Bitcoin is at a new high, is anyone on Twitter posting a Rolex?

Written by: Pix

Compiled by: Luffy, Foresight News

In every crypto cycle, there comes a time when wealth becomes visible to the naked eye. Not just on-chain or in portfolio screenshots, but in the real world.

A year ago, an unknown person walked into a dealership, bought a watch with cash, and posted a photo of his wrist wearing it online. This moment, seemingly insignificant, marks an important shift in market psychology.

Why watches?

The logic is simple. Rolex is a Veblen product (note: refers to a product with higher price, higher demand).

The higher the price, the more people want to buy. They don't show value through functionality, but through price. Because what people buy is not practicality, but status.

When the new rich class quickly becomes rich, the first thing they want to do is let others know that they are rich.

They don't go to buy farmland or national debt. They will buy things that symbolize status. Watches, cars, and sometimes NFTs in JPEG format are also bought.

But the actual situation is not as simple as it seems at first glance......

Lagging reactions

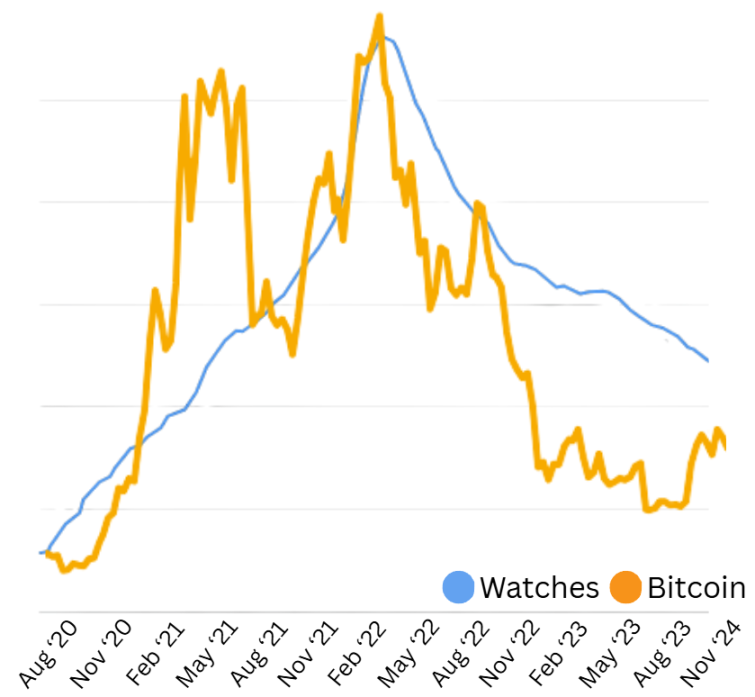

In 2020 - 2024, the watch index vs. Bitcoin price

In 2021, most people believe that the price of luxury watches will rise with cryptocurrencies.

But if you look closely at the timing, the watch market did not boom when Bitcoin hit its first all-time high. But at the second high, at that time, tokenized JPEG (NFT) once hit the price of a house.

The surge in Rolex prices is not the beginning of a bull market, but the culmination of a bull market.

The value of this phenomenon lies in the lag in the luxury market. The lag time is not long, but it can just reflect the law. This can be seen in the data.

The watch index lagged behind on the way to the crypto rally, peaking a little later and then crashing almost simultaneously.

In the year following the crypto crash, the price of Rolex fell by nearly 30%. Not because the need has disappeared, but because the identity needs that drive the need have dried up.

This makes the watch an unusual signal. They do not predict fundamentals but reflect market sentiment.

And, clearer than most of our existing metrics......

A different type of indicator

In traditional finance, there are volatility indices. In the cryptocurrency space, there are funding rates. But both are indirect measures of market behavior.

Luxury goods are different. They tell you not only what investors are doing, but also how they feel.

How rich they feel and how much they want the world to notice them.

It's not perfect. But when you see a watch changing hands at twice its retail price, or someone releasing their own custom NFT Rolex, it usually means the market is close to the top.

Because at that time, wealth had already been earned and entered the consumption stage.

So, where are we in the cycle now?

current cycle

Currently, we are back near the all-time high. Bitcoin is rising, and so is Ethereum.

Even "mass" cryptocurrencies like ADA and XRP have risen by 50% in the past month.

However...... The Rolex market is calm. The price is stable, and some styles are still unsalable. The dealer did not say that there was a shortage of goods, and the premium was not high.

At first glance, this may seem like a bearish signal, but it could actually be the opposite. The fact is that the profits of this cycle have not yet spread widely.

