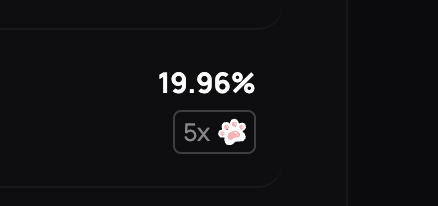

The $USDXL dynamic rate controller in action. When USDXL is below peg, rates ramp up.

The best way to reduce the rate is to buy USDXL off the market, pushing peg up, reducing rate, then pay back at a discount to $1.

Of course, you reduce your points exposure. We're seeing just how much people value @HypurrFi points and their positions.

This is what points are for by the way, to get a perspective on market value, position value, and how users are pricing their positions vs their debt exposure. Active research with real value and real users is exquisite signal.

You can deposit $BTC, borrow $USDT at 10%, swap it for USDXL at a discount, and lend it to the $BUDDY isolated market for 33% until peg restores by the way. Hell of a trade.

1.54K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.