Animoca Seeks to IPO in the US, Is GameFi Still Worth Bet On?

By Steven Ehrlich, Unchained

Compiler: Felix, PANews

Cryptocurrency is all the rage again. Bitcoin hit an all-time high of $111,814, Coinbase became the first cryptocurrency company to enter the S&P 500 index, and more and more crypto companies are looking to go public.

One of them is Animoca Brands, a Hong Kong-based Web3 company whose stake is traded in private markets and spans everything from NFTs and crypto games to investment platforms with a portfolio of more than 500 companies.

The company, which was delisted from the ASX in 2020 due to its association with cryptocurrency, grew its valuation from $100 million to $5.9 billion in 2022, a major reversal during the pandemic. However, it faded into the public eye during the crypto winter, the NFT crash, and the subsequent meme coin boom. In addition, Oppenheimer's estimate of the global gaming market is $180 billion, and the GameFi boom has not attracted much attention, which is undoubtedly exacerbated.

Today, under the leadership of CEO Yat Siu, Animoca has developed a profitable business strategy. According to unaudited financial statements published on the company's website, Animoca made a profit of $97 million last year, an increase of 185% from 2023.

Today, influenced by the Trump administration's cryptocurrency-friendly policies, Animoca is one of many multinational companies seeking to strengthen their business ties with the United States, including listings on the NASDAQ or the New York Stock Exchange, among others. In an interview, Siu said: "We think the US is going to be the largest crypto market in the world, so it would be foolish if we didn't try to enter this market." But he cautioned that going public in the U.S. is just one of many opportunities the company is currently exploring.

What happens to the Animoca? It will depend on how well GameFi and NFTs are funded, and whether investors agree with Animoca's claim that the company is the best "shovel" type of investment in the GameFi movement.

Thegaming industry is in the coldAlthough

theTrump administration's tariffs have had little impact on the global gaming industry, the gaming industry is still highly vulnerable to changes in the macroeconomic situation. Martin Yang, senior analyst at Oppenheimer's equity research, said: "Overall, the gaming industry is doing okay, but not as well as it did during the pandemic. The gaming industry has experienced two years of strong growth, but now the overall growth rate is likely to be only 3% to 6% per year."

The situation is even more worrying for GameFi, which is primarily present in the mobile gaming market. Due to the freemium model and fairly low cost of mobile gaming, the market downturn may seem counterintuitive to outside observers, but it's an important detail to understand the gaming industry, as it explains why crypto gaming struggles to catch on.

Mike Hicke, senior analyst at The Benchmark Company, said in an interview: "The feeling was like, 'Oh, people are either not paying for the game at all, or they're just paying a little bit,' so it was thought that the mobile gaming model was viable and the macro environment was challenging." "But in fact, from a few years ago, we found that this is the most vulnerable market". He also said that even many large independent mobile game studios, such as Zynga, have been acquired, and many are facing layoffs.

