Since its launch 16 weeks ago, Timeboost has accounted for nearly 50% of Arbitrum DAO's revenue.

---

What is Timeboost? It's an optional fast lane you can pay for that gives your transaction about a 200ms head start.

How it works: Users bid in sealed auctions to get their txs live before others.

Benefits: Reduces network spam and captures MEV value for the chain rather than off-chain searchers.

Impact: Generated almost $3M revenue in slightly more than 3 months; applicable to other chains.

---

Revenue So Far

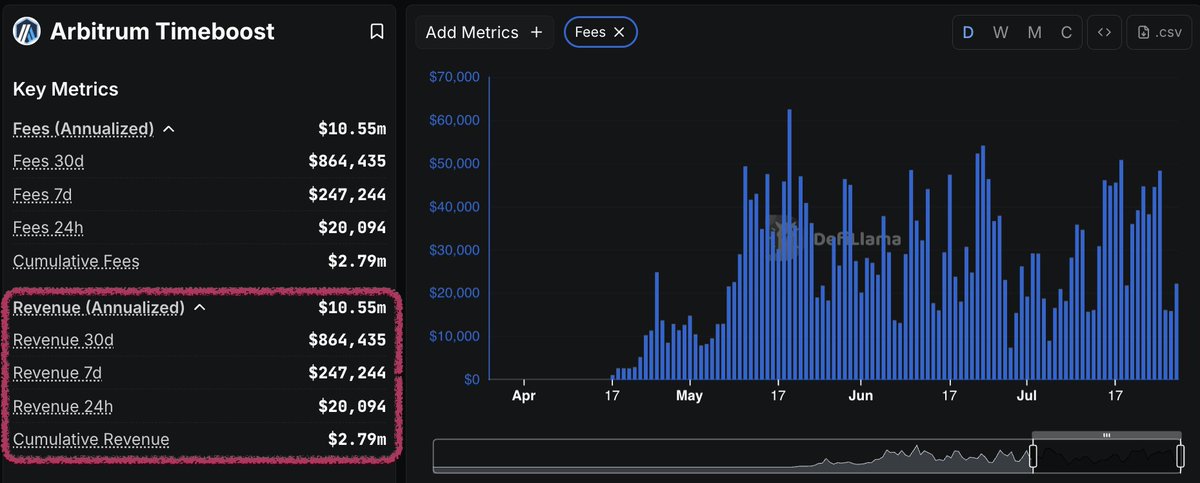

Timeboost generated $2.79M in fees over its first 16 weeks. As @DefiLlama shows, that's $10.5M annualised. These go directly to the Arbitrum DAO.