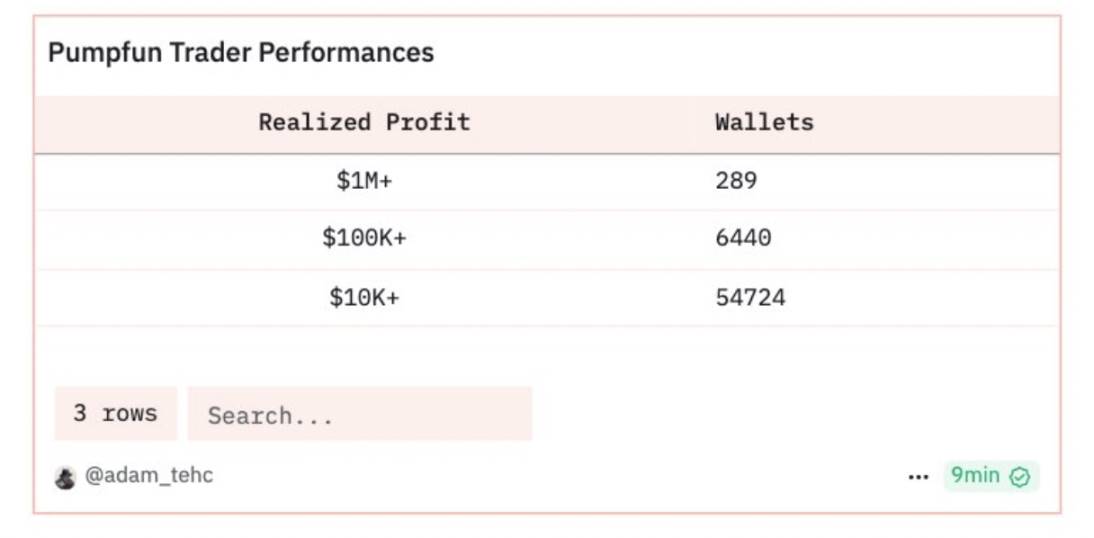

The recent memecoin craze has only created hundreds of millionaires. This is not enough to drive a market built on a broad speculative surplus (referring to the watch market).

You can see signs of this pattern returning. More Rolex photos are popping up on crypto Twitter (CT) and mentions are getting more and more, but now it's nowhere near as hot as it was in 2021.

It is also worth remembering that last time, the watch market did not fluctuate until later in the cycle.

Not when Bitcoin peaked first, but after the second peak, when everyone felt rich and everyone wanted to be noticed.