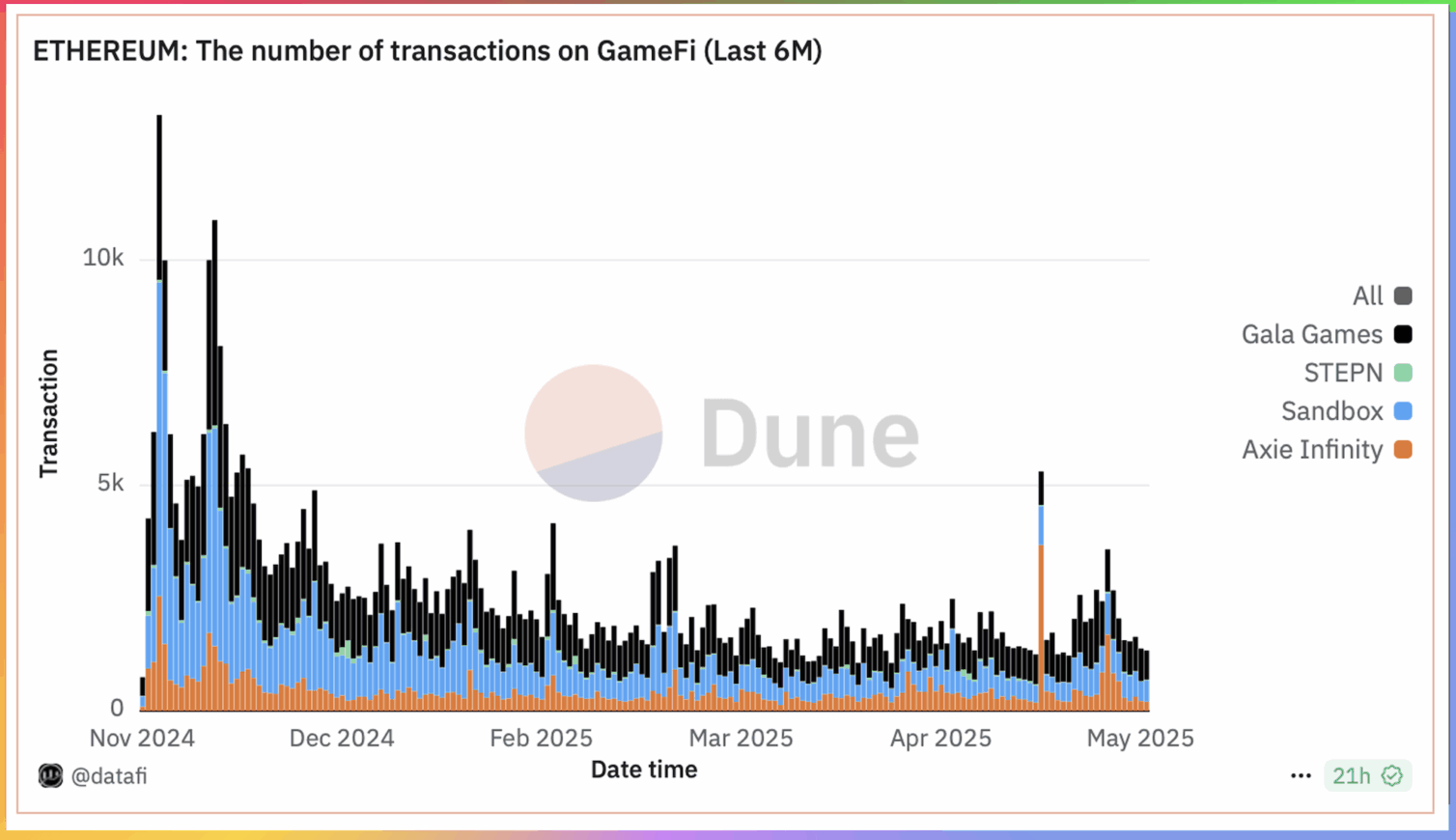

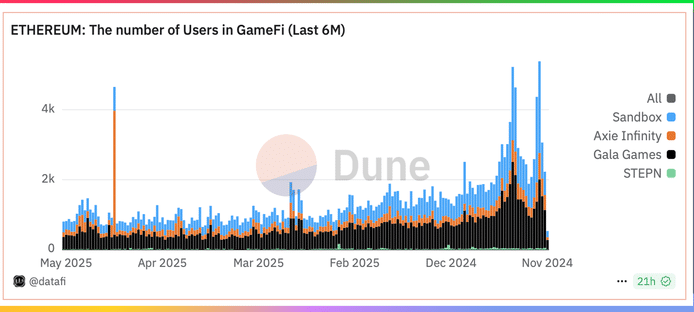

How do these trends relate to the crypto space? The data shows that GameFi is underperforming, but this phenomenon may also be exacerbated by the fact that GameFi's loyal user base is much smaller than the overall gaming market. Ethereum is the dominant blockchain in the space, and its key metrics such as transaction volume and number of users have dropped significantly, as shown in the chart below (the second graph should be read from right to left).

B2B layout for Animoca

In this environment, Animoca's profitability has almost tripled in one year. How does it do it? By becoming the main liquidity engine or market maker of GameFi. Siu believes that it is more stable, safer, and perhaps even more profitable for Animoca to provide financial infrastructure support to these companies, such as an over-the-counter trading desk, than launching more games in an already crowded environment. "That's the evolution of business." "We know that a lot of small companies don't have that infrastructure when they launch games, and they don't know how to do it. We buy their tokens and provide capital market support. "It sounds like a financial business, but it's really just an extension of what is called an issuance business.

How does this affect Animoca's business? In 2023, the majority of the company's revenue comes from Web3 operational activities, including wholly-owned projects such as virtual worlds, chess games, and online education platforms. But from 2023 to 2024, this revenue has dropped by 39.5%, and 2024 has been an extremely prosperous year for cryptocurrency. But the company's profits jumped 185% year-on-year. What is the reason? Its digital asset advisory business grew by 114%, while all capital markets activity was focused on this business.