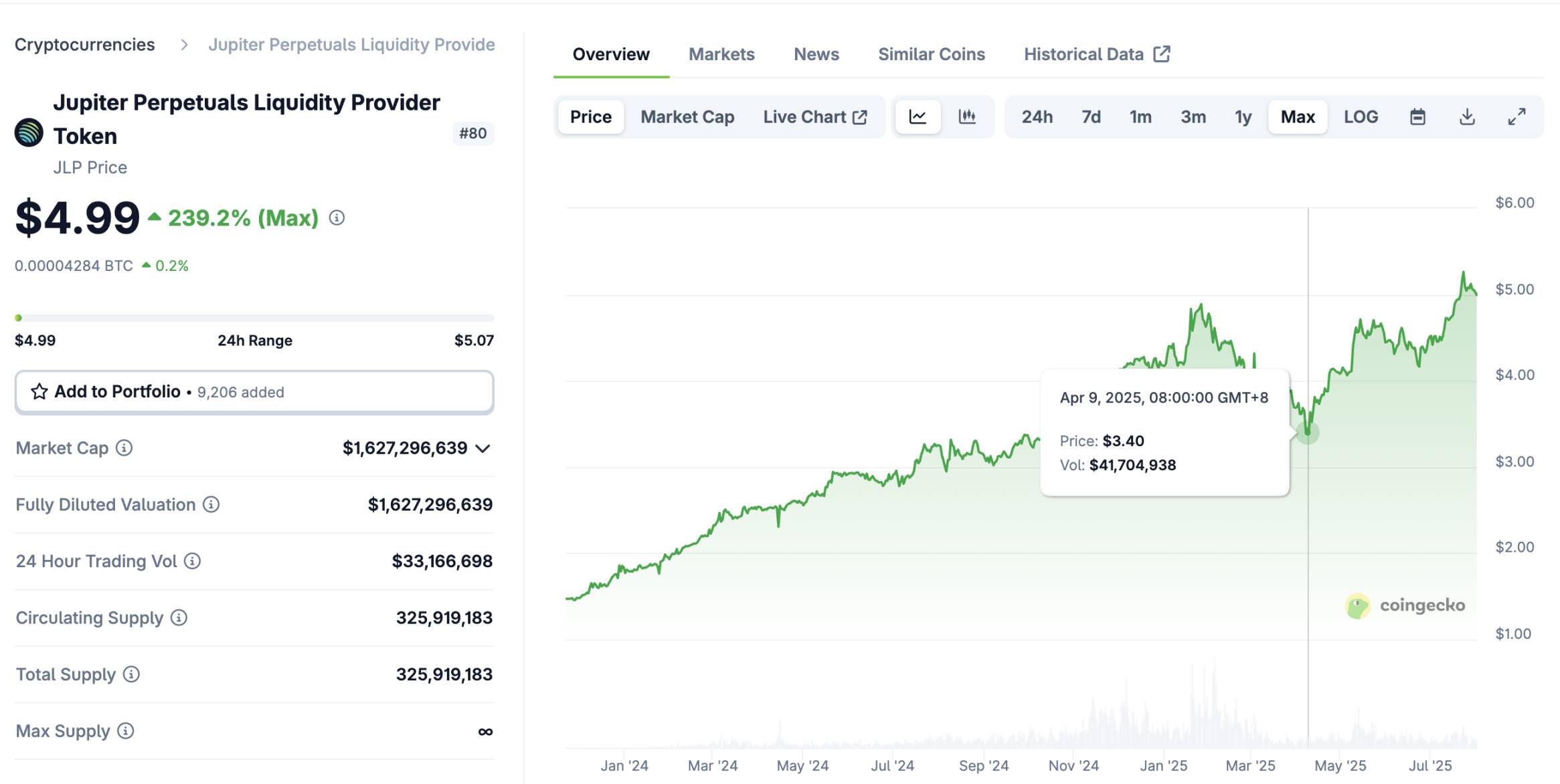

To make money, step 1 is often to find a quality asset. It is no exaggeration to say that even if you look at the entire crypto world, JLP is one of the best quality assets. It has risen 3 times in the first year of its launch, and the maximum drawdown is a 30% correction in March. While performing well, the capital volume exceeds $1 billion and the capacity is extremely large, how does it do it?

JLP price action, data: coingecko

JLP stands for Jupiter Perpetual Liquidity Provider Token, which is the Jupiter Perpetual Contract Liquidity Provider Token. Holding JLP is equivalent to depositing money into Jupiter as a futures trader. Contract traders make a profit, JLP will lose money, and vice versa. After countless similar products have been repeatedly verified, contract traders always lose money on a long-term scale, which is the first income of JLP.

75% of the Jupiter perpetual contract transaction fees will return to JLP, and the generous fee income will keep JLP's annualized income above 30% for a long time, sometimes even more than 50%.