History does not repeat itself, but it rhymes

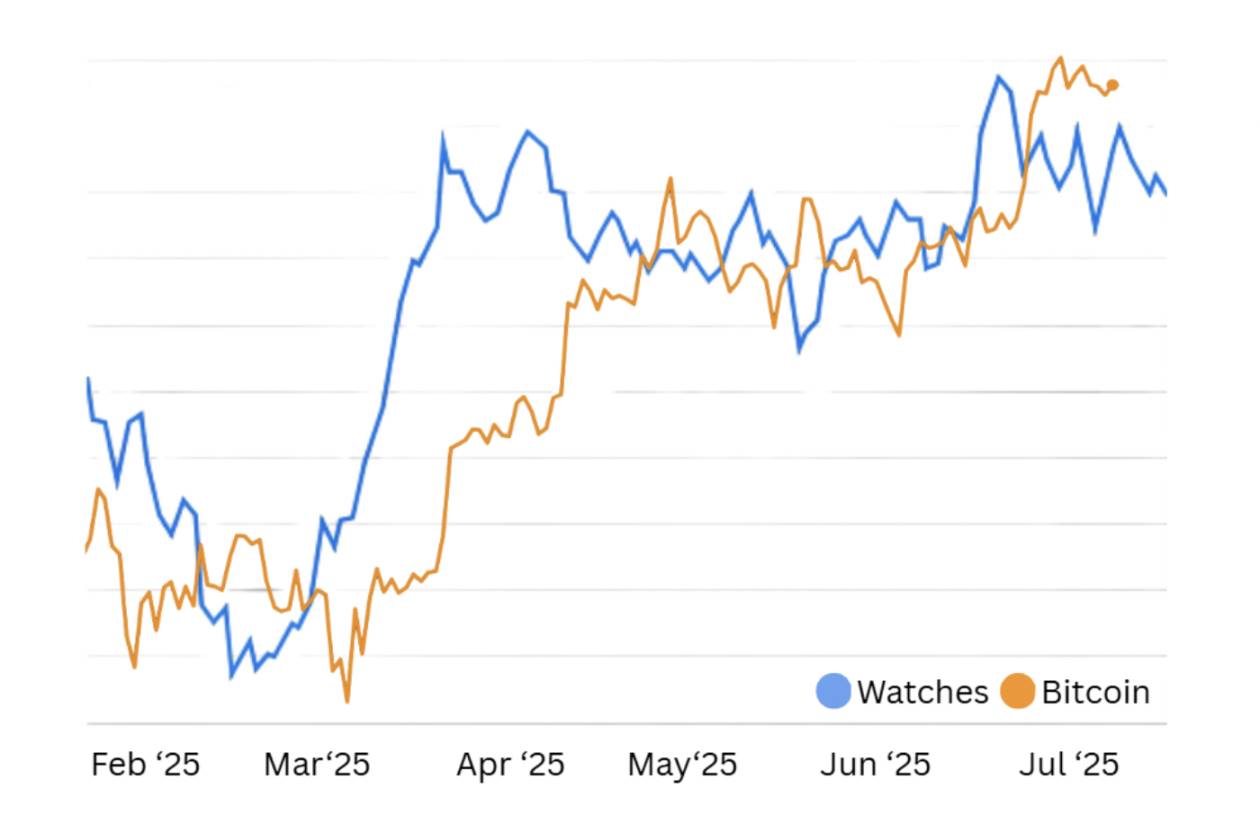

The situation has changed over the past few months. Bitcoin and watch prices began to move in tandem. Not perfectly synchronized, but an obvious association emerges.

This was not the case in the last cycle. In 2021, the watch market lagged. First the crypto rise, then the NFT boom, and then the Rolex price surge.

And this time, the watch has begun to change? Well, not exactly......

This time, the chart takes on a different look. Watches and Bitcoin began to rise almost simultaneously.

Since March, they have been moving almost in sync. But if you stretch the timeline, it's different.

