July has been nothing short of explosive for Ethereum.

In just a few weeks, $ETH has surged from $2,486 on June 30th to over $3,800, marking a +50% gain — one of the strongest monthly $ETH performances in recent memory.

But price alone doesn’t tell the full story.

ETH Spot ETFs have posted net inflows every single day since launch

Not a single day of red. That’s not just bullish — that’s conviction.

Some key takeaways:

• $ETH is outpacing BTC in July • Retail and institutional momentum are aligned

• On-chain metrics like staking, L2 activity, and gas usage are also trending upward

• Institutional appetite is rising fast.

If this pace keeps up, July 2025 may go down as the month Ethereum flipped the narrative.

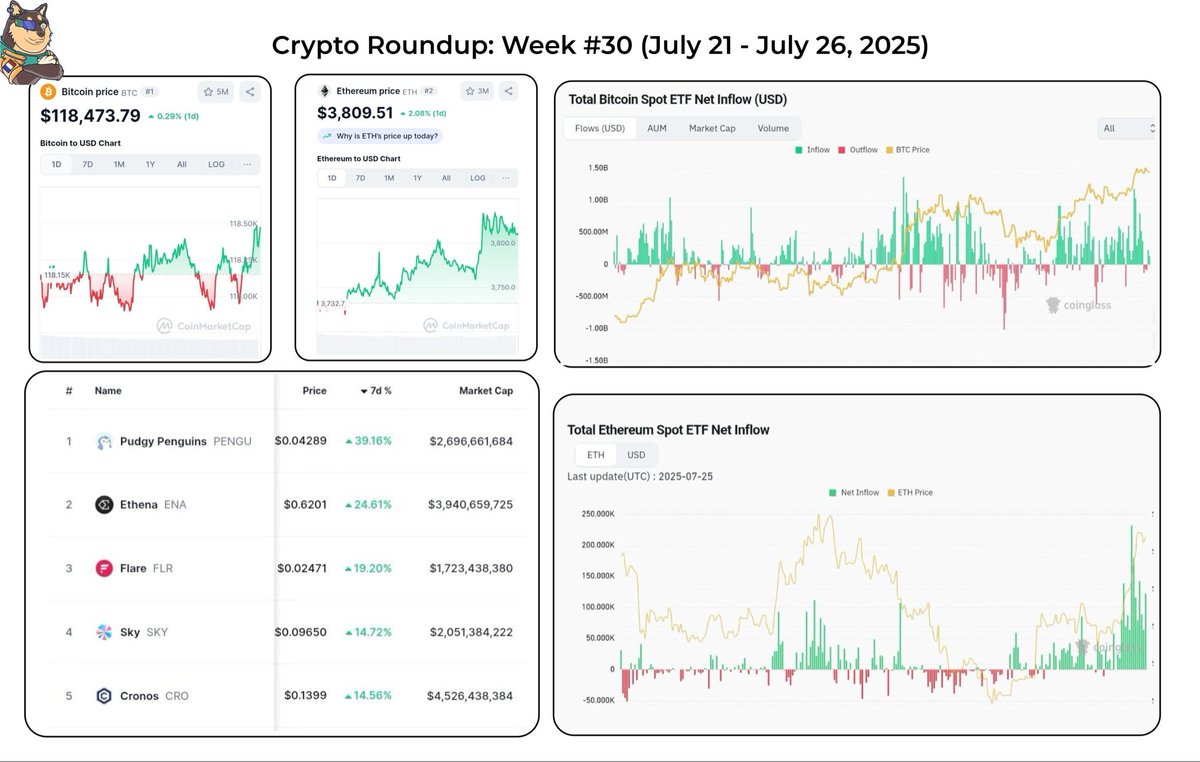

Crypto Roundup: Week #30 (July 21 - July 26, 2025)

Ethereum flipped the script.

Bitcoin held the line near ATHs.

But the Ethereum breakout was the story.

The inflows told the truth.

This wasn’t retail.

It was ETF driven, institution backed, and rotation confirming.

And now, it’s undeniable:

Ethereum has become the crypto native reserve asset.

● Institutional Shift in Motion

-> $ETH ETFs pulled $1.85B in just five days 25× more than BTC ETFs

-> Ethereum price surged 26%+, breaking through $3,800

-> Ethereum ETF AUM crossed $20.6B, now compounding daily

-> BlackRock’s ETHA fund led with $440M in a single day

● Market Stats

$BTC

- $118,473

- $2.35T market cap

- $72.3M ETF inflow (7D)

- ETF AUM: $158B

$ETH

- $3,809

- $459.9B market cap

- $1.85B ETF inflow (7D)

- 20.6B+ in ETH ETF AUM

● Top Movers (>$200M MC)

1. $PENGU: +39.16%

2. $ENA: +24.6%

3. $FLR: +19.20%

4. $SKY: +14.72%

5. $CRO: +14.52%

● Fundraising Flows

Liquidity rotated back to early-stage bets, but this time around, AI infra, tokenization, and agent orchestration split the pot.

-> Courtyard raised $30M (tokenized physical collectibles infra)

-> Gaia pulled $20M for decentralized AI infra (Mirana, SIG, Mantle)

-> Poseidon closed $15M seed led by a16z (IP-cleared AI training data)

-> Questflow raised $6.5M for AI agent orchestration (Animoca, Tezos)

-> Delabs Games pulled $5.2M for AI x Web3 gaming

-> Omo raised $1.1M pre-seed to build multi-agent orchestration

Treasury activity also ticked up with multiple structured entities buying spot $BTC and $ETH directly instead of raising rounds.

● Major Headline Stack

- Ethereum ETF inflows: $1.85B in 5D

- Bitcoin ETF inflows: $72.3M in 5D

- GENIUS Act passed: Stablecoin legal framework now live

- BlackRock ETHA daily inflow: $440M (record)

- Kraken expands tokenized asset suite, adds ETFs and FX synthetics

- Solana sees inflows return on $DOGE correlation spike

- 98 corporates raised $43B+ YTD to add BTC/ETH to treasuries

16.47K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.