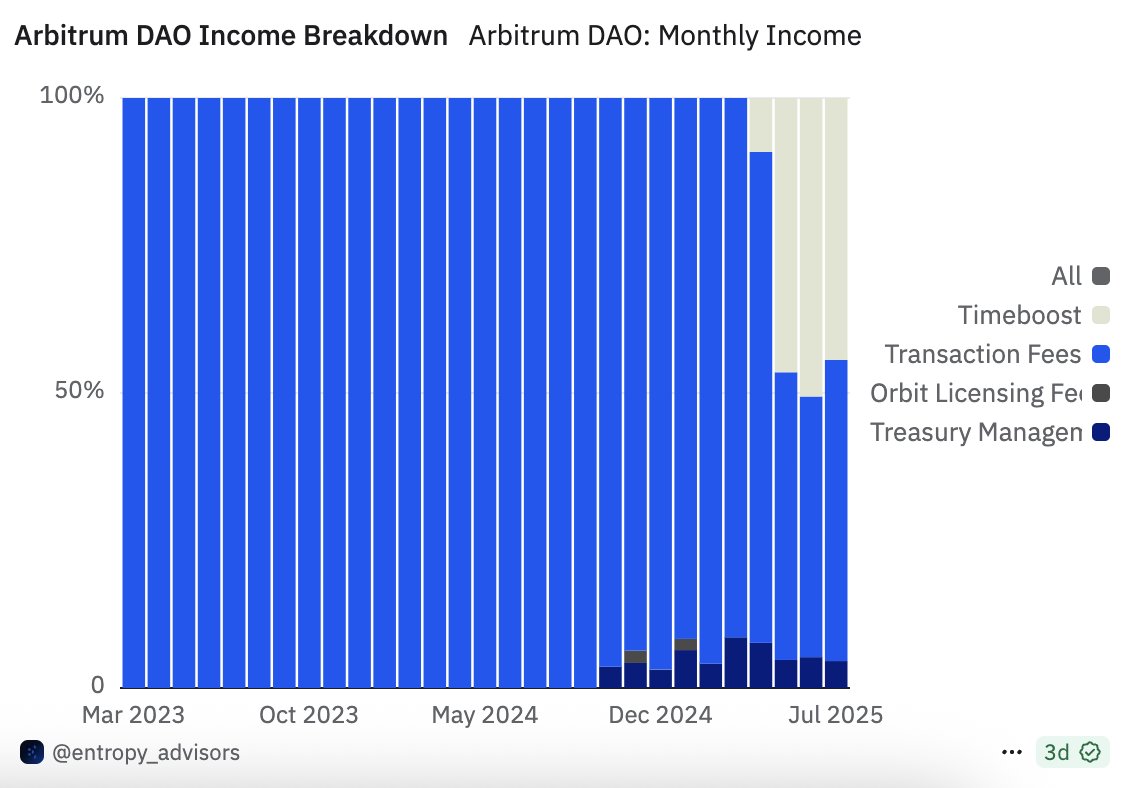

Moreover, as shown in a detailed dashboard from @EntropyAdvisors that you can check on @Dune, this number accounts for approximately 50% of Arbitrum's total revenue (44.4% in the last month), just overtaken by the sheer volume of transaction fees.

Dune Dashboard was done by @0x___Brick and @tomwanhh. Link in the image description.

---

The Whole Story

First and foremost, @arbitrum has private mempools. Unlike networks like Ethereum and Bitcoin, no one can view the order of transactions before they are confirmed on the chain. Consequently, the potential MEV of third-party actors is also lowered.

Still, @OffchainLabs (the development team behind Arbitrum) implemented this mechanism to give users the ability to put their transactions on top of others', by paying more fees.

Furthermore, it is interesting to note how these auctions are legal and transparent, while actual MEV's ethical (and legal) correctness remains debated.

The cohorts that mostly utilise Timeboost are arbitrageurs & MEV searchers, high-frequency traders, liquidators, and market makers/protocols to conduct MEV transparently.

---

Deeper Dive on How Timeboost Works

1. Express Lane & Auction System

Every 60 seconds, users have the opportunity to bid on an auction to advance their transaction, allowing it to enter the Express Lane first.

Why every 60 seconds?

Cause 10s or sub-second auctions would probably:

- Increase complexity & gas costs

- Reduce auction quality

2. Bidding Token

Bids can be made in any ERC-20 token; For Arbitrum One and Nova, the default bidding token is WETH.

3. Timing and Delays

Normal (non-express-lane) transactions face a default 200ms artificial delay before sequencing (which was not present before Timeboost introduction). Instead, block times remain at ~250ms, so finality for regular Txs extends to ~450ms (~250ms + 200ms).

Express-lane transactions bypass this delay.

4. Sequencer Handling & Fairness

Entering the express lane does not allow the user to reorder transactions, view the mempool, or guarantee absolute front-running dominance.

In practice, the user can bid a price to get their tx live faster, but they are not guaranteed that it will be accepted because they cannot see the mempool and therefore cannot see the other bids.

5. Economic Cost

Let's say the user with the highest bid paid 0.1 WETH, while the second-highest bid paid 0.05 WETH. The winning bidder will only pay 0.05 WETH.

This was thought to encourage honest bidding and disincentivize overpaying for priority.

---

Isn't the 200ms delay terrible UX?

While this may slow down highly specialized actions like CLOBs and high-frequency trading, for the vast majority of users this delay doesn't make a real difference.

In fact, our brain only begins to discern visual stimuli within about 100ms and 200ms. Therefore, Timeboost doesn't impact our perception of using the chain.

---

Do other chains use similar technology?

Although several chains allow end users to choose their own gas to speed up their transactions, none have yet implemented a similar auction mechanism.

However, as specified by the OffChain Labs developers, Timeboost could also be implemented on other chains, while also being compatible with the future Arbitrum implementation of a decentralized sequencer.

---

PS: If you're a nerd, check out the original academic paper:

"Buying Time: Latency Racing vs. Bidding in Transaction Ordering"

1.96K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.