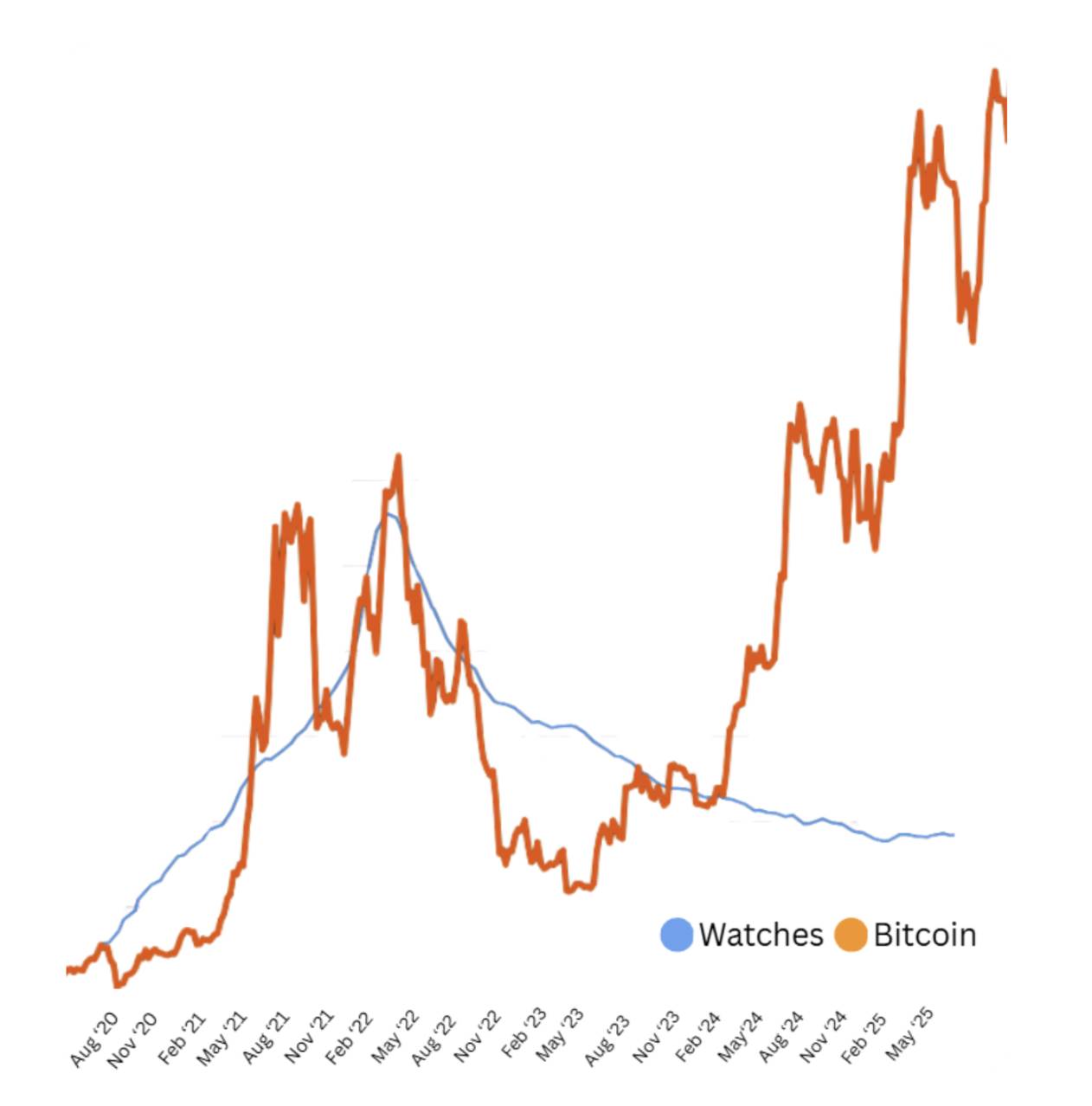

A bigger picture

Bitcoin is close to its all-time high, but the watch is not. Most styles are still well below their 2022 peaks.

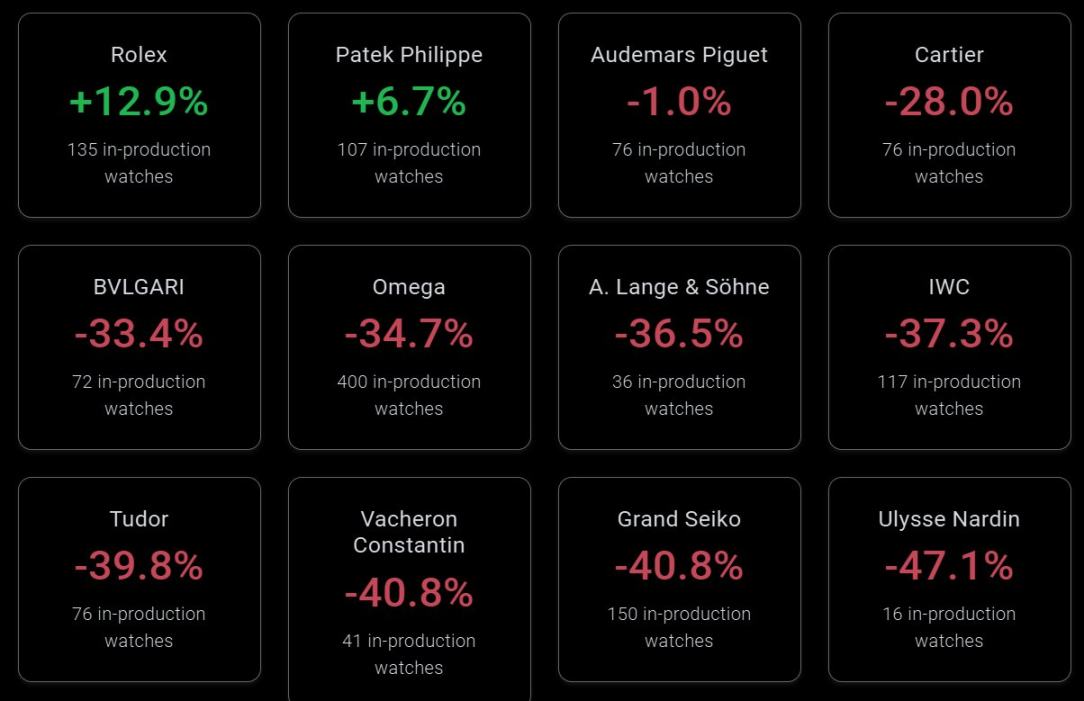

Except for Rolex and Patek Philippe, the entire watch market is sluggish. Cartier, Omega and even Audemars Piguet – all cost 30% - 40% less than retail prices.

This is important because it conveys two messages.

First of all, we are not yet in the frenzy stage. Second, most watches are still bad investments at the moment.

They are not designed to preserve value, but to assert identity.

The rise in watch prices again does not mean that we have reached the top of the cycle, but it does indicate that we have passed a large part of the cycle.

People start buying status symbols when they feel that the most difficult part has passed.

Typically, this is the middle of the cycle, probably two-thirds of the way through the cycle.

Wealth is accumulating, confidence is returning, but the real consumption wave has not yet begun. When the consumption wave arrives, you don't need a chart to detect it, you will feel it tangibly.