JLP itself is made up of 47% SOL, 8% ETH, 13% BTC, and 32% USDC, maintaining exposure to crypto assets. So in 2024, when SOL was strong, JLP rose more than 3 times with the first two gains. During the three months when SOL fell from $295 to $100, JLP has hit a new high after the price of SOL recovered, with a decline of 30% due to JLP's limited risk exposure and the first two income buffers.

In this way, the scenario of JLP losses is that contract traders make short-term profits in extreme market conditions (but statistics show that they will lose money sooner or later...). ), and the long-term price of crypto assets weakened. And the long-term risk seems to be only the latter. As long as this part of the risk is hedged, we can get a high-yield strategy with the underlying high-quality assets.

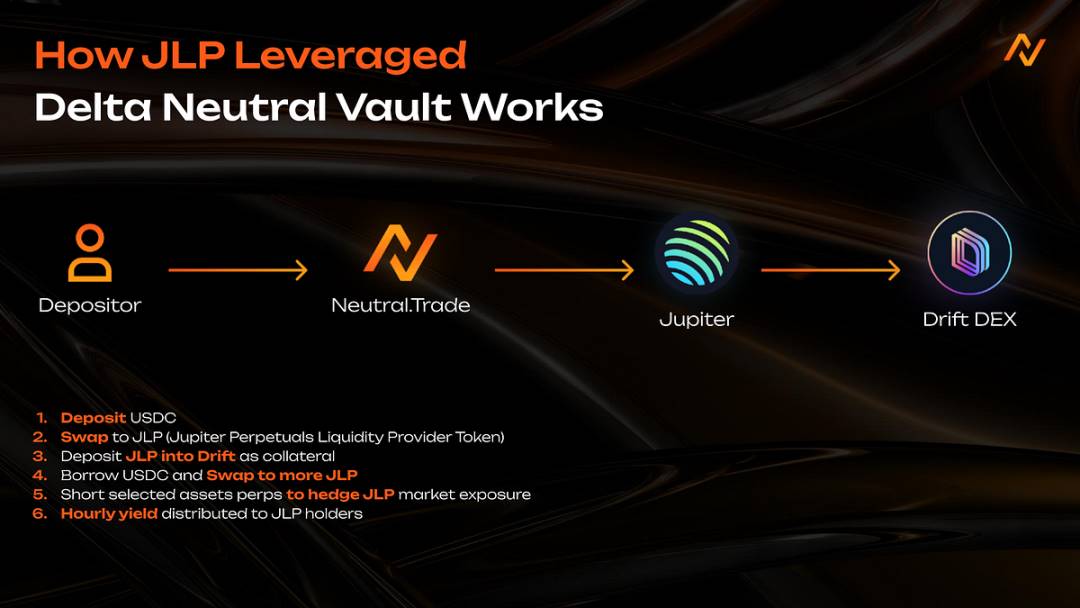

Neutral is 1 institutional-grade on-chain strategy hedge fund on Solana that offers such a strategy solution:

Users deposit USDC and exchange USDC for JLP. Stake JLP in the lending protocol, lend USDC and exchange it for JLP. (Profit is made when the annualized return of JLP is greater than the borrowing interest), and finally use the perpetual contract (Drift) to short the share of crypto assets (SOL, ETH, BTC) corresponding to the JLP held to make the strategy risk-neutral (theoretically there will be no loss due to price fluctuations).

The strategy's Neutral vault now has a TVL (total lock-up value) of over $12 million, an annualized return of over 15%, and a maximum drawdown of less than 2%.

Retail investor risk and institutional advantages

So why don't I execute this strategy myself and leave it to a product like Neutral? You will not be charged a fee if you come by yourself (Neutral charges a performance fee of 10 ~ 25% for various strategies, and the corresponding proportion is deducted from the profit. )

The reason is simple: retail investors often fail to manage the risk of complex strategic returns.

In the process of implementing the above strategy, there is a risk of liquidation and abnormal funding rates in short hedging, and there is a risk of loss caused by long-term interest rate inversion in the lending leverage. Even if you don't sleep and watch the market, you may not have extra funds to add margin and unravel the lending cycle in case of emergency.

Institutional-level hedge funds are monitored by the team 24 hours a day, have rich experience in handling various systemic risks and prepare plans, and are indeed an order of magnitude stronger than retail investors in terms of risk management and control. The premise of income is the safety of the principal, and whether to believe that you use the Degen model in exchange for the highest return, or sacrifice part of the income in exchange for more secure risk control, needs to be carefully considered based on personal circumstances.

Project Overview

Back to the Neutral project itself. It is not the only on-chain hedge fund on the market, and it was chosen to be introduced because it is being promoted in cooperation with the Solana Chinese community and has a relatively reliable endorsement. Secondly, it also has an ongoing points system, with the expectation of issuing coins, and while earning strategic benefits, it can also eat more than one fish and lay out the airdrop of the project. (Its points calculation rule is: 1 point is generated for every $1 asset in 1 year, which is equivalent to 1 point per day for depositing $365)

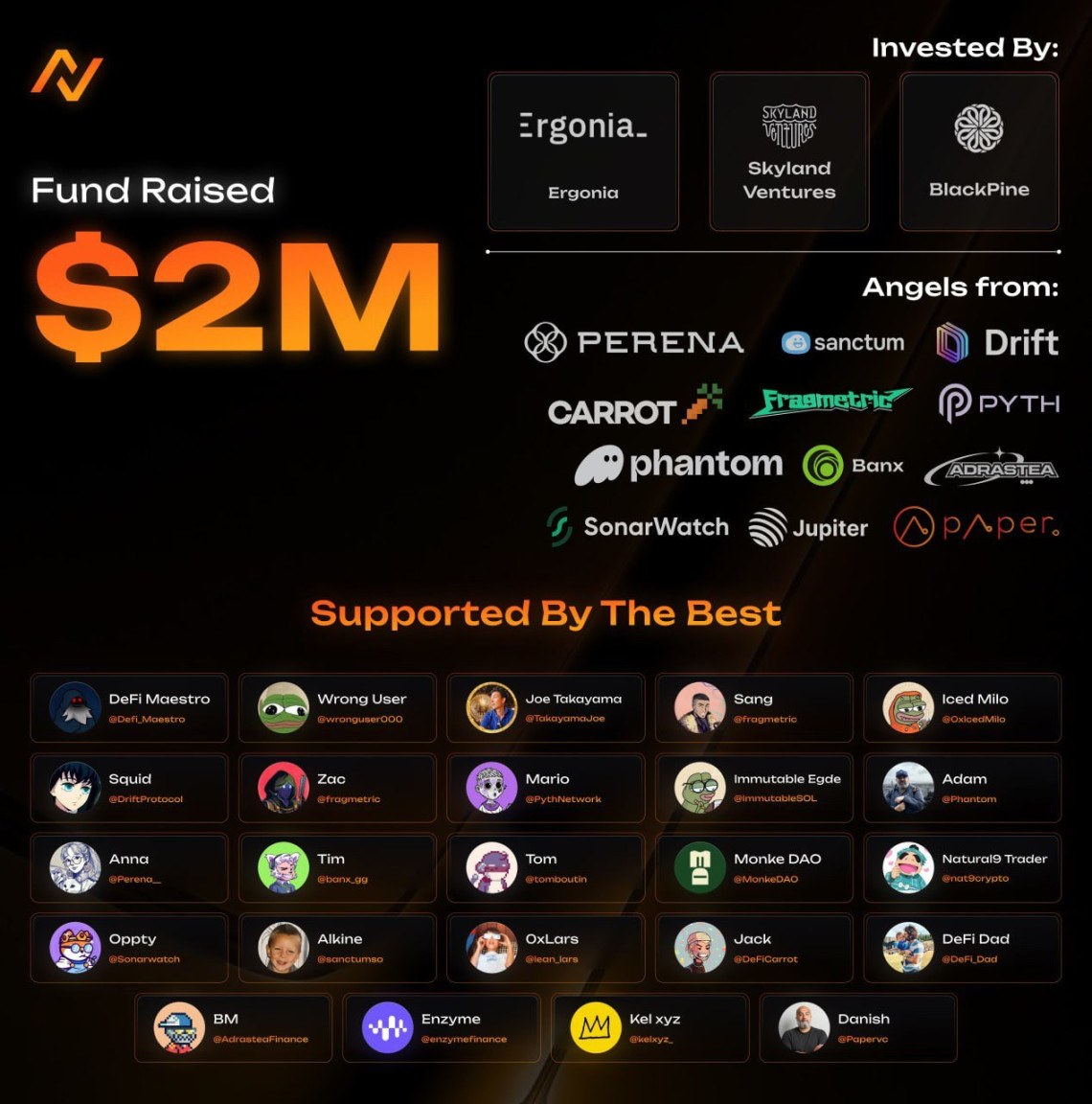

Originally an award-winning project in the Solana Radar hackathon, Neutral has grown to a budding emerging protocol with a TVL of nearly $36 million and nearly $2.5 million in revenue for users. The founders, Rick and Jared, are veteran quantitative traders from Goldman Sachs and the world's top three hedge funds. On June 1, Neutral announced that it had received $2 million in financing from Cumberland and a number of Solana ecosystem projects and participants.

In addition to the main JLP neutral strategy, Neutral also has multiple income strategies, including Hyperliquid tariff arbitrage. It is important to note that not all strategies are risk-neutral, and strategies marked with Directional may fluctuate wildly with market conditions, so interested readers can do their